HIGHLIGHTS

Local Markets

- Inflation Stabilizes

- Headline Inflation (Sept): 0.4%

- Local Yields Elevated

- 2-year: 3.68%

- 10-year: 5.53%

International Markets

- Inflation Eases

- CPI (Sept): 2.40%

- PCE (Aug): 2.20%

- US Yields Softened

- 2-year: 3.93%

- 10-year: 4.02%

Investor Outlook:

- Moderating Inflation

- Interest Rate Changes

- Bond Market Stabilization

This week, we at Bourse review the Fixed Income markets and the changing interest rate environment, both locally and internationally. With inflation cooling and interest rates softening, should fixed income investors rethink strategies? We discuss some factors to take into consideration below.

Local Markets

Local Inflation Moderates

Local inflation, as measured by the Central Statistical Office (CSO), has stabilized in 2024. Headline inflation is up 0.4% (Year-on-Year) YoY in August 2024 compared to 0.7% in December 2023, driven by food inflation which has been more volatile, fluctuating to 1.5% YoY in August 2024 from -1.1% YoY as at December 2023. The relatively low food inflation has been supported by a slowdown in global food prices reported by the Minister of Finance in the reading of the FY2025 budget. Meanwhile, core inflation (which excludes food prices) moderated at 0.1% YoY in August 2024 from 1.2% YoY in December 2024.

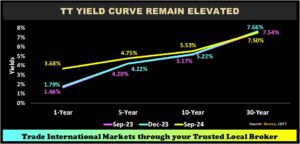

TTD Yields Remain Elevated

Government of the Republic of T&T (GORTT) yields advanced during the first three quarters of 2024 with shorter term interest rates notching the largest increase. The 1-year yields climbed 189 basis points (bps) to 3.68% in September 2024 from 1.79% in December 2023. The rise in short term rates can be attributed to effects of government borrowing and other liquidity constraints. Resultantly, financial institutions would have increased offer rates for fixed income instruments in the short term. Year to Date (YTD) changes were moderate in the medium term as rates rose 53 bps and 31 bps respectively for the 5-year and 10-year yields to 4.75% and 5.53%. Conversely, 30-year yields slid from 7.66% to 7.50% over the same period.

Commercial Banks Average Excess Reserves Fluctuate

The Central Bank lowered the primary reserve requirement ratio from 14% to 10% in July, 2024, amid liquidity constraints in the local environment. The reserve ratio is the percentage of a commercial bank’s deposits that must be held in a non-interest-bearing cash reserve. The lowering of the primary reserve requirement is expected to amplify liquidity in the system, boost borrowing and stimulate economic activity. Subsequent to the adjustment, Commercial Banks Average Excess Reserves increased by 71% Month on Month (MoM) from $3.46 billion in July 2024 to TT$5.92 billion in August 2024, followed by a 9% MoM increase to TT$6.48 billion as at September 2024. The Central Bank last decreased the primary reserve requirement ratio in March 2020 from 17% to 14% during the COVID-19 pandemic to stimulate the economy.

Local Bond Market Outlook

Inflation remains subdued throughout 2024, with projections of relatively steady inflation for the remainder of the year. Domestically, interest rates are expected remain relatively stable in the short term with the Central Bank Monetary Policy Committee holding the repo rate at 3.50% since March 2020.

With the recent adjustment to the commercial banks’ reserve requirement ratio, there has been a noticeable increase in excess liquidity as shown by the growing commercial banks excess reserve data. While the lowering of the reserve ratio promotes borrowing and economic activity, bond issuances for the public investors remain scarce. While we can anticipate the government may be issuing bonds in the future to narrow the fiscal gap for FY2025 of $5.5B, it is likely the issuances may remain as private issuances with limited access to individual investors. The two more popular investment options to local bond investors remain the exchange traded bonds, NIF series B, NIF series C, NIF 2 and the GORTT 4.25% 2037.

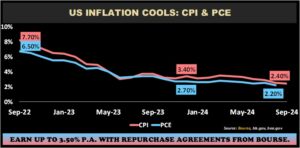

US Inflation Cools

US inflation data, measured by the Consumer Price Index (CPI), ranged between the 2.40%-3.50% during 2024. The CPI recorded its lowest figure since 2021, at 2.40% in September 2024. The US Federal Reserve’s (Fed) preferred measure of inflation, the Personal Consumption Expenditures (PCE) index, has settled within the range of 2.00%-3.00% for 2024. As at August 2024 the PCE recorded a low of 2.20%, closer to the Fed’s 2.00% target, further supporting rate cut projections by the US Federal Reserve.

