BOURSE SECURITIES LIMITED

January 29th, 2018

A look at Conservative Investing

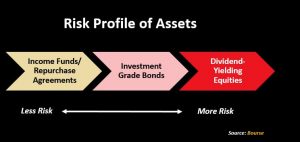

This week, we at Bourse discuss some of the options available to the conservative investor. Risk-averse individuals – with the main objective of preserving capital – gravitate towards leaving money in a bank account as a conservative and passive form of savings. There are, however, several opportunities in the local environment which provide low-risk avenues to earning higher returns.

Conservative Investing

Investors who seek stability, or little to no volatility when investing are characterized as conservative investors. Conservative investing employs a strategy that focuses on income generation and capital preservation.

Conservative investors usually opt for securities that are liquid, that is, securities that can be easily converted to cash without any significant diminution in value. Thus conservative investors show a preference for securities such as fixed income and money market securities, repurchase agreements and may even include a minor allocation to stable dividend paying shares. Conservative investors can consider either short-term or longer-term investments, given their specific needs.

Money Market Funds (Income-oriented Funds)

Money market or income-oriented mutual funds are among the lower end in the risk spectrum. This type of investment can serve short-term and emergency cash needs, as well as provide an element of stability to help diversify your portfolio. Money market funds contain relatively low-risk holdings, as compared to equity type funds. An investor seeking stable income and high liquidity could consider investing in a money market or income-focused mutual fund.

Money market mutual funds offer investors better returns (ranging from 1.25% to 1.75% on TTD denominated accounts and 0.80% to 1.50% on USD denominated accounts) than ordinary savings accounts, which are approximately 0.2%. Investors seeking access to this short-term instrument may do so through one of the various money market funds available, such as the Savinvest Investment Income Fund (managed by Bourse).

Repurchase Agreements

Repurchase agreements, commonly referred to as Repos, are another type of short-term investment, which offer higher rates than traditional savings accounts or money market funds. Repos are generally suitable for clients with lower liquidity needs, that is, clients who are able to commit their funds for a period of time in order to achieve a higher rate of return.

Repos are similar in nature to fixed deposits, providing a fixed rate of return over a specified period of time. The investment period can be customized according to the investor’s needs and usually ranges from 3 months to 3 years.

The principal or initial investment in a repurchase agreement is fully collateralized by financial securities such as bonds and equities. In other words, in the unlikely event that the repo seller is unable to repay the investor’s principal at maturity, the assets can be sold to recover the investment.

The return on Repos may range from 1.50% to 2.75%, depending on the length of investment, amount to be invested and type of collateral used. Several providers, including Bourse, offer repurchase agreements to investors.

Bonds

A bond is a fixed income instrument in which a lender (investor) loans money to a borrower (bond issuer). In general, bonds pay a fixed interest payment to the investor until the bond matures and at maturity, the investor’s principal or face value is repaid in full.

Bonds are often medium-term investments (greater than three years). Bonds provide more attractive returns, typically above those offered by money market funds and repurchase agreements.

Different bonds often have different levels of risk, which is usually reflected in its credit rating. A bond’s credit rating is a measure of the issuer’s ability to repay its debt and is usually assigned by rating agencies such as Moody’s and Standard & Poor’s (S&P). Credit ratings can be classified into two broad categories, investment grade (issuers with a strong capacity to meet financial obligations) and high yield (issuers with a weaker capacity to meet financial obligations). Conservative investors, preferring to minimize risk, would tend to opt for investment grade bonds.

Investment grade bonds currently offer investors yields ranging from 3.5% to 5.0%, depending on an investor’s time horizon, risk tolerance (preference for investment grade vs high yield bonds) and availability of currency (TTD or USD).

Dividend-Yielding Stocks

Stocks are traditionally not considered to be conservative investments, given the potential for a loss in value should stock prices decline. Although stocks are viewed as higher risk, a strategy of investing in stocks with (i) relative price stability and (ii) consistent dividend payments is becoming more popular as a relatively conservative investing option. This strategy tends to be favoured especially in low-interest rate environments. Investors could consider stocks with the following characteristics when looking for stability:

- An attractive dividend yield with relatively low to moderate dividend pay-out ratio. Additionally, stocks which pay dividends frequently (two to four times per year) are attractive for investors seeking steady income from their portfolio.

- Attractive valuations (low price-to-earnings multiples) relative to the company’s competitors or industry average. Low valuations provide a buffer against potential for steep price declines.

- Stable earnings with modest long-term growth.

Investor Considerations

Investors should always consider their return requirements, investment horizon and liquidity needs to better determine the suitability of investments for their portfolio. It makes sense to have your money work for you by investing it rather than leaving it in a savings account, as long as you are comfortable with your investment choices.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”