HIGHLIGHTS

Local Market

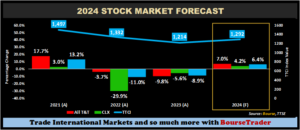

- FY 2024 Projected Performance:

- TTCI: ↑ 6.4%

- ALL T&T: ↑7.0%

- CLX: ↑4.2%

- Market Drivers:

- Continued Economic Growth ↑

- Subdued Energy Production ↓

- Cooling Inflationary Pressures ↑

- Acquisition Activity ↑

- Geographic Diversification Initiatives↑

International Market

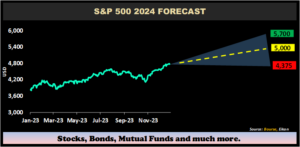

- FY 2024 Projected Performance:

- S&P 500 -8.3% to +19.5%, base case 4.8%

- Market Drivers:

- Slowing Economic Growth ↓

- Cooling Inflation ↑

- Peak Interest Rates

With 2023 now in the rear-view mirror, this week we at Bourse consider the potential direction of local/regional (and international) equity markets in the year ahead. We discuss possible drivers of the investment environment in 2024 and provide an outlook on the various market sectors, given that some themes continue to persist in the markets. Finally, we share some insights on how investors could position their stock portfolio to best manoeuvre the uncertain markets.

Local stock market growth forecast

Following consecutive years of declines, Trinidad & Tobago Stock Exchange (TTSE) listed equities are forecast to advance in 2024. Locally domiciled stocks, as measured by the All T&T Index, are forecast to grow 7.0%, following a 9.8% decline in 2023. The Cross-Listed Index (CLX), featuring TTSE-listed businesses in Jamaica and Barbados, is projected to advance 4.2% (2023: -5.6%). Resultantly, the T&T Composite Index (TTCI) is forecast to advance 6.4%, which – if realized- would partially offset an 8.9% fall in 2023.

Local Markets Drivers

- The economy is expected to benefit from continued economic growth which will likely provide support to improved corporate earnings and thereby encouraging investor confidence and generating chances for long-term growth. Economic growth is expected to remain positive as evidenced by the MoF’s growth forecast of 2.7% in 2023 and projected to remain broadly similar in 2024 and 2025 compared to the International Monetary Fund (IMF’s) forecast of 2.5% gross domestic growth in 2024.

- According to forecasts provided in the FY2024 Budget, Domestic Natural Gas Production is expected to stabilize at approximately 2.6 bcfd in FY 2024 and 2.5 bcfd in FY2025, with additional projects by BpTT, EOG and Shell in 2024-2026 contributing to ‘maintaining’ natural gas production levels. In terms of pricing, the Budgeted Natural Gas price for FY2024 is estimated at $5.00/MMBtu, with energy revenues expecting to contribute roughly 31% of Total Revenue in FY2024.

- Cooling inflationary pressures from primarily imported sources may be partially offset by increased cost of living items including impending property taxes and increased utility rates. The introduction of the increased minimum wage should, in turn, soften the impact of higher living costs on consumption patterns.

At the specific stock level:

- For 2024, the outlook for continued acquisition activity remains positive, with companies seeking to (i) create further value accretion both organically and inorganically, and (ii) increase market share and/or diversify business risk.

- Geographic Diversification Initiatives. Companies that actively pursue geographic expansion, whether organic or inorganic, are more likely to receive positive sentiment from investors who are looking for companies with “built-in” diversification benefits.

- Stable-to-Improving earnings, coupled with retractions in price have led to Relatively Attractive Valuations becoming available to investors. This should be supportive of stronger stock market performance in 2024, all other factors considered.

- Capital Market Developments? New equity opportunities have been few and far in between for investors over the past several years. However, 2024 could be a year of new additions to the TTSE. Investors will be anticipating the cross-listing of Seprod Limited’s AS Brydens & Sons Holdings Limited, one of T&T’s largest distributors. The company successfully listed on the Jamaican Stock Market on November 10th, 2023. NCB Financial Group Holdings Limited (NCBFG’s) consideration of an Additional Public Offering (APO) for up to 300,000,000 new shares, or approximately 12% of its outstanding share capital. The domestic bond market is gearing up for the (National Investment Fund) NIF 2 offer, which according to the Minister of Finance – will have a tenor of 5 years and a very attractive interest rate. Finally, the Small and Medium Enterprise (SME) market pipeline could be set for increased activity, with the CEO of the TTSE hinting at potentially up to 18 new listings in the year ahead.

Sector Outlooks Resilient

Banking. The banking sector, which accounts for around 55.5% of the total market value and is the largest sector by market capitalization, is expected to advance 8.2% in 2024. While stock-specific drivers may vary, broad sector drivers include (i) continued revenue growth, (ii) resilient regional economic activity and (iii) consistent profitability margins. The resultant earnings growth, when combined with relatively attractive valuation multiples, lead to forecast sector stock price movements ranging from +1% to +17%. Within the sector, 2 stocks are rated ‘Overweight’ (OW), and 3 stocks are rated Marketweight (MW).