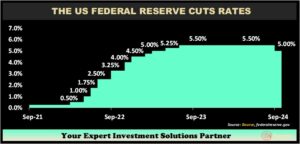

US Fed Cuts Rates

The US Federal Reserve lowered the Fed rate by 50 bps in its September 2024 Fed meeting, down to 4.75% -5.00% range. This comes as the first interest rate cut since March 2020. The last interest rate adjustment took place in July 2023 where rates have held steady since, at 5.25% – 5.50% range until August 2024. The encouraging inflation data in the US has provided the confidence for the US Federal Reserve to reduce rates. Consequently, analysts anticipate two more rate cuts in the November and December 2024 meetings, bringing the estimated range to 4.25%- 4.50% by the end 2024. Further rate cuts are expected in the upcoming year which are estimated to bring the terminal rate in 2025 to approximately 3.50%. The anticipated rate cuts will be highly dependent on economic data and the health of the US economy.

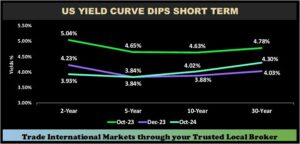

US Yield Curve Lower in the Short Term

The US Treasury Yield curve has remained inverted since 2022, signifying that yields on long-term bonds are lower than yields on short-term bonds. 2-year US treasuries fell 30 bps from 4.23% in December 2023 to 3.93% in October 2024, following the recent fed rate cut. Similarly, 1-Month to 6-Month treasuries also trended lower with respective rates at 4.90% and 4.40%, compared to 5.60% and 5.26% respectively in December 2023. Meanwhile, the 10-year yield inched up 14 bps from 3.88% in December 2023 to 4.02% in October 2024.

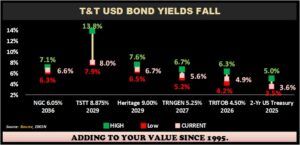

T&T-related USD Bond Yields Decline

For investors considering USD bonds, Trinidad and Tobago’s USD-denominated bond yields declined over the past 52-week period. For example, the Government of Trinidad and Tobago’s (TRITOB) 4.50% USD bond due 2026 is currently trading at 4.90%, under its 52-week high of 6.30%. Meanwhile, Trinidad Generation Unlimited (TRNGEN) 5.25% 2027 is trading at 5.60%, 110 bps below its 52-week high of 6.70%.

S&P Global Ratings affirmed Trinidad and Tobago’s credit rating at ‘BBB-’ on September 06th 2024 with a stable outlook. T&T is expected to experience marginal economic growth over the coming two years with The World Bank projecting growth at 2.3% in 2025 and 0.9% in 2026. TT USD bonds remain a viable option to reduce exposure to local currency while taking advantage of the still-high yielding environment.

International Fixed Income Outlook

According to the July 2024 World Economic Outlook, The International Monetary Fund expects global growth to average 3.2% for 2024 with global inflation declining from 6.7% in 2023 to 5.9% in 2024. This moderating of inflation can be attributable to a number of factors including falling energy prices and cooling labour markets. With global tensions on the rise, it is yet to be seen to what extent this will play in inflation forecasts. Nonetheless, with inflation cooling in the US, closer to the Fed’s target of 2%, interest rate cuts are expected to continue throughout 2025. While the bond market has experienced some stabilization within the year as the Fed maintained interest rates, we do expect bond prices to rise with anticipated fed rate cuts, given the inverse relationship between bond yields and bond prices. Bond issuers should benefit from the lower interest rate expectations given borrowing cost should decline, supporting borrowers credit quality and improve debt servicing. Nevertheless, with US interest rates declining, investors should take advantage of the opportunity to lock in higher rates for the longer term.

For both local and international investors, the ongoing changes in the interest rate environment prompted by supportive inflation data continue to influence opportunities in the fixed income market. As always, we recommend consulting a trusted investment advisor, such as Bourse, to make more informed investment decisions for your portfolio.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”