HIGHLIGHTS

- Banking Sector Performance Drivers

- Resilient Earnings

- Improved economic activity

- Correction in Market Valuations

- Cooling inflationary pressures

- Banking Sector Performance Outlook

- Improving Net Interest Income

- Increased Demand for Loans

- Improving Cost Management

- Economic Activity Normalization

This week, we at Bourse review the Banking Sector of the Trinidad & Tobago Stock Exchange (TTSE), the largest sector by value or market capitalization, accounting for over half of the TTSE’s total market value. Despite weaker regional investor sentiment reflected in lower stock prices, banking sector earnings have been broadly improving over the course of 2023. Could positive earnings momentum result in price recovery across the sector, or will investors continue their more cautious approach to publicly-listed banks? We discuss below.

Bank Earnings Resilient

The Banking Sector accounts for roughly 55.5% of total index value on the Trinidad and Tobago Stock Exchange (TTSE). Recovering from COVID-affected years in FY2020 and FY2021, the Banking Sector portfolio’s (Banking Stock Portfolio) trailing twelve-month aggregate Earnings per Share (TTM EPS) – assuming an investor held one share of each banking company/group –amounted to $17.88, 2.9% higher than EPS for FY2022 of $17.38. This improvement in earnings notably surpassed pre-covid levels of FY2019 ($17.74) since the pandemic derailed global economic activity. Earnings would have recovered from the FY2020 low of $10.57 per share.

Better Earnings, Prices Lower

Despite an aggregate recovery in earnings, four of the five banking sector constituents experienced year-to-date declines in their stock prices. FCI was the only banking stock with a positive year-to-date change in its stock price (↑32.1%).

Data from the Trinidad and Tobago Stock Exchange (TTSE) showed that the value (market capitalization) of publicly-listed Banking stocks declined 19.5% from $80.1B in 2021 to $64.4B at the end of 2022. Year to date, the market value is up a modest 1.5% at $65.4B, despite lower prices of majority of the sector stocks.

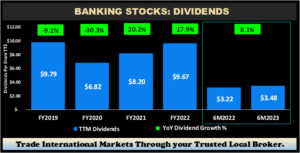

From a dividend perspective, total dividends from our Banking Sector Portfolio would have normalized post-COVID, with investors receiving total dividend income of $9.67 in FY2022. The trailing six-month total dividend (6M2023) amounted to $3.48, or an 8.1% increase relative to the $3.22 which would have been received in the prior comparable period. Healthier dividend flow could be interpreted as an indicator of Banking stocks’ (i) improving profitability and (ii) reduced uncertainty about the operating environment, which would ordinarily enhance shareholders’ confidence.

Banking Stock Value on Offer?

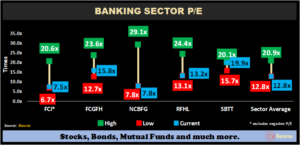

The Banking Sector Price to Earnings (P/E) Average is currently trading below its 5-year average (16.5 times), at a multiple of 12.8 times. The P/E ratio represents a gauge of how much investors would have to pay for every dollar of earnings generated by a company. Higher P/E multiples suggest stocks are more expensive. Elevated P/E multiples were evident in 2020-2021, where earnings may not have kept pace with stock price increases in the sector.

Some degree of mean reversion has taken place in 2022 and 2023, with a combination of stock price correction and earnings growth resulting in improving P/E multiples. Banking sector stocks are now relatively more attractive – to their recent historical levels – possibly enticing to investors. For instance, NCBFG’s valuation is cheap relative to its 5-year historical average (17.8 times), trading at a current P/E multiple of 7.8 times. FirstCaribbean International Bank Limited (FCI) currently trades at the most relatively attractive P/E ratio (7.5x), as compared to the Scotiabank Trinidad and Tobago Limited (SBTT) which trades at the relatively most expensive P/E multiple of 19.9x.

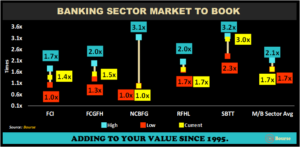

Another valuation metric used to assess relative value is the Market to Book (M/B) multiple, which measures a company’s current market value (or price per share) relative to the book/carrying value per share of a company’s net assets.

