BOURSE SECURITIES LIMITED

28th August 2017

Market Reacts to Lower Earnings

This week, we at Bourse take a closer look at how investors, through stock price movements, have responded to companies’ earnings reports for the recently concluded quarter ended June 2017. We focus on trends in overall profits after tax and earnings per share (EPS) growth for each index for the period January 2017 to June 2017 and provide some insight into how investors may make adjustments to their portfolios.

Stock market flat

Year-to-date, the Trinidad and Tobago Composite Index (TTCI) has advanced 2.3%. The limited upward movement of the TTCI continues to be supported by the positive contribution of the Cross-Listed Index, (up 17.5% YTD), which has outweighed the All T&T Index’s downward move (down 2.3% YTD).

In terms of individual stock performance, National Commercial Bank Financial Group Limited (NCBFG) was the best performing security, advancing 64.0% year-to-date. NCBFG’s market capitalisation now accounts for 10.0% of the TTCI. Guardian Holdings Limited (GHL) stock remains a major mover in 2017, advancing 30.4% YTD, with a market capitalisation of 3.2%. On the opposite end, National Flour Mills Limited (NFM) and One Caribbean Media Limited (OCM) recorded the biggest price declines of 16.7% and 25.1% respectively. Republic Financial Holdings Limited (RFHL) and First Citizens Bank Limited (FIRST), however, account for 13.8% and 6.6% of the TTCI’s market capitalization respectively. RFHL (down 6.0% YTD) contributed to a weighted average return of -0.8% while FIRST (down 9.5% YTD) pulled the TTCI down by 0.6%.

Revenues grow, EPS falls

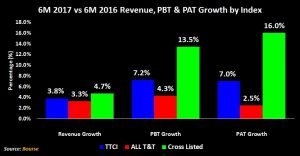

On aggregate, companies on the TTCI experienced revenue growth of 3.8% for the period January to June 2017 versus the comparable 2016 period, accompanied by profit before tax (PBT) growth of 7.2% and profit after tax (PAT) growth of 7.0%. Locally listed companies, represented by the ALL T&T index, saw revenues improve by 3.3%. PBT increased 4.3% while PAT also moved up 2.5%. Cross-listed companies fared better, with revenues improving 4.7% while PBT moved up 13.5%. Cross-listed PAT grew 16.0% for the period.

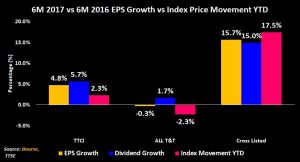

From an earnings per share (EPS) perspective, however, local corporate performance was moderately higher. On aggregate, the TTCI experienced an increase in EPS of 4.8%, while dividends grew 5.7% and the TTCI advanced 2.3% YTD. Companies in the ALL T&T Index faced a 0.3% decline in EPS, compared to an improvement in dividends of 1.7%. The ALL T&T Index fell 2.3% YTD. Cross-listed companies reported EPS growth of 15.7% for the period, coupled with dividend growth of 15.0%. The cross-listed index advanced 17.5% YTD.

The EPS growth and index movement is broadly consistent with the economic realities locally and abroad. The Trinidad and Tobago economy continues to grapple with subdued activity and foreign exchange shortages. This, coupled with higher corporate taxes, would have weighed on the performance of local companies. Regionally, cross-listed companies have benefited from improving macroeconomic fundamentals, particularly in Jamaica. This has fuelled both EPS growth and investor confidence through higher valuations, reflected in the continued ascent of the Cross-Listed Index.

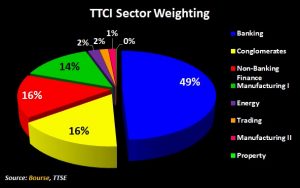

Sector Performances follow Corporate Earnings

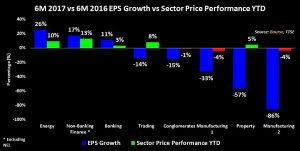

The Energy sector, comprised solely of Trinidad and Tobago NGL Limited (TTNGL), was the best performing from an EPS growth perspective, increasing 26%. TTNGL would have benefitted from improved product prices for the six month period in 2017 over the comparable period in 2016. The sector (represented by TTNGL’s price) advanced 10% YTD.

The Non-Banking Finance sector experienced EPS growth of 25%, (excluding NEL). The sector’s price performance (up 13% YTD), was driven by Guardian Holdings Limited (GHL), JMMB Group Limited (JMMBGL) and Sagicor Financial Corporation (SFC). Most companies within the sector reported significant fair value gains in the investment portfolios.

Banks continued to show resilience in a restrained environment. For the period under review, banks saw increases in EPS by 11%. NCBFG was the best performer, with EPS growth of 47%. Other notable improvements in EPS stemmed from RFHL (5%) and Scotia Bank Trinidad and Tobago Limited (SBTT) (8%). The sector climbed 3% YTD.

Conglomerates recorded a 15% fall in EPS. GraceKennedy Limited saw the biggest decline in EPS (down 23%). The two other groups within the sector (AMCL, MASSY) also experienced declines in EPS.

All companies in the Manufacturing 1 sector faced declines in earnings. Within the sector, weighted EPS dipped 30%. Guardian Media Limited (GML) experienced the largest dip in EPS (down 117%), followed by Unilever Caribbean Limited (UCL) (down 71%). Trinidad Cement Limited (TCL), which constitutes the majority of the Manufacturing 2 Sector, experienced a reduction in EPS of 86%. TCL continues to face competition from other regional players, while demand for cement has contracted locally.

Investor Implications

With the results for the first half of 2017 now in, investors may be considering what, if any change in investment strategy is needed.

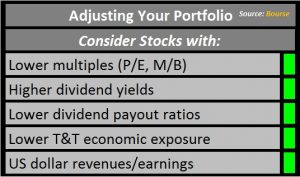

Some themes which may help to preserve/enhance a portfolio in current conditions include seeking stocks that (i) have relatively low valuations (low P/E multiples, market-to-book values etc.), (ii) offer above-average dividend yields, (iii) have the ability to preserve dividend payments (low dividend payout ratios), (iv) have lower business exposure to Trinidad and Tobago and (v) offer an implicit/explicit hedge against the TTD (USD revenues/earnings).

Investors might also consider Bourse’s Investment Themes:

(i) Lengthen Your Investment Horizon

(ii) Diversify Across Asset Classes

(iii) Diversify Across Geographic Regions

(iv) Diversify Across Currencies

(v) Target Positive Inflation Adjusted Returns

Whether you are positioning your investments to best navigate the prevailing conditions, or taking a longer-term approach to investing, it always makes sense to consult a trusted and experienced advisor, such as Bourse, to make more informed investment decisions.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”