HIGHLIGHTS

Revenue 2023/2024

- Gross Domestic Product:

- FY2022: + 1.5%

- FY2023: + 2.1%

- Revenue:

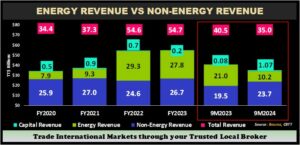

- Total Revenue ↓ 13.6% YoY from $40.5B in 9M2023 to $35.0B in 9M2024

- Energy Revenue ↓ 51.4% YoY to $10.2B in 9M2024

- Non-Energy Revenue ↑ 22.1% YoY to $23.7B in 9M2024

- Capital Revenue ↑ from $85.6M in 9M2023 to $1.1B in 9M2024

Expenditure 2023/2024

- Expenditure:

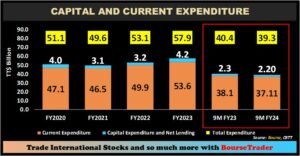

- Total Expenditure ↓2.7% YoY from $39.3B in 9M2023 to $40.4B in 9M2024

- Current Expenditure ↓2.6% YoY from $38.1B in 9M2023 to $37.1B in 9M2024

- Capital Expenditure ↓ 5.2% YoY

- Fiscal Deficit 2023/2024:

- Fiscal Deficit: Estimated at $9.6B

With the Honourable Minister of Finance’s (MoF) slated to deliver T&T’s FY2024/2025 National Budget Statement today, we review some of the key components of the budget equation in anticipation of the fiscal course to be set for T&T. Investors, businesses, and the public alike would be keenly focused on matters of revenue generation, government spending, the fiscal balance and debt management under fairly dynamic economic conditions. For investors, in particular, the fiscal measures outlined for FY2024/25 will be evaluated to determine what, if any, potential impact they may have on financial market performance.

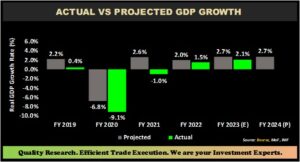

Will Real GDP Remain Positive?

In comparison to the past historical period between FY2019-FY2021, T&T’s Real Gross Domestic Product (GDP) growth has remained relatively positive in recent historical periods, from FY2022 onwards, wherein 1.5% increase in growth was experienced in FY2022 and 2.1% estimated growth in FY2023, according to the International Monetary Fund (IMF). Growth rates were impacted by the volatile energy sector, in terms of production levels and prices, in addition limited monetary policy changes and policies have constrained government’s ability to implement appropriate fiscal measures.

The MoF would have estimated 2.7% GDP growth for both FY2023 and FY2024 in the FY23/24 budget statement. The IMF Staff Report as at June 2024 projected T&T’S real GDP at 2.4% for FY2024, slightly below estimates of the MoF. S&P Global’s rating review in September 2024 forecast T&T real GDP growth of 0.3% in 2024. With energy sector output relatively constrained, the CBTT in its July 2024 Economic Bulletin posited that the non-energy sector would be important to growth, buoyed by consumer demand.

Revenue Dips

Total Revenue for FY2024, initially projected at $54.0B, was adjusted downward to $51.0B ($3.0B less than original estimates) in the Mid-Year Review on June 7th, 2024.

Total Revenue for the first nine months of fiscal 2023/2024 (9M 2023/2024) – based on available data from the Central Bank of Trinidad and Tobago (CBTT)- was $35.0B, 13.6% lower than the $40.5B reported in 9M2022/2023.

Energy Revenue as reported more than halved, declining from $21.0B in 9M2022/2023 to $10.2B. This would most likely be attributable to lower energy commodity prices and subdued domestic energy production. Meanwhile, Non-Energy Revenue (68% of Total Revenue) advanced by $4.3B or 22.1% to $23.7B in 9M2023/2024. According to the CBTT’s Economic Bulletin, July 2024, the proceeds from the sale of CLICO’s subsidiary, Methanol Holdings International Limited (MHIL) in December 2023 contributed to increased Capital Revenue from $81.6M to $1.1B in 9M2023/2024.

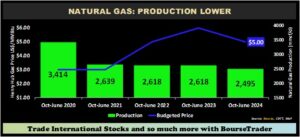

Available data from the Ministry of Energy and Energy Industries (MEEI) showed that natural gas production averaged around 2.5 bcfd during the October-June 2024 period (9M 2023/2024), which was broadly consistent with the MoF’s FY2024 Budget Statement forecast of domestic natural gas production of approximately 2.6 billion standard cubic feet per day (bcfd) in FY2024 and 2.5 bcfd in FY2025. Daily crude oil production in T&T averaged just under 50,000 barrels per day (bopd) for the 9M 2023/2024 period.

On the pricing front, Brent Crude Oil and WTI Crude Oil prices have averaged US$85.98/barrel and US$78.49/barrel respectively. Original estimates from the FY2024 budget were based on a budgeted oil price of US$85.00/barrel – this was further revised down to US$80.25/barrel.

Similarly, the budgeted Natural Gas price was revised to US$3.87/MMBtu, from original estimate of US$5.00/MMBtu. According to the MoF, this is based on the netback prices of three natural gas benchmarks: Henry Hub (US), European NBP (Natural Balancing Point) and Japan/Korea benchmark (JKM). Year-to-date, Henry Hub Natural Gas prices have averaged US$2.42/MMBtu.

