| HIGHLIGHTS Budget, Growth and Debt · Lower revised Revenue projection for 2020 of TT$38.5B · Expenditure projection maintained for 2020 at TT$53.1B · Fiscal Deficit widening to TT$14.5B (initial estimate TT$5.3B) · MoF projecting GDP contraction of 2.4% in 2020 (IMF forecast -4.5%) · In funding the Fiscal Deficit: o Debt to GDP ratio forecast to exceed 70% in 2020 (MoF) o HSF Drawdown of US$400M in May 2020 o Lower likelihood of Asset Sales, given timing requirements Investor Considerations · Will Corporate Earnings struggle? Likely · Will local and international T&T bond yields increase? Likely · Can T&T maintain its international credit rating in 2021? Less Likely · Can Public Debt levels be controlled? Less Likely · Can Total Expenditure be curtailed? Less Likely · Will there be further drawdowns on the HSF? Likely |

THE MID-YEAR REVIEW: AN INVESTOR PERSPECTIVE

This week, we at Bourse evaluate the 2020 Mid-Year Review delivered by the Honourable Minister of Finance, considering the information provided from the perspective of investors. COVID-19 has significantly altered the short-term budget equation for Trinidad & Tobago, likely having a ripple effect on the country’s finances over the medium term as well. With the Revenue/Expenditure balance now tilted toward a more pronounced Fiscal Deficit, investors will be keenly sifting through economic projections to determine how the investing environment could be affected.

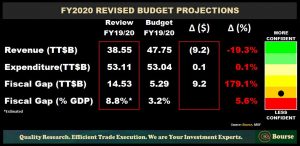

Revenue Contracts Sharply, Expenditure Held Constant

At the start of fiscal 2020, the Trinidad and Tobago government projected Revenue of $47.75B, $16.2B of which was generated by the energy sector predicated on an oil price of US$60 per barrel and a gas price US$3.00 per MMBtu. With energy markets contracting and energy commodity prices plummeting due to the onslaught on the COVID-19 virus, forecast prices were initially revised on March 11th to US$40.00/barrel for oil and US$1.80/MMbtu for natural gas. Following further pronounced declines in energy prices, the FY2020 budget was again revised based on US$25 per barrel for oil and US$1.80 per MMBtu for gas. The mid-year forecast FY2020 figure for Revenue now stands at $38.55B, $9.2B or 19.3% lower than initial projections.

The composition of the $9.2B revenue shortfall encompasses an estimated $3.8B loss in taxes on Income and Profits, $750M in Business Levy and Green Fund Levy, $600M in taxes on Goods and Services and International Trade, $2.5B in Royalties and Production Sharing and $1.2B in Profit from State Enterprises, among other areas.

Budgeted expenditure for FY2020 was revised to $53.11B, (a marginal increase of 0.1%) at the Mid-Year Review compared to the initial projection at the start of fiscal 2020. This was facilitated by the reallocation of Public Expenditure to focus on healthcare and monetary assistance to those individuals/businesses negatively impacted by COVID-19. Reallocation of projected expenditure for fiscal 2020 include (i) Income Tax Refunds for persons owed refunds in the amount of $20,000 or less, (ii) VAT refunds and VAT Bond issuance, (iii) Social welfare grants [Salary Relief and Food Support] , (iv) One-time fuel relief grants, (v) $100M to the Credit Union Sector for soft loans to their members, with an additional $100M provided to the sector specifically for loans to SMEs and (vi) a soft loan programme for SMEs amounting to $300M to be administered by First Citizens Bank Limited among others.

| Investor Considerations · Will Energy Revenues recover in FY2020 and FY2021? · Will the Non-Energy Sector rebound as the economy ‘reopens’? · Can Government Expenditure be moderated to reduce fiscal deficits? |

Growth falters

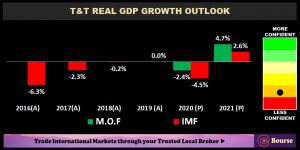

According to IMF data, T&T’s economy contracted from 2016 to 2018, flat-lining in 2019 with 0.0% Real GDP growth. The Ministry of Finance (MoF) expects a contraction of -2.4% for 2020, a forecast which diverges from the IMF’s 2020 projection of a -4.5% contraction (April 2020). The MoF has also projected growth in 2021 of 4.7% (in contrast to the IMF’s 2.6% 2021 forecast for T&T), based on projected energy prices of US$40.00 per barrel for oil and US$2.90 per MMBtu for gas. 2021 budgeted energy prices are broadly consistent with the U.S. Energy Information Administration’s (EIA) forecast of US$43.88 per barrel of WTI crude oil and US$3.08/MMBtu.

