Weekly Review

May 18th 2020

Reviewed: RFHL, FIRST and NCBFG HY2020 Performance

This week, we at Bourse review the financial performance of three Banking Sector stocks, Republic Financial Holdings Limited (RFHL), NCB Financial Group Limited (NCBFG) and First Citizens Bank Limited (FIRST) for their half year financial periods ended, 31st March, 2020.

| HIGHLIGHTS RFHL HY2020 · Earnings: EPS fell 30.8% from $4.83 to $3.34. · Performance Drivers: o Increased credit loss expenses due to COVID-19 o Absence of one-off gains experienced in HY2019. · Outlook: o Likely headwinds to growth from (i) faltering loan demand and (ii) potential increase in Credit Loss Expenses. · Rating: Adjusted from BUY to NEUTRAL. FIRST HY2020 · Earnings: EPS improved 2.6% from $1.56 to $1.60. · Performance Drivers: o Improved banking operations and expense management. · Outlook: o Revenue growth risks elevated o Impairment expenses likely to increase · Rating: Maintained at NEUTRAL. NCBFG HY2020 · Earnings: EPS declined 21.1% from $0.24 to $0.19. · Performance Drivers: o Absence of HY2019 one-off gains · Outlook: o GDP contractions in main operating jurisdictions o Muted returns from investment activities o Elevated Impairment expenses · Rating: Maintained at NEUTRAL.

|

The largest stock by market capitalization, RFHL’s performance was negatively affected by a rise in credit loss expenses in light of the economic impact of COVID-19 and the occurrence of one off gains in 2019. Similarly, NCBFG reported a muted performance in HY 2020 on account of one off gains in HY 2019 due to the sale of an associated company. Meanwhile, FIRST recorded a modest improvement to its HY performance, attributed to the performance of its banking operations and expense management strategies.

REPUBLIC FINANCIAL HOLDINGS LIMITED (RFHL)

RFHL reported an Earnings Per Share (EPS) of $3.34 in HY 2020, 30.8% lower than $4.83 reported in HY 2019, with the prior year performance benefitting from a one off net gain of TT$93.1M.

RFHL was able to report a 14.3% YoY increase to Net Interest Income, which stood at $2.03B relative to a prior $1.78B. Other Income of $944.9M recorded a 34.7% uptick. The Group recorded an Operating Income of $2.98B, 20.1% more than $2.48B reported in the same period last year. Operating Expenses for the period suffered a 35.6% increase, incurring a cost of $1.75B, partially due to an uptick in expenditure to protect its staff and clients from the threat of the COVID-19 virus and likely upswings in expenditure resulting from consolidated operations of new acquisitions. Operating Profit for the period stood at $594.6M compared to $1.0B in HY 2019. Importantly, HY 2019 included a significant one-off gain related to the write back of retirement benefits.

Excluding this one-off gain in HY 2019, Operating Profit would have improved 3.0%. Credit Loss Expense recorded a significant increase in HY 2020, as the Group has set aside provisions of $367.7M to account for potential losses arising out of current economic conditions. Profit Before Taxation (PBT) stood at $844.1M in HY 2020, 42.5% lower than $1.47B recorded in HY 2019. On an adjusted basis, PBT in HY 2019 amounted to $1.03B. Even after adjustments, HY 2020 PBT would have fallen an estimated 18.0% YoY.

In HY 2020, Taxation Expenses recorded by RFHL amounted to $235.4M, with the Effective Tax Rate being 27.9%. Net Profit after Taxation (PAT) for the period was $608.7M, 26.7% less than the $830M recorded in the prior period.

Operating Income Surges

Having completed the acquisition of the Bank of Nova Scotia’s operations in Anguilla, Dominica, Grenada, St. Lucia, St. Kitts & Nevis, St. Vincent & The Grenadines and St. Maarten as at the 1st November, 2019, RFHL was able to benefit from an inorganic boost to Operating Income for the HY 2020 period. With the consolidation of these entities to RFHL’s financial statements in HY 2020, the Group recorded a 20.1% increase to Operating Income for the period. Other Income, which accounts for 32% of the Group’s Operating Income, grew 34.6% in the period while Net Interest Income, which comprises the other 68%, grew 14%.

