| HIGHLIGHTS TTNGL FY 2020 Earnings: EPS 95.2% lower, from $0.84 to $0.04. Performance Drivers: Pandemic-Impacted Demand for NGLs Energy Market dislocation – Lower NGLs prices Outlook: Improving NGLs prices Slow Recovery in NGLs demand Uncertain domestic Natural Gas production horizon Rating: Maintained at NEUTRAL. Energy Prices Update Year to Date Price Performance: WTI Crude ↑ 31.6% Brent Crude ↑29.4% Henry Hub Natural Gas ↑15.2% |

TTNGL Falls as Energy Markets Recover

This week, we at Bourse review the performance of the Trinidad and Tobago NGL Limited (TTNGL) for its financial year ended the 31st of December, 2020. TTNGL declined on account of lower Natural Gas Liquids (NGL) production and prices encountered by its sole investee company, Phoenix Park Gas Processors Limited (PPGPL), which affected the share of profits received. TTNGL also recorded an Impairment Loss on its assets in FY2020, further weighing on its performance. With energy prices recovering sharply since the lows of the COVID-19 pandemic, could TTNGL rebound or are further pressures on the horizon? We discuss below.

Trinidad and Tobago NGL Limited

TTNGL generated Earnings per Share (EPS) of $0.04 for the year ended 31st December 2020, down 95.2% from a previous $0.84. Share of Profit from Investment in Joint Venture (PPGPL) declined 49.5% to $45.6M as Natural Gas Liquids (NGLs) prices – like other global energy prices – collapsed under pandemic-induced uncertainty. Interest Income and Foreign Exchange Gains amounted to a combined $0.35M, 73.5% lower. Cumulatively, Total Income was $45.9M relative to $91.6M in the prior year, down 49.9%. After reporting a $40.0M Reversal Gain in FY2019, TTNGL incurred an Impairment Loss of $38.1M for FY2020, further denting its FY2020 performance. Operating Expenses summed to $1.4M, 18.9% lower than a prior $1.8M. Profit Before Tax was $6.4M a 95.1% decline, following $129.8M in the prior year. Overall, Profit for the Period was $6.4M relative to a prior $129.5M. Excluding the Impairment Loss on the Group’s performance, TTNGL’s estimated Profit for the Period was $44.5M, or an EPS of $0.29.

NGLs Prices Recover

Phoenix Park Gas Processors Limited (PPGPL), the underlying subsidiary of TTNGL derives its profitability primarily through the fractionation and export of butane, propane and natural gasoline. In the first six months of 2020 (H1 2020), the weighted basket of NGLs produced by PPGPL averaged an estimated US$0.57 per gallon, 34% lower relative to a weighted basket price of US$0.87 in the same comparable period in 2019. Recovery was recorded in the last half of 2020 however, with the weighted basket of NGLs averaging US$0.72/gallon, marginally lower than an average of US$0.75/gallon for the same period in 2019. Notably, for the months of January and February 2021, the weighted basket of NGLs averaged US$1.03/gallon, 35% greater than US$0.76/gallon recorded for the same period in 2020. Year to date, weighted basket of NGLs have averaged US$1.05/gallon.

NGL Production, Exports Decline

With demand for NGLs prone to cyclicality, TTNGL has traditionally reported varying production and export volumes for its products. In FY2020, however, the unforeseen economic conditions arising out of the pandemic derailed demand for NGLs and other energy commodities. At the close of 2020, the Export of NGLs by PPGPL stood at 6.5M barrels relative to 8.1M barrels in 2019, a 20.0% decline. Production, meanwhile, stood at 7.2M barrels relative to 8.5M in 2019, down 15%. Natural Gas production in 2020 fell similarly, down 15% from 3.6MMscf/d in 2019 to 3.0MMscf/d in 2020.

NGLs Production, Exports Sluggish in 2021

The most recent Ministry of Energy and Energy Industries (MEEI) data indicates that PPGPL ‘produced’ a total of 1.1M barrels of NGLs in the months of January and February 2021, 20% lower than the corresponding period in 2020. Exports, on the other hand, reported a steeper decline of 32%, primarily linked to no reported exports of natural gasoline in February 2021. The aforementioned improved NGLs pricing environment could potentially offset production/export weakness, if sustained.

The Twin Eagle Wildcard

In February 2020, TTNGL announced the acquisition of US-based midstream operator, Twin Eagle Liquids Marketing LLC (TEL) by its subsidiary company PPGPL. The entity is engaged in the marketing, trading and transportation of NGLs throughout Canada, USA and Mexico, having established pipelines across these territories. With the events of FY2020 likely to have adversely impacted the contribution of TEL to TTNGLs performance, investors will be keenly looking for guidance from TTNGL on the prospects of TEL in a more ‘normal’ 2021 operating environment.

The Bourse View

TTNGL has declined 21.9% year-to-date, currently priced at $13.28 with a price to book ratio of 0.63 times (below its 5-year historical average of 0.83 times). Improving NGLs prices have not yet translated into improved sentiment around the stock, within the context of domestic natural gas production volatility and highly-publicized closures of petrochemicals plants. Notably, most of the previously closed/idled plants have restarted operations.

Economic re-openings could also provide added momentum for energy markets, though at the regional level the resumption of ‘normal’ economic activity remains very much a stop-start affair. Despite the recent disappointment of the much-heralded BHP’s Broadside exploration results to date, several Energy sector projects (once successful) are anticipated to improve Natural Gas production through 2025.

Having lost its appeal as a high-dividend stock in recent times, TTNGL has understandably struggled to retain the confidence of income-oriented investors focused on the short-to-medium term horizon. For the more patient – and perhaps more optimistic – investor, however, consideration might be given as to how to best take advantage of what (if any) recovery in the stock’s fortunes over time. Bourse maintains a NEUTRAL rating on TTNGL.