Conglomerates: Accounting for roughly 20% of total market capitalization, the Conglomerate sector is forecast to advance 8% in 2024. Individual stock price movements are expected to range between +5% to +13%. Revenue growth, solid margins and acquisition activity are features which should be generally supportive of stock price improvement within the sector. Within the sector, 1 stock is rated ‘Overweight’ (OW) and 2 stocks are rated Marketweight (MW).

Non-Banking Finance: The Non-Banking Finance sector (12% of market capitalization) is projected to modestly decline in 2024 by 2%, with individual stock price movements -17% to +8%. Within the sector, 3 stocks are rated Marketweight (MW) with 1 stock is rated Underweight (UW).

The Manufacturing and Trading sectors endured a challenging 2023, with the Manufacturing I sector declining 31.4% while the Manufacturing II sector fell 13.1%. Looking ahead, the performance of constituent stocks within Manufacturing and Trading sectors is estimated to range from -13% to +15% in 2023. Within the sectors, 1 stock is rated Overweight (OW), 8 stocks are rated Marketweight (MW) and 1 stock is rated Underweight (UW).

Energy: Lone energy sector member, Trinidad and Tobago NGL Limited (TTNGL) declined 52.6% in 2023. The major negative impact to TTNGL’s performance came from a significant non-cash impairment loss of in 2022, primarily due to a change in the valuation model utilized by TTNGL in estimating the value of its associate company, PPGPL. Investors would have been acutely aware of the absence of dividend payments in 2023. While the 2024 outlook remains highly uncertain, the forecast for TTNGL’s price movement, premised on (i) a resumption of dividends, (i) limited further impairment charges and (iii) considering the book value per share, is between +20% to +35%.

US Stocks to grind higher?

The S&P 500 rebounded 24.2% in 2023 after a painful 2022, propelled by cooling inflation and looming interest rate cuts. With eyes now turned towards 2024, factors that are likely to drive U.S market sentiment and direction include:

- Slowing (but positive) economic growth – U.S economic growth is expected to slow from an estimated 2.5% in 2023 to 1.6% in 2024, on account of still-elevated interest rates, falling household savings and weakened consumer spending.

- Cooling Inflation – The latest December 2023 consumer price index (CPI) report continued to reflect signs of easing inflationary pressures, reinforcing the Federal Reserve optimism about the path for inflation. If sustained, this may have a positive effect on consumer demand and corporate earnings.

- Peak Interest Rates – After 11 consecutive rate hikes since March 2022, the Fed held interest rates unchanged since its July 2023 policy meeting at a target range of 5.25% to 5.5%. At their December meeting, Federal Reserve Officials concluded that interest rate cuts are likely in 2024 and expects a three quarter-percentage point (75bps) cuts by the end of 2024, if inflation data continues to cooperate. The timing of rate cuts depends on how long the policy rates will remain restrictive to be assured that inflation is on a sustainable and timely path back to its 2% target.

- Geopolitics – Geopolitical tensions seen in 2023 are likely to persist through 2024. The U.S presidential elections, the Israel-Hamas conflict, Russia-Ukraine war and the ongoing rivalry between the U.S and China could potentially rattle global markets.

Consensus estimates give the S&P 500 a median 12-month price forecast of 5,000, implying a 4.8% upside from its December 2023 closing level of 4,770. The highest 2024 target by US analysts is currently 5,700 (up 19.5%), with the most conservative forecast a level of 4,375 (or 8.3% lower).

Investor Considerations

Locally, companies are poised to benefit from moderating inflation and a modest uptick in economic growth, while acquisition activities/geographical expansion initiatives and more stable financial markets may provide further support to stocks. Equities experienced broad-based weakness throughout 2023, despite improved reported financial performance from most companies. Resultantly, valuations have become more compelling for equity investors. Continued focus on stocks that exhibit (i) attractive valuations through lower price-to-earnings (P/E) multiples, (ii) strong company fundamentals, (iii) above-average dividend yields and (iv) provide a partial hedge to the TTD through USD earnings/dividends remain appropriate.

Internationally, consensus estimates for US markets points to a modest appreciation in 2024, despite cooling economic growth expectations. As we enter a new year, diversification remains one of the most effective ways of enhancing risk-adjusted investment performance. Investors should maintain some level of diversification of their portfolio, not only through stock selection but by asset classes as well. Less-active investors may consider a broad-market investment vehicles such as a mutual fund or Exchange Traded Funds (ETFs) to gain market exposure while benefitting from a ready-made diversified portfolio.

As always, investors are encouraged to consult a trusted investment adviser such as Bourse to make the most informed investment decisions.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”