RFHL’s inorganic growth drive is set to continue into 2020, as the Group’s acquisition of Scotiabank’s banking operations in the British Virgin Islands is in progress, pending requisite regulatory approval.

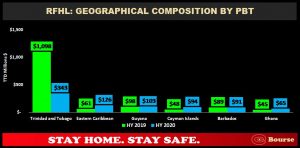

RFHL reported a contraction in the performance of its domestic operations as PBT from Trinidad and Tobago moved from $1.1B in the prior period to $343M. The decline in performance has been attributed to two primary factors; firstly, the absence one off gains as experienced in HY 2019 resulting from the Write-back of Post-Retirement Medical Benefits amounting to $438M and secondly a significant increase to Credit Loss Expenditure for HY 2020, $220M more than that recorded in the prior period.

RFHL would have recorded a significant uptick across operations in the Eastern Caribbean and Cayman Islands, benefitting from the Group’s inorganic growth within these regions through acquisitions.

COVID-19 Affects Operations

The COVID-19 virus has forced the closure of borders and inhibited the operations of business across most industries. Consequently, businesses and individuals alike would have experienced a contraction in their flows of income. In the context of a considerably more challenging operating environment, RFHL could confront headwinds to growth through (i) a likely decrease to its top-line performance as loan demand falters and (ii) potential further increases to Credit Loss Expenses.

In Trinidad & Tobago, the Central Bank of Trinidad & Tobago has acted to boost liquidity in the banking system by reducing the reserve requirement ratio to 14% from a prior 17%, increasing the funds available for lending to the public by commercial banks by an estimated $2.6B. From a lending perspective, reducing the repo rate to 3.5% from 5% has signalled lower interest rates for would-be borrowers. Although borrowing conditions have improved, it remains to be seen whether these changes would stimulate economic activity in an environment riddled with financial uncertainty.

The Bourse View

At a current price of $132.50 and having appreciated 1.0% year to date, RFHL trades at a trailing P/E of 16.0 times, above the sector average of 13.9 times and offers a trailing dividend yield of 2.9%, relative to a sector average of 4.5% (3.7% excluding special dividends). The Group took a prudent approach, given the prevailing uncertainty, to reduce its interim dividend payment to $0.60 from a previous $1.25 as COVID-19 continues to dampen the economy. Based on above average valuations and adverse economic conditions, Bourse adjusts its rating on RFHL to NEUTRAL.

FIRST CITIZENS BANK LIMITED (FIRST)

First Citizens Bank Limited (FIRST) reported Earnings per Share (EPS) of $1.60 for the six months ended 31st March, 2020, a 2.6% improvement from $1.56 recorded in the previous year.

Net Interest Income advanced 7.9% for the period from $793.5M to $856.3M, while Other Income slipped 2.9% to $323.3M. Subsequently, Total Net Income stood at $1.2B, a 4.7% increase Year on Year (YoY) from $1.1B. Impairment Expenses Net Recoveries amounted to $27.3M, significantly higher than $0.1M for HY 2019, mainly driven by an expected credit loss for Other Financial Assets of $5.9M as compared to an expected credit write back of $17.7M in the previous year. Expenses also increased to $583.3M (up 3.5%) resulting in an Operating Profit of $569M, a 1.0% improvement from the prior period.

Share of Profit in Associates and Joint Ventures remained relatively flat at $10.3M, resulting in a Profit before Taxation (PBT) of $579.3M, 1.0% higher than $573.4M recorded in HY 2019. The Effective Tax rate was marginally lower for the period, moving from 31.1% to 30.2%. Overall, Profit after Taxation (PAT) stood at $404.4M, up 2.4% from $394.9M for the prior comparable period. FIRST’s improved results for the period were attributed to the performance of its banking operations and expense management strategies. As such, increased profitability for the period was reflected by an efficiency ratio of 49.2%, lower than the prior year’s ratio of 50.2%.

