MASSY, AMCL Earnings Decline

| HIGHLIGHTS

MASSY HY2020 · Earnings: EPS down 9.4% from $2.66 to $2.41. · Performance Drivers: o One-off cost of $24M from the transfer and pending sale of a subsidiary. o Lower Investment Income due to the downturn of financial markets · Outlook: o Likely headwinds to growth in the countries of operations due to COVID-19. · Rating: Downgraded from BUY to NEUTRAL.

AMCL Q12020 · Earnings: EPS fell 68.4% from $0.79 to $0.25 · Performance Drivers: o Dampened financial markets. o Adverse economic conditions. · Outlook: o Potential headwinds to profitability due to altered consumer spending patterns amid economic uncertainty. · Rating: Maintained at NEUTRAL.

|

This week, we at Bourse review the financial performance of two stocks in the Conglomerate Sector, Massy Holdings Limited (MASSY) for the half year period ended March 31st, 2020 and Ansa McAL Limited (AMCL) for the first quarter ended 31st March, 2020. MASSY’s performance was reportedly affected by several one-off events as well as a general slowdown from COVID-19. Similarly, AMCL’s performance was negatively impacted by COVID-19 restrictions and the subsequent headwinds to financial markets.

MASSY HOLDINGS LIMITED (MASSY)

Massy Holdings Limited (MASSY) reported a Basic Earnings per Share (EPS) of $2.41 for the half year ended March 31st 2020 (HY 2020), 9.4% lower than the EPS of $2.66 for HY 2019. The Group generated Revenue of $6.3B, a 2.6% improvement from $6.2B for the prior year. MASSY managed to grow revenues across its main portfolios (Integrated Retail, Gas Products and Motors & Machines) in Q2 2020 despite the sale of MASSY Security Guyana and Massy Technologies Applied Imaging in 2019 and the transfer of Seawell Air Services to a buyer, with pending approval of the sale transaction from the Barbados Fair Trade Commission. Operating Profit after Finance Costs fell 10.9% for the period, from $401.7M to $358.1M. Share of Results of Associates and Joint Ventures also experienced a 26.8% decline from $46.4M to $34.0M.

Profit Before Tax (PBT) shed 12.5%, falling from $448.2M to $392.1M which was reflective of two ‘extraordinary’ events. Firstly, the transfer and pending sale of Seawell Air Services led to a loss of $24M due to severance costs and an impairment on the value of the assets that were transferred. Secondly, Investment Income generated by Massy United Insurance Limited and TIRCL (captive reinsurance) investment portfolios were suppressed by the downturn in US Stock Market share prices in Q2 2020 amidst the backdrop of uncertainty surrounding COVID-19. While described as extraordinary, fluctuations in assets prices are generally viewed as part of normal operational performance. As a result, the combined marked-to-market loss in value incurred was $34.9M.

According to the Group, PBT excluding ‘extraordinary’ items would have improved by 0.6% or $2.8M. Despite a lower Income Tax Expense of $161.3M from $ 129.4M, partly due to lower tax rates in Barbados, the Group recorded a Profit for the Period of $262.7M down 8.4% from the prior year.

Segment Analysis

The Group’s three main portfolios recorded an improved performance for HY 2020. The largest segment, Integrated Retail (42% of PBT), contributed $200M to PBT, 9% higher than HY 2019 with stay-at-home restrictions causing an uptick in demand for grocery items. Part of the increase in grocery goods may have come in the form of demand being ‘pulled’ forward, with hoarding and panic-buying being observed as COVID-19 uncertainty increased.

Gas Products (23% of PBT) generated PBT of $110M, a 14% increase Year on Year (YoY) driven by an increase in demand for packed Liquefied Petroleum Gas (LPG), Oxygen and Nitrogen. According to the Group, this was partially reflective of changes in consumer patterns and higher healthcare expenditure surrounding COVID-19. The result was commendable, one delivered despite a 6% decline in Third Party Revenue due to a decrease in volumes demanded from hotels and restaurants amidst COVID-19 restrictions. Motors & Machines (17% of PBT) grew 7% for the period, recording a PBT of $83M notwithstanding the loss of about a week of sales during March in T&T and Colombia as the automotive dealership and rental services were temporarily shut down.

The Information Technology & Communications (ITC) segment generated PBT of $29M, 5% higher than the previous year as technology and remote transactions/services were of high importance on account of COVID-19 lockdown restrictions. Meanwhile, the Financial Services segment and the Strategic & Other Investments segment both contracted significantly for HY 2020, declining 43% and 72% respectively.

