BOURSE SECURITIES LIMITED

1st April, 2019

Equity Markets Advance – Q1 2019

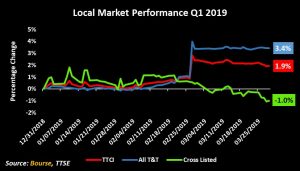

This week, we at Bourse review the performance of the local and international equity markets for the first quarter (Q1) of 2019. Regionally, the Trinidad and Tobago Composite Index would have advanced modestly, while the Cross Listed Index fell marginally. Internationally, equity markets rallied during Q1 2019 in the face of a more challenging economic environment.

Local Market Review

The Trinidad and Tobago Composite Index (TTCI) rose 1.9% Year-to-Date (YTD), on the heels of the 2.9% increase recorded in 2018. The All T&T Index, which accounts for 67.3% of the TTCI by market capitalization, was the major driver of this performance, advancing 3.4% YTD. This marked an improvement over the 1.4% decline recorded last year. On the other hand, the Cross Listed Index fell 1.0% in the first quarter 2019.

Major Movers

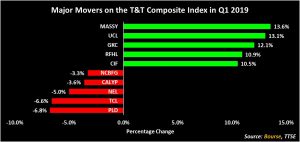

Looking at the major movers in YTD price change terms, Massy Holdings Limited (MASSY) advanced 13.6%, followed by Unilever Caribbean Limited (UCL, +13.1%), GraceKennedy Limited (GKC, +12.1%), Republic Financial Holdings Limited, (RFHL, +10.9%) and the CLICO Investment Fund (CIF, +10.5%). Four out of the five major decliners YTD were domiciled in Trinidad. These included Point Lisas Industrial Port Development Corporation Limited (PLD, down 6.8%), Trinidad Cement Limited (TCL, down 6.6%), National Enterprises Limited (NEL, down 5.0%) and the Calypso Macro Index Fund (CALYP, down 3.6%). Finally, Jamaican based NCB Financial Group Limited (NCBFG) declined 3.3% YTD.

On the Local Horizon

Q2 2019 is expected to contain several notable events, including the potential conclusion of the takeover of Guardian Holdings Limited (GHL) by NCBFG and approval and conclusion of the acquisition of Sagicor Financial Corporation (SFC) by Alignvest Acquisition II Corporation. SFC, with a current market capitalization of TT$ 2.70B, will be delisted from the Trinidad and Tobago Stock Exchange (among other Exchanges) following the successful completion of the transaction. According to the Minister of Finance, the Honourable Colm Imbert in his FY2018/2019 Budget statement, investors can expect another National Investment Fund bond-type offering in 2019. The upcoming mid-year budget review may provide more details on this potential offering and any new developments.

International equity markets upbeat

US Markets Rally

The U.S. equity market, as measured by the S&P 500 Index, bounced back in resounding fashion with a YTD return of 13.1% as at the end of Q1 2019. This occurred despite slowing GDP growth predictions by the IMF (down to 2.5% in October 2018 from 2.7% in July 2018) and setbacks resulting from the US Government shutdown which extended well into Q1 2019. The performance represents a marked improvement from the previous year’s comparative results – a decline of 1.2% – and its best quarterly performance since 2009. Reports have indicated that trade tensions between the US and China – which have had a dampening market effect in past periods – may come to a resolution as a trade agreement becomes more likely. This, in addition to the decision by the US Federal Reserve to refrain from hiking interest rates further in 2019, has boosted investor sentiment.

Latin America volatile

Latin American equity markets were broadly positive in the first quarter, despite volatility stemming from various geopolitical and economic factors, closing the quarter with a +4.7% return. Like the US, growth for Latin America is projected at 2.0% in 2019 (IMF), 0.2% down from the October 2018 projections. The Brazil equity market, as measured by the IBOVESPA Index recorded a 6.8% YTD USD return. Opposition has been greater than anticipated regarding the proposed pension reforms for the country – an effort geared toward reducing the social security deficit and boosting growth following the recession of 2015-2016. The Mexico stock market, as measured by the MEXBOL Index, advanced 5.0% YTD. Market volatility stemmed from the decision by its President to cancel the partially-built Mexico City Airport, as well as some uncertainty regarding state oil firm, Pemex. IMF growth predictions for Mexico, fell from 2.5% to 2.1% due to a decline in private investment.

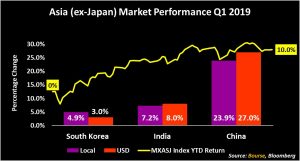

Asia (ex-Japan) rallies

The advance of Asian (ex-Japan) equity markets, up 10.0% YTD, was driven by a surge in Chinese stocks, up 27.0% YTD. Investors appear to be anticipating the successful conclusion of a trade agreement between the US and China, as well as promises by China policy makers for an injection of economic stimulus through monetary and fiscal policy changes in 2019 following slowing economic growth statistics. Indian stocks closed 8.0% higher at the end of Q1 2019. Looking forward, the performance of the India market may be affected by political factors associated with the general election, set for the beginning of the second fiscal quarter.

European stocks climb amidst Brexit murkiness

Eurozone markets advanced over the course of the first quarter 2019 amid United Kingdom’s Brexit gridlock. Investors seem to be focused on the prospect of the end of the US-China trade tensions and the lower risk of Eurozone recession driven by German market resilience. European stocks, as measured by the STOXX 50 Index, advanced 9.4% on average in Q1 2019.

Investor Considerations

While stocks markets have been buoyant thus far in 2019, investors should still exercise diligence in adding to their portfolio. Consider the following strategies when looking at possible opportunities:

Local Stocks

• Target stocks with relatively attractive valuations (low price/earnings multiples), as well as above-average dividend yields.

• Stocks with lower dividend pay-out ratios may also be favourable, as they may have a higher capacity to preserve the level of dividends paid to investors.

• Investors can also consider companies with a lower exposure to Trinidad and Tobago and revenues/earnings in US dollars, as this could mitigate the impact of lower economic activity and potentially provide a hedge against depreciation of the TT dollar.

International Stocks

Trading international stocks, ETFs and more is possible with our new BourseTrader service, which provides investors with access to a world of international investment opportunities.

• With individual stocks, favour names where there may be a credible growth story. Alternatively, pick ‘stable’ names with more measured growth and dividend characteristics.

• If you’re going the route of Exchange Traded Funds (ETFs), find a theme that you feel comfortable with. Be it country, sector, region or otherwise, there are many ETFs to choose from which could provide attractive returns to your portfolio while also offering a greater measure of diversification.

As always, investors should consult a trusted and experienced advisor, such as Bourse, to find out more information.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”