Local Markets

- 2022 Performance:

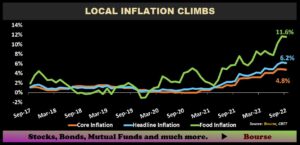

- Inflation Continues

- Food inflation: 11.6 %

- Headline inflation: 6.2%

- Core inflation: 4.8%

- Repo Rate maintained at 3.50%

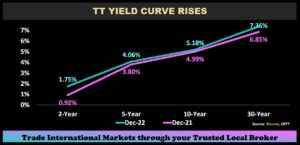

- TT Yield Curve

- 2-Year: 1.75% (↑ 83 bps YTD)

- 10-Year: 5.18% (↑ 19 bps YTD)

- 30-Year: 7.36% (↑ 51 bps YTD)

- Inflation Continues

International Markets

- 2022 Performance:

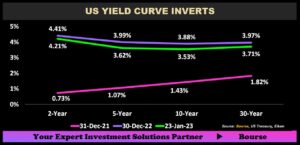

- US Yield Curve Inverts

- 2-Year: 4.41% (↑ 368 bps YTD)

- 10-Year: 3.88% (↑ 245 bps YTD)

- 30-Year: 3.97% (↑ 215 bps YTD)

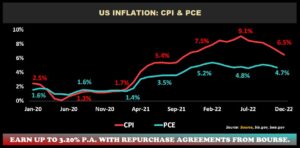

- Inflation climbs

- CPI: 6.5% YoY (Dec 2022)

- PCE: 4.7% YoY (Nov 2022)

- US Yield Curve Inverts

Investor Considerations:

-

- Persistent Inflation

- Elevated Interest Rate Environment

- Credit Quality and Availability of Assets

- Economic Recovery

This week, we at Bourse consider the drivers of both local and international Fixed Income Markets and how investors may tailor their portfolios in the year ahead. To what extent will these drivers such as persistent inflation, elevated interest rates and the economic outlook impact bond investors? We discuss below.

Local Market

TTD Yields Inch Higher

The Government of the Republic of Trinidad & Tobago (GORTT) TT-dollar bond yield curve shifted upward in 2022 to varying degrees. Short-term yields displayed the most pronounced movement, with the 2-year yield jumping from 0.92% in December 2021 to 1.75% in December 2022 (+0.83%). Meanwhile, the 5-year yield increased by 26 bps to 4.06% over the same period. Longer-term yields such as the 10-year and 30-year increased by 19 bps and 51 bps to 5.18% and 7.36% respectively. Subject to bond availability, investors would have had little choice but to look at longer time periods to earn returns in excess of prevailing inflation rates.

Inflation Continues on Upward Trend

Food Inflation as of September 2022 was recorded at 11.6% according to the Central Bank of Trinidad & Tobago. However, data recently reported for November 2022 from the Central Statistical Office (CSO) illustrates that prices of food and non-alcoholic beverages jumped by 13.8% from November 2021 to November 2022. Additionally, CSO reported the All Items index was 8.01% higher YoY as at November 2022, driven by global supply chain constraints, food price increases and Fuel price increases.

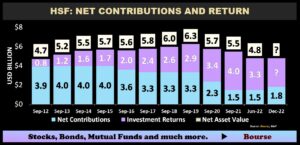

Heritage and Stabilization Fund Received Contributions

The Honourable Minister of Finance indicated a recent deposit of US$182M was made into the Heritage and Stabilisation Fund (HSF), bringing total funds deposited to the HSF in 2022 at US$345M. As at June 2022, the total net asset value of the HSF was US$4,771.5 million, approximately US$528.0 million lower than the previous quarter’s closing value of US$5,299.5 million, mainly due to the decline in international equity markets.

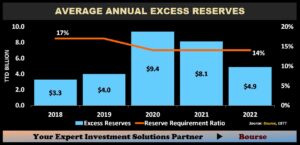

Commercial Excess Reserves Moderate

Average excess reserves for Commercial Banks decreased in 2022 compared to 2020 and 2021, despite the continuance of the Primary Reserve Requirement Ratio of 14%. Financial system credit to businesses rose by 9.6% in October 2022 on a year-on-year basis. Banking system liquidity remained elevated in mid-December (TT$7.1 billion in excess reserves at the Central Bank), suggesting that cash is available to supply borrowing needs in the near-term

Local Interest Rates to remain steady?

Trinidad & Tobago’s economy appears set to continue on a path of recovery, underpinned by the start-up of several production-boosting energy upstream projects and relatively robust energy commodity prices.

In its monetary policy announcement released in December 2022, the CBTT maintained the repo rate at 3.50%. With inflationary pressures more likely to subside in coming periods and no urgent need to control excess liquidity, domestic interest rates are expected to remain relatively low. The Central Bank noted that it would be prepared to deploy further monetary tools namely more active open market operations in its attempt to curb inflation. Persistent excess liquidity and ongoing demand for fixed income opportunities, particularly by large institutions and asset managers, suggest an accommodative environment for borrowing by the Government of the Republic of Trinidad & Tobago (GORTT) as and when needed. The extent to which this could translate into bond investment opportunities for non-institutional investors remains uncertain.

