HIGHLIGHTS

Local Markets

- 2023 Performance:

- TTCI ↓ 8.9%

- All T&T ↓ 9.8%

- CLX ↓ 5.6%

- Performance Drivers:

- Resilient Earnings

- Cooling Inflation

- Weak Investor Sentiment

- Outlook:

- Economic Normalization

International Markets

- 2023 Performance:

- US Markets – S&P 500 ↑ 24.2 %

- European Markets- Euro Stoxx 50 ↑ 15.6%

- Asian Markets – MXASJ ↑ 4.6%

- Latin American Markets – MSCI EM ↑ 25.1%

- Performance Drivers:

- Cooling Inflationary Pressures

- Geopolitical Tensions

- Outlook:

- Economic Normalization

We take this opportunity to wish you a very Happy New Year from the team at Bourse! This week, we review the performance of local and international stock markets for 2023. T&T and major regional markets were broadly lower in a year influenced by weaker investor sentiment. International equities, meanwhile, had a stellar 2023 after a challenging prior year. Resilient growth, cooling inflation trends and the increased likelihood US interest rate cuts were all supportive of international markets, despite ongoing geopolitical tensions. Will markets maintain trend into 2024, or could new developments and/or changes in investor sentiment change their course? We discuss below.

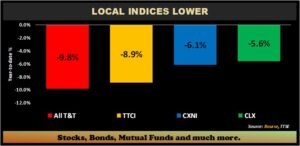

Local Indices Lower

Local/regional equities endured a second consecutive year of declines. The All Trinidad and Tobago Index (All T&T) contracted 9.8%. The Trinidad and Tobago Composite Index (TTCI) fell 8.9% to end at 1,214.05, with a less-pronounced decline of the Cross Listed Index (CLX), which had a 5.6% decline. The Caribbean Exchange Index (CXNI), a broader indicator of regional equity performance, fell 6.1%. With 46.1M shares traded for $216.0M, MASSY Holdings Ltd. (MASSY) led the volume traded on the Trinidad & Tobago Stock Exchange (TTSE). National Enterprises Limited (NEL) followed, with 15.4M shares traded for $56.8M.

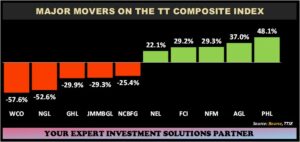

Major Movers

Prestige Holdings Limited (PHL) increased 48.1% on account of strong sales growth. Agostini Limited (AGI) advanced 37.0%, reflecting greater profitability, higher margins, and ongoing acquisition activity. National Flour Mills (NFM) expanded by 29.3%. First Caribbean International Limited (FCI) rose by 29.2% on improved revenue and earnings. National Enterprise Limited (NEL) saw a 22.1% gain in 2023, supported by higher dividends.

For 2023, major decliners included NCB Financial Group Limited (NCBFG, â 25.4%), JMMB Group Limited (JMMBGL, â 29.3%), Guardian Holdings Limited (GHL, â 29.9%), Trinidad and Tobago NGL (NGL, â 52.6%), West Indian Tobacco Company Limited (WCO, â 57.6%).

Some notable transactions by publicly listed companies in 2023 included:

- Massy Holdings Limited (MASSY) had three acquisitions: Rowe’s IGA supermarkets in Jacksonville (which closed December 2022), Air Liquide operations in Trinidad acquired January 2023 and IGL Jamaica acquisition which closed in May 2023.

- GraceKennedy Limited (GKC): The acquisition of Scotia Insurance Caribbean Limited, rebranded as GK Life, concluded in March 2023. Unibev Limited, a fully integrated spring water producer, was acquired by GraceKennedy Limited (GKC) in August 2023 and completed on October 27th, 2023.

- Agostini Limited (AGL): The acquisition for Chinook Trading Canada was completed in May 2023 with 80% of the shares. Health Brands Limited was acquired and concluded on August 2023. AGL acquired a 20% stake in Agora Technologies Ltd. (trading as oDeliver) in November 2023.

Comm. Services, Technology sectors boost US stocks

The bellwether index for US equity markets, the S&P 500 ended 2023 strongly, advancing 24.2% after a tough 2022.