Market to Book (M/B) multiples have been reasonably stable over the past five years in the Banking sector, averaging between 1.7 times and 2.1 times from FY2018 to FY2023. The current M/B Banking Sector average stands at 1.7 times. Relative to historical levels, most banking stocks are trading at the lower range of their respective 5-year trailing M/B ratios. For instance, NCBFG currently trades at a M/B ratio of 1.0x relative to its 5-year average of 2.0 times, as compared to SBTT which trades at the relatively most expensive M/B multiple (3.0x).

Cost Management Improves

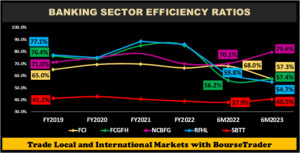

The efficiency ratio demonstrates how effectively Banks manage its overhead costs relative to revenue generation; a lower ratio represents better performance. With the exception of NCBFG, all banks were able to lower their efficiency ratios from pre-COVID levels (FY2019).

On a comparable period basis, NCBFG was also the least favorable amongst its peers, with its ratio increasing from 74.6% in 6M2022 to 84.0% for 6M2023. Both FCI and RFHL managed to lower their efficiency ratios to 57.3% and 54.7% respectively in 6M2023. FCGFH’s efficiency ratio marginally increased from 56.2% to 57.4% in 6M2023. SBTT’s ratio increased from 37.9% in 6M2022 to 40.5% for the six months ending 2023. SBTT has consistently performed better amongst its peers within the past 5 years with efficiency ratios ranging from 38.9% – 42.6%.

Credit Quality Improves

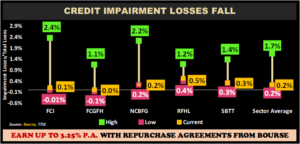

The Banking sector current average for Credit Impairment losses as a percentage of Total Loans stands at 0.2%, on par with the lowest average for this sector within the last five years. This represents a sharp decline from highs seen in 2020. Impairment Losses tend to rise in tandem with the growth of loan portfolios, however the heightened uncertainty caused by the Covid-19 pandemic drove provisions up to a sector average of 1.7%. With inflationary pressures cooling regionally, and economic activity getting back to full swing, impairment losses have moderated. The reduction of impairment losses may signal an improvement in perceived quality of banks’ loan portfolios as the probability of delinquency, distress and/or default abates.

Investor Considerations

From a macroeconomic standpoint, banks’ financial performance in subsequent periods will depend on the health of regional economies and associated activity. The resumption of economic activity has improved general consumption and spending, helping local recovery efforts. As indicated in the Central Bank of Trinidad and Tobago (CBTT’s) May 2023 Monetary Policy Report, the T&T banking system remains ‘well capitalized and profitable with adequate liquidity levels and appears to be well-positioned to absorb shocks and manage growing credit demand.’ Demand for loans continues to grow as inflationary pressures ease and consumers’ appetite for discretionary items expand. While it remains to be seen if this momentum carries forward, recent results suggest that banks appear to be resilient.

From an investment perspective, the Banking Sector is currently trading in more attractive valuation territory. For income-focused investors, stocks such as SBTT and FCI currently offer more attractive dividend yields of 4.5% and 4.3% respectively, while FCI offers the additional advantage of obtaining dividends in US dollars. Growth-focused banking sector investors might look at RFHL and NCBFG, who have executed multiple acquisitions over the past several years. FCGFH has also taken initiatives to grow through acquisition, albeit with less tangible results.

Given that the banking sector has been exhibiting growth coupled with effective cost management, the current relatively attractive valuations make a reasonably compelling case for adding select Banking stocks to an investment portfolio. Banks have and should continue to be a ‘blue-chip’ component of any investment portfolio with a longer-term horizon, usually delivering a mix of capital appreciation and dividend income across economic cycles. The typically stringent regulation of the Banking industry provides another layer of comfort for investors, who can place some level of reliance on robust regulations positively influencing the management of these systemically important institutions. As always, investors should consult a trusted and experienced advisor, such as Bourse, to make informed investment decisions.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”