BOURSE SECURITIES LIMITED

12th June, 2017

TTNGL – Then and Now

This week, we at Bourse discuss the now-open Additional Public Offering (APO) of TTNGL. In the Mid-year budget review, the Honourable Minister of Finance indicated that The Government of the Republic of Trinidad and Tobago (GORTT) would make an offer for an additional sale of its shareholding in TTNGL, through its nominee, The National Gas Company of Trinidad and Tobago Limited (NGC). A total of 40,248,000 class B shares is being offered to the public at a price of TT$21.00 per share. We review the performance of TTNGL and its investee company – Phoenix Park Gas Processors Ltd (PPGPL) – since its Initial Public Offering in 2015.

TTNGL’s Financial Performance

The financial performance of TTNGL and its profits available for distribution depends directly on the performance of its sole investee company, Phoenix Park Gas Processors Ltd (PPGPL), of which TTNGL owns 39%.

Performance drivers of PPGPL

PPGPL’s main business involves the processing and fractionation of natural gas liquids (NGLs), which includes propane, butane and natural gasoline.

The main performance drivers of PPGPL include (i) NGLs prices, (ii) Gas Inlet Volumes, (iii) Gas ‘Richness’, (iv) Export of NGLs from PPGPL and (v) Operating Margins.

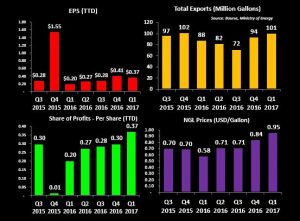

(i) NGLs Prices

From the Prospectus of the TTNGL APO, NGLs prices received by PPGPL declined from an average US 156.74 cents per gallon in 2014 to US 70.86 cents per gallon in 2016. As at the first quarter in 2017, the price of NGLs based on a weighted basket of propane, butane and natural gasoline stood at US 97.32 cents per gallon, 42% higher when compared to the same period in 2016. Continued improvements/stability in the price of NGLs would result in improved FY2017 performance by PPGPL.

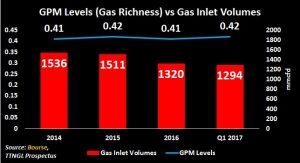

Gas Inlet Volumes

Gas Inlet Volumes refer to the amount of natural gas processed by PPGPL. Volumes have been on a downward trend since 2014. As at March 2017, Gas Inlet Volumes stood at 1,294 million standard cubic feet per day (mmcfd), 9.8% lower when compared to March 2016 (1,434 mmcfd).

(iii) Gas ‘Richness’

Gas ‘richness’ relates to the content of NGLs present in gas processed. Gallons Per Thousand, or GPM, is a measure of the number of gallons of NGLs extracted per thousand cubic feet of natural gas processed. A lower GPM level means gas is drier (which means there are less NGLs for PPGPL to extract and sell) and vice versa. GPM levels have remained relatively stable since 2014.

(iv) Export of NGLs from PPGPL

On the volume side, exports of NGLs from PPGPL declined from 2.84M BBLS in the first quarter of 2015 to 2.09M BBLS in the first quarter of 2016. There has been a marginal reversal in this trend, whereby exports have increased to 2.40M BBLS in the first quarter of 2017, an improvement of 14.7% when compared to the first quarter in 2016. Looking ahead, new gas production – expected to come on stream at various stages throughout 2017 to 2020 – could support/improve export of NGLs.

(v) Operating Margins

PPGPL’s Gross Profit (GP) and Net Profit (NP) Margins, both measures of profitability, have averaged 41.7% and 21.9% respectively from 2012 to 2016. This reflects relatively stable performance of the company, even in the face of more challenging operating environments in 2015 and 2016. For the first quarter in 2017, the GP Margin was 38.6% while the NP Margin stood at 21.7%. PPGPL has undertaken a rationalization of its expenses, focusing on improving cost efficiencies in its Operating and Administrative expenses.

Should investors participate?

TTNGL’s offer price of $21.00 per share results in a trailing dividend yield of 7.14%; the highest on the local stock exchange by some margin. The average trailing dividend yield on the local stock exchange is 3.53% (excluding the Manufacturing 2 sector).

TTNGL reported a position in cash and cash-equivalents $403M as at March 2017, or roughly $2.61 per share. As a holding company with relatively limited cash expenses, this balance could become available for distribution to investors over time. TTNGL earns revenue is USD. As per the Additional Public Offering prospectus, TTNGL ‘may elect from time to time to declare and pay dividends in either TTD or USD.’

Within the last 12 months, TTNGL traded within a narrow price range from $20.30 to $24.75, at an average of $22.47. The $21.00 offer price falls on the lower end of this 12-month range, and could therefore provide an entry point for investors who have been waiting for such an opportunity.

Investors may recall that Bourse’s rating on TTNGL stock, based on the most recently released results for the quarter ended March 31 2017, was a BUY. This was on the basis of (i) a high trailing dividend yield, (ii) a healthy per-share cash position, (iii) the potential of continued stabilization/recovery of revenues through expected improvements in local energy production and global pricing and (iv) an implicit hedge against the TTD through its USD earnings. Post-announcement of the Additional Public Offering, the BUY rating has been maintained.

As always, investors should consult a trusted and experienced advisor, such as Bourse, to make a more informed investment decision.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”