| HIGHLIGHTS Local Market

International Markets

|

Equity Markets Broadly Mixed in 2020

Best wishes to You and Yours from the team at Bourse!

This week, we review the performance of local and international equity markets in 2020. The overarching theme of COVID-19 was the primary driver of investment sentiment throughout the year, resulting in convulsions across most financial markets. Locally, stocks fell as investors anticipated prolonged effects from the pandemic. Internationally, on the other hand, all major regions with the exception of Latin America overcame several economic and geopolitical hurdles to post strong returns.

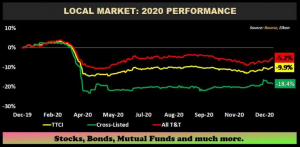

Domestic Market Impacted by Pandemic Pressures

The COVID-19 pandemic brought with it multiple challenges across global financial markets, with the Trinidad and Tobago Stock Exchange being no exception. The three major local market indices were all in negative territory at the end of 2020 relative to their levels at the start of the year. The Cross Listed Index, comprising four stocks listed on both the domestic and regional exchanges (3 in Jamaica, 1 in Barbados), reported the largest decline of the three indices, down 18.4%. Locally-domiciled stocks were seemingly more resilient, with the ALL T&T Index down 5.2%. The Trinidad and Tobago Composite Index, which tracks the performance of all Tier 1 stocks lost 9.9% in 2020.

Major Market Movers in 2020

Despite the pandemic conditions, National Flour Mills (NFM) and Trinidad Cement Limited (TCL) reported a reversal of recent fortunes to lead market gains. Manufacturing I stock NFM, appreciated 55.6% and sole constituent of the Manufacturing II segment, TCL rose 25.0%. Ansa Merchant Bank Limited (AMBL) and Republic Financial Holdings Limited (RFHL) also advanced in 2020, adding 11.5% and 2.9%.

Guardian Media Limited (GML) and One Caribbean Media Limited (OCM) posted material declines this year, recording decreases of 54.4% and 43.3% in price. Energy-related entities, National Enterprises Limited (NEL) and Trinidad and Tobago NGL (TTNGL) rounded out the list, each suffering declines of 45.7% and 29.0% respectively. Meanwhile, Manufacturing I stock Unilever Caribbean Limited (UCL) lost 27.6%.

Notable transactions by publicly listed companies in 2020 included:

- On the 31st May, RFHL completed the acquisition of Scotiabank’s operations in the British Virgin Islands with the transaction strengthening the banking Group’s asset base by roughly US$15.5B or TT$103.9B.

- Effective 30th September, Guardian Holdings Limited acquired the insurance and annuities portfolio of NCB Insurance Company Limited.

- On the 20th November, Ansa Merchant Bank Limited received approval by the Central Bank of Trinidad and Tobago for the acquisition of Bank of Baroda Trinidad and Tobago Limited. The transaction remains ongoing.

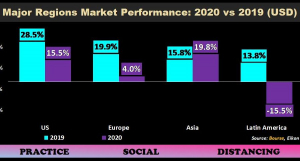

Financial Markets Record Rebound

The novel coronavirus (COVID-19) brought with it unforeseen changes to the global economy, stoking concerns across global financial markets in early 2020. However, as economies have begun normalising and with medical breakthroughs leading to the creation of multiple COVID-19 vaccines, investor sentiment gradually improved. At the end of 2020, all major regional financial markets, with the exception of Latin America, posted positive returns. Asia, the region which first reported COVID-19 cases, was the best performing major region this year, advancing 19.8% (2019: 15.8%).

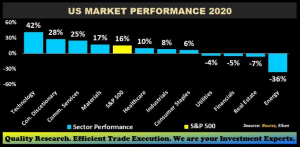

US Markets Advance

US markets were heavily impacted by uncertainty in the first half of 2020, particularly in the month of March, when a record four circuit breakers were triggered to prevent potentially destabilizing market selloffs. Since then, US markets have rebounded in astounding fashion, leading the S&P 500 to appreciate 15.5% at the end of 2020. The phenomenal performance, within the context of a global pandemic, was fuelled by extraordinary monetary policy initiatives by the US Federal Reserve and multiple stimulus packages enacted by the US Government.

In a reversal of a previous series of rate increases, the US Federal Reserve cut its benchmark lending rate in March 2020 to a target of 0.00% to 0.2% from a prior 1.00% to 1.25%, leaving rates at near-zero for the foreseeable future. The US government spent US$6.55T, 47% greater than that in 2019 (US$4.45T) with Income Security, Social Security, Health and Medicare accounting for 59% of the total. Income Security spending totalled US$1.26T in 2020 relative to US$583B in 2019, illustrative of the use of fiscal spending to cushion the economic shock of the virus.

Asia Markets End Higher

South Korea and Taiwan were the best performing markets in the Asia region for 2020, advancing 40.6% and 30.7% respectively in USD terms. Asia’s largest economy China was also buoyant in 2020, with its stock market advancing 21.2%. Hong Kong was the only region in negative territory, down 5.3% at the close of December, as ongoing domestic tensions weighed on market sentiment. India’s stock market ended 2020 13.0% higher, as improving economic conditions and continued expansionary measures by the Central Bank and government supported investor sentiment. In November, the Indian government announced a new stimulus package of US$16.1B to be spent on creating jobs and bolstering economic recovery.

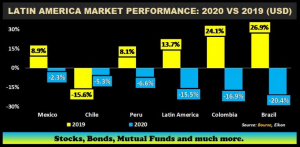

Latin American Markets Lower

Latin American stocks retreated in 2020 after broadly posting robust gains in the prior year, with Brazilian stocks declining 20.4% in USD terms. The performance of stock markets was adversely affected by the volatility of Brazil’s Real in 2020. Mexico, Latin America’s second largest economy, reported the smallest decline in performance relative to its peers, depreciating 2.3% for the year. Both economies are projected by the International Monetary Fund to rebound going into the new year, potentially pointing to continued recovery for financial markets.

European Markets Mixed

The European region delivered a mixed bag in terms of performance for 2020, with Spain and England remaining lower relative to levels at the start of the year. Germany was the best performing market, advancing 12.8% in USD terms, followed by last year’s best performer Italy which added 2.7%. France also reported growth advancing 1.9% at the close of 2020. England was down 12.0%, being the worst performing of the European nations for 2020, as the country reported a more infectious strain of the COVID-19 virus, spurring concerns and upending prior recovery. In December, UK lawmakers approved a tariff free EU-UK trade deal which is expected to improve economic activities going forward, with the EU accounting for 43% exports from and 27% of imports to the UK in 2019.

Investor Considerations

With the worst of the pandemic uncertainty now seemingly left in 2020, economies are projected to recover into 2021. The dissemination of COVID-19 vaccines at a global level should continue to support the resumption of ‘normal’ activity, much to the relief of businesses and investors alike. As countries focus on rebuilding their economic engines, there is the reduced likelihood of geopolitical conflicts which should also be supportive of markets in 2021. Continued fiscal and monetary stimulus will also aid investor sentiment. Potential risks include growing reports of a new strain of the coronavirus and the efficacy of recently launched vaccines in preventing its spread, as well as the still-unquantified degree of permanent economic damage caused by COVID-19.

Next week, we take a look at how local/regional stocks could fare in 2021 and some of the key drivers to anticipated performance. We also consider how internationally-focused investors could go about allocating their portfolios in the year ahead.