BOURSE SECURITIES LIMITED

September 12th, 2016

FCI Earnings Up

This week, we at Bourse evaluate the most recent financial performance FirstCaribbean International Bank Limited (FCI), which has posted positive results for its nine-month period under review. We give our view on its performance thus far and outlook for the stock going forward.

FirstCaribbean International Bank Limited (FCI)

For the nine months ended July 31st 2016, FCI reported EPS of TT$0.46, a 27.8% increase or TT$0.10 from the TT$0.36 earned in the comparable period a year prior.

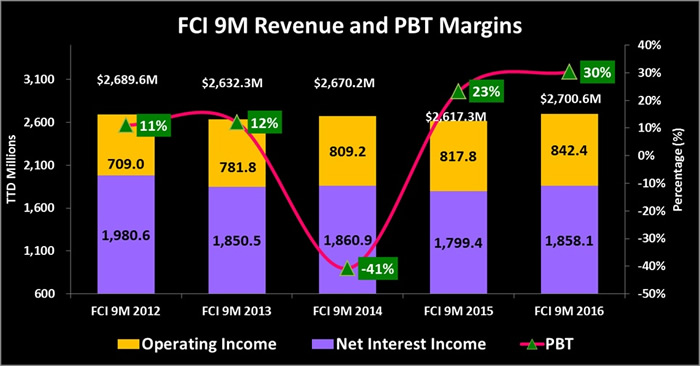

The Bank’s Net Interest Income grew by 3.3% (TT$58.7 million) as a 1.1% (TT$23.8 million) decline in Interest Income was offset by a proportionally higher fall in Interest expense of 21% (TT$82.5 million). These lower funding costs, coupled with an increase of 3.0% (TT$24.6 million) in operating (non-interest) income, contributed to growth of 3.2% (TT$83.3 million) in Total Revenue from TT$2.6 billion to TT$2.7 billion.

An increase of 3.9% (TT$67.9 million) in operating expenses was attributable to higher business taxes, project related expenditures and other operating costs. FCI’s loan loss impairment declined significantly by 68.9% ($160.4 million), from $232.9 million to $72.5 million on better loan loss performance and a reduction on non-productive loan balances. The Bank managed to reduce its non-productive loan balance by TT$1.4 billion (down 32%) from TT$4.4 billion a year ago to TT$3 billion.

As a result of these improvements, Income before taxation advanced 27.0% (TT$175.8 million) from TT$651.2 million to TT$827 million. After-tax profits reflected a corresponding increase of 27.6% (TT$160.8 million) from TT$583 million to TT$743.8 million.

Outlook

FCI’s notable improvement in its loan loss recovery bodes well for the Bank’s future performance. The Bank’s current non-performing loans account for approximately 7.3% of total loans when the average of the other listed banks in the sector is 3.5%. Continued reduction of non-productive loan balances would have the effect of lowering loan loss impairment, and strengthening of the loan portfolio could have the effect of increasing net interest income.

Importantly, revenue for the 9-month period of fiscal 2016 was the highest within the past 5 years. Interest costs have also moderated, contributing to wider Net Interest Income margins.