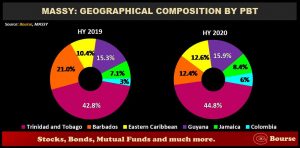

Trinidad and Tobago continues to be MASSY’s core profit region by PBT (44.8%) and contributed $214M to PBT, 3.3% lower YoY. The second largest contributor to PBT for HY 2020 however was Guyana (15.9%), replacing Barbados from the previous year, which now contributes 12.4% as compared to 21.0% in 2019. The Group reported growth in Jamaica, the Eastern Caribbean and Colombia with PBT improving 9.9%, 11.4% and 67.2% respectively.

COVID-19 Impact

During the month of March, all of MASSY’s operating jurisdictions initiated different levels of lockdown restrictions and prohibitions to non-essential business activities. The Group was able to stay operational for the most part, with the majority of its businesses being classified as essential and services such as online ordering, curb side pickup, home delivery and remote working having been implemented.

Presently, many countries which MASSY operates in have begun slowly easing restrictions and reopening their economies. The Group, however, is likely to face some headwinds to performance as regional economies are now expected to contract significantly in 2020 (with the exception of Guyana, projected to grow 53% in FY2020). The reality of a post COVID-19 world, opened but without a vaccine, is one in which global demand and tourism activity will likely remain muted.

On a positive note, the recovery of financial markets in the past few weeks could lead to a reversal of fortunes in the performance of the Financial Services segment should asset values stabilize or continue to improve.

The Bourse View

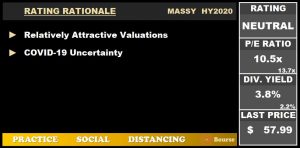

At a price of $57.99, MASSY currently trades at trailing P/E of 10.5 times, below the Conglomerate sector average of 13.7 times. The stock also offers investors a trailing dividend yield of 3.8%, above the Conglomerate sector average of 2.2% despite the Group’s decision to declare a Half Year Dividend of $0.50, 9% lower than the prior year’s payment of $0.55. On the basis of relatively attractive valuations, but tempered by a less than favourable outlook driven by COVID-19 in the Group’s operating jurisdictions, Bourse downgrades its rating to NEUTRAL on MASSY.

ANSA MCAL LIMITED (AMCL)

Ansa McAL Limited (AMCL) reported a Diluted Earnings per Share (EPS) of $0.25 for the first quarter (Q1) of 2020, 68.4% lower than an EPS of $0.79 reported in Q1 2019. Revenue for the period was marginally lower in Q1 2020 to stand at $1.5B, a 0.2% ($3.1M) Year on Year (YoY) decline. Operating Profit fell 62.7% to $77M in Q1 2020, in comparison to $206.4M reported in the previous period. Finance Costs grew by $13.9M (or 121.5%), to $25.3M. Share of Results of Associates and Joint Venture Interests grew by $8.4M to $16.4M in Q1 2020. Profit Before Tax (PBT) experienced a 66.5% reduction for the period, from $202.9M to $68.0M. The Group recorded Taxation expenditure of $23.5M, with the Effective Tax Rate moving from 22.5% to 34.5%. Resultantly, Profit for the Period stood at $44.6M, down 71.7%, in comparison to $157.4M reported in Q1 2019. Overall, Profit Attributable to Equity holders amounted at $42.7M, down 68.5% from a previous $135.6M which was recorded in Q1 2019.

Segment Analysis

Of its four operational segments, Ansa McAL recorded the largest decline in performance from Insurance & Financial Services. Being largely prone to shifts in the economy, this segment shrunk an unprecedented 155% to end the first quarter of 2020 with a Loss Before Tax of $47M relative to a Profit Before Tax of $86M in the prior comparable period. The swing in profitability was likely impacted by the steep decline of financial markets, as well as increasing credit loss expenses as the Group proactively accounts for the higher likelihood that clients may not be able to meet interest payments.

Acquisition initiatives appear to remain underway. In December 2019, the Group acquired Barbados-based Trident Insurance Company Limited. The acquisition of Bank of Baroda Trinidad Limited by Ansa Merchant Bank Limited (AMBL) remains ongoing subject to the approval of regulatory requirements.

Manufacturing, Packaging and Brewing was also negatively affected by the implications of COVID-19 measures as manufacturing plants were forced to shut their doors for approximately 6 weeks. Like most other regionally focused companies, the effects of COVID-19 are likely to be extended as economies contract and demand comes under pressure. With the recovery of financial markets in Q2 2020 (so far), AMCL’s Insurance and Financial Services segment may benefit from a reversal of fortunes in its next reporting period.

The Bourse View

At a current price of $54.50, AMCL trades at a trailing P/E of 17.0 times, above the Conglomerate sector average of 13.7 times. The stock offers investors a trailing dividend yield of 0.55%, well below the average of its industry peers of 2.21%. This is in large part due to AMCL’s prudent decision to not pay a final dividend for FY 2019. On the basis of ongoing acquisition activity, but tempered by relatively high valuations and adverse economic conditions, Bourse maintains a NEUTRAL rating on AMCL.