BOURSE SECURITIES LIMITED

2nd March, 2020.

Markets Crash Amidst COVID-19 Chaos

International equity markets endured a difficult week, with investors seemingly sent into panic mode by the potential impact of the Novel Coronavirus, referred to as COVID-19. Since its emergence in Wuhan, China, the virus has quickly spread to over 47 countries, with a reported 83,000 cases and over 2,800 confirmed deaths. Despite a relatively low fatality rate, COVID-19’s high infection rate has led to fears of a broad slowdown in global economic activity. Will this be just another speedbump in an otherwise smooth road for equity markets over the past few years, or could COVID-19 cause more serious damage to investor portfolios?

Global Markets Lower

COVID-19’s financial market impact has been at a global level. Regional Exchange Traded Funds (ETFs) have tumbled in the past week, reflecting considerable worry among investors.

The SPDR S&P 500 ETF Trust (SPY), which mirrors the performance of the S&P 500 Index, experienced a week on week (WoW) correction having fallen 11.2%. The iShares Latin America 40 ETF (ILF), which replicates the performance of Latin American markets with a heavy weighting in Brazil, experienced a week on week decline of 9.9%. The Vanguard FTSE Europe Index Fund ETF (VGK) European markets fell 10.0% WoW as the COVID-19 continues to spread within the region. Italy has now reported the largest number of confirmed cases outside of Asia. Despite being at the epicentre of the virus, the iShares MSCI All Country Asia ex Japan ETF (AAXJ) declined 4.4%.

All US Market Sectors fall

All 11 sectors of the US S&P500’s Index declined over the past week, with the hardest hit sectors being Financials, Energy and Materials. Anticipated lower economic activity and severe disruptions to supply chains would have stoked concerns of weaker corporate performance. The Energy Select Sector SPDR Fund (XLE) fell 16.4%, while the Financial Select Sector SPDR Fund (XLF) slipped 13.6%. The Materials Select Sector SPDR Fund (XLB), meanwhile, fell 12.6%.

Airlines, Cruise Stocks hit hard

With increasing worry related to travel and news of cruise ship passengers being quarantined because of COVID-19, Airline and Cruise line stocks felt the brunt of investor fears in the past week.

American Airlines Group (AAL) delivered the worst performing US Airline performance, dropping 31.5% over the past week. Other major airline stock declines included United Airlines Holdings (UAL) and JetBlue Airways (JBLU), falling 21% and 23.4% respectively.

Major Cruise ship stocks also declined during the week, despite a price rally on Friday. Carnival Corporation & Plc (CCL), Norwegian Cruise Line Holdings Ltd. (NCLH) and Royal Caribbean Cruises Ltd. (RCL) were pummelled by investors, falling 19.7%, 20.7% and 24.2% respectively WoW.

Energy

Stocks within the energy sector declined as investors reacted to the impact of COVID-19 on global energy demand. Familiar names within the Trinidad & Tobago energy landscape such as Royal Dutch Shell (RDS-B) fell 10.1% over the week, with BP Plc (BP), BHP Group (BHP), EOG Resources Inc. (EOG) and Methanex Corporation (MEOH) declining 11.5%, 14.1% 14.8% and 15.6% respectively.

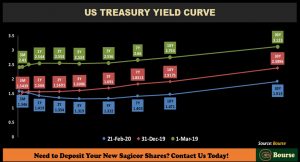

US Treasury Curve Inverts…again

The US Treasury Yield Curve has again inverted amid uncertainty by investors about the spread of the coronavirus (COVID-19) and its impact on global growth. The yield curve inverted between the 3-month to 10-year, with the 10-year Treasury Yield surpassing its lowest level since July 2016. The 10-year has fallen 128.2 basis points year-on-year (y-o-y) from 2.75% on 1st March 2019 to 1.47% at the end of February 2020 and 44.7 basis points since the start of the year. Investors wishing to earn higher yields by investing in longer dated US Treasuries have experienced a fall of 120.8 basis points in the yield of the 30-years US Treasury from 3.12% on 1st March 2019 to below 1.91% at the end of February 2020.

Markets expect US Interest Rate Cut

Market Participants have increased their expectation for a cut in US interest rates by the Federal Open Market Committee (FOMC) of the US Federal Reserve (Fed) at its next meeting in March 2020. The probability of a 25 basis point (0.25%) cut in US interest rates is currently 73%.

Any cut to support economic activity, while usually positive for markets, could also signal to investors the magnitude of COVID-19’s anticipated impact on global growth.

Investor Positioning

Investors large and small will undoubtedly be considering the next steps in adjusting their international portfolios. The elevated climate of uncertainty has the capacity to unnerve even the calmest heads. So, just how should you be responding to this latest international development? As always, it depends on your capacity to take risk.

For the Conservative or Low Risk investor, the current market volatility is usually best avoided. This may be as simple as doing nothing, if you are already on the investing ‘sidelines’ or if you are invested in instruments such as money market mutual funds, repurchase agreements or other low risk solutions. For the low risk investor with some exposure to international equity markets, the prudent approach might be exiting the market for now.

For the Moderate or Medium Risk investor, the best course of action might be to ride through the volatility. It is still fairly early to determine the severity and length of the impact that COVID-19 could have on the global economy and financial markets. Accordingly, the Moderate investor might be minded to avoid cutting losses, but at the same time not want to risk adding additional exposure to international equity at this time.

For the Aggressive or Higher Risk investor, the recent sharp market correction could be viewed as an opportunity to add stocks to your portfolio. Many blue-chip companies have experienced double-digit declines in the past week, putting them at fairly attractive levels. While it is not clear whether the market has ‘bottomed out’ with the latest correction, the higher-risk tolerant investor may be inclined to begin acquiring stocks which have undeservedly taken a beating in the latest market meltdown.

As always, it makes good sense to consult with an expert investment adviser such as Bourse to make the most informed investment decision.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”