HIGHLIGHTS

TTNGL

- FY2023 – Earnings: Loss Per Share: ($3.54), 38.3% higher, from LPS of ($2.56)

- Q12024- Earnings: Earnings Per Share: $0.20, 122.2% higher, from EPS of $0.09

- Performance Drivers:

- Operational/ market challenges faced by PPGPL

- Non-Cash Impairments in FY2023

- Outlook:

- Potentially increased production

- International Expansion

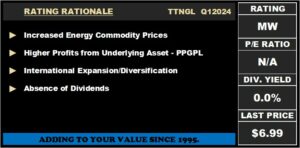

- Rating: Revised to MARKETWEIGHT

Energy Prices Update

- Year to Date Price Performance:

- WTI Crude ↑7%

- Brent Crude ↓9%

- Henry Hub Natural Gas ↑3%

NEL HY2024

- Earnings: Loss Per Share of $0.22 from a prior EPS of $0.75

- Performance Drivers:

- Significant Decrease on Fair Value of Investee Companies

- Lower Dividend Income

- Outlook:

- Potential Increase in Natural Gas Supply

- Rating: Maintained at MARKETWEIGHT

This week, at Bourse, we assess the financial performance of Trinidad and Tobago NGL Limited (TTNGL) for the fiscal year ending December 31st, 2023, and the first quarter ending March 31st, 2024, as well as National Enterprises Limited (NEL) for the six months ending March 31st, 2024. TTNGL’s delayed publication of its audited financials – for the second consecutive year – revealed a decline in earnings due to operational challenges faced by its sole asset, Phoenix Park Gas Processors Limited (PPGPL). However, there was a positive turn in Q12024, with increased profits from PPGPL contributing to improved financial performance. Conversely, NEL experienced reduced dividend income and an unrealized decrease in fair value from one of its investments in the Energy Sector.

TTNGL FY2023: A Challenging Environment

TTNGL generated a Loss per Share (LPS) of $3.54 for the year ended 31st December 2023, 38.3% higher than the LPS of $2.56 in FY2022.

Share of Profit from its Investment in Joint Venture, Phoenix Park Gas Processors Limited (PPGPL) dropped 83.3% to $28.0M in FY2023 from $168.3M in the prior comparable period. Interest Income increased 21.9% to $0.1M. Cumulatively, Total Income stood at $28.2M relative to $168.3M in the prior year, down 83.2%.

For the second consecutive year, TTNGL’s performance was negatively impacted by an impairment loss of $573.6M (FY2022: $562.4M). This translated to a Loss Before Tax of $547.7M in FY2023 (FY2022: $396.6M). Overall, Loss for the Period amounted to $547.7M in FY2023.

Operating Headwinds in FY2023.

Excluding the impact of the impairment charge, FY2023 remained challenging on account of several factors. At its Broker meeting held on June 7th, 2024, TTNGL reported FY2023 challenges faced by its investee company PPGPL, including:

- a 46% increase in feedstock costs to its plant in FY2023 vs FY2022,

- Lower production on lower gas inlet volume and liquids content (down 8% vs FY2022),

- Higher Overhead & Operating costs (up 10% vs FY2022) and

- Lower product prices (down 30% vs FY2022)

The cumulative effect to PPGPL was an 85% lower Profit after Tax relative to FY2022.

Q12024: Performance Improves

Having weathered the storm in FY2023, TTNGL reported an Earnings per Share (EPS) of $0.20 for the first quarter ended 31st March 2024 (Q12024), $0.11 higher than a previous $0.09 in Q12023.

Share of Profit from Investment in Joint Venture, (PPGPL) advanced by $15.9M, from $14.9M to $30.8M. According to TTNGL, conditions for PPGPL improved in Q1 2024 on account of:

- a 23% decrease in feedstock costs to its plant vs Q12023,

- higher production (lower gas inlet volume, but higher liquids content) up 17% vs Q12023,

- Higher Phoenix Park Energy Marketing (PPEM) volumes and margins, up 37%

- Higher product prices (up 13% vs Q12023)

The cumulative effect to PPGPL was a 108% higher Profit after Tax relative to Q12023.

