Republic, NCBFG Record Lower Profits

HIGHLIGHTS

NCBFG FY 2020

- Earnings: EPS fell 34.9% from $0.57 to $0.37

- Performance Drivers:

- Consolidation of GHL’s operations ▲

- Declines in Gains on Foreign Currency and Investment Activity ▼

- Higher Credit Impairment Losses ▼

- Absence of one off gains recorded in 2019 ▼

- Outlook:

- Possible headwinds to organic growth amid adverse economic conditions

- Potential increases to Credit Impairment Losses

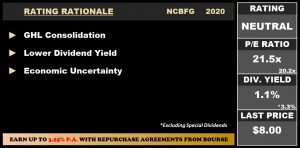

- Rating: Maintained at NEUTRAL.

RFHL FY 2020

- Earnings: EPS contracted 43.1% from $9.73 to $5.54

- Performance Drivers:

- Escalated Credit Loss Expense ▼

- Absence of one off gains experienced in 2019 ▼

- Impairment of Commercial Banking Activities in Barbados ▼

- Outlook:

- Likely headwinds to growth from potential increase in Credit Loss Expenses

- Geographical expansion from Acquisition Activities

- Rating: Maintained at NEUTRAL.

This week, we at Bourse review the financial performance of the Caribbean’s largest indigenous banks, NCB Financial Group Limited (NCBFG) and Republic Financial Holdings Limited (RFHL) for the year ended September 30th 2020. NCBFG’s earnings fell year-on-year (YoY), having been shorn of several one-off gains recorded in 2019, while being partially offset by the consolidation of GHL’s operations. RFHL, meanwhile, reported lower earnings on account of reduced operating income, impairment costs and the absence of one-off gains recorded in the prior period.

NCB Financial Group Limited (NCBFG)

NCBFG reported an Earnings Per Share (EPS) of TT$0.37 for the Financial Year ended September 30th 2020 (2020), 34.9% less than the EPS of TT$0.57 reported in 2019. The Group’s core Revenue driver, Net Interest Income, grew 17.7% YoY to TT$2.4B from a previous TT$2.1B. Net Result from Banking and Investment Activities were relatively unchanged, 0.5% lower (TT$3.51B) from a prior TT$3.53B. Net Result from Insurance Activities expanded from TT$663.9M in 2019 to TT$1.5B in the current period (+124.9%), bolstered by NCBFG’s consolidation of Guardian Holdings Limited (GHL). Overall, Net Operating Income improved by 19.4%, to TT$5.0B from a previous TT$4.2B. Operating Expenses increased 26.0% to TT$3.8B, influenced by Finance cost.

Share of Profit of Associates moved from TT$133.3M to TT$14.4M, an 89.2% reduction with GHL no longer being accounted for as an associate company. Profit Before Tax was $1.3B, 26.6% less than $1.7B recorded in 9M 2019. On an after-tax basis, Net Profit attributable to Equity Holders fell 36.1% to $878.2M. Excluding one-off gains of TT$379.4 recorded in 2019, Net Profit attributable to Equity holders would have declined by 11.7% YoY.

GHL’s Consolidation Boosts Income

Net Operating Income for the Group has consistently increased between 2017 to 2020. Effective May 2019, NCBFG increased its stake in GHL from a previous 29.97% to 61.97%, resulting in the consolidation of GHL’s performance with the rest of the NCBFG Group. Net Operating Income expanded 19.4% in 2020, primarily driven by inorganic growth from Insurance Activities (Net), the biggest beneficiary from the consolidation, which advanced 124.9% to $1.5B, for the period under review.

Net Interest Income, which accounts for 48.2% of Net Operating Income, increased 17.7%, mainly attributable to the integration of a full year of GHL’s financial results and a 7.1% growth in NCBFG’s loan portfolio. Similarly, Net Fee and Commission Income grew 11.4%. Meanwhile, Gains on Foreign Currency and Investment Activities (8.1% of Operating Income), declined 42.9% YoY, on account of subdued trading activity and heightened volatility in financial markets in early 2020 and a depreciation (9.7% YTD) of the Jamaican Dollar. With declines in the investment activities and escalated Credit Impairment Losses offsetting increased Net Interest Income, Net Result from Banking and Investment Activities remained relatively flat, down 0.5%.

Only two of NCBFG’s seven segments recorded YoY improvements, bolstered by GHL’s operations. Life and Health Insurance and Pension Fund Management, which accounts for 60.7% of Operating Profit, experienced an increase of 26.6%, to record a profit of $1.2B in 2020. General Insurance (15.9% of Operating Profit) expanded by 166.5%. This would have been related directly to the acquisition of GHL and subsequent consolidation.

The Bourse View

NCBFG is currently priced at $8.00 and trades at a price to earnings ratio of 21.5 times, relative to a sector average of 20.2 times (excluding FCI). The stock offers investors a trailing dividend yield of 1.1% relative to the Banking Sector average of 3.3% (excluding special dividends).