Expenditure Remains Sticky

Total Expenditure for FY2024 was originally projected to be $59.2B, revised upward to $60.6B at the mid-year review.

Total Expenditure for 9M24 amounted to $39.3B, fairly consistent with the $40.4B in 9M23. Current Expenditure, a leading component of Total Expenditure, is usually recurrent in nature, non-capital forming and covers government spending on day to day running costs. Capital Expenditure, on the other hand, focuses on long-term asset formation. Current Expenditure, which remained relatively consistent with prior reporting periods, accounted for roughly 94% of Total Expenditure, whereas Capital Expenditure made up 6%, in-line with historical levels. For the first nine months of FY23/24, the allocations of current and capital expenditures stayed mostly unchanged.

A significant portion of Total Expenditure is allocated to Transfers & Subsidies, with a five-year average of 54.2% from FY2019 to FY2023. The share of Transfers & Subsidies in Total Expenditure increased from 51.9% in FY2019 to 56.5% in FY2022, before slightly declining to 55.9% in FY2023. As of the first nine months of FY2023/2024, it represented 55.0% of Total Expenditure. In times of revenue uncertainty, expenditure may be looked at to analyze any possible reductions that could support the fiscal gap.

Fiscal Deficit Widens

As communicated during the Mid-Year Review, the Fiscal Deficit is expected to widen from the initial $5.2B to $9.6B in FY23/24.

S&P Global Ratings latest report on Trinidad and Tobago affirmed the sovereign at investment grade (‘BBB- ‘), noting that the country is expected to experience fiscal deficits amidst low growth with increased debt burden over time. With relatively constant expenditure, the magnitude of deficits will inevitably depend on the ability to stabilize what has been historically volatile revenues, driven by the cyclical energy prices and declining energy production.

Fiscal Deficit Funding Options

With a larger fiscal gap anticipated, the Government has three primary options to address it: (i) Borrowing through debt issuance, (ii) tapping into savings (HSF) and (iii) Monetization of Assets.

Borrowing is readily available option for the Government to fund the fiscal deficit. In reference to the TTD Yield curve and international USD rates, the higher interest rate environment remains a weighing factor on the Government’s cost of borrowing. Nevertheless, the Government issued a number of private placements in 2024 for budgetary purposes and general reasons. In addition, GORTT issued a US$750M USD bond in June 2024 at a rate of 6.40% set to mature in 2034. With USD benchmark rates now on the decline, future borrowings (all other factors constant) from international market may come at potentially lower costs.

The Net Asset Value (NAV) of the Heritage and Stabilization Fund (HSF) stood at US$5.90B as at March 31, 2024, an increase of US$239M from December 2023. As energy production and oil/gas prices continues to fluctuate, a decline in budgeted energy revenue of 10% could produce an opportunity for possible withdrawal from the HSF. Withdrawals from the Heritage and Stabilization Fund provide support once specified criteria set out in Section15 and 15A of the HSF act are satisfied. The conditions for withdrawal states “where the petroleum revenues collected in any financial year fall below the estimated petroleum revenues for that financial year by at least ten per cent, withdrawals may be made from the Fund.”

Asset Sales/Monetization involves the sale of state-owned or private assets to raise capital, a useful option for addressing fiscal shortfalls. In this context, on December 22nd, 2023, the Colonial Life Insurance Company (CLICO) sold its subsidiary, Methanol Holdings International Limited (MHIL) to Consolidated Energy Limited (CEL) effectively relinquishing its control of MHIL. CLICO sold 5,653,700 shares or 56.53% of the issued and outstanding shares in MHIL. The Government of the Republic of Trinidad and Tobago’s (GORTT) owns 49% of share capital of the CLICO.

Fiscal Measures Update

Property Tax Collection Begins

T&T officially began implementing its long-anticipated property tax system. The revenue collected would modernize tax administration and add another tax-based inflow to utilize for expenditure. Since its initially proposed form, the Property Tax Amendment Act of 2024 reduced the tax rate from 3% of Annual Rental Value (ARV) to 2% of the ARV for residential properties. Recently, the MoF announced an extension for property tax payments from September 30th, 2024, to November 29th, 2024.

Additionally, the Government received the green light from the Privy Council to proceed with plans for the Trinidad and Tobago Revenue Authority (TTRA). The TTRA is intended to replace and consolidate the functions of the existing Board of Inland Revenue (BIR) and the Customs and Excise Division, ultimately improving tax collection and compliance. Estimates of the annual domestic tax gap are as high as $10 billion, suggesting that effective implementation of the TTRA could materially improve the revenue side of T&T’s fiscal equation.

Utility Rate Adjustments to be finalized

In the FY2023/2024 budget statement, the MoF indicated that the Government intended to continue providing utility rebates to lower income and vulnerable groups. The Regulated Industries Commission (RIC) proposed electricity rate hikes in the latter part of 2023, recommending an increase in home/domestic electricity bills between 15% to 64% as well as an increase in electricity bills for commercial customers. An adjustment to utility rates would represent a reduction in subsidies, which for electricity has been estimated at $768M annually.

Within the current environment, it is quite likely that new fiscal measures will be put forward to better balance the fiscal equation. We at Bourse take this opportunity to wish the Minister of Finance a successful delivery in the reading of the Fiscal 2024/2025 budget.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives, or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”