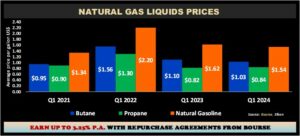

Benchmark NGLs Prices Lower

Benchmark Natural Gas Liquids (NGLs) prices were broadly lower for the period as a result of weaker global demand for NGLs driven by a warmer-than-expected winter coupled with greater NGL inventories.

Average Butane prices dwindled 6.4% from US$1.10 per gallon in Q12023 to US$1.03 per gallon in Q12024, while average Propane prices gained 2.4% from US$0.82 per gallon to US$0.84 per gallon. Natural Gasoline declined 4.9% to US$1.54 per gallon in Q12024 from US$1.62 in the prior comparable period. Year to date, the weighted basket of NGLs has averaged US$1.20 per gallon.

However, TTNGL alluded improved performance in Q12024 due to higher Mont Belvieu NGL prices, rising 13% relative to the prior period. This can be likely attributed to improved margins received from its contracts with counterparties.

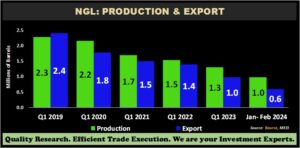

Domestic Production, Exports Decline

Production and exports of NGLs have continued on a generally downward trend based on available official data, notwithstanding PPGPL’s reported improved production in Q1 2024.

NGLs output declined 15.4% from 1.5M (BBLS) in Q12022 (Jan to March 2022) to 1.3M BBLS in January-March 2023. Exports of NGLs by PPGPL was recorded at 1.0M BBLS during the period Jan-March 2023 (Q12023), relative to a previous 1.4M BBLS, down 29.7%.

According to the most recent data published by the Ministry of Energy and Energy Industries (MEEI) up to February 2024, NGL Production reached 1.0M BBLS for the period Jan-Feb 2024 with Exports of NGLs amounting to 0.6M BBLS for the same period.

Cash Resources but…No Dividends

TTNGL’s dividend payments have been volatile, reflective of the cyclical environment pervading the energy industry. Since FY2018, investors attracted to the potential of a significant dividend income haven been left somewhat disappointed as dividends dwindled. With the last dividend having been received in FY2022, investors are now – more than ever – concerned as to when the next cashflow from TTNGL will be realized.

TTNGL asserted that it is considering all possible options to quickly address the current lack of dividends for shareholders. This, as legislation currently prevents TTNGL from distributing dividends to its shareholders. As of March 2024, TTNGL had cash and near cash resources amounting to $127.1M. In other words, if TTNGL fully utilizes its cash resources for dividends, it could pay out dividends of up to $0.82 per share. In the continuing absence of dividends and operating in a dynamic and cyclical industry, investors’ nerves and patience will be severely tested.

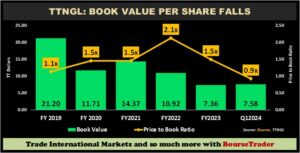

TTNGL’s book value per share contacted in FY2023, attributed to a decline in profitability of its sole investee company (PPGPL) following lower energy commodity prices.

The company’s Book Value Per Share (BVPS) declined from $10.92 in FY2022 to $7.36 in the most recent period. After peaking at 2.1 times in FY2022, the Price-to-book (P/B) in FY2023 fell to 1.5 times, in line with its five-year average. At Q12024, the P/B ratio reached to a low of 0.9 times implying that investors are purchasing the stock at a discount relative to the book value of its net assets per share.

The Bourse View

TTNGL currently trades at a market price of $6.99 down 36.5% year-to-date. The stock currently trades at a market-to-book ratio of 0.9 times.

Despite an improved first quarter performance, TTNGL continues to face notable risks as investor sentiment remains weak on scepticism about the company’s prospects and the resumption of dividend payments. On the basis of a relatively attractive market-to-book ratio, tempered by uncertainty surrounding the current operating environment and the absence of dividends, Bourse revises its rating on TTNGL to MARKETWEIGHT.