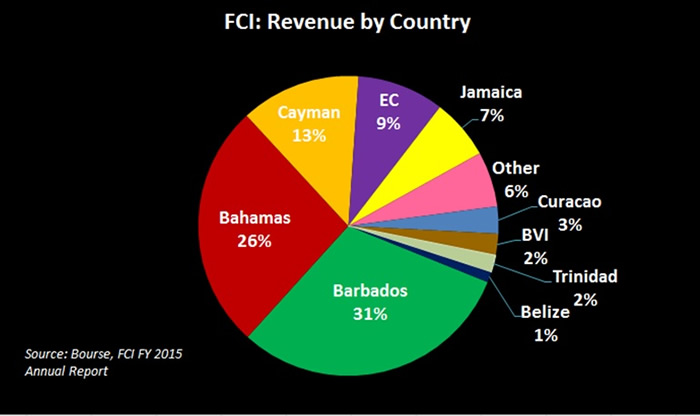

Another positive driver of future performance is the reasonably well-diversified revenues of the Bank. With 2% of revenues being generated from Trinidad & Tobago, FCI would be mostly spared from the country’s economic downturn; unlike most stocks listed on the local exchange. Apart from its considerable exposure to Barbados (30.6% of revenues) which has had tepid growth in past years, FCI also has significant exposure to the Bahamas and the Cayman Islands with 26.4% and 12.9% of revenues respectively.

The Bourse View

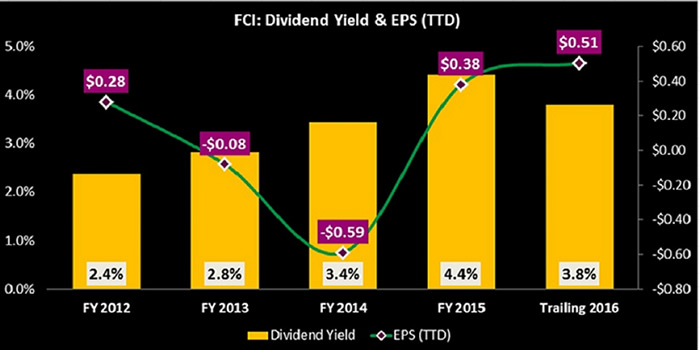

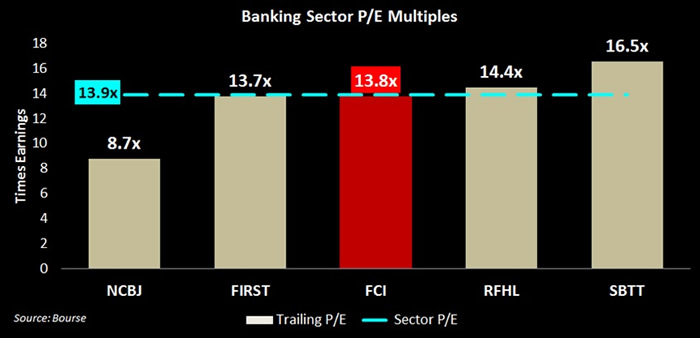

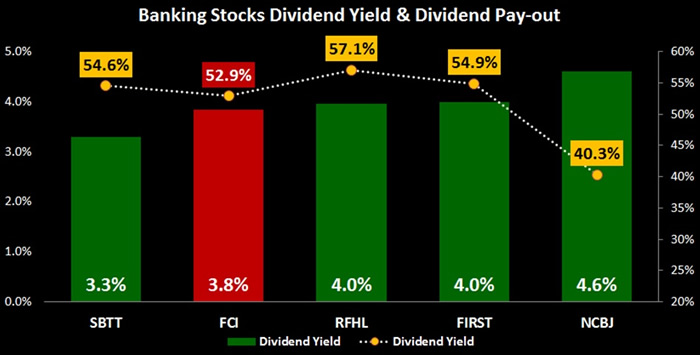

At a current price of TT$6.95, FCI is trading at a P/E multiple of 13.8x, in line with the banking sector average P/E of 13.9x. The 38.7% appreciation of FCI’s share price year-to-date (having started the year at a price TT$5.01), reflects the stock’s positive financial performance and its attractive USD dividend payments, an increasingly important factor as the TTD experiences further depreciation relative to the USD. FCI offers a dividend yield of 3.8% and has a dividend pay-out ratio of 52%, in line with its sector peers.

Based continuing improvement in performance, moderate valuation and favourable dividend payment currency, Bourse places a BUY rating on FCI.

For the detailed report and access to our previous articles, please visit our website at: https://www.remotestores.com

For more information on these and other investment themes, please contact Bourse Securities Limited, at 628-9100 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”