PBT Trends Upward

Over the past four year periods, FIRST’s PBT has trended modestly upwards with a Compound Annual Growth Rate (CAGR) of 4.9%. For HY 2020, PBT was marginally higher, increasing 1.0% to $579.3M. Retail & Corporate Banking continues to be the Group’s largest segment (62% of PBT) and has consistently improved from HY 2017 to HY 2020, contributing $499M for the period, 6% higher YoY. On the other hand, Treasury & Investment Banking (32.7% of PBT) remained relatively flat at $262.9M for the period, 0.1.% lower than 2019. The smallest segment, Trustee & Asset Management (5.3% of PBT) recorded marginal growth of 1% in its PBT contribution, moving from $42.6M to $43.1M.

Up until HY 2019, FIRST’s Expected Credit Losses moved in tandem with its Loans to Customers from HY 2017. Despite the YoY increase in Loans to Customers for HY 2019 from $15.8B to $17.6B, the Group’s Expected Credit Losses plummeted from $47.1M to $0.1M on account of write backs associated with obtaining restructured instruments from the Government of Barbados. However, provisions were increased to $27.3M in HY 2020 (a 27x increase) alongside a 10.5% uptick in customer loans to $19.5B.

Looking forward, FIRST’s Net Interest Income could become challenged as (i) the Group (like other banks in the sector) has deferred loan payments for three months to those customers who meet the relevant requirements and (ii) there is a heightened possibility of default on loan payments for those who do not meet requirements amidst halted business operations and a surge in unemployment levels. The Group’s Expected Credit Losses are at risk of rising.

COVID -19 Impact

FIRST’s HY 2020 results may not have fully reflected the effects of COVID-19. In response to the Government’s request to banks to make provisions for the impact of the pandemic, the Group has employed a number of measures (effective for at least 3 months) including:

- With respect to credit cards- interest rate reduction to 1.67% per month, the deferral of monthly payments for the period and the waiver of late fees.

- A cut in the Group’s prime lending rate from 9.5% to 7.5%, effective March 20, 2020. Loan instalments will be deferred, with the commensurate waiver of penalty charges/fees for customers of good standing.

- The waiver of rental fees on the Point of Sale terminals at Merchants for the period.

- Other customizable provisions including specific relief and/or additional working capital facilities (especially for critically affected industries) and flexible payment options. The Finance Minister announced that the Government will execute a $300M loan programme for Small and Medium Enterprises (SMEs) through First Citizens Bank, whereby all of the interest and part of the collateral would be subsidized.

The implementation of these measures may have a mixed impact on the Group going forward. Against the backdrop of the economic downturn resulting from the global pandemic, Standard and Poor’s has downgraded its T&T sovereign credit rating to BBB- , which has led to the decline in FIRST’s rating to BBB- from BBB.

The Bourse View

At a current price of $43.28 (down 2.7% YTD), FIRST trades at a Trailing P/E ratio of 14.3 times, above the Banking sector’s average of 13.9 times. The stock also offers a Trailing Dividend Yield of 3.7%, below the sector’s average of 4.6% and in line with the sector’s average excluding special dividends of 3.7%. This comes as the Group has opted to reduce the second interim dividend for the 6-month period from $0.46 to $0.28 per share in light of the current economic conditions surrounding COVID-19. On the basis of fair valuations and a modest improvement in performance, but tempered by the potential impact of COVID-19 on its operations, Bourse maintains a NEUTRAL rating on FIRST.

NCB FINANCIAL GROUP LIMITED (NCBFG)

NCB Financial Group Limited (NCBFG) recorded an EPS of TT$0.19 for the six months ended 31st March, 2020 a 21.1% decline from an EPS of TT$0.24 recorded in HY 2019.

The Group reported Net Interest Income of TT$1.3B, a 40% increase from $952M recorded in HY 2019, meanwhile Net Fees and Commission Income for the period grew 39% YoY to stand at TT$544M, both on account of the consolidation of GHL’s operations. Gain on FX and investment activities experienced a TT$283M decline relative to the same period last year due to heightened volatility within financial markets in light of the COVID-19 pandemic. Nevertheless, Net Result from Banking and Investment Activities rose 22%, reporting a figure of TT$1.9B.

