HIGHLIGHTS

FY2024 Projections

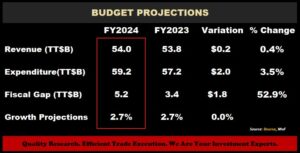

- Revenue: TT$54.0B

- Expenditure: TT$59.2B

- Fiscal Deficit: TT$5.2B

- Real GDP Growth: 2.7%

Notable Fiscal Measures

- Investor Specific

- TTMB Merger Progresses, IPO Unclear

- Wider Economic

- Retirement Age Increase Advances

- Property Tax to Commence

- Minimum Wage Increase

- Energy Sector Moderation

This week we at Bourse review the recently delivered national Budget for FY2024, taking an investor’s perspective. While not necessarily providing the fireworks many had anticipated, the Honorable Minister of Finance’s proposed fiscal measures and forecast figures could have a significant influence on investor sentiment. What are the implications for investors? Are there any clear opportunities on the horizon? We discuss below.

Revenue and Expenditure Summary

Revenue for FY2024 is forecast to be $54.0B, broadly in-line with FY2023’s projected revenue levels. Expenditure, meanwhile, is forecast to increase to $59.2B, with a resultant fiscal deficit of $5.2B. Notably, the fiscal deficit for the now-completed FY2023 widened from an initial $1.5B to $3.4B in the latest revised figures.

More on Expenditure

Total Expenditure for FY2024 is projected at $59.2B, 3.5% higher than FY2023 estimated total expenditure of $57.2B. If realised, the projected expenditure for the coming fiscal year would be the highest expenditure since FY2015. Current Expenditure is estimated at $53.0B for FY2024, with Capital Expenditure estimated at $6.2B. In the FY2024 budget delivery, the MoF expressed a desire to expand capital expenditure as a priority to “create jobs and stimulate economic activity”. It should be noted that Capital Expenditure has consistently fallen short of budgeted estimates in the past 5 fiscal years.

Can Real GDP growth continue?

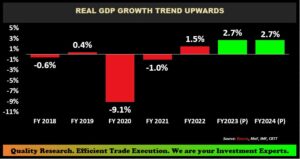

Real Gross Domestic Product (GDP) growth is forecast to be 2.7% in FY2023, expected to continue momentum from a previous 1.5% in FY2022. The MoF also forecasts growth for FY2024 of 2.7% by the MoF (3.2% by IMF). T&T’s economic fortunes rely heavily on the energy sector, which contributed approximately 46.5% of GDP in FY2023. Whether or not these growth estimates materialize will be greatly dependent on globally energy prices, given the lacklustre production outlook for domestic energy commodities in FY2024 and beyond.

Debt to GDP Climbs

T&T’s Debt to GDP level increased to 70.9% to close FY2023. Adjusted General Government Debt has steadily risen across the previous 5 years, with a 6.4% increase from $129.0B in FY2022 to $137.2B in FY2023. Despite this increase, the Debt to GDP measure has remained below the stated ‘soft target of 75%, as attributed to rising levels of Nominal GDP throughout the years. With expected net borrowing to fund the projected fiscal deficit, the Debt:GDP ratio would likely increase throughout the course of FY2024.

Investor Considerations

Gas Production Stagnant

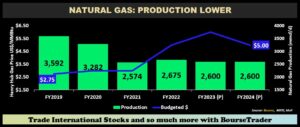

The MoF acknowledged that the production levels of natural gas utilized by the petrochemical industry was well below total installed capacity of 4.2 billion cubic feet per day (bcfd). Based on available data, production levels are currently averaging 2.6 bcfd (October – June 2023). Domestic Natural Gas Production is expected to stabilize at approximately 2.6 bcfd in FY2024 and 2.5 bcfd in FY2025, with additional projects by BpTT, EOG and Shell in 2024-2026 contributing to ‘maintaining’ natural gas production levels. On the pricing side, the Budgeted Natural Gas price for FY2024 is estimated at $5.00/MMBtu, with energy revenues expecting to contribute roughly 31% of Total Revenue in FY2024. This is based on the netback prices of three natural gas benchmarks: Henry Hub (US), European NBP (Natural Balancing Point) and Japan/Korea benchmark (JKM). The netback price takes into account the cost of liquefaction, transportation, regasification and marketing. For the 9M 2022/2023 period from Oct’22 – June’23, the net back price averaged US$5.81/MMBtu, a 10.0% decline from US$6.46/MMBtu in the corresponding comparable period. (Source: Review of the Economy 2023).

Minimum Wage to Increase

The MoF proposed a 17.0% increase in the minimum wage, or $3.00/hour, from $17.50 to $20.50 per hour effective January 1, 2024. According to the MoF, the introduction of the new minimum wage is anticipated to impact approximately 190,000 workers, increasing monthly disposable income by $480 for an individual working a 40-hour week. With the estimated number of persons impacted, this could increase disposable income, all other factors held constant, by approximately $1.1B annually. The net effect of the proposed minimum wage increase remains to be seen.

Property Taxes Coming

The MoF announced that the collection of property taxes is set to commence in FY2024, with Residential Tax being the first segment of Property Tax to be collected. The base for calculating property taxes is the annual rental value (ARV) of a property discounted by 10% (for ‘vacancy’) with the application of a 3% tax on the discounted annual rental value.

Importantly, the MoF noted that of the roughly 600,000 properties on record, 400,000 would fall into the Residential class. Further, the MoF estimated that approximately 50% of Residential properties would be subject to annual Property Tax of between $540 to $1,080. This suggests that 50% of residential property owners would contribute between $108-$216M in property taxes annually, with the remainder of (presumably higher rental value) properties contributing considerably more on an annual basis. The net impact on consumers would be a decrease in disposable income and aggregate consumer demand, while the overall effect on the economy remains unclear.

Future Water, Power Tariff Increases?

The Electricity and Water tariffs are likely to be adjusted with the adoption of a new pricing system as mentioned in the reading of the FY2022/2023 budget. In the FY2023/2024 statement, the MoF alluded to the Government’s continuation of providing utility rebates to lower income and vulnerable groups. T&T’s water rate of US$0.31 per cubic metre is currently the lowest in the Caribbean and the electricity tariff of US$0.052 per kilowatt hour is the second lowest in the Caribbean region. The inevitable outcome of utility rate adjustments could result in a broad inflationary impact leading to increases in the cost of living, coupled with lower disposable income for consumers.

The Bourse View

Despite the modest fiscal surplus recorded in FY2022, the projected estimates for revenue and expenditure for FY2023 and FY2024 indicate a return to budget deficits. While expenditures remain fairly ‘sticky’ in nature, revenues have proven to be more volatile. In the context of a challenging near-term domestic energy production environment, the revenue side of the budget equation will become even more sensitive to changes in global energy prices.

The implementation of property taxes could adversely affect consumer demand. On the other hand, the proposed increase in the minimum wage could potentially increase aggregate disposable income, with the response from those incurring the additional costs (businesses etc.) as yet uncertain. Considering other items in the budget such as the reference to power and water tariffs, as well as the persistent disequilibrium in the foreign exchange markets, investor sentiment may not necessarily have been boosted by the FY2024 fiscal outlook.

For more insight and perspective into (i) how the FY2024 budget could impact investors and consumers and (ii) how investors may want to navigate the current financial markets, join us for our free Bourse Investor Webinar on Thursday October 12th, 2023. Email info@boursefinancial.com to register.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives, or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”