HIGHLIGHTS

Local Markets

- Q12025 Performance:

- TTCI ↓ 2.2%

- All T&T ↓ 3.2%

- CLX ↑ 1.1%

- Performance Drivers:

- Resilient Earnings

- Cooling Inflation

- Weak Investor Sentiment

- Outlook:

- Economic Normalization

International Markets

- Year-to-Date Performance:

- US Markets – S&P 500 ↓8.8%

- European Markets- IEUR ↑ 8.5%

- Asian Markets – AAXJ ↓2.3%

- Latin American Markets – ILF ↑7.7%

- Performance Drivers:

- Tariff Policy Uncertainty

- Geopolitical Tensions

- Outlook:

- Economic Normalization

This week, we at Bourse, review the performance of local and international stock markets. Locally, investor sentiment continues to remain weak, reflected in lower stock prices and trading activity despite broadly resilient earnings. Meanwhile, International equities have been rattled by tumultuous changes to global trade policy. US stocks have led the declines amid escalating volatility and uncertainty driven by US global tariffs, which have been met with reciprocity in some instances. In light of this, we examine the latest developments and offer investors strategies to navigate these turbulent financial waters.

Local Indices Lower

Major indices on the Trinidad and Tobago Stock Exchange (TTSE) showed mixed results at the close of the first quarter of 2025. The All Trinidad and Tobago Index (All T&T) saw a decline of 3.2% for Q1 2025. In contrast, the Cross Listed Index (CLX), which includes some of the largest publicly traded regional companies, rose by 1.1% during the same period. As a result, the Trinidad and Tobago Composite Index (TTCI) decreased by 1.3%, closing the quarter at 1,049.95. MASSY Holdings Limited (MASSY), followed by NCB Financial Group Limited (NCB), were the top volume leaders on the First Tier Market for Q1 2025, with 10.5M and 2.7M shares traded, respectively.

Major Movers

LJ Williams Limited ‘B’ (LJWB) led gains appreciating 20.0% during the quarter, while JMMB Group Limited (JMMBGL) advanced 14.0%, notwithstanding weaker financial results. Point Lisas Industrial Port Development Corporation Limited (PLD) advanced 6.7%. One Caribbean Media Limited (OCM) increased 5.3% and First Citizens Groups Financial Holdings Limited (FCGFH) improved 3.9% supported by modest revenue and earnings growth.

For Q12025, major decliners included Guardian Media Limited (GML, ↓ 20.0%), Ansa McAL Limited (AMCL, ↓ 16.4%), Trinidad and Tobago NGL (NGL, ↓ 15.5%), Scotiabank Trinidad and Tobago Limited (SBTT, ↓ 7.4%) and Trinidad Cement Limited (NGL, ↓ 6.0%).

Tariffs Roil International Markets

US stocks fell in March, with the S&P 500 posting a correction (a drop of 10% or more from its peak) after reaching an all-time high on February 19th of 6,144. The financial markets endured several weeks of elevated volatility sparked by uncertainty surrounding trade tensions and tariff policies introduced by US President Donald Trump.

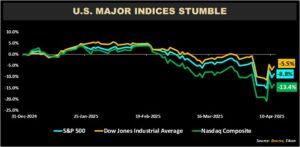

The S&P 500 Index and the tech-heavy Nasdaq Composite Index declined 8.8% and 13.4% respectively, year-to-date (YTD). The blue-chip Dow Jones Industrial Average (DJIA) is down 5.5% YTD.

U.S. sectors broadly lower

The benchmark index for U.S. equity markets, the S&P 500, declined by 8.8% year-to-date. Both the Consumer Discretionary and Technology sectors posted double-digit losses, contributing significantly to the broader market downturn.

Year-to-date, sector ETF performance has shown notable divergence. The Consumer Discretionary Select Sector SPDR Fund (XLY) declined by 15.4% as investors place expectations of rising future costs. Similarly, the Technology Select Sector SPDR Fund (XLK) fell 14.7%, pressured by escalating trade tensions and potentially higher cost of production in the U.S.—particularly affecting tech firms with international supply chains. In contrast, the Consumer Staples Select Sector SPDR Fund (XLP) and the Utilities Select Sector SPDR Fund (XLU) each posted a modest gain of 2.2% and 0.8% respectively. Utilities and Consumer Staples are often viewed as ‘defensive’ sectors, with consumer demand usually less sensitive to economic cycles.

Regional Exchange Traded Funds (ETFs) are delivering returns that outpace their US counterparts in 2025, with Europe and Latin America trading in positive territory. Trade uncertainty under the new U.S. administration has fueled concerns about rising inflation and a slowing U.S. economy, which has worked in favour of international markets.

As at Friday April 11th 2025, Asian markets are currently down 2.8% YTD while US markets declined 8.9%. Europe and Latin America yielded positive results, up 8.5% and 7.7% respectively, YTD.

