BOURSE SECURITIES LIMITED

16th March, 2020

GHL Improves, COVID-19 Worsens

This week, we at Bourse review the performance of Guardian Holdings Limited (GHL) for the financial year ended December 31st 2019. The Group posted strong earnings and Net Income growth, primarily attributed to increased investment activity income throughout the year.

On the international front, the COVID-19 outbreak has now been declared a pandemic by the World Health Organization (WHO) as the number of countries infected continues to grow at an alarming rate. Global government officials have continued to put forward policies in an attempt to contain the novel coronavirus and its economic effects. At home, T&T reported its first confirmed case of the virus on Thursday March 12th 2020. We discuss below.

Guardian Holdings Limited (GHL)

For the year ended 31st December, 2019, Guardian Holdings Limited (GHL) reported Diluted Earnings Per Share (EPS) of TT$2.98, a 29.6% improvement from the prior year comparable period of TT$2.30.

The Net Result from Insurance Activities was up 6.6%, from $898.9M to $958.6M in FY 2019. Net Income generated from Investing activities stood at $1.37B for the period, 35.3% higher Year on Year (YoY), while Fee and Commission Income from Brokerage Activities advanced marginally (2.3%) to TT$117.1M. However, this was tempered by an increase in Net Impairment Losses on Financial Assets which was attributed to the IFRS 9 provisioning and a 14.4% increase in Operating Expenses stemming from internal reorganization, efficiency and technological advancements and the implementation of IFRS 17. Subsequently, Operating Profit for the Period amounted to TT$836.7M from TT$687.5M in the previous year (up 21.7%). The Group incurred a lower taxation charge, moving from TT$164.6M in FY 2018 to TT$151M. Overall, Profit for the Year advanced 29.9% from TT$535.2M to TT$695M. Similarly, Profit Attributable to Shareholders increased by 29.7% to record a figure of $692.3M.

Outlook

At the end of its 2019 financial year, GHL experienced a 20.7% increase in its Net Income from All Activities. The Life, Health and Pension Business line recorded a 24.3% YoY improvement in Net Income. The Group attributed the uptick in this segment to growth stemming from its English-speaking markets as increases from the Dutch regions in FY 2018 were non-recurring.

GHL’s Property and Casualty business segment generated an 11% increase to Net Income in FY 2019, the improvement was credited to organic growth and income streams arising from the acquisition of new businesses. In FY 2019 however, GHL accounted for a net loss reserve account of $86M before tax, due to claims arising from Hurricane Dorian, consequently increasing the Group’s liabilities. Asset Management, the smallest of GHL’s income drivers, grew 18.9% YoY.

Net Income from Investing Activities was the primary contributor to GHL’s YoY uptick in Net Income from all Activities, comprising 56% of the total. In FY 2019 GHL’s investment portfolio generated income of $1.37B relative to $1.01B earned in 2018. Growth trends recorded in US and Jamaican markets over the course of 2019 were credited with GHL’s 35% YoY increase in Net Income from Investing Activities.

However, due to the persistently volatile conditions present in equity markets, GHL has reminded shareholders that it cannot reasonably predict the recurrence of gains achieved in 2019. The Group recorded a $50M increase to Investment Income arising from a rebalancing of its portfolio to achieve what it deems a cautious equilibrium of risk and reward. This likely refers to a conscious effort made by the Group to realise gains on assets which may be more prone to volatility, in an effort to reduce exposure to unpredictable market conditions.

At the end of its financial year, GHL reported a 14.4% increase to its Operating Expenses with this being attributed to the execution of strategies designed to improve the company’s competitive edge and enhance efficiency, as well as costs incurred through the Group’s implementation of IFRS 17 – Insurance Contracts.

The Bourse View

Currently priced at TT$22.00, GHL trades at a trailing price to earnings ratio of 7.4 times, below the Non-Banking sector’s average (excluding NEL) of 12.1 times. The stock also offers investors a trailing dividend yield of 3.4%, above the sector’s average (excluding NEL) of 2.6%. On the basis of relatively attractive valuations, but tempered by heightened volatility within international financial markets, Bourse maintains a NEUTRAL rating on GHL.

COVID-19 Fears Intensify

International investors’ fears further intensified this week as COVID-19 was officially declared a pandemic by the World Health Organization (WHO) and continued to hamper global markets. The number of countries and territories affected surged to 137 while the number of reported cases has spiked, now standing at 144,052 with 5,397 recorded deaths. The recovery rate of the novel virus is now at approximately 49%, while the fatality rate is around 4%.

More global policy makers have announced measures to respond to the economic and market threats of the pandemic, receiving mixed reactions from investors. The Bank of England (BOE) declared an emergency cut in interest rates on Wednesday from 0.75% to 0.25%, the lowest level recorded to date. Later that day, in the presentation of the UK’s budget, Chancellor Rishi Sunak announced plans for what he referred to as “the largest fiscal boost in 30 years”, including a £5B emergency response fund to support public services and £30B worth of stimulus to ease the impacts of the COVID-19 virus on the economy. Currently, the UK has reported 798 cases of the virus.

