HIGHLIGHTS

FCGFH FY2023

- Earnings: Earnings Per Share increased 5.8% from $2.91 to $3.08

- Performance Drivers:

- Increased Operating Profit

- Credit Impairment Loss

- Elevated Valuations

- Outlook:

- Sustained Economic Recovery

- Rating: Maintained at MARKETWEIGHT

NCBFG FY2023

- Earnings: Earnings Per Share of TT$0.14, 68.2% lower from EPS of TT$0.45

- Performance Drivers:

- Resilient Banking Results

- Weaker Insurance Results

- Outlook:

- Anticipated Dividend Normalization

- Rating: Assigned as OVERWEIGHT

This week, we at Bourse review the performance of two key members of the local Banking Sector, First Citizens Group Financial Holdings Limited (FCGFH) and NCB Financial Group Limited (NCBFG) for their fiscal years’ ended September 30th, 2023 (FY2023), respectively. FCGFH reported positive earnings growth supported by increasing revenue. NCBFG, meanwhile, reported lower earnings on account of weaker results from its insurance activities. What might investors expect in the coming months? We discuss below.

First Citizens Group Financial Holdings Limited (FCGFH)

First Citizens Group Financial Holdings Limited (FCGFH) reported an Earnings Per Share of $3.08 for the fiscal year ended September 30th, 2023 (FY 2023), up 5.8% relative to $2.91 reported in the prior comparable period.

Net Interest Income stood at $1.86B, 24.5% higher than $1.49B reported in the prior year. Fees and Commissions increased 7.0% to $494.2M and Other Income declined 4.7% to $135.4M. Overall, Total Net Revenue improved 15.6% to $2.47B, with a comparable period standing at $2.14B in FY 2022. The Group reported a Credit Impairment Loss on Loans of $56.2M in FY 2023, relative to a Credit Impairment Writeback in the prior period of $17.3M. Administrative Expenses and Other Operating Expenses increased 9.9% and 8.9% respectively. Share of Profit in Joint Ventures advanced 36.3% to $5.1M, while Share of Profit from Associates contracted 17.1% to $19.0M in the current period. Profit Before Taxation (PBT) climbed 15.9% to $1.07B from a previous $922.7M. Taxation Expense rose 54.9% to $293.1M, with the taxation rate moving from 20.5% to 27.4%. Profit After Taxation increased 5.9% from $733.5M in the prior period to $776.8M.

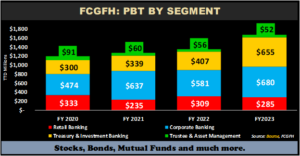

Segment Performance Mixed

FCGFH’s Profit Before Tax (PBT) grew 15.9% YoY. From a segment perspective, its Retail Banking segment PBT – accounting for 15.7% of PBT prior to eliminations – fell 7.8% from $309M in FY 2022 to $285M in FY 2023. Corporate Banking (39.6% of PBT before eliminations) grew 17.1% to $680M. Treasury and Investment Banking PBT advanced 60.7% to $655M, while Trustee and Asset Management’s PBT contribution declined 6.1% to $52M.

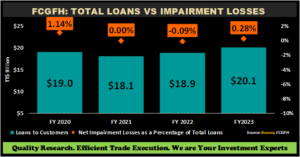

Credit Impairment Losses

FCGFH Loans to Customers increased 6.4% over the period from $18.9B to $20.1B in FY 2023, reflecting increased in demand for loans. Credit Impairment Losses on Loans increased both in absolute terms (to $56.2M) and relative terms (0.3% of Total Loans), though still remains at very healthy levels.

Domestic and regional economies are showing indications of persistent recovery, however global growth is expected to be sluggish. FCGFH is now working on extending loans and short-term investments while also prioritizing customers and strengthening their digital capabilities.

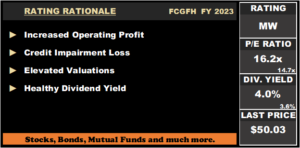

The Bourse View

FCGFH is currently priced at $50.03 and trades at a P/E ratio of 16.2 times, above the Banking Sector average of 14.7 times. The stock offers a dividend yield of 4.0%, above the sector average of 3.6%. Net Interest Income and Loan growth are positives for the Group, notwithstanding an increase in associated loan impairments (which remain relatively low). On the basis of positive earnings momentum, marginally elevated relative valuations and ongoing financial market recovery, Bourse maintains a MARKETWEIGHT rating on FCGFH.

NCB Financial Group Limited (NCBFG)

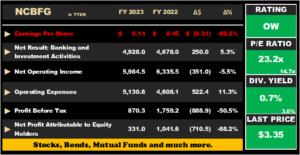

For the twelve months ended September 30, 2023 (FY2023), NCB Financial Group Limited (NCBFG) reported an Earnings Per Share (EPS) of TT$0.14, a 68.2% decline when compared to the previous comparable period.