National Enterprises Limited (NEL)

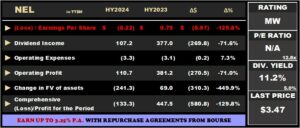

NEL reported a Loss per Share of $0.22 for the six months ended 31 March 2024 (HY2024), a significant swing from an Earnings Per Share of $0.75 in the prior comparable period.

Notably, the Group’s Dividend Income fell by 71.6 % to $107.2M from $377.0M in the previous period. Other Income increased 44.5%, from $5.3M in HY2023 to $7.6M in HY2024. Operating Expenses grew by 7.3% to $3.3M in HY2024, from $3.1M in HY2023. Operating Profit fell by 71.0% to $110.7M in HY2024, led by a significant decline in dividend income.

NEL reported a Loss Before Tax of $130.8M in the current period, down from a profit of $450.2M (HY2023). The change in fair value of assets amounted to $241.5M, 449.9% lower relative to $69.0M in the prior comparable period. For the review period, tax expenses lowered by 6.0% to $2.5M. Overall, the Group recorded $133.3M in total comprehensive loss in HY2024, which was 129.8% lower than the previous comparable period.

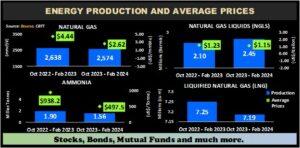

Energy Prices Reduced

Within the period October 2023 – February 2024 Natural Gas production in T&T averaged 2,574 mmcf/d, lower than an average of 2,638 mmcf/d in the prior comparable period. The average price of Natural Gas (using Henry Hub pricing) declined 41.0% year-on-year (YoY) to US$2.62/MMBtu for the period October 2023- February 2024, relative to a previous average of US$4.44/MMBtu.

Domestic production of Natural Gas Liquids (NGLs) improved by 16.6%, from 2.10M barrels/day to 2.45M barrels/day over the comparable period. Using a weighted basket, the average prices for NGLs (propane, butane and natural gas) declined 6.8%, averaging US$1.15/Gallon from US$1.23/Gallon in the prior comparable period.

NEL’s exposure to the Ammonia industry would have been adversely affected by a 47.0% drop in Ammonia prices, which declined from an average of US$938.2/Tonne to US$497.5/Tonne in October 2023 – February 2024. Domestic Ammonia production also trended downwards, moving from 1.90 million Tonnes (MT) to 1.56 MT.

During the period October 2023 – February 2024 Liquefied Natural Gas (LNG) production stood at 7.19M cubic meters, 0.9% lower than 7.25M cubic meters in the prior period.

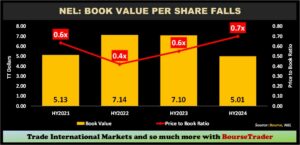

NEL’s book value per share declined in HY2024, driven by a decline in the valuation of its investee companies. The Group’s Book Value Per Share (BVPS) fell from $7.10 in HY2023 to $5.01, down 29.5% in the most recent period. When combined with the fall in its stock price, NEL’s price to book ratio increased from 0.5 times in HY2023 to a current level of 0.7 times.

The Bourse View

At a current price of $3.47, NEL’s stock is currently trading at a market-to-book value of 0.7 times, below its recent historical average of approximately 1.0 times. The stock offers investors an attractive trailing dividend yield of 11.2%, relative to a sector average of 4.9%. The Board of Directors declared an interim dividend of $0.15 per share to shareholders on record as at June 5th, 2024, to be paid on June 18th, 2024.

As indicated in the Central Bank of Trinidad and Tobago (CBTT’s) January 2024 Economic Bulletin, continued buoyancy in the non-energy sector is anticipated to boost economic activity in the short-term, whereas the energy sector is forecast to remain muted. Over the medium to long term, several planned natural gas projects due to investments by upstream companies (BpTT, EoG, Shell) are expected to enhance the energy sector. Near-term, however, energy sector activity and financial performance is likely to remain tepid. Investors remain cognizant of the uncertainty surrounding the energy sector, the volatility in global energy markets, and other regional geopolitical factors. On the basis of attractive dividend yields but tempered by lower dividend income, Bourse maintains its MARKETWEIGHT rating on NEL.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”