Investor Considerations:

Local Market

- Persistent Inflation

- Low Interest Rates

- Economic Recovery

- Increased GORTT Bond Issuances

- Limited Non-GORTT Bond Options

Investor Considerations:

International Market

- Moderating Inflation

- Peaking Interest

- Bond Market Stabilization?

- Credit Quality Deterioration?

- Availability of Assets

This week, we at Bourse provide an update on local and international bond markets year-to-date, asking the question: ‘Is Fixed Income Currently Attractive?’ With varying factors driving both TT-dollar and US-dollar fixed income markets, are conditions favourable for investors focused on this asset class? What are the investment opportunities available? We discuss below.

Local Fixed Income Markets

Local fixed income market conditions remained broadly unchanged throughout the first quarter of 2023, characterized by relatively stable interest rates and a paucity of bond investment options. Domestic inflation, a concern for both consumers and investors, appears to be peaking.

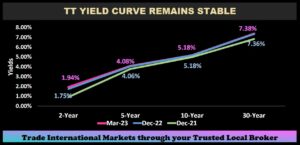

‘GORTT’ Yields Hold Firm

Government of the Republic of Trinidad & Tobago (GORTT) TT-dollar bond yields remained relatively flat over the first quarter. The most notable movement was at the short-term end of the curve, with 2-year yields climbing 19 basis points from 1.75% in December 2022 to 1.94% in March 2023. Mid-to-Longer-term yields remained relatively unchanged. 5-year yields inched up from 4.06% in December 2022 to 4.08% in March 2023, while 30-year yields crept up from 7.36% to 7.38% in the same time period.

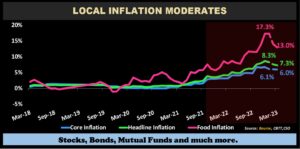

Domestic Inflation Cooling?

According to Central Bank of Trinidad and Tobago (CBTT), Core inflation for January 2023 was 6.1%. Headline Inflation experienced a slight decline of 0.4% from December 2022 to 8.3% and the Food Inflation remained unchanged from December 2022, at an elevated 17.3% as at January 2023.

Preliminary Index data released by the Central Statistical Office (CSO) suggests a moderation in inflation, with notable declines the Food and Non-Alcoholic Beverages Price Indices for February 2023 and March 2023. Food Inflation declined to 14.0% in February and 13.0% in March. Headline inflation, meanwhile, fell to 7.6% in February and 7.3% in March 2023. Core inflation remained at 6.0% into March 2023.

Market Outlook

While trending lower based on recent data, Inflation is expected to remain persistent. Continued moderation would rely on falling food, shipping and raw material prices. Adjustments to utility rates and other living costs could, however, keep domestic inflation at above-average levels.

Domestic interest rates are likely to remain low, despite inflation levels. In its March 2023 announcement, the Monetary Policy Committee maintained the repo rate at 3.50%. The main objective of keeping interest rates low remains fostering economic activity through access to affordable credit. Increasing interest rates might not be particularly effective in curbing inflation, with price pressures likely driven from imported sources.

GORTT Bond Issuances have, thus far, been sporadic year-to-date. With (i) the rapid decline in Natural Gas prices and (ii) relatively stable domestic hydrocarbon production, the likelihood of below-budgeted energy-related revenues is increased. Any wider-than-forecast fiscal gap could be filled, at least in part, through increased state borrowing via bond issuance.

Even with increased GORTT bond issuance, investors still face fairly limited access to non-GORTT bonds options. Accessibility is also sometimes a challenge with GORTT issuances, which have been predominantly brought to market through private placements. Investors looking at actively traded/liquid bonds trading over the Trinidad & Tobago Stock Exchange (TTSE) are limited to (i) several GORTT bonds (of which only 1 is currently ‘actively’ traded) and (ii) the National Investment Fund’s (NIF) Series A, Series B and Series C bonds.

International Fixed Income Markets

In contrast to relatively calm domestic fixed income markets, international bonds markets have endured a fairly eventful past few months. Market expectations and investor sentiment continue to be whipsawed by inflation data, recessionary concerns and ongoing geopolitical tensions.

