BOURSE SECURITIES LIMITED

29th May, 2017

AMCL, GKC earnings lower

This week, we at Bourse review the performance of two stocks in the Conglomerate sector – ANSA McAL Limited (AMCL) and GraceKennedy Limited (GKC) – for the first quarter ended on March 31st 2017. Both groups reported lower earnings for the period under review, though attributable to different reasons. We provide an outlook on the performance of both companies for the remainder of the year.

ANSA McAL Limited (AMCL)

AMCL reported Earnings per Share of $0.78 for the first quarter ended March 2017, 2.5% lower when compared to the same period in 2016.

AMCL’s revenue decreased by $14.2M (1.0%) for the quarter. Despite the shortfall in revenue, Operating profit climbed to $216.0M, an improvement of $9.3M or 4.5%. This filtered into an increase in Profit Before Tax of $10.0M (4.9%). Higher corporate taxes, which pushed the effective tax rate from 23% to 28% led to an overall decrease in profitability. Taxation Expense moved up by $11.1M (23.2%), while Profit After Tax amounted to $155.1M, a marginal decline of $1.1M (0.7%).

Outlook

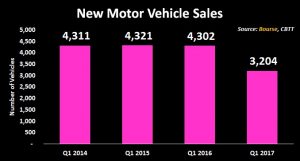

AMCL’s Profit Before Tax from the Automotive, Trading and Distribution segment fell by $9.9M or 24.8% for the quarter. The decline in new motor vehicle sales in T&T of 25.5% in the first quarter of 2017, when compared to the same period in 2016, would have negatively impacted on this segment. In the current economic environment, it is unlikely that the trend of lower vehicle sales will be reversed in the near term.

Profit Before Tax from the Manufacturing, Brewing and Packaging segment increased by $10.9M or 15.5%. The recent acquisitions by the Group of Easi Industrial Supplies Limited (T&T) and Indian River Beverage Corporation (USA) may have supported the increase in Profit Before Tax in this segment. The acquisitions are expected to generate US dollar earnings, which would prove useful for the Group’s ongoing operations.

The Insurance and Financial Services segment recorded growth in Profit Before Tax of $32.7M or 65.3%. The positive performance would have stemmed from the $42.7M increase in Operating Profit of Ansa Merchant Bank Limited, for the first quarter ended March 2017.

The Loss Before Tax of $0.5M suffered by Guardian Media Limited for the first quarter ended March 2017, would have contributed to the decline of $23.6M in Profit Before Tax in the Media, Retail, Services and Parent Segment. The Chairman noted that the loss incurred by Guardian Media Limited was attributable to continued contraction in corporate advertising spending. Sluggish economic conditions suggest that this segment could continue to struggle in the near term.

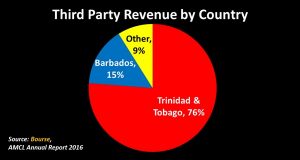

A relatively high exposure to Trinidad and Tobago and Barbados of 76% and 15% respectively could prove to be challenging for the Group, given the muted economic environment in both these territories. This was further highlighted by the recent credit rating downgrade of both countries by Standard and Poor’s as well as Moody’s Investor Services.

The Bourse View

At a current price of $66.00, AMCL trades at a trailing P/E of 16.5 times, above the Conglomerate sector average of 13.9 times. The trailing dividend yield of 2.3% is below the sector average of 2.8%. The increase in Taxation Expense more than offset the improvement in Profit Before Tax and may likely continue to weigh on earnings. On the basis of a relatively stable performance, but tempered by a high exposure to Trinidad and Tobago and Barbados and above-average valuations, Bourse maintains a NEUTRAL rating on AMCL.

GraceKennedy Limited (GKC)

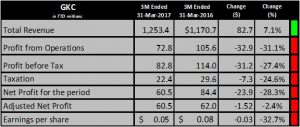

GKC reported diluted Earnings per Share (EPS) of TT$0.053 for the three months period ended March 31st 2017, a decrease of 32.7% when compared to TT$0.079 reported in the corresponding 2016 period.

Despite an increase in Total Revenue to TT$1,253.4M (up TT$82.7M or 7.1%), Profit from Operations decreased TT$32.9M while Profit before Tax (PBT) fell to TT$82.8M, a decline of TT$31.2M or 27.4%. Net Profit for the period declined to TT$60.5M from TT$84.4M, a reduction of 28.3% compared to the prior period. In the first quarter of 2016 however, there was a non-recurring gain realized from the sale of a non-operating subsidiary, which resulted in a higher Net Profit. Excluding the non-recurring gain from Q1 2016 results, Net Profit in Q1 2017 was still 2.4% lower than the prior period.

Outlook

The Money Services segment regained its spot as the most profitable segment for GKC when compared to prior first quarter performances, generating 45% of total Profit Before Tax (PBT) while accounting for 8.3% of total revenue. GKC’s Food Trading Segment accounted for 79.4% of total revenue but 43.4% of total PBT. This segment experienced a decline in PBT despite an increase in sales in the first quarter. The fall in PBT was attributed to higher costs and expenses associated with expansion and renovation initiatives. GKC in May 2017 sold its 30% stake in Trident Insurance Company Limited, valued at TT$2.9M. The Group noted that a gain should be made from this disposal and should be recorded in its six months results.

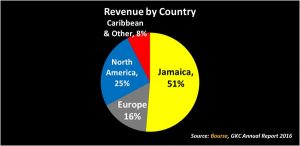

GKC has had success in generating a greater percentage of revenues in ‘hard currency’ countries. Revenues generated in North America and Europe as a percentage of total revenue have grown from 30% in 2013 to 41% as at 2016. This would provide GKC with an increasingly substantial source of revenue in foreign currency.

The Bourse View

At a current price of TT$2.85, GKC trades at a trailing P/E of 15.2x, above the Conglomerate average of 13.9x. The dividend yield stands at 1.9%, below the sector average of 2.8%. The stock trades at a market to book of 1.22x, below the sector average of 1.26x. On the basis of its muted performance, low dividend yield and a relatively high P/E, Bourse maintains a NEUTRAL on GKC.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”