Sagicor Suffers Loss

| HIGHLIGHTS SFC FY2020

|

This week, we at Bourse review the financial performance of Sagicor Financial Company Limited (SFC) for the financial year ended, December 31st 2020. Just over a year since listing on the Toronto Stock Exchange (TSX), shareholders have had little to cheer with SFC’s share price tumbling from its initial conversion price of C$10.00. In pandemic-stricken 2020, the Group reported a loss on account of increased benefits and losses linked to its associate entity, Playa Hotels and Resorts N.V. Will SFC regain momentum in the months ahead, or will muted financial performance prevail? We discuss below.

Sagicor Financial Company Limited

Sagicor Financial Company Limited reported a Fully Diluted Loss Per Share in FY2020 of US$0.024 relative to an Earnings Per Share of US$0.55 in FY2019. Positively, the Group expanded its Net Premium Revenue by 13.5% to US$1.4B in FY2020. Income generated by investments and assets fell approximately 22.2% year-on-year, as financial market conditions associated with the pandemic affected performance. Additionally, the Group’s Credit Impairment Losses jumped by almost 5 times its FY2019 value (US$4.9M) to US$24.0M in FY2020.

Ultimately, Total Revenue remained fairly resilient increasing 0.6%, supported by growth in its Net Premium Revenue. Total Benefits in the year grew 9.4%, propelled by increases in annuity and life insurance benefits. Total Expenses, however, fell 5.0% primarily due to the non-recurrence of Listing and Other Transaction Costs recorded in FY2019. Share of Operating Loss/Income of Associates and Joint Ventures alongside Loss on Impairment of Investment in Associates and Joint Venture contributed a combined total of US$66.8M. Overall, Income Before Taxes moved to US$27.6M relative to US$163.3M in the prior year.

Adjusting Income Before Taxes for Loss on Impairment of Investment in Associates and Joint Venture, then the Group would have reported a pre-tax Income of US$59.4M, 63.6% less than that reported in the prior year. Income Taxes for the year equated to a cost of US$42.7M, which ultimately led to a Net Loss for the Year of US$15.1M compared to a Net Income of US$104.1M reported in the prior year. Net Income Attributable to Equity Holders contracted by 108.1% from US$44.5M to a Loss of US$3.6M.

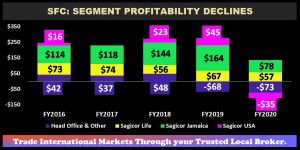

All Segments Decline

Sagicor Jamaica, the largest contributor of the Group’s Income Before Tax, contracted 52.5% in year. Total Revenue generated by this segment was down 14.0% in FY2020. Roughly one fifth of Sagicor Jamaica’s revenue is generated by Fees and Other Revenue (↓22.1% YoY) of this 23% historically is earned through Hotel Revenue. Sagicor Jamaica owns 14.9% of Playa Hotels & Resorts N.V. (Playa) with the pandemic limiting global travel in 2020, the segment recorded not only a decline in revenue from its holding but also an increase in expenses. The pandemic prompted Sagicor Jamaica to record an Impairment Loss of Associates and Joint Venture of US$31.8M and a Share of Operating Loss of Associates and Joint Venture of US$38.2M related to Playa. Ultimately the recording of these cost items, in addition to a decline in revenue generated by Sagicor Jamaica, led to the segment earning an Income before Tax of US$77.8M relative to US$164.0M in FY2019.

Sagicor Life USA reported a Loss Before Tax of US$34.6M in FY2020 a reversal of a prior year Income Before Tax of US$44.8M. Notably, the Total Revenue generated by this segment was 21% higher YoY propelled by a 34% increase in Net Premium Revenue. However, this was accompanied by an increase in Net Policy Benefits (↑54%) and Net Change in Actuarial Liabilities (↑42%). The impact of these aforementioned expenditure items led to a 38% increase in Total Benefits and Expenses which amounted to US$713.6M relative to US$516.7M in FY2019, more than offsetting Total Revenue.

Sagicor Life recorded a 14.0% decline in Income Before Tax moving to US$57.5M from a prior US$66.8M. Comprising of operations primarily in the Southern Caribbean region, Total Revenue generated by this segment was down 1.9% as economic pressures persisted in the year. Total Benefits and Expenses were relatively unchanged at US$469.1M from a previous US$470.0M.

Head Offices and Other recorded a Loss Before Tax of US$72.7M compared to US$68.1M. A decline in Inter-Segment Revenue of 82% from US$41.7M to US$7.7M was primarily responsible for the decrease in segment performance. Total Benefits and Expenses were 13.0% higher.