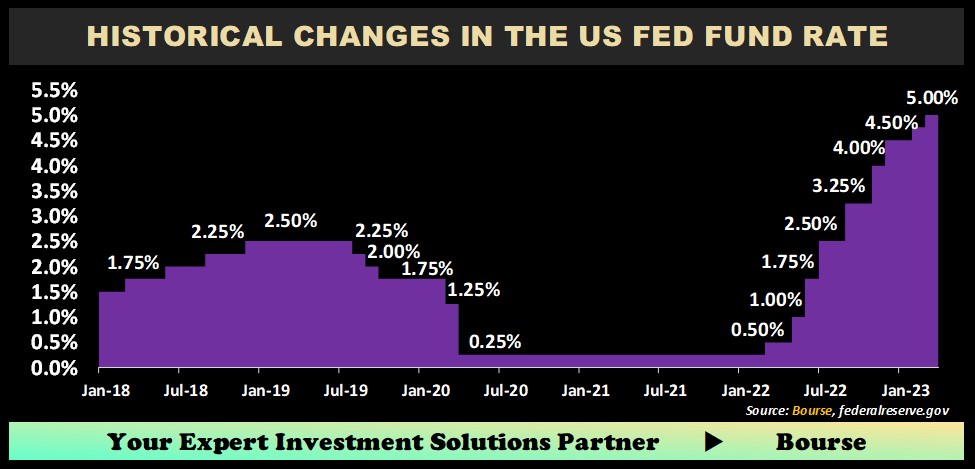

US Interest Rates, Inflation Peaking?

The US Federal Reserve’s (the Fed) most recent 25-bps (0.25%) hike in March 2023 brought the current the Fed Funds rate to 4.75%-5.00%, its highest level since 2007. According to the Fed’s median forecast, interest rates are expected to increase one more time in 2023 before peaking, in the Fed’s battle to curb inflation.

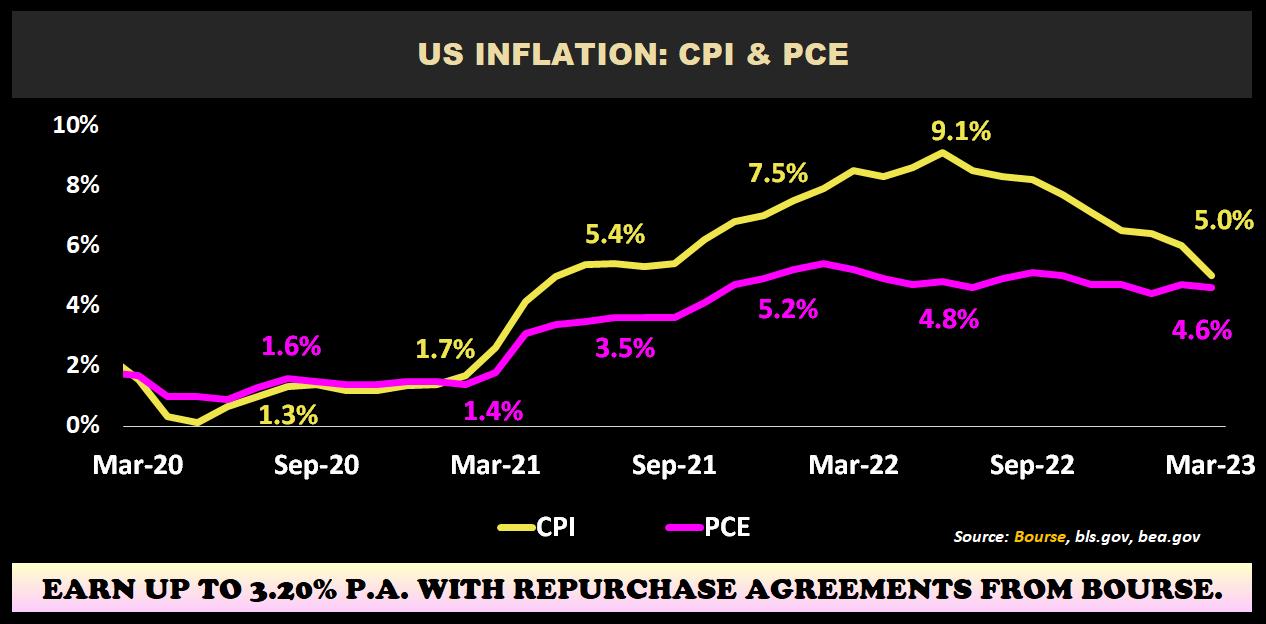

The US Consumer Price Index (CPI) slowed to 5.0% annually as at March 2023. CPI is down from a year ago (reported at 8.5% in March 2022) and is presently at its lowest since May 2021. Personal Consumption Expenditure (PCE), the Fed’s preferred measure of inflation, is currently at 4.6%, showing a decrease year over year as March 2022 PCE was 5.2%. Although still well above the Fed’s target level of 2.0%, the decrease in both values is a move in the right direction. US policymakers will now be weighing how much further they need to go with interest rate hikes to subdue inflation.