Funding the Fiscal Deficit

The T&T Government has three broad options available in bridging the widened fiscal gap, including:

- Private and/or public offerings of state-owned assets.

- Drawing down on accumulated savings from the Heritage and Stabilization Fund (HSF)

- Domestic and/or International Borrowing

While several state-owned or controlled companies could be considered for partial/total sale [including but not limited to the National Gas Company of Trinidad and Tobago (NGC), National Enterprises Limited (NEL), First Citizens Bank Limited (FCB), National Flour Mills Limited (NFL) and Point Lisas Industrial Port Development Corporation Limited (PLIPDECO)], market conditions and time constraints make asset sales a less likely option. Focus, then, shifts toward a combination of borrowing and drawdowns on the HSF.

The country’s Heritage and Stabilization Fund is intended to provide a fiscal buffer from external shocks to the economy. The fund has grown to over US$6B according to the Honourable Minister of Finance as at June 2020, with the published December 2019 quarterly report from the Ministry of Finance stating the HSF was US$6.5B, representing an estimated 26% of the twin island’s 2019 Gross Domestic Product (GDP). The current US$6B in the HSF represents net contribution amounting to US$2.9B and US$3.1B in capital appreciation and interest respectively. The government can withdraw up to US$1.5B (TT$10B) in any financial year from the HSF, currently representing 25% of the fund’s value. The most recent withdrawal was US$400M in May 2020 from the HSF for fiscal deficit funding, bringing the total withdrawals from the fund since the global oil shock in 2015 to US$1.03B.

| Investor Considerations · Will there be additional HSF Drawdowns in FY2020? · How will Credit Rating agencies view depletion of the HSF? · When will contributions to the HSF resume? |

The country’s Net Official Foreign Reserves stood at US$6.89B in May 2020, according to the Central Bank of Trinidad and Tobago (CBTT). The reserves also serve to smooth foreign exchange market imbalances caused by balance of payment (BOP) deficits, which have contributed to a decline in the country’s international reserves from a high of US$11.4B in December 2014, before the fall in global energy prices. At present, T&T foreign reserves results in an Import Cover of 8.0 months, well above the international standard of 3 months but below the country’s historical peak of 14.1 months in April 2011. The reduction in reserves and import cover is likely to remain in its current trend, should net foreign exchange consumption patterns persist.

The government has access to various sources of funding to manage (in the short-term) the widening deficit. The Honourable Minister of Finance alluded to T&T’s access to over $20 billion from multilateral agencies such as the Inter-American Development Bank (IADB), CAF, the World Bank and other international and local banks. Additionally, the sovereign has access to almost TT$4 billion in low cost funding rapid financing instruments from the International Monetary Fund (IMF). The domestic and international markets for the issuance of bonds are also available to support the economy through the pandemic.

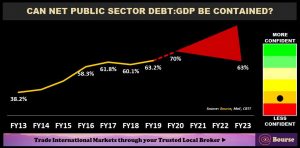

Debt to GDP

The debt-to-GDP ratio for Trinidad and Tobago is expected to expand to 70%, from 60.1% recorded in the quarter ended 30th March, 2020. This increase is owed to the rise in expenditure to stem the impact of COVID-19 on the economy and population, coupled with a forecast decline in economic output. Thus far, the government received approval for a US$50 million loan by CAF and the Inter-American Development Bank (IDB).

This increase in relative indebtedness is expected to be partly remedied by the growth in GDP in FY2021, with the economy expected to expand somewhere between the IMF’s 2.6% growth projection and the MoF’s 4.7% forecast.

Debt: GDP in Context

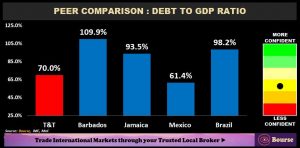

In isolation, surpassing the 70% debt:GDP level seems concerning. Comparing to select regional peers provides additional context. Jamaica and Barbados – both of which have turned to the IMF for policy based loans- have significantly higher debt levels, even post-restructuring of debt under IMF programmes. According to the IMF, Jamaica’s debt burden to GDP is estimated to stand at 93.5% in FY2019/20, whereas, Barbados should report a debt to GDP ratio of 109.9%. Turning to our Latin American neighbours Mexico and Brazil, the IMF is projecting debt to GDP ratios of 61.38% and 98.24% respectively. In this context, Trinidad and Tobago’s likely increase in indebtedness should not push it into financial jeopardy, once managed properly.

