SFC Advances, CIF Slips

This week, we at Bourse review the six-month results for the period ended June 2017 for Sagicor Financial Corporation Limited (SFC) and provide investors with an update on the Clico Investment Fund (CIF). SFC recorded growth in earnings over the period, with its share price advancing 7.4% year to date. The unit price of CIF, on the other hand, has slipped 8.5% year-to-date, with much of the decline taking place in the recent few weeks.

Sagicor Financial Corporation Limited (SFC)

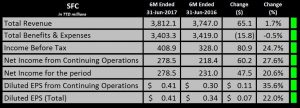

Sagicor Financial Corporation (SFC) reported diluted Earnings per Share (EPS) of TT$0.41 for the six month period ended on June 2017, an improvement of 22% compared to the EPS of TT$0.34 reported for the corresponding period last year. Excluding results from discontinued operations in the prior period, EPS improved 35.6% over the comparable period.

SFC’s generated revenue of TT$3.8B, an increase of TT$65.1M (1.7%). Total Expenses and Benefits declined TT$15.8M to TT$3.4B for the six-month period. Profit before Tax jumped 24.7% to TT$408.9M, while Net Income advanced 20.6% to TT$278.5M from TT$231.0M reported a year earlier. Net Income from continuing operations grew 27.6% over the comparable period.

Outlook

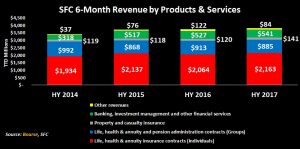

The growth in SFC’s Net Premium Revenue of TT$145M (6.7%) outweighed the TT$80M decline in Net Investment & Other Income, contributing to an overall increase in Total Revenue at the end of the June 2017. The fall in revenue from Net Investment & Other Income was attributed to lower realised investment gains compared to HY 2016.

SFC’s revenue from Life, Health & annuity contracts (individual and group) collectively accounted for 80.0% of total revenue at the end of HY 2017. Revenue from Life, health & annuity insurance contracts related to individuals grew 4.8% year-on-year and accounted for 56.7% of total revenue. Including the Property and casualty segment, revenue from insurance activities grew 2.9% and accounted for 83.6% of total revenue. Revenue from Banking, investment management and other financial services increased 2.6% over the same period in 2016. Notably, however, revenue from this segment has advanced 70.2% since HY 2014 and its contribution to total revenue has expanded from 9.3% in HY 2014 to 14.2% in HY 2017.

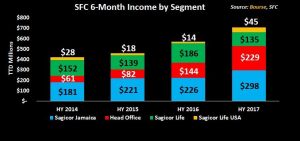

With improvements in its Sagicor Jamaica (TT$72M) and the Head Office operations (TT$85M), SFC reported higher Net Income from Continuing Operations despite the decline in net income from Sagicor Life (TT$51M). Income from the Sagicor Life segment fell 27.4% year-on-year to TT$135M in HY 2017.

The Bourse View

At a current price of $8.30, SFC trades at a trailing P/E of 6.18 times, below the Non-Banking Finance sector average of 10.45 times (exclusive of NEL). SFC offers investors a relatively attractive trailing dividend yield of 4.1%, higher than the sector average of 3.5%. Based on attractive valuations and improving financial performance, Bourse maintains a BUY rating on SFC.

Does the CLICO Investment Fund (CIF) offer value?

Investors would have noticed the sudden decline in the unit price of CLICO Investment Fund (CIF) in recent weeks, which have raised some concerns. One possible explanation for this decline could be the recent rumblings between the shareholders of CLICO and the Government, as both parties battle for control of the fate of CLICO’s assets.

Fund Background

Investors may recall that in December 2011, the Government of Trinidad and Tobago offered a combination of cash, 20 one-year zero coupon bonds with maturities ranging from years 1-10 and Government 11-20 year bonds to investors in exchange for short term investment products (STIPS) issued by CLICO and British American Company Limited. Subsequently in 2012, the Government established the CIF, upon which bondholders of the Government 11-20 year bonds were invited to subscribe for units in CIF at a rate of 40 units per $1,000 of face value.

Initially, 70% of CIF was comprised of Republic Financial Holdings Limited (RFHL) shares, with the remaining assets comprised of Government bonds with a coupon rate of 4.25%. Provision was made for the possibility of CIF comprising of 100% of RFHL shares. The objective of CIF is to hold these assets until the redemption date (January 2nd, 2023). Upon redemption, the Government shall distribute the RFHL shares and other assets in CIF to the unitholders.

As at June 2017, 86% of the assets in CIF was comprised of RFHL shares. Consequently, the performance of RFHL is likely to have a significant impact on the Net Asset Value (NAV) of CIF.

Outlook

Within the space of 23 trading days, the traded price of CIF moved from $22.39 to $20.70 (down 7.5%). The fall in CIF’s price would have coincided with news of CL Financial shareholders and the Government jostling for control of the beleaguered Group’s assets. While this headline noise is likely to have stirred investor confidence, the underlying assets in the CIF have remained relatively stable. For the nine month period ended June 2017, RFHL recorded Earnings per Share of $5.93, an improvement of 5.7% from the comparable period in 2016. RFHL’s dividend payments have remained constant. The dividends received by CIF from RFHL contribute to the total income generated by the Fund. In turn, at least 95% of this income is to be distributed to CIF unitholders.

The Bourse View

Prior to this rapid decline, CIF’s price has traded within a relatively narrow range of $22.31 to $22.80 for the last two years. CIF’s traded price of $20.70 represents a 9.9% discount to its estimated NAV $22.97. The traded price stands at its 4 year low, and has not traded below $20.70 since February 2013. Additionally, CIF has not traded at this magnitude of a discount to its NAV since April 2016. CIF’s trailing dividend yield of 4.73% is the third highest on the market.

On the basis of a significant discount to its NAV, relative stability in the value and cash flows from the assets in the Fund and an attractive dividend yield, Bourse maintains a BUY rating on CIF.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

For more information on these and other investment themes, please contact Bourse Securities Limited, at 628-9100 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”