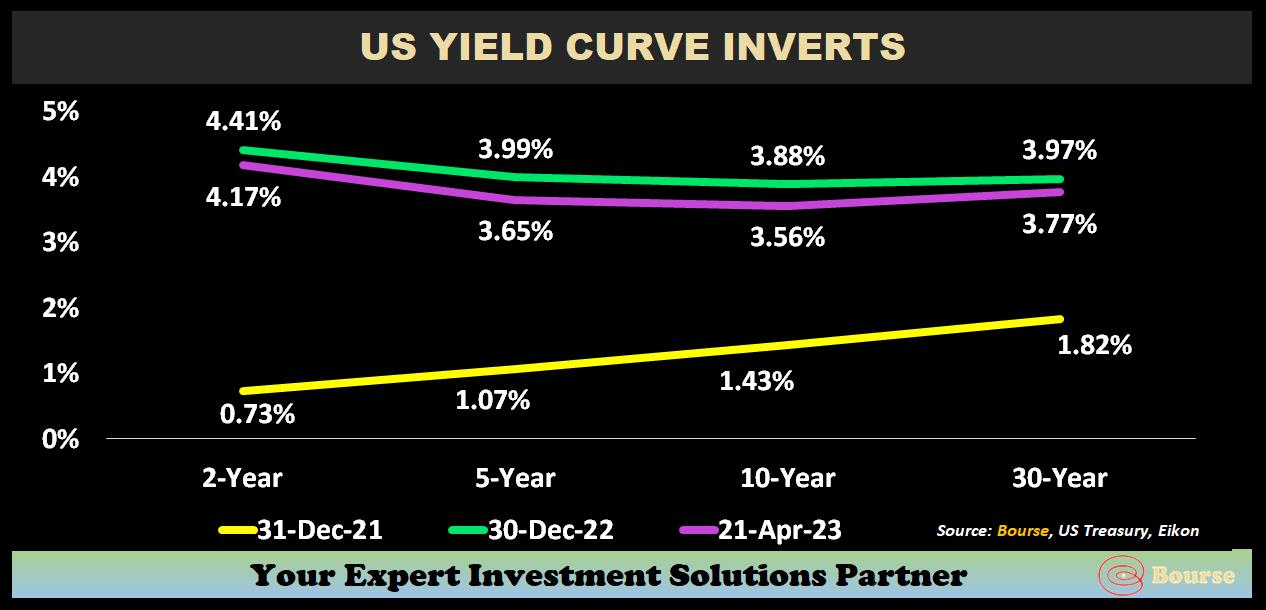

US Treasury yields stabilize

As at April 21st, 2023, the yield on ten-year U.S. government bonds declined 32 basis points YTD to 3.56%, while the yield on two-year bonds fell 24 bps YTD to 4.17%. The decline in yields could signal that peak US interest rates may be on the horizon, as US Federal Officials hint at a slow down or pause in rate hikes. The atypically inverted yield curve (where longer-term bonds offer lower yields than shorter-term maturities), could also be reflecting both inflation expectations and the rising risk of recessionary-like conditions.