Playa Holdings Change

Initially holding 20M shares in Playa, on the 15th January, 2021 Sagicor Jamaica sold its entire position in the Hotel Group (20M shares) for a net cash consideration of US$96M. 11,499,000 of its Playa shares were sold via a public offering, while the remaining 8,501,000 shares were subsequently acquired by parent Sagicor Financial Company Limited for a cash consideration of US$5.00 per share less commission expenses (approximately $4.80 per share). The transaction means that the parent company SFC will now have 10,001,000 shares in Playa Hotels & Resorts, with the holdings now classified under Fair Value through Profit and Loss (FVTPL). For investors, this could likely result in (i) a non-recurring loss on disposal from the Playa sale being recognized in Q1 2021, as well as (ii) the recognition of gains through Other Income from the appreciation of Playa shares at the end of Q1 2021 (Playa shares closed Q1 2021 at a price of US$7.30/share).

Regional External Revenues Mixed

Despite economic headwinds, SFC’s USA operations reported an increase in revenue of 15.9%, accounting for 37% of external revenue in FY2020. Individual annuity sales accounts for 90% of Sagicor’s USA operations and within the year the Group was able to expand its consumer base. According to the International Monetary Fund (IMF), the US economy is scheduled to grow 6.4% in 2021. SFC’s growth prospect in the region has been underpinned by the addition of approximately a quarter billion-dollars’ worth of new business production to its US Balance Sheet in Q42020. Additionally, with the Group currently holding a cash base of US$360M, there remains the potential for growth through acquisition activities in combination with organic means.

Jamaica, which contributed to 31% of external revenue, contracted by 12.3% owing to the depreciation of the Jamaican dollar and the impact of the restrictions on the economy’s tourism. The Jamaican economy is forecast to grow by 1.5% in 2021 by the IMF (April 2021 World Economic Outlook) following a 10.2% decline in 2020. Although, Jamaica continues to report a stable flow of remittances, delays in country’s vaccine rollout and tepid demand for global tourism could present challenges to the near term growth potential of SFC in the country.

Trinidad and Tobago (14% of SFC’s FY2020 external revenue) rose 6.8% during the year. Sagicor Life’s pursuit of the insurance portfolios of Trinidad and Tobago domiciled entities, British American Trinidad and Clico, remains ongoing given current litigation matters with the Central Bank of Trinidad and Tobago and Maritime Life (Caribbean) Limited.

Barbados (10% of external revenue) rose 3.7% while Other Caribbean (9% of Revenue) contracted by 13.8%. SFC has exposure to St Vincent and the Grenadines, St Lucia (Other Caribbean) and Barbados, countries which were directly or indirectly affected by the eruption of the La Soufrière Volcano. The economic impact of the eruption could have some effect on SFC’s operations in these regions in the short run, though the Group remains largely focused on Life and Health insurance.

Share Price Lower Despite Buybacks

SFC’s conversion price offered to investors to list on the Toronto Stock Exchange (TSX) in December 2019 was CAD$10.00. Post-listing, the price has trended generally lower. As at the 23rd of April, SFC was priced at CAS$5.95. In effort to provide liquidity to selling shareholders of SFC (which currently trades at 63% of its book value), the Group commenced a share buyback program in June 2020 to purchase up to 8M shares from the market. As at the end of FY2020, 2.94M shares were repurchased, bringing SFC’s share buyback program to 36.8% completion. Notably, despite recording a decline in its price on the TSX, in terms of its TTD, pre-conversion equivalent price, SFC is currently trading at TT$7.46 per share. Pre-announcement of its migration to the TSX, the price on the Trinidad and Tobago Stock Exchange(TTSE) was $7.00. As at the date of ‘suspension’ on the TTSE, SFC was priced at $10.90.

As part of the acquisition by Alignvest Acquisition II Corporation in 2019 and listing on the TSX, SFC was suspended from trading on TTSE. Pursuant to the Securities Act, SFC has now been approved for delisting from the local exchange.

The Bourse View

Sagicor Financial Company Limited is currently priced at CAD$5.95 and trades at a market to book ratio 0.6 times relative to a peer average 1.1 times. The stock offers investors a trailing dividend yield of 4.8% slightly higher than its industry peer average of 4.4%. The Group declared a fourth quarter dividend of US$0.05625, payable on April 21st 2021. As economic conditions continue to (slowly) normalize across SFC’s operating jurisdictions amid ongoing vaccine rollouts, its investment portfolio performance is anticipated to recover. However, the recent resurgence of cases in the Caribbean and the USA could slow the pace of recovery for economies in which SFC operates. On the basis on vaccine rollouts, stabilizing financial markets and consistent dividends but tempered sluggish economic recovery Bourse maintains a NEUTRAL rating on SFC.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”