AMCL, MASSY Report Lower Earnings

| HIGHLIGHTS MASSY 9M 2020 · Earnings: EPS 10.4% lower, from $3.84 to $3.44 · Performance Drivers: o Improved Investment Income from rebound in financial markets o Lower Revenue in operational segments excluding Integrated Retail · Outlook: o Likely headwinds to growth in the countries of operations due to COVID-19 · Rating: Maintained at NEUTRAL AMCL HY 2020 · Earnings: EPS 66.4% lower, from $1.43 to $0.48 · Performance Drivers: o Adverse economic conditions. o Stalled manufacturing activities for approximately 6 weeks · Outlook: o Potential headwinds to profitability due to altered consumer spending patterns amid economic uncertainty · Rating: Upgraded to NEUTRAL |

This week, we at Bourse review the financial performance of two powerhouses in the Conglomerate Sector, Massy Holdings Limited (MASSY) for the nine-month period ended June 30th 2020 and Ansa McAL Limited (AMCL) for the half year ended June 30th 2020. Both groups were impacted by generally lower consumer activity as a result of the ongoing COVID-19 pandemic. Will lower consumption prolong reduced earnings, or will adjustments be made to cope with the ‘new normal’? We discuss below.

MASSY HOLDINGS LTD. (MASSY)

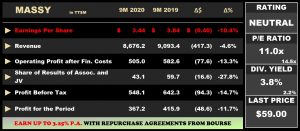

MASSY reported an Earnings per Share (EPS) of $3.44 (down 10.4%) for the nine-month period ended June 30th 2020 (9M 2020), compared to $3.84 earned in 9M 2019. Revenue declined 4.6% to $8.7B from $9.1B in the prior comparable period. Operating Profit After Finance Costs fell 13.3% Year on Year (YoY), from $582.6M to $505.0M. Share of Results of Associates and Joint Venture recorded a 27.8% ($16.6M) decrease owing to declines in the performance of Caribbean Industrial Gases Unlimited and Massy Wood Group. Profit Before Tax (PBT) fell 14.7%, from $642.3M to $548.1M, while Profit for the Period closed at $367.2M, 11.7% lower than the $415.9M reported in the previous period.

Revenue Trends Lower

MASSY’s overall revenue trended 4.6% lower at the end of 9M 2020. Excluding Integrated Retail (IR), all other operational segments experienced revenue declines. MASSY’s largest segment, IR (2020 Revenue: 60%), recorded a 3% uptick in Revenue, benefiting from limited disruptions to its Massy Distribution chains and Massy Stores during the lockdown period. Motors and Machines, the second largest contributor to revenue (2020: 19%), declined by 11%. Lockdown measures resulted in delayed sales for Massy Motors and relatively stagnant demand for rental services, likely influenced by a reduction in construction activities.

Gas Products (7% of Revenue) generated $681M, a 12% YoY decline. This comes amid global challenges in the energy market and reduced production from petrochemical firms in Trinidad, resulting in lower Nitrogen Sales according to MASSY’s CEO, Mr. Gervase Warner. Revenue from Financial Services fell 1%, with Massy Insurance benefitting from a rebound in the US stock market in the 3 months ended June 2020. Information, Technology and Communication saw the sharpest decline of 28%.

Barbados contribution to PBT falls

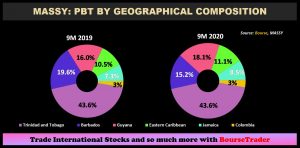

PBT across all of MASSY’s operating jurisdictions declined in 9M 2020. Trinidad and Tobago remains MASSY’s core contributor to PBT (43.6%), adding $277.4M to PBT, 14.2% lower than the comparable period. Meanwhile, Guyana has replaced MASSY’s traditional second highest contributor of PBT, Barbados, to account for 18.1% of PBT. Barbados now contributes 15.2% to MASSY’s PBT, which declined by 33.4% YoY to $96.7M.

Each of the operating jurisdictions is likely to face some impediments to growth and with Latin America and the Caribbean economic contraction forecast of 9.4% (IMF), MASSY may face some headwinds in the near term. Notwithstanding this, MASSY aims to continue to seek growth opportunities outside of its traditional jurisdictions (T&T and Barbados), specifically in Guyana and Colombia.