Net Interest Income rose 6.1% to TT$2.74B. Net Fee and Commission Income was boosted 11.4% from TT$1.54B to TT$1.71B. Gain on Foreign Exchange and Investment Activities improved by 29.7% to TT$937.6M from a previous TT$722.7M. Overall, Net Result from Banking and Investment Activities settled at TT$4.93B, up 5.3% relative to TT$4.68B in the prior period. Net Result from Insurance Activities amounted to TT$1.06B, down 36.3%. compared to TT$1.66B in FY2022, resulting in a 5.5% decline in Net Operating Income (from TT$6.34B to TT$5.98B). When coupled with an 11.3% increase in Operating Expenses (from TT$4.61B to TT$5.13B), Operating Profit fell 50.6% from a previous TT$1.73B in FY2022 to TT$853.9M. NCBFG reported TT$16.4M in Share of Associate Profit, 48.6% lower than previously recorded in FY2022. Profit after Tax fell by 56% to TT$668.7M. Resultantly, Net Profit Attributable to Equity Holders for the Period amounted to TT$331.0M, down 68% from TT$1.04B in the previous comparable period.

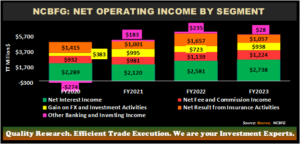

Operating Income Lower

The Group recorded a decline of 5.5% in net operating income compared to the previous reporting period in FY2022. Net Interest Income, the largest component of Net Operating Income (45.8%), rose 6.1% as the Group’s interest-earning assets grew. The Group recorded a 7.4% increase in Net Fee and Commission Income (20.5% of Net operating Income), supported by gains from investment securities and increased net loans. Net Revenues from Insurance Activities (17.7% of Net Operating Income) contracted 36.3%, from TT$1.66B in FY2022 to TT$1.06B in FY2023. Gains on Foreign Currency and Investment Activities (15.7% of Net Operating Income) jumped 29.7% to TT$937.6M. Other Banking and Investing Income fell 88% to TT$28.1M relative to $234.8 in FY2022, primarily driven by double-digit growth (94.7%) in credit impairment provisions.

Operating Profit by Activity

Life and Health Insurance & Pension Fund Management amounted to TT$939M relative to TT$1.43B in the comparable period, a decline of 34.2%, due to a non-recurring actuarial adjustment of $4.3B in relation to the restatement of 2022 financial year, coupled with related costs and technological expenses due to the adoption of IFRS 17. Treasury and Correspondent Banking, the second largest contributor of OP fell 20.3% from TT$541M to TT$431M in the current period. Wealth, Asset Management, and Investment Banking, fell 3.8%, resulting in Operating Profit of TT$384M, likely attributable due to reduced investment activities. The Group’s Corporate and Commercial Banking division declined 6.7% to TT$271M. Similarly, Payment Services dropped by 33.5% to TT$65M relative to TT$98M in the prior period. General Insurance climbed 99.5% from TT$254M to TT$507M, owing to improved revenue and profitability from the Dutch Caribbean and Bermuda operations. Consumer and SME Banking Wealth contributed the least to Operating Profit, negatively impacted by one-off gains from the sale of a few locations housing branch operations and increased credit impairment losses, which resulted in a deficit of TT$31M.

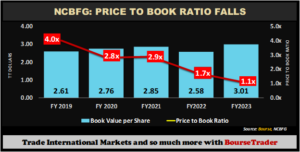

NCBFG posted an EPS of TT$0.14 for the twelve months ended September 30th, 2023, 68.9% lower than TT$0.45 in FY2022. The Group’s Price-to-Earnings (P/E) multiple grew significantly from 9.9 times to 23.3 times in the current reporting period, still relatively elevated compared to its 5-year historical average of 21.0 times and the current banking sector average of 15.0 times.

NCBFG’s book value per share (BVPS) expanded in FY2023, increasing from TT$2.58 in FY2022 to TT$3.01 in the most recent period. The P/B ratio has progressively declined in the past five reporting periods, from 4.0x in FY2019 and currently at 1.1x in FY2023, below its five-year average of 2.5 times.

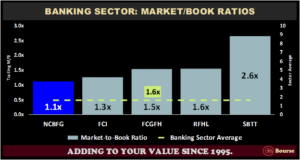

When compared to current P/B ratios for the banking sector, NCBFG appears to be relatively cheap using this metric.

The Bourse View

NCBFG currently trades at a price of $3.35 and a trailing PE ratio of 23.2 times, above the Banking Sector average of 14.7 times. The stock currently offers investors a trailing dividend yield of 0.7%, below the banking sector average of 3.6%.

Net result from Banking and Investment Activities remain resilient, notwithstanding weaker Insurance Activities performance brought about in part by changes in accounting standards. NCBFG’s relatively cheap P/B ratio both historically and when compared to its Banking sector peers, suggest some measure of value on offer. NCBFG, in its FY2023 Annual Report, asserted that it is aiming to achieve a dividend payout ratio of 50%, which – if realized based on current earnings and its current price – would bring its dividend yield up to 2%. Investors would be keenly monitoring this particular goal, given the absence of dividends from NCBFG stock until recently. On the basis of resilient banking and investment activities, an anticipated normalization of results post-adoption of IFRS 17, relatively attractive valuations (when considering P/B ratios) and the resumption of dividend payments to shareholders, Bourse assigns an OVERWEIGHT rating on NCBFG.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase, or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (I) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives, or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”