The high-growth Technology sector, represented by Technology Fund (XLK) propelled the market, up 54.7% largely driven by optimism over artificial intelligence. The ‘Magnificent 7’ companies, which include Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms and Tesla – accounted for about two-thirds of the gains in the S&P 500 in 2023. The Communication Services Sector (XLC) and Consumer Discretionary Sector (XLY) also excelled for the year, expanding 51.4% and 38.4% respectively.

In contrast, traditionally defensive domains that lost ground included Utilities (XLU â 10.2%), and the Consumer Staples sector (XLPâ 3.4%), adversely affected by inflation and the high interest rate environment resulting in these sectors being relatively less attractive.

European Stocks Higher

Investor confidence in European markets improved during 2023 with a robust performance by European equities. The pan-European index rose 15.6%, compared to a loss of 10% in 2022, with several European indexes outperforming the benchmark, including those in Italy, Spain, France, and Germany. Investor optimism about European markets were generally upbeat throughout 2023, amidst positive economic growth reports from the European union. Italian equities (+32%) performed the best amongst its peers, driven by banks, auto and defence stocks. Spanish and French markets followed closely, advancing 26.6% and 20.1% respectively. German equities grew 20.1% in 2023 relative to a decline of 20.1% in 2022. English stocks advanced ‘just’ 9.2%, compared to a decline of 9.8% in the prior period.

China, Hong Kong weigh on Asian Markets

Asian equities achieved mixed results in 2023, as the ongoing fragile relationship between China and western countries weighed on investor sentiment. Taiwan equities led gains within the region, advancing 26.7% in 2023 compared to a decline of 29.9% in 2022. India equities grew 18.1% from a previous negative position of 6.0%, powered by better-than-expected macroeconomic growth and steady corporate earnings. South Korean equities advanced 15.7% in the current period from a decline of 29.2% in FY2022. Hong Kong equities continued its decline, down 15.6% (2022) and 13.8% in the current period. The benchmark Asia ex- Japan index advanced 4.6% in 2023 compared to a decline of 19.7% in the prior period. Chinese equities also endured a second year of losses, declining 23.6% (2022) and 13.3% (2023). Despite global economic headwinds, growth in many Asian economies remained resilient in 2023 which may provide some degree of optimism.

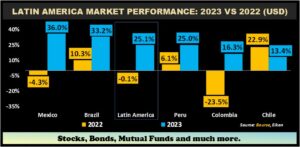

Latin American equities posted major gains in 2023, surpassing their emerging market peers and rising 25.1%. Mexico was the best performing market, advancing 36.0%, driven by robust private consumption and investment. Brazilian equities gained 33.2%, aided by strong export growth and foreign direct investment. Peruvian shares advanced 25.0% in 2023 despite weak domestic demand. Columbia and Chilean stocks also posted positive gains in 2023, expanding 16.3% and 13.4% respectively.

Investment Outlook and Considerations

Domestically, the outlook remains cautiously optimistic with some momentum in regional economic activity and moderating inflation. Recently, the Central Bank of Trinidad and Tobago (CBTT) reported that while energy output decreased, non-energy sector activity increased and aggregate demand remained stable, illustrated by strong consumer demand, real estate mortgage and business spending. In Latin America and the Caribbean, The World bank projects growth of 2% in 2023 and 2.3% in 2024.

With the local equity market retreating in 2023 despite generally improving conditions and stronger earnings, this should create an opportunity for investors with a longer-term outlook to snap up stocks at relatively attractive valuations. Investors should continue to focus on stocks that exhibit (i) attractive valuations through lower price-to-earnings (P/E) multiples, (ii) strong company fundamentals, (iii) above-average dividend yields and (iv) provide a partial hedge to the TTD through USD earnings/dividends.

Internationally, equity markets are forecast to move generally higher in 2024, even with cooling economic growth forecasts. According to the IMF’s November 2023 World Economic Outlook, global growth will slow from 3.5% in 2022 to 3% in FY2023 and 2.9% in FY2024, reflecting slowdowns for the largest economies (US, Euro, China).

For investors who may want to de-risk their exposure to equities, diversification across different sectors remains a useful approach to reducing overall portfolio risk. For a relatively passive investor, the best approach to gain broader market exposure is to consider equity mutual funds and/or equity index exchange traded funds (ETFs). As always, investors are encouraged to consult a trusted and experienced advisor, such as Bourse, to better position their portfolios for the year ahead.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase, or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives, or agents, accepts any liability whatsoever for any direct, indirect, or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”