The Bourse View

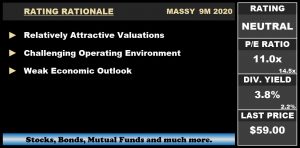

At a current price of $59.00, MASSY trades at a trailing P/E of 11.0 times, below the Conglomerate sector average P/E of 14.5 times. The stock offers investors trailing dividend yield of 3.8%, above the Conglomerate sector average of 2.2%. With the resurgence of local COVID-19 cases locally and high levels of uncertainty, a portion of MASSY’s revenue may face some headwinds in the upcoming periods, potentially offset by demand in the consumer non-discretionary segment. On the basis of relatively attractive valuations, but tempered by challenging economic conditions, Bourse maintains a NEUTRAL rating on MASSY.

ANSA MCAL LIMITED (AMCL)

Ansa McAL Limited (AMCL) reported a Diluted Earnings per Share (EPS) of $0.48 for the six months ended June 30th 2020 (HY 2020), 66.4% lower than an EPS of $1.43 reported in HY 2019. Revenue for the period amounted to $2.7B in HY 2020, down 11.7% from $3.1B reported in HY 2019. Operating Profit declined 56.6% to $172.3M in comparison to $397.4M reported in the previous period. Resultantly, the Operating Margin dipped to 6.3% from 12.8% Year-on-Year(YoY). Profit Before Tax (PBT) experienced a 62.4% decline for the period, from $391.1M to $146.9M. Despite a 1.5% marginal growth in Share of Result of Associates and Joint Venture Interests to $15.8M, PBT Margin shrank to 5.4% as Finance Costs climbed 88.9%. Consequently, Profit for the Period fell 68.2% from $303.4M reported in HY 2019 to stand at $96.6M in HY 2020.

Segment Analysis

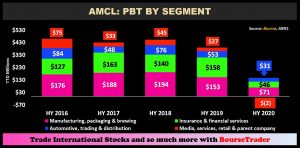

AMCL’s main contributor to PBT for HY 2020 – Manufacturing, Packaging and Brewing (48.4%) – reported a decline of 53.5%, amounting to $71.1M. This comes as revenue declined 16% in the segment due to limited business operations and the closure of plants for approximately 6 weeks to facilitate social distancing measures. This segment could continue to face some challenges with relatively sluggish construction activity as demand shifts away from non-essentials.

The second largest contributor to revenue, Insurance and Financial Services (31.4%), experienced a sharp 70.8% decline, amounting to $46.2M. Despite a 12.2% increase in revenue in this segment and rebound in financial markets, higher Finance and Impairment costs adversely impacted PBT.

The Automotive, Trading and Distribution segment, which accounts for 21.2% of PBT, fell 41.2%. Whilst demand for vehicles is likely to remain challenged in the upcoming periods, the offering of pharmaceuticals, food and beverages in the trading and distribution segment could support AMCL’s revenue.

The Media, Services, Retail and Parent Company segment experienced the sharpest decline of 105.6%. This segment may benefit from a one-off boost in the upcoming period, driven by Guardian Media Limited’s (GML) broadcast of the Caribbean Premier League (CPL) Tournament and significant media consumption of airtime and other traditional media avenues related to T&T’s 2020 general elections.

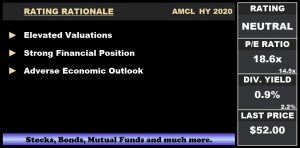

The Bourse View

At a current price of $52.00, AMCL trades at a trailing P/E of 18.6 times, below the Conglomerate sector average of 14.5 times. The stock offers investors a trailing dividend yield of 0.9%, below the sector average of 2.2%. With more clarity on the ongoing COVID-19 situation, AMCL declared an interim dividend of $0.15, $0.15 (50%) lower than the dividend paid in 2019, to be paid on September 7th 2020. With Trinidad and Tobago and Barbados grappling with the economic effects of COVID-19, AMCL’s nonessential segments may face some challenges in the upcoming periods. On the basis of elevated valuations and a strong financial position, but tempered by an adverse economic outlook, Bourse maintains a NEUTRAL rating on AMCL.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”