BOURSE SECURITIES LIMITED

10th June, 2019

Sagicor Shareholders Approve Acquisition, JMMB Advances

This week, we at Bourse provide an update on the progress of the proposed Alignvest-Sagicor transaction, with the shareholder meeting having been held on June 4th, 2019. We also review the latest financial results of Jamaica Money Market Brokers Group Limited (JMMBGL), whose performance will likely be influenced by ‘New Sagicor’ going forward.

Sagicor Financial Corporation Limited (SFC)

Sagicor Financial Corporation Limited (SFC) shareholders gave their resounding support for the proposed acquisition by Alignvest Acquisition II Corporation (AQY), at the Scheme of Arrangement meeting which occurred on 4th June, 2019. Of the shareholders casting their votes in person or by proxy, 94.2% voted in favour of the transaction. This translated to approval from 99.5% of the number of Sagicor shares which were voted at the meeting. SFC Shareholders are reminded that the deadline for submission of the Consideration Election Form is on Tuesday 11th June, 2019. Forms can be easily accessed at www.remotestores.com, and can be submitted via email to legal_election@sagicor.com.

Jamaica Money Market Brokers Group Limited (JMMBGL)

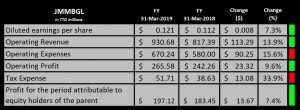

JMMBGL reported Earnings per Share (EPS) of TT$0.12 for the financial year ended March 31st 2019, a 7.3% increase over the EPS of TT$0.11 recorded in the prior year.

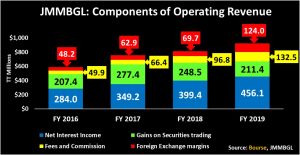

There was a significant improvement in Interest Income in FY 2019 of TT$88.0 M (10.7%), to TT$907.3M from TT$819.4M. Interest Expense also increased 7.5% year-on-year (YoY) to TT$451.3M. Net Interest Income overall improved some TT$56.7M or 14.2% YoY. The Group’s Fee and Commission Income rose 20.1% or TT$12.3M YoY. However, this was offset by a TT$37.1M decline in Gains on Securities Trading, from TT$248.5M to TT$211.4M. Foreign Exchange Margins from Cambio Trading amounted to TT$124.0M, 77.9% higher than that of FY 2018. Fees from Managing Funds also experienced a significant 65.6% increase of TT$23.4M. Overall, Operating Revenue closed at TT$930.7M for FY 2019, 13.9% over the TT$817.4M earned in FY 2018. Despite a 15.6% uptick in Operating Expenses, Operating Profit experienced growth of 9.6% and stood at TT$251.32M for the year. Taxes paid increased 33.9% from TT$38.6M to TT$51.7M, with the Effective Tax rate climbing from 17.2% to 20.6%. Overall, Profit for the Year improved to TT$199.61M, an increase of 7.3% over the profit of TT$186.0M in FY 2018.

Outlook

JMMBGL has improved Operating Revenue by almost 58% over the past three consecutive financial years, from TT$589.5M in 2016 to TT$930.7M. Net Interest Income and Gains on Securities Trading continue to be the major contributors to Operating Revenue, accounting for 49.0% (TT$456.1M) and 22.7% (TT$211.4M) respectively in 2019. Net Interest Income grew 14.2% in FY 2019, supported by a 22.2% expansion in Loans and Notes Receivables and a 5.7% increase in Investment Securities. The TT$113.3M growth in Operating Revenue in FY 2019 was also attributable to a TT$54.3M (77.9%) improvement in Foreign Exchange Margins, as well as an increase in Fees Earned from Managing Funds of 65.6%.

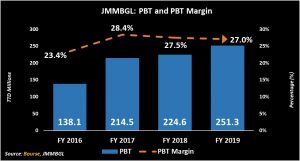

Profit Before Tax (PBT) experienced healthy growth of 11.9% in FY 2019, from TT$224.6M to TT$251.3M, and has recorded steady improvement since FY 2016. PBT Margins, however, have fallen marginally from 28.4% in FY 2017 to 27.0% in FY 2019. This would have been on account of the 15.6% uptick in Operating Expenses fuelled by an 17.8% (TT$43.5M) increase in Salaries and Benefits.

JMMBGL announced on 16th May, 2019, their commitment to invest between US$200M – US$250M in Class B shares of Alignvest Acquisition II Corporation (AQY), the proceeds of which will be used to fund the Sagicor-AQY acquisition. The transaction will ultimately result in JMMBGL owning at least 20% of the ‘New Sagicor’ company. Indeed, JMMGL’s significant financial investment into Sagicor reinforces the group’s growth through acquisition efforts. To put it in context, as US$250M investment is roughly 50% of JMMBGL’s current market capitalization and about 10% of the Group’s Total Assets.

The Bourse View

At a current price of TT$2.09, JMMBGL’s share price has rallied 19.4% YTD. The stock trades at a trailing P/E of 17.3 times, above the Non-Banking Finance sector average of 12.8 times (excluding NEL). The trailing dividend yield is 1.2%, lower than the sector average of 2.9%. The Market to Book ratio of 2.2 is higher than the sector average of 1.4. At these valuations, it would appear that JMMBGL is priced for growth by investors. On the basis of continued core revenue growth and the upside potential from the Group’s stake in ‘New Sagicor’, but tempered by relatively high valuations and a low dividend yield, Bourse maintains a NEUTRAL rating on JMMBGL.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”