BOURSE SECURITIES LIMITED

17th June, 2019

FCI Stumbles, SBTT Improves

This week, we at Bourse review the financial performance of two companies within the Banking Sector of the local stock exchange, FirstCaribbean International Bank Limited (FCI) and ScotiaBank Trinidad and Tobago Limited (SBTT), for the first half of their respective financial years ended 30th April, 2019. While both banks remained profitable, overall net profits were driven in opposite directions due to certain tax-related events.

FirstCaribbean International Bank Limited (FCI)

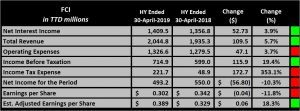

FirstCaribbean International Bank Limited (FCI) reported Earnings per Share (EPS) of TT$0.30 for the half year (HY) ended April 30th 2019, 11.8% lower than the EPS of $0.34 recorded in HY 2018. The Bank’s performance has been impacted by the occurrence of various one-off events including a deferred tax asset write-off (TT$146.7M), incremental credit provisions of Barbados Government USD debt restructuring (TT$ 29.5M). Conversely, a release of provisions for 2017 hurricane credit losses (TT$36.9M) would have tempered these losses. Adjusting for these items would have resulted in an estimated EPS of $0.39, 18.2% above the HY 2018 estimated EPS of $0.33.

Revenues grow, earnings volatile

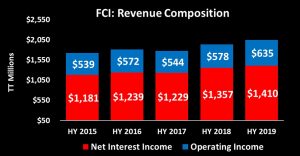

FCI experienced a 5.7% (TT$109.5M) improvement in Total Revenue from TT$1.935B to TT$2.044B. Interest and Similar Income rose by TT$66.5M (4.3%), however, this growth was tempered by a 6.6% (TT$13.8M) increase in Interest and Similar Expenses. Net Interest Income grew 3.9% from TT$1.36B to TT$1.41B YoY. Operating Income also increased 9.8% or TT$56.8M YoY, while Credit Loss Expense on Financial Assets declined 94.2% (TT$53.5M) from TT$56.8M to TT$3.3M. As a result, Income before Tax rose 19.4% to TT$714.9M in HY 2019. The Bank’s Income Tax Expense rose to TT$221.7M, a significant 335% increase over the TT$48.9M incurred in HY 2018. Overall, Net Income for the period fell to TT$493.2M, 10.7% (TT$56.8M) lower than the TT$550.0M earned in HY 2018.

Outlook

FCI’s Total Revenue has trended upward over the past four years. According to the Chief Executive Officer, the 5.7% improvement in Total Revenue over that of HY 2018 was on account of higher volumes and interest margins, which ultimately increased Net Interest Income 3.9% YoY to TT$1.41B. Operating Income grew from TT$578M in HY 2018 to TT$635M in HY 2019.

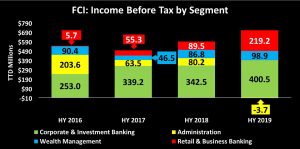

FCI’s Income Before Tax (PBT) has shown steady improvements over the past two years, growing 19.4%, from TT$599.0M in HY 2018 to TT$714.9M in HY 2019. While three of FCI’s four operating segment recorded higher PBT, a major contributor to growth was the Retail & Business Banking (RBB) segment, from TT$89.5M to TT$219.2M YoY. The PBT earned by the Corporate and Investment Banking (CIB) segment grew 16.9% YoY from TT$342.5 to TT$400.5M, fuelled by a reversal of Credit Loss Expense on Financial Assets. Finally, the Wealth Management (WM) segment, recorded 23.3% higher PBT YoY from TT$86.8M to TT$98.9M. The Administration segment recorded the weakest performance, with a Loss of TT$3.7M before Taxes.