Net Results from Insurance Activities was a significant contributor to performance in HY 2020, reporting an income contribution of TT$2.6B compared to TT$1.5B in the previous comparable period. This uptick is performance was primarily attributed to the consolidation of NCBFG’s majority holding of GHL on its financial statements. Overall, Net Operating Income stood at TT$2.6B a 50.1% improvement from the prior year (due to the GHL consolidation), while Operating Expenses rose 61.0% at TT$2.0B for similar reasons.

Overall, Operating Profit was reported at TT$675.5M, 23% more than that recorded in the prior comparable period. Profit Before Taxation fell 15.5% relative to HY 2019, with NCBFG not benefiting from any one-off gain from the sale of a subsidiary as enjoyed in the prior comparable period. Nevertheless, the Group was able to benefit from TT$9.7M tax credit in HY 2020, pushing its Net Profit for the Period to TT$635.8M, 7.6% greater than HY 2019. Overall the Group recorded a Net Profit Attributable to Shareholders of TT$455.7M, a 23.1% decline from HY 2019, meanwhile Net Profit Attributable to Non-Controlling Interests grew to TT$180.2M, a result of claims of minority shareholders to GHL’s profit.

Operating Profit Trends Higher

NCBFG’s previously owned a 29.97% stake in GHL (acquired in 2016) was increased by a further 31.99% in May 2019, bringing its ownership stake to 61.97%. Therefore, with HY 2020 reporting NCBFG’s performance post consolidation, it is not comparable with any prior period.

With all divisions of GHL’s operations now being absorbed into NCBFG’s financial statements, all revenue driving components of Operating Profit recorded significant growth with the exception of Gains on FX and Investment Activities, which faced headwinds due to the volatility within financial markets caused by the COVID-19 virus.

The Group’s largest segment, Life Insurance & Pension Fund Management (32.3% of Operating Profit), increased 13.6% from the HY 2019 to HY 2020. The Wealth, Asset Management & Investment Banking segment improved 19.1%, the Corporate Banking segment increased 20.1% and the General Insurance segment would have been boosted significantly from TT$19M to TT$118M. The consolidation of GHL’s results would have been a major driver for this improvement, leading to a 24% increase in overall Operating Profit YoY.

Meanwhile, the disruption to various sectors of the economy including Tourism, Manufacturing, Transport and Logistics on account of COVID-19 is expected to dampen operations of NCBFG’s business segments which have exposure to these economic impacts. The Treasury & Correspondent Banking segment experienced a decline of 7.3% YoY as investment activities and gain on foreign currency were negatively impacted by losses on equity securities and a fall in the income of foreign exchange. The Consumer and SME segment experienced an Operating Loss of TT$13M for HY 2020 as compared to its TT$30M Operating Profit in the prior year period.

COVID-19 Impact

As the IMF projects severe contractions in GDP for the Caribbean region, NCBFG’s operations within these jurisdictions such as Jamaica, Bermuda, Barbados, the Cayman Islands and T&T are expected to be impacted with its largest contributor (75%), Jamaica, projected to experience a decline in Real GDP of 5.6% for 2020. The economic slump has already begun impacting the Group for Q2 2020 through losses on foreign currency and investment activities, heightened credit impairment losses, reductions in fee and commission income and decreases in the carrying values of investment securities. NCBFG has already implemented some measures to assist its clients during the pandemic including temporarily waving bank transaction fees, deferment of loan payments and the use of technology to conduct certain transactions electronically.

The Bourse View

At a current price of TT$7.48 (down 31.1% YTD), NCBFG trades at a Trailing P/E ratio of 14.7 times, above the Banking sector’s average of 13.9 times. The stock also offers investors a Trailing Dividend Yield of 1.7%, below the sector’s average of 4.6% (3.7% excluding special dividends). On the basis of growth via the consolidation of GHL but tempered by poor valuations and the impact of COVID-19 on the Group’s operations, Bourse maintains a NEUTRAL rating on NCBFG.

For more information on these and other investment themes, please contact Bourse

Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

Disclaimer: This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.