Energy Prices Show Stabilization

After a particularly volatile 2020, energy prices have shown signs of continued stabilization. Year to date, prices of WTI, Brent and Henry Hub Natural Gas have increased 31.0%, 29.8% and 15.8% respectively. Underpinning the upward price movement are OPEC led production cuts, easing of restrictions and economic recovery, influenced by vaccination campaigns.

According to the US Energy Information Administration (EIA) in its April 2021 Short-term Energy Outlook, WTI is forecast to average US$58.89/barrel in 2021 and Brent Crude is estimated to average US$62.28/barrel for the same period. Henry Hub Natural Gas Price is estimated to average US$3.04/MMBtu in 2021, 49.8% higher than its 2020 level of US$2.03/MMBtu.

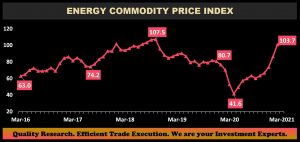

ECPI Records Recovery

The Energy Commodity Price Index (ECPI) is a measure of the average energy prices faced by domestic producers based on T&T’s ten largest energy commodity exports. After experiencing headwinds in energy market conditions in 2020, the ECPI reached a historical low of 41.6 in April 2020 and improved to 73.7 in December 2020. With the rebound in energy prices influenced by vaccination campaigns and supply cuts and contractions, prices trended upwards to end at 103.7 in March 2021.

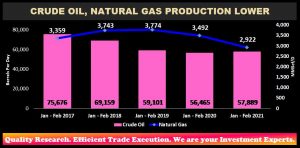

Domestic Crude Oil, Natural Gas Production Lower

In recently published data by the MEEI, domestic Natural Gas production was shown to have averaged 2,922 MMBtu per day in the first two months of 2021 a 16% decline as compared to 3,492 reported in the same period last year. Crude Oil production fared relatively better with barrel per day averaging 57,889 in January to February 2021, 2.5% greater than that reported in the prior corresponding period.

A More Positive Production Forecast?

T&T has installed natural gas capacity utilization of 4.4 billion cubic feet per day (bcf/d), 1.5bcf/d more than production in the first two months of 2021 (2.9 bcf/d). The late Minister of Energy noted in a March interview that production is unlikely to return to 4 billion cubic feet per day until 2025. In the short to medium term, the following projects are anticipated to come on stream to alleviate ongoing production challenges:

- Touchstone Exploration which recently confirmed the presence of liquids rich natural gas through tests on its Cascadura Deep-1 well, noted a peak production of approximately 4,567 barrels of oil equivalent per day and 90% being natural gas. The production rate included approximately 24.5 mmscf/d of natural gas and 477 barrels per day of NGLs.

- Shell’s Barracuda and Colibri, scheduled to come online in 2021 and 2022 respectively, are expected to have a cumulative capacity of 450 mmsfc/d.

- In February 2021, BHP’s Ruby project was reported as being 62% completed, with 100% completion scheduled for the end of the year. Ruby is expected to have capacity of up 16,000 barrels of oil per day and 80 mmsfc/d of natural gas.

- The offshore Cassia C Compression platform project is also forecast to come on stream in 2022. The platform is expected to have throughput capacity of 1.2bcf/d.

- Shell’s Manatee field, viewed as a pivotal component of T&T’s return to full capacity production of natural gas, is projected to come on stream in 2025 with total resources of 2.7 trillion cubic feet of natural gas.

In terms of oil production, recent projections (perhaps optimistically) placed T&T’s crude oil production at over 90,000 barrels of oil per day by 2025, with most of the increase linked to Heritage Petroleum Company Limited.

Market Update

The end of April brings about the start of the Q1 2021 earnings season and the commencement of another phase of lockdown measures, as T&T attempts to navigate a second wave of the virus.

Kicking off earnings season for big banks is First Citizens Bank Limited (FIRST) reporting an Earnings per Share of $1.21 for the half year ended 31st March, 2021, 24% lower than $1.60 recorded in HY 2020. FCB reported a decrease in Total Net Income for the period coinciding with an increase in Impairment Losses. The Group also declared a second interim payment of $0.28 for FY2021, in line with that paid in the same quarter last year.

Parent company of Guardian Holdings Limited, NCB Financial Group (NCBFG) also reported half year earnings with an Earnings per Share of TT$0.11 relative to TT$0.18 in the prior comparable period. The decline in the Group’s performance being attributable to 13.2% increase in its Operating Expenses and a Taxation Expense of TT$151.3M relative to the previous period where a Tax Credit of TT$9M was recorded. NCBFG, declared a dividend payment of JMD$0.50 or TT$0.02 to be paid on the 31st of May, this is the Group’s first payment since March 2020.

Trinidad Cement Limited (TCL) led the Manufacturing Sector into earnings season reporting an Earnings Per Share (EPS) of $0.08 for the first quarter of FY2021 relative to prior $0.01. Improved earnings were linked to an increase in revenue and strengthened margins. Unilever Caribbean Limited (UCL) also reported first quarter results with an EPS of $0.32 relative to a previous $0.17, as the Group continues to record improved margins. A more in-depth review of these companies’ earnings will be published in a subsequent review.

Amid the reinstatement of lockdown measures across T&T for the next three weeks including the closures of restaurants, malls and other recreational locations, corporate entities may face another round of revenue headwind. For banks there may be the potential for Impairment Losses to, remain elevated, while the manufacturing sector and cyclical based entities may face limited demand growth linked to shifts in disposable income. With government revenue generating ability already facing declines owing to challenges in the energy sector, there is limited possibility of stimulus spending aimed at supporting the economy.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”