With economic uncertainty being a likely driver of weaker performance in the coming quarters, tempered by the Group’s potential realization of synergies with recently acquired Guardian Holdings Limited, Bourse maintains a NEUTRAL rating on NCBFG.

Republic Financial Holdings Limited (RFHL)

RFHL reported a Diluted Earnings Per Share (EPS) of $5.54 in 2020, 43.2% lower than $9.73 reported in 2019. RFHL was able to report a 4.7% YoY increase to Net Interest Income, which stood at $4.0B relative to a prior $3.8B (on an unadjusted basis). Other Income fell to $1.7B, a 15.5% decline, again, before adjustments. Operating Income marginally fell by 2.3% to $5.7B. Operating Expenses for the period increased 23.2% to $3.6B, partially due to higher costs to protect its staff and clients from the threat of COVID-19, expenditure resulting from consolidated operations of new acquisitions and the impairment of RFHL’s commercial banking operations in Barbados.

Operating Profit for the period stood at $2.1B, compared to $2.9B in 2019 (27.6% lower). Credit Loss Expense expanded by 174.6%, as the Group set aside provisions of $621.2M to account for potential losses in the current economic environment. Profit Before Taxation (PBT) stood at $1.5B, 45.3% lower than $2.7B in the previous period. Excluding the impact of one-off items which occurred in 2019, Profit Attributable to Equity holders of the Parent reportedly declined by $593.6 million or 39.6%. Without adjustments, Net Profit Attributable to Equity Holders of the Parent contracted by 42.8% to $904.1M.

Operating Income Edges Lower

During FY 2020, RFHL completed the acquisition of Scotia Bank’s operations in St. Maarten and the Eastern Caribbean on November 1st 2019 and Scotiabank’s operations in the British Virgin Island on June 1st 2020. With the consolidation of these entities in RFHL’s Financial Statements in FY 2020, RFHL recorded a 4.1% increase in Net Interest Income (FY 2020: $4.0B), which accounts for 70.1% of Operating Income. Excluding these acquisitions, Net Interest Income would have decreased by 3.1% YoY, attributable to reduced interest rates on loans, volatility in financial markets and higher borrowing costs and lease liabilities (IFRS 16).

On the other hand, Other Income contracted by 15.5% in 2020 to $1.7B. In 2017 RFHL would have benefitted from a Post-Retirement Medical Benefits (PRMB) Write-back which was not repeated in the current period. Excluding this benefit and the aforementioned acquisitions, Other Income would have declined by 1.2% YoY, owing to reduced/waived fees and commissions and lower transaction volumes. The decline in Other Income outweighed the increases in Net Interest Income and as a result, Operating Income declined 2.3%, after rising for 3 consecutive periods (2017 – 2019).

RFHL recorded contractions in its operations with PBT declining 45.8% to $1.5B in the period under review. The operational decline has been attributable to three primary factors; firstly, the absence of one off gains from a Write-Back of PRMB in 2019, heightened credit loss expenditure for 2020 ($395.0M higher) and Impairment of Goodwill of RFHL’s Commercial Banking Operations in Barbados in the context of adverse economic conditions.

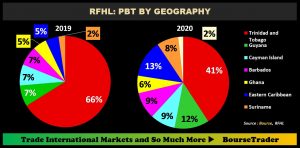

PBT from Trinidad and Tobago, RFHL’s main operating jurisdiction (40.8% of PBT) declined by 66.3% YoY to record an amount of $569M. PBT from Guyana (12.2% of PBT) contacted by 10.8%. The Eastern Caribbean Islands and Suriname saw a 52.9% and a 76.8% increase in PBT whilst The British Virgin Island accounted for $25M, collectively representing 22.5% of PBT.

The Bourse View

At a current price of $133.03 and having appreciated 1.4% year to date, RFHL trades at a trailing P/E of 24.0 times, above the sector average of 20.2 times (excluding FCI). The stock offers a trailing dividend yield of 2.0%, relative to a sector average of 3.3% (excluding special dividends). The Group took a prudent approach, given the prevailing uncertainty, to reduce its final dividend payment to $2.10 from a previous $3.25. Collectively, RFHL’s total dividend payment for 2020 amounted to $2.70, 40% lower than 2019. RFHL’s Total Assets expanded by 19.2% to stand at $104.3B, reflecting growth from acquisition activities and the Group continues to remain well capitalized in the volatile economic environment. RFHL’s President and CEO recently noted that the effects of COVID-19 could weigh on the Group’s performance for at least another year, signaling to investors that earnings could remain challenged despite vaccine hopes. On the basis of the geographical diversification of operations but tempered by relatively high valuations and adverse economic conditions, Bourse maintains a NEUTRAL rating on RFHL.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”