International Markets

Fed Fund Rate Hikes Slows Pace

The US Federal Reserve (Fed) revealed a 0.50% increase in the US Federal Funds rate (Fed Rate) at its last meeting of 2022 (December), taking US benchmark rates to the highest level in 15 years. This action followed four consecutive rate hikes of 0.75%, which represented the Fed’s most aggressive policy moves since the 1980’s. The current Fed rate stands in the range 4.25% – 4.50%, marking the highest fed fund rate since December 2007, just ahead of the global financial crisis. With Inflation remaining well above the Fed’s 2% target, officials have stressed the need to see consistent declines in inflation before materially adjusting US interest rate policy. Markets are pricing a slowdown in Interest rate hikes into 2023, with an estimated 25 basis point hike at the next Federal Open Market Committee (FOMC) meeting in February 2023. Economists forecast the 2023 Fed Fund rate to stand in the range between 5.10% and 5.40%; near the level rates stood at in 2006.

US Treasury Yields Stay Elevated

US Treasury Yields advanced significantly YoY, with the 2-year US Treasury yield ending 2022 up at 4.22%, whereas the 10-year Treasury yields increased 245 bps to 3.88% at the end of 2022. The unusual phenomenon of shorter-term yields exceeding longer-term yields indicates, among other factors, considerable uncertainty of short-term interest rate policy.

US Inflation Moderating

The US Consumer Price Index (CPI) rate of increase slowed to 6.5% annually as at December 2022. Core Personal Consumption Expenditure (PCE), the Fed’s preferred measure of inflation, has held relatively flat for the 6-month period, reported at 4.70% in November 2022, but still stood well above the Fed’s target 2% level. Despite CPI being up from a year ago, (5.7% in November 2021), a 0.1% decrease month-on-month was observed in December 2022. In digesting this data, US policymakers will now be weighing how much further they need to go with interest rate hikes, given the apparent moderation of price increases.

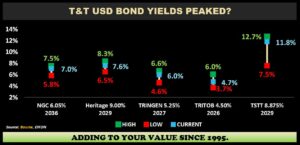

Have T&T USD Bond Yields Peaked?

Yields of T&T USD-denominated bonds sharply rose (with a concurrent fall in bond prices) over the past 12 months, seemingly peaking during the course of 2022. In similar fashion to global USD-denominated bonds, the bonds of issuers such as The National Gas Company of Trinidad and Tobago Limited, Heritage Petroleum Company Limited, Trinidad Generation Unlimited, and the Government of the Republic of Trinidad & Tobago have since recovered price-wise, with yields trending downward in the latter stages of 2022. For example, the Trinidad & Tobago 4.50% USD bond due 2026 had a peak yield of 6.00% but trended down to an average of 4.82% in December 2022, presently trading at a yield of 4.73%.

International Bond Market Outlook

The Head of the International Monetary Fund (IMF) has reconfirmed its 2.7% growth forecast for 2023 in its publication dated October 2022. The IMF Managing Director expects another “tough year” ahead for the global economy, with inflation remaining a tenacious issue. Meanwhile, the World Bank’s latest ‘Global Economics Prospects’ report forecasts global growth to slow to 1.7%, a downward revision to the 3.0% previously expected. The FOMC lowered its U.S. growth targets for 2023, putting expected real GDP gains at just 0.5%. As inflation moderates and investors increasingly anticipate peak US interest rates, global bond markets could be set up for continued stabilization and/or price recovery in 2023. Importantly, this outlook is premised on the non-occurrence of any significant credit market events and/or limited credit quality deterioration, which remains a low-probability outcome barring any deep recessionary conditions across major economies.

Investor Considerations

With conditions seemingly more favourable for the fixed income investor as we move deeper into 2023, investors may be able to breathe a sigh of relief after a quite eventful 2022.

Repurchase agreements, income mutual funds and short-term deposits remain a viable go-to for the lower risk tolerance investor. Repos are fully backed and secured by collateral offering flexible terms for the low risk investor. While Income funds are perfect for warehousing funds for while other opportunities are sought.

For the USD Investor, there continues to be opportunities for the moderate and higher risk tolerance investors in USD bonds with US interest rates at the highest range in over a decade. The moderate risk tolerance investor should stick to investment grade bonds which have a higher credit quality and lower risk of default.

The higher risk tolerance investor could look at speculative bonds which carry higher yields, should you believe that credit conditions will stabilize/improve during the course of 2023. The prospect of peak interest rates may also encourage investors to look at longer-term bonds, to capitalize on price gains should interest rates begin to decline in 2023. As always, it makes good sense to work with a trusted investment advisor, such as Bourse, to ensure you make the most informed investment decisions when building a portfolio to suit your specific investment needs.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”