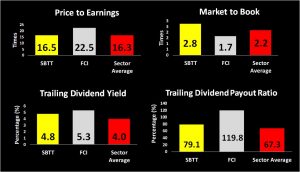

The Bourse View

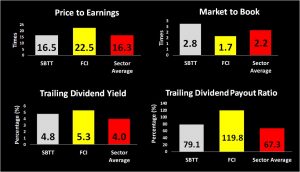

At a current price of $8.31, FCI trades at a trailing P/E of 22.5 times, above the Banking sector average of 16.3 times. However, adjusting for non-recurrent items, FCI trades at an estimated trailing P/E of 11.7 times. The stock offers investors a trailing dividend yield of 5.3% which is well above the sector average of 4.0% and includes a special dividend of TT$0.107 (US$0.0159) to be paid on 5th July, 2019. The dividend yield would be 4.0% exclusive of this special payment. More importantly, the stock pays dividends in USD, providing a hedge against any movement in the TTD. Based on FCI’s attractive dividend yield and improved earnings on an adjusted basis, but tempered by the fall-out of its exposure to the Barbados market, Bourse maintains a NEUTRAL rating on FCI.

Scotiabank Trinidad and Tobago Limited (SBTT)

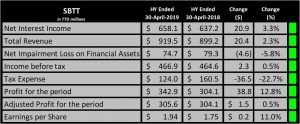

Scotiabank Trinidad and Tobago Limited (SBTT) reported Earnings per Share (EPS) of $1.94 for the half year (HY) ended April 30th 2019, 11.0% higher than the $1.75 earned in HY 2018.

SBTT generated $658.1M in Net Interest Income in HY 2019, 3.3% ($25.7M) higher than $637.2M in HY 2018. This, in turn, drove Total Revenue up 2.3% ($20.4M) to $919.5M over the same period. However, Non-Interest Expenses stood 6.4% ($22.7M) higher at $377.9M compared to $355.2M in HY 2018. Net Impairment Losses on Financial Assets declined 5.8% YoY, from $79.3M to $74.7M. The net effect resulted in marginal growth of 0.5% in Income before Taxation from $464.6M in HY 2018 to $566.9M in HY 2019. The Group recorded Provisions for Taxation of $124.0M, a significant 22.7% reduction YoY due to a one-off tax credit realized in Q1 2019. As a result, the effective tax rate declined from 34.6% to 26.6%. Overall, SBTT earned $342.9M in Profit for the period, 12.8% higher than the $304.1M earned in the prior comparable period. Under the assumption of a normalized effective tax rate (34.6%), Profit for the period would have experienced marginal growth of $1.5M or 0.5% YoY.

Outlook

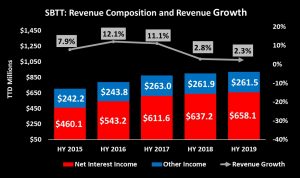

SBTT’s Total Revenue has recorded consistent improvements since HY 2015, however, YoY growth has slowed from 12.1% in HY 2016 to just under 2.3% in HY 2019. Net Interest Income, accounting for 71.6% of Total Revenue, increased 3.3% YoY. This was attributable to growth of almost $960M (6.8%) in Loans to Customers and a $42.0M (3.5%) increase in Investment Securities YoY. Conversely, Other Income remained relatively flat at $261.5M for the HY 2019.

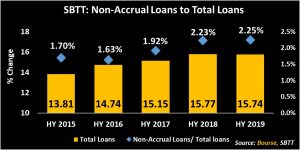

SBTT continues to maintain the credit quality of its loan portfolio, with the ratio of Non-Accrual Loans to Total Loans remaining relatively stable YoY at 2.25%. Despite the moderate increase in this ratio over the last three comparable periods, it continues to remain lower than that of other companies within the Banking sector which are listed on the local stock exchange. Despite the increase in Loans to Customers, Total Loans declined marginally YoY, from $15.77B in HY 2018 to $15.74B in HY 2019. This was on account of a 59.4% fall Loans and Advances to Banks and Related Parties, from $1.67B to $676.1M. Ultimately, this contributed to a decrease in Total Assets from $25.5B to $25.2B.

The Bourse View

At a current price of $62.51, SBTT trades at a trailing PE of 16.5 times, in line with the Banking Sector average of 16.3 times. The stock offers investors a trailing dividend yield of 4.8% also higher than the Banking Sector average of 4.0%, with a payout ratio of 79.1%. On the basis of marginal growth in profitability on a normalized basis and fair valuations, Bourse maintains a NEUTRAL rating on SBTT.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”