BOURSE SECURITIES LIMITED

15th April, 2019

OCM struggles, AHL improves

This week, we at Bourse review the performance of two companies within the Manufacturing 1 sector – One Caribbean Media Limited (OCM) and Angostura Holdings Limited (AHL) – for their financial years ended December 31st 2018. While OCM’s profitability continued to be affected by adverse regional economic conditions and changing industry trends, AHL benefitted from improvements in international exports and domestic sales. We discuss the performance of each company and provide an outlook.

One Caribbean Media Limited (OCM)

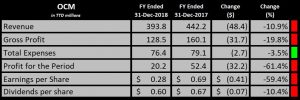

One Caribbean Media Limited (OCM) reported Earnings per Share (EPS) of $0.28 for financial year (FY) ended 31st December 2018, a 59.4% reduction from the EPS of $0.67 reported in FY 2017.

OCM generated Revenue of $393.8M in FY 2018, an 11.0% decline from the $442.2M reported in FY 2017. Gross Profit fell $31.7M, from $160.1M to $128.5M, resulting in a decrease in Gross Profit Margin from 36.2% to 32.6% for the year. Total Expenses incurred during the year amounted to $76.4M, representing a moderate 3.5% decline year-on-year (YoY). However, Impairment Losses on Financial and Other Assets were reported as $17.3M, almost doubling the 2017 figure of $8.8M. OCM’s Share of Profit from Associate and Joint Ventures improved by $3.1M YoY, from $1.2M to $4.3M. Profit Before Tax amounted to $38.2M, a significant 47.4% drop from the previous year’s results. Taxation expense fell to $17.9M from $20.0M, with an increase in the Effective Tax rate from 27.7% in 2017 to 47.0% in 2018. Overall, Profit for the Year closed at $20.2M, a 61.4% reduction from the $52.4M reported in 2017.

Outlook

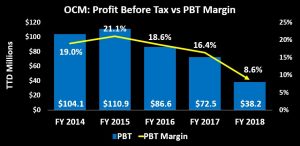

OCM continues to grapple with challenges to profitability, recording a steady decline in Profit Before Tax (PBT) and the PBT Margin over the past three years. PBT reduced to $38.3M in FY 2018, approximately one-third of the PBT recorded in FY 2015. PBT Margin fell from 16.4% in FY 2017 to 8.6% in FY 2018. Revenue generation remains highly influenced by the cyclicality of media events such as sporting and election activity. Furthermore, profitability has been adversely affected by a more competitive market environment due to the growing popularity of more cost effective advertising through social media and other digital avenues. This was compounded by adverse economic conditions in its operating jurisdictions, specifically Trinidad and Tobago and Barbados. According to the Chairman, the Group has embarked on strategic transformational initiatives to improve operational efficiency and to take advantage of the new digital landscape. The Group would have absorbed the one-off and restructuring costs associated with these ventures in 2018, ultimately contributing to the decline in profitability. Looking forward, the Group expects to benefit through foreign exchange earning potential from its 55% shareholding in One Caribbean Flexipac Industries and Solutions Limited which should be operational by Q3 2019.

The Bourse View

At a current price of $10.15, OCM’s share price has retreated 1.4% year-to-date. OCM’s trailing P/E is 36.3 times, above the Manufacturing 1 sector average P/E of 22.5 times (excluding GML and UCL) and the stock’s three-year average of 26.6 times. The stock currently offers a trailing dividend yield of 5.9%, above the sector average of 4.6% (excluding GML and UCL). OCM’s trailing dividend payment has declined to $0.60 from $0.67 per share in 2017 and has a current payout ratio of 214.3%. On the basis of OCM’s continued economic challenges and relatively high valuations but tempered by an above average dividend yield and the prospect of higher revenue through restructuring and new developments, Bourse maintains a NEUTRAL rating on OCM.

Angostura Holdings Limited

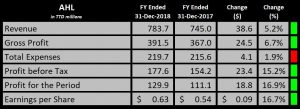

Angostura Holdings Limited (AHL) reported Earnings per Share (EPS) of $0.63 for the FY ended 31st December 2018, up 16.7% from the EPS of $0.54 reported in FY 2017.

Revenue for the year improved 5.2% from $745.0M in FY 2017 to $783.7M in FY 2018, attributable to a change in accounting procedures to include excise tax in Gross Revenue. Gross profit increased by $24.5M, amounting to $391.5M. Gross profit margin rose marginally to 50.0% compared to 49.3% in 2017. Higher Selling and Marketing Expenses (up 16.0% or $20.3M) was offset by an $11.0M or 13.6% drop in Administrative Expenses. Other Expenses also declined by $4.7M or 70.4% YoY, from $6.6M to $2.0M. Profit Before Tax (PBT) closed at $$177.6M, up 15.2% from the previous year’s comparative figure of $154.2M. PBT margin for the period increased slightly from 21% in 2017 to 23% in 2018. Overall, Profit for the Year amounted to $129.9M, 16.9% or $18.8M improvement YoY.

Outlook

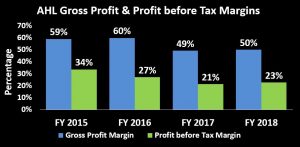

Following a strategic shift in 2017 – to downsize the unprofitable Commodity Trade segment, while focusing on marketing to build the global profile of Branded products – AHL has experienced an improvement in Revenue. This growth filtered into FY 2018, with Revenue generated from the Branded Trade segment (95.6% of total Revenue) expanding 6%, from $707.0M in 2017 to $749.1M in 2018. In contrast, Revenue from the Commodity Trade segment amounted to only 4.4% (or $34.6M) of Total Revenue in FY 2018 and has consistently fallen over the past three years.

AHL’s Gross Profit Margin has shown marginal growth from 49% in FY 2017 to 50% in FY 2018. PBT Margin, which has experienced a downward trend over the past two years, has recovered moderately in FY 2018, up to 23% from 21% (FY2017). The Group has undertaken various marketing initiatives mainly to boost its global exports, the costs of which have ultimately tempered profitability in FY 2018. The benefits of such activities have materialized through increased international Bitters sales and could continue to translate into revenue growth going forward. Furthermore, through the potential for higher USD earnings from international operations, AHL will earn valuable foreign currency.

The Bourse View

At a current price of $16.00, AHL trades at a trailing P/E of 25.4 times, above the Manufacturing 1 sector average of 22.5 times (excluding GML and UCL). The stock offers a trailing dividend yield of 1.5%, below the sector average of 4.6% (excluding GML and UCL). On the basis of a strong international brand with USD earnings and improving profit margins, but tempered by a relatively low dividend yield and above-average valuations, Bourse maintains a NEUTRAL rating on AHL.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”