HIGHLIGHTS

Local Markets

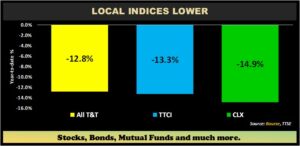

- 9M2024 Performance:

- TTCI ↓ 13.3%

- All T&T ↓ 12.8%

- CLX ↓ 14.9%

- Performance Drivers:

- Resilient Earnings

- Weak Investor Sentiment

- Outlook:

- Economic Normalization

International Markets

- 9M 2024 Performance:

- US Markets – S&P 500 ↑ 20.8%

- European Markets- MSCI Euro ↑ 9.0%

- Asian Markets – MXASJ ↑ 17.4%

- Latin American Markets – MSCI EM ↓ 16.0%

- Performance Drivers:

- Cooling Inflationary Pressures

- Geopolitical Tensions

- Outlook:

- Increased Economic Activity

This week, we at Bourse review the performance of local and international stock markets for the first nine months of 2024 (9M2024). With mixed earnings results locally, stock prices continue to be impacted by tepid investor confidence. Meanwhile, international equities were broadly higher, fuelled by strong corporate earnings and US interest rate cuts. Will markets improve in the upcoming months?

Local markets lower

For the nine-months ended September 30, 2024 (9M2024) all major indices of the Trinidad and Tobago Stock Exchange (TTSE) remained in negative territory. The All Trinidad and Tobago Index (All T&T) fell 12.8%, while The Cross Listed Index (CLX), which includes some of the top publicly traded regional companies, fell 14.9% during the current review period. The Trinidad and Tobago Composite Index (TTCI) declined 13.3% to close at 1052.80. The overall volume leader on the First Tier Market for the first nine-months of 2024 was MASSY Holdings Limited (MASSY), totaling 24.1M shares traded at the value of TT$95.8M.

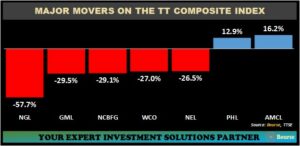

Major Movers

In a year thus far marked by limited stock advances, Prestige Holdings Limited (PHL) increased 12.9% year-to-date (YTD), with Ansa McAL Company Limited (AMCL) advancing 16.2%.

Major decliners for 9M2024 included Trinidad and Tobago NGL (NGL, â 57.7%), Guardian Media Limited (GML, â 29.5%), NCB Financial Group Limited (NCBFG, â 29.1%), West Indian Tobacco Company Limited (WCO, â 27.0%), and National Enterprises Limited (NEL, â 26.5%).

US stocks climb higher

US equity markets, as gauged by the S&P 500, rose 20.8% for the nine months September 30, 2024, with all sectors trading in positive territory year-to-date.

The Utilities Sector (XLU) (↑27.6%) and Communication Services (XLC) (↑24.4%) led overall gains in the S&P 500 performance, backed by solid earnings and AI-driven interest. The Financial Sector (XLF) and Industrials Sector (XLI) also rallied 20.5% and 18.8% respectively in 9M2024. The Energy Sector (XLE) is the sole sector that recorded a single digit gain of 4.7% for the period under review.

Analysts expect the Federal Reserve’s communicated rate cuts could boost U.S. growth, encouraging investors to buy shares of regional banks, industrial companies, and other beneficiaries of a strong economy and lower rates. Analysts from Goldman Sachs raised the S&P 500 year-end 2024 target to a level of 6,000 from 5,600 implying an upside of 4.1% from September 30th closing level of 5,762.

European Markets Broadly Higher

European markets, as measured by the MSCI Europe Index, rose 9.0% in 9M2024 relative to 6.2% in 9M2023. European stocks experienced strong performance, driven by growth in the information and communication sectors and increased investor sentiment across regional economies. Spanish shares increased by 18.6%, benefiting from rising export products and services. Italian equities rose 13.4% compared to a 17.7% gain in the prior period (9M2023). German and English markets yielded returns of 13.0% and 11.9%, respectively. France equities increased 2.1%, compared to 8.9% in 9M2023.

Asian Markets resilient

Asian equities overall performance was broadly positive. The Asia (excluding Japan) index expanded by 17.4% in 9M2024, relative to a decline of 2.7% in 9M2023. Chinese stocks grew 26.1%, from a prior decline of 9.2%, driven by wide-ranging fiscal policy stimulus measures. Similarly, Hong Kong equities rose 24.5% compared to a decline of 10.2% in the prior reporting period. Amidst improved economic conditions, Taiwanese equities surged by 19.8% owing to increased export sales. Indian equities advanced 15.9% due to growth in public infrastructural investments and an increase in private real estate investments. South Korea declined 4.1%, lagging its peers, amidst lower global exports.

Latam markets mixed

The Latin American region grappled with adverse economic conditions, with Latin equities down 16.0%, from a prior 8.1% advance in 9M2023. Peruvian shares led the region, increasing 15.3%. Chilean equities rose 2.6%. Colombian equities gained 0.7% in 9M2024, while Brazilian equities fell 12.5%, with Mexico equities lagging its peers, down 21.2%.

Investor Considerations and Outlook

Locally, investor sentiment remains subdued despite generally resilient corporate earnings reported from several major companies on the Trinidad and Tobago Stock Exchange (TTSE). A moderate level of economic uncertainty continues to linger likely owing to contractions in the domestic energy sector despite growth experienced in the non-energy sector. Over the medium term, several planned projects such as the Dragon Gas Field, Cocuina-Manakin Gas field as well as Shell’s Manatee Project are expected to improve production levels of natural gas. Overall, energy production volumes are anticipated to remain relatively subdued until the latter half of the decade.

The Honourable Minister of Finance (MoF) in his FY2025 Budget Statement estimated real GDP growth of 1.9% for the fiscal year 2024. The World Bank in its October 2024 economic review projects growth in Latin America and the Caribbean at 1.9% in 2024, increasing to 2.6% in 2025, with Trinidad and Tobago real GDP growth estimated at 2.2% in 2024 and 2.3% for 2025.

The correction in market prices led to an improvement in valuations of local equities. For the investor with a longer-term time horizon, these conditions are often attractive for adding quality assets to a portfolio. The tried and tested long-term investment approach, focusing on companies with (i) solid business models, (ii) sustainable competitive advantages, (iii) attractive valuations, and (iv) credible growth prospects continue to be a valuable strategy.

Global markets continue to strengthen after providing strong gains in the first nine months of 2024, primarily due to solid corporate profitability, the beginning of central banks’ interest rate cut cycles, and improved investor confidence – as fears of an economic recession dwindled.

The U.S Federal Reserve (FED) began cutting interest rates in September 2024 and intends to continue with additional cuts through the remainder of 2024 and into 2025. Also likely to influence market sentiment in Q4 is the escalating conflict in the Middle East, as well as upcoming US Presidential elections in November 2024 which could have significant implications for geopolitical relations and trade policies.

Diversification across sectors and asset classes remains an effective strategy for reducing overall portfolio risk. Investment vehicles such as Exchange Traded Funds (ETFs) or equity mutual funds provides a simpler, more accessible way to achieve broad market diversification. Investors can also consider ETF’s which diversify by sector, country or even investment region (Asia, Latin America, US, Europe etc.). Investors who prioritize securing their principal and have a lower risk tolerance can consider Repurchase agreements and cash or near-cash holdings like income mutual funds, where investment capital is exposed attributed next to no capital risk.

As always, investors should speak with a reliable and knowledgeable advisor like Bourse to make more informed investment decisions.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase, or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives, or agents, accepts any liability whatsoever for any direct, indirect, or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”