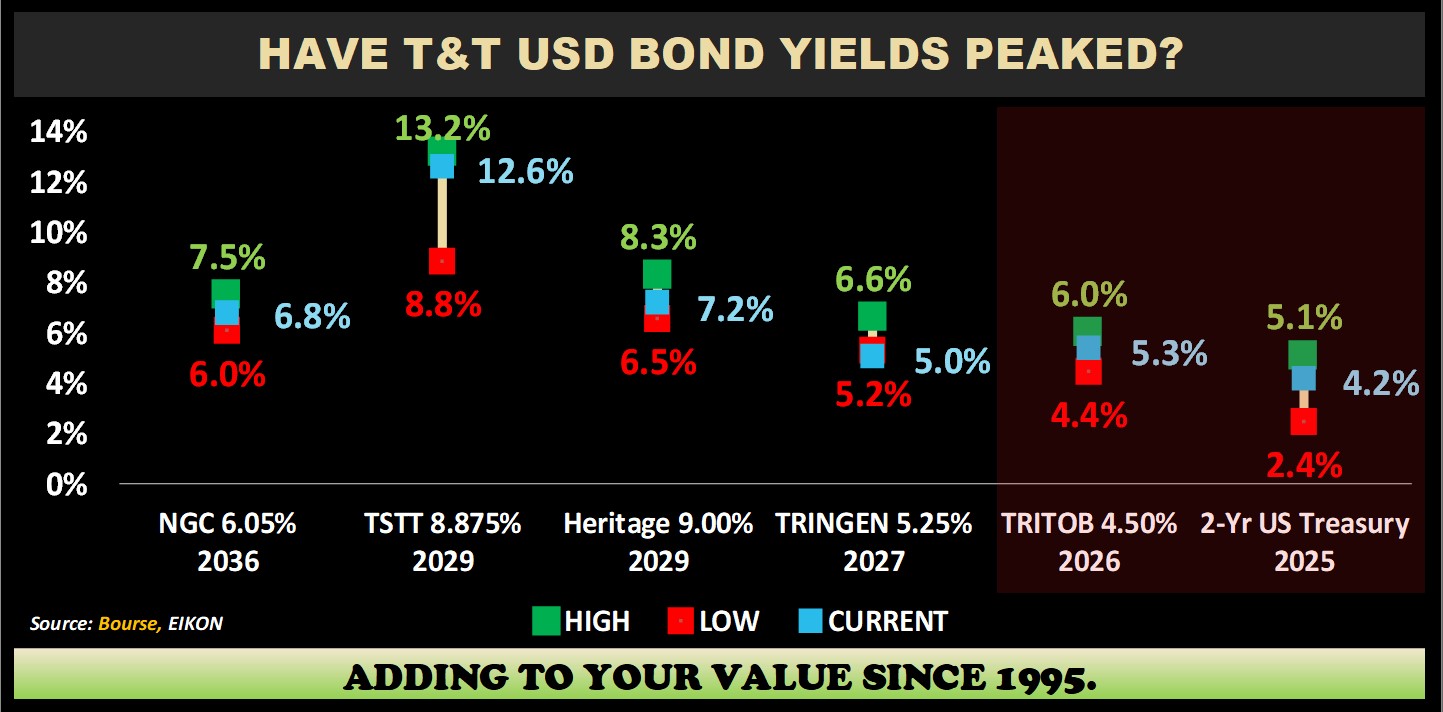

For investors with US dollars looking at domestic USD-denominated bonds, Trinidad & Tobago-related USD-denominated bond yields have broadly declined over the past 12 months. For example, Trinidad Generation Unlimited’s 5.25% USD bond due 2027 hit its 52-week high of 6.6% in November 2022, while The Government of Trinidad & Tobago’s 4.50% USD bond due 2026 USD Bond reached its 52-week high in June 2022. Both bonds are now trading at indicative yields of 5.0% and 4.6% respectively, closer to their 52-week lows.

International Fixed Income Outlook

Recent inflation data and a slowing of the Fed’s interest rate hikes suggests that US inflation may be moderating. The Federal Reserve’s lower than previously projected rate hike in March 2023 of 25 bps (25 bps lower than the previously projected 50 bps anticipated hike) also suggests that peak US interest rates could occur sooner than initially anticipated.

Better clarity on interest rates (specifically the end of the current rate hiking cycle) could provide conditions for broad-based bond market stabilization, which would be welcome news for fixed income investors longing for a more predictable bond environment. However, a call for bond market conditions could be premature, in the context of (i) still-elevated US interest rates and (ii) recessionary conditions. Under these circumstances, bond issuers (borrowers) would confront elevated refinancing costs at a time when they may be less able to afford it. The result, should conditions persist, could be a general deterioration in credit quality across fixed income markets, with observable indicators such as increasing defaults and/or bond restructurings.

Investor Considerations

So, is it the right time to create or add to your fixed income portfolio? On the local front, despite relatively limited TT dollar options, persistent inflation makes it imperative that your excess cash be gainfully employed. Though somewhat limited in access to traditional TTD bond investments, there are a growing number of fixed income opportunities. The fixed income investment menu for investors has (slightly) broadened to include Repurchase Agreements and other options, to complement more traditional Fixed Deposits and Income Mutual Funds. These options are offered by several providers in the T&T financial landscape, including Broker-Dealers (such as Bourse), Non-Bank Financial Institutions (NFIs) and Commercial Banks.

For those investors with US dollars, the likelihood of peak US interest rates and moderating inflation could prompt investors to consider increasing USD fixed income holdings. With recessionary concerns lingering, however, special attention should be paid to ensuring your fixed income investments are of sufficiently robust credit quality, to mitigate any concerns that could arise under more challenging economic conditions. For USD Fixed Income investors, the investment menu remains quite broad. USD-denominated Income Funds, Repurchase Agreements, Deposits, US Treasuries and Government, Quasi-Sovereign and Corporate bonds are all broadly accessible to investors.

As always, it makes good sense to consult with a trusted and expert investment adviser – like Bourse – to ensure you make the most informed investment decisions.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”