Trinidad and Tobago Acknowledges COVID-19 Impact

With a heavy dependence on the export of oil and gas, Trinidad and Tobago’s economy is particularly susceptible to changes in commodities prices. COVID-19 concerns resulted in a capitulation of oil prices early in the week, prompting a response by T&T’s Minister of Finance to provide clarity on the ongoing developments with respect to budgetary considerations.

T&T’s Fiscal 2020 budget was premised on contributions from oil revenue in the region of $11.004B, or 23% of the projected total revenue of $47.749B. In light of prevailing conditions, the Honourable Minister on Tuesday announced an amendment to average oil price assumptions of US$40 per barrel from the initial US$60 per barrel. The budgeted price of natural gas was also cut to US$1.8 per MMBtu from a prior US$3 per MMBtu. The Minister indicated that because of these changes in assumptions, Total Revenue is estimated to fall short of prior projections by $3.5B. Total Expenditure, initially projected at $53.036B, is not yet expected to be reduced, given concerns of the potential contractionary effects on the economy. The result, holding all else constant, could mean a widening of the fiscal deficit to $8.787B from the prior $5.287B estimate.

Negative Sentiment Seeps into Domestic Market

With markets sliding internationally and a deteriorating domestic fiscal position, negative sentiment has already begun seeping into the market. At Friday’s close, the TT Composite Index had declined 1.14% WoW. In the past week, the biggest decliners would have been Energy sector stock TTNGL (-16.8% WoW), Non-Banking Finance sector Stock JMMBGL (-15.7% WoW), Manufacturing sector stock OCM (-6.5% WoW) and Conglomerate sector stocks GKC (-2.6%) and MASSY (-1.7%).

With the first case of COVID-19 being confirmed on Thursday, many citizens engaged in frenzied attempts to stock up on medical supplies and other essentials. Effectively, demand for certain goods are being ‘pulled’ forward, which could result in a short-term boost for distributors of pharmaceutical and and fast-moving consumer goods.

President Trump Addresses the US

On Wednesday night, President Trump made an address providing information on the current state of the country’s COVID-19 outbreak and highlighting strategies which will be implemented to counteract the effects of the global pandemic. He outlined several policies including:

- A 30-day travel ban on travellers from 26 European countries (excluding the UK), effective from Friday 13th March, 2020 at midnight. American citizens who have undergone the relevant screenings will be exempted.

- Payroll tax relief, contingent on approval from Congress.

- Tax deferrals without interest or penalties for certain individuals and businesses affected by the novel coronavirus, which the President claims will add more than US$200B of liquidity to the economy.

- Small business loans amounting to approximately US$50B via the Small Business Administration to compensate businesses whose income is hampered by the outbreak. This is also dependent on approval from Congress.

US Markets Stumble

Markets went into a tailspin on Monday, as a collapse in oil prices and fears of a global recession triggered the S&P 500’s Level 1 7% circuit breaker within the first 10 minutes of trading. The circuit breaker is intended to mitigate an unruly decline in markets. The activation of this circuit breaker led to markets being closed for 15 minutes. At the end of the trading day the S&P 500 shed 7.6%

Markets received some brief respite on Tuesday as President Trump announced his plans to implement a fiscal stimulus package to combat the economic threat posed by the coronavirus, spurring waves of renewed investor sentiment. At Tuesday’s close, the S&P 500 climbed 4.9%, 135.67 points higher than Monday’s close.

US markets took a downturn once again on Wednesday, with the S&P 500 losing 4.9% as the World Health Organization (WHO) officially declared the coronavirus a pandemic. Investors reacted in panic to the news with the number of new countries affected surging worldwide.

On Thursday, US markets tanked again, initiating a level one circuit breaker for the second time in just 4 days, as the S&P 500 tumbled below the 7%-mark mere minutes after it opened. Investors appeared even more panicked by President Trump’s address on Wednesday night concerning COVID-19 and strategies being put in place to protect the citizens and the economy. The S&P 500 closed 9.5% down and the Dow Jones Index fell 9.99%, the worst single-day decline since the infamous ‘Black Monday’ crash in 1987.

Investors experienced reprieve on Friday as market participants warmed up to the Federal Reserve’s plan to inject more than US$1.5T into the banking system in the coming days. Additionally, President Trump declared a national emergency in order to combat the coronavirus and its consequent fallout. At the end of the trading day, the Dow Jones Industrial Average rose 9.4% while the S&P 500 advanced 9.28%.

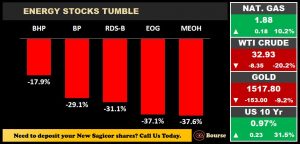

Energy Stocks Tumble

Energy stocks recorded even larger losses this week, as COVID-19 sent shocks throughout the economy after President Trump announced a 30-day travel ban on European countries and tensions among oil producers, Russia and Saudi Arabia escalate. Methanex Corporation (MEOH) continued to record the largest loss week on week (WoW) of 37.6% Meanwhile, BHP Group (BHP), BP Plc (BP), Royal Dutch Shell (RDS-B) and shed 22.6%, 25.6%, 26.1% and 39.4% respectively WoW.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”