Global Tariffs on Focus

In early 2025, the United States initiated a series of tariff implementations affecting various trading partners. Since then, tariff policy has seen multiple pauses, increases and similar actions, obfuscating economic and trade forecasts:

- February 1st: President Trump announced a 25% tariff on most imports from Canada and Mexico, effective February 4th.

- February 3rd: Trump delayed tariffs on Canada and Mexico for 30 days.

- February 4th: 10% tariffs were put in place against China. China issued retaliatory tariffs.

- February 10th: 25% tariffs on steel imports from all countries and aluminum tariffs raised from 10% to 25%.

- March 4th: Trump levied 25% import tariffs on Canada and Mexico, as well an additional 10% tariff on China bringing the total to 20%.

- March 6th: Trump postponed 25% tariffs for goods covered by the US- Mexico-Canada Agreement.

- March 26th: Trump announced 25% on imported cars and car parts.

- April 2nd (“Liberation Day”), The US implemented sweeping tariffs targeting all major trading partners. These measures included a universal 10% tariff on all imports to the United States that included 26 Caribbean Countries, effective April 5th, 2025. Additionally, higher ‘reciprocal’ tariffs were imposed on countries with high trade deficits with the US, including China (34%), the European Union (20%), South Korea (25%), India (26%), Taiwan (32%) and Japan (24%).

- April 9th, 2025: Temporary 90-day pauseon any further tariff increases with a lowered Reciprocal Tariff of 10% on most trading partners (excluding China), effective immediately. This move framed as a goodwill gesture amid ongoing trade negotiations with over 75 Countries.

- April 11th, 2025: China announced that it will raise tariffs on US goods from 84% to 125%.

The series of moves has revealed the apparent primary focus of US trade policy: China, though a Universal tariff of 10% and other duties on autos and metals will remain, pending negotiations. Given, that China was the only nation to retaliate to the April 2nd tariffs, its exports to the US would now face cumulative tariffs of 145%. This escalation stems from a series of tit-for-tat measures, with each nation increasing tariffs in response to the other actions, significantly intensifying the trade war and impacting global economic relations.

Regional Impact of U.S Tariffs

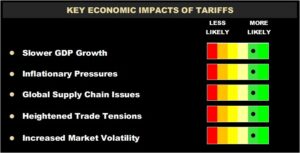

The full implementation of US tariffs could have significant regional and global consequences. While the reported intent of these tariffs involves a revival of US manufacturing, protecting American industries and job creation, the near-term impact is likely to drive input costs higher for US manufacturers reliant on imported materials, which will likely result in increased consumer prices. The general consensus economic forecast would include slow-to-no growth combined with increased inflationary pressures; a phenomenon commonly referred to as ‘stagflation’.

On the International front, retaliatory tariffs from China and the emerging markets could escalate the trade conflict, disrupting global supply chains, especially in electronics, automotive and industrial goods. According to the Office of US Trade, the U.S imported US$438B worth of goods from China, and exported US$144B in 2024.

Regionally, the impact to smaller economies heavily reliant on US imports and tourism could likely see rising input costs and reduced demand. According to the International Trade Centre, T&T’s exports to the US accounted for 34% of total exports in 2023. However, the country’s largest export commodities (Crude Petroleum and Natural Gas) are currently exempt from the universal tariff. According to T&T’s Ministry of Trade and Industry, preliminary data reveals that approximately 47% of the total value of exports to the United States specifically, will not be affected. While there may be greater opportunities for intra-regional trade, increased shipping and logistics costs and high import content adding to inflationary pressures could strain the Caribbean’s near-term economic outlook.

Is this a buying opportunity?

Market corrections usually represent an opportunity to acquire stocks at more attractive valuations. For investors looking at US/global markets, the major question to be addressed would be the conclusion of the so-called ‘tariff tantrum’. Will it be relatively short-lived, (i) fizzling out with trade relations returning to the status quo, or (ii) being watered down to a much less disruptive form? Or, will the US dig its heels in, materially changing the economic landscape and market expectations of corporate performance? Periods of market stress have historically and consistently offered long-term rewards for diversified investors who look through near-term volatility and focus on having their capital spend more time in the market.

For instance, consider the performance of the S&P 500 Index over the period 2000 to April 2025. Despite having endured several periods of heightened volatility (financial crises, the ‘Dot Com’ bubble, ‘9/11’ Covid 19 pandemic, rising geopolitical tensions etc.), the S&P 500 delivered an average annualized return of 6.0% (excluding dividends) over the period. This highlights the value of long-term investing, as markets tend to reward patience over time.

Locally, the equity market has endured a period of prolonged decline since peaking in 2021. Equities have continued to experience broad-based weakness, despite improved reported financial performance by some blue-chip stocks. The decline in market prices has improved valuations, with many securities now trading at Price-to-Earnings (P/E) ratios well below their historical averages, making them attractive for those with a longer investment horizon.

Investors should review their portfolio periodically and consult a trusted and experienced advisor, such as Bourse, to make better informed decisions.

This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”