What does this mean for investors?

The domestic economy is likely to record weaker economic performance over the coming few months. The Debt-to-GDP ratio, meanwhile, is estimated to increase to over 70%, with perhaps somewhat-optimistic estimates of normalization (60-63%) by 2023. These factors, combined with the government’s necessary drawdown from the Heritage and Stabilization Fund, are likely to weigh on investor sentiment.

Several publicly-listed companies have already reported muted financial performances for the year thus far, opting in many instances to eliminate or reduce dividend payments. Stocks across all sectors of the local/regional equity markets are likely to be impacted by the fallout from the COVID-19 pandemic.

Stocks face headwinds

In light of conditions brought forth by the COVID-19 pandemic, the domestic economy has grappled with suppressed demand for goods and services as well as halted production and operations across a multitude of industries. With disposable income for many economic participants being reduced and consumer spending patterns being altered, essentially all segments of the economy are expected to confront weaker demand. These sentiments have, to some extent, been expressed in the local stock market.

Year to date, the Trinidad and Tobago Composite Index (TTCI) has depreciated by 10.1%, compared to an increase by 4.6%, for the same period last year. This depreciation was heavily weighted by the Banking Sector (the largest sector by market capitalization).

All sectors of the local market have been negatively impacted by the COVID-19 virus. Companies like The West Indian Tobacco Company Limited (WCO) and Trinidad Cement Limited (TCL) were forced to temporarily halt production, while companies like Guardian Holdings Limited (GHL) and JMMB Group Limited (JMMBGL) have faced headwinds from increased volatility in financial markets. The Energy Sector meanwhile, comprising of lone stock Trinidad and Tobago NGL Limited (TTNGL), has reported a decline in performance as global energy markets battled with excess supply and suppressed demand. While Trinidad and Tobago has embarked on its economic reopening, consumer confidence and spending patterns are likely to remain subdued as economic uncertainty persists.

Could T&T US$ and TT$ bond yields increase?

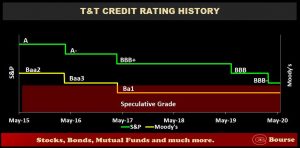

The sovereign credit rating of Trinidad and Tobago has been impacted by the fall in global crude oil and natural gas prices triggered by the coronavirus pandemic. International credit rating agency S&P Global Rating (S&P) downgraded the country’s credit rating in March 2020 from ‘BBB’ to ‘BBB-’, one notch above non-investment grade. The downgrade reflected S&P’s expectation of lower oil and gas prices over several years, leading to a larger increase in the government’s need to depend on debt financing. Moody’s Investor Services (Moody’s) also took action in May 2020 because of lower demand and prices for crude oil and natural gas, changing its outlook for T&T from stable to negative. Moody’s credit rating of the country has been non-investment grade at ‘Ba1’ since 2017, when the agency downgraded the rating based on the expectation of rising debt levels. Negative pressure on the country’s credit rating is expected to continue, potentially impacting the country’s cost of borrowing and access to funding.

Depletion of HSF savings, rising debt levels and muted economic growth set the platform for potential downward rating action. Despite low levels of reported inflation and considerable excess liquidity in the local banking system (TT$8.3B as at May 2020), T&T is likely to face increased borrowing costs in the domestic market. Internationally, borrowing costs are having more pressure to move upward, even with the US Federal Reserve moving USD interest rates to near-zero for the foreseeable future.

Investors in T&T domestic and international bonds are may require a greater rate of return (through higher yields) should the country’s fiscal position stabilize at/ deteriorate from current levels. Despite the sanguine outlook presented, investors are unlikely to be in any more comfortable or confident a position with the latest information arising from the Mid-Year Review. The effects of COVID-19 have adversely impacted the already delicate state of economic activity, which appeared poised to deliver some modest level of growth after several years of economic contraction.

For now, investors will be most focused on how the short-term economic shock to T&T is handled, as well as how quickly economic activity can (if at all) return to some semblance of normalcy. In the medium term, managing debt levels, stimulating growth and reining in unnecessary expenditure will likely be key to bolstering investor confidence.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”