HIGHLIGHTS

AMCL 9M2023

- Earnings: Earnings Per Share of $1.63

- Performance Drivers

- Higher Revenues

- Non-Cash Mark-to-Market Gains in Investment Portfolios

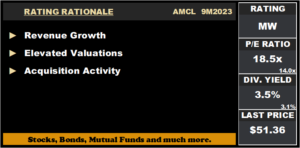

- Rating: Maintained as MARKETWEIGHT

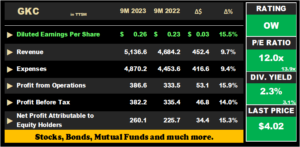

GKC 9M2023

- Earnings: Earnings Per Share of TT$0.26, up 15.5% from TT$0.23 in 9M2022

- Performance Drivers:

- Revenue Growth

- Improving Margins

- Rating: Maintained at OVERWEIGHT

This week we at Bourse review the performance of two stalwarts of the Conglomerate sector on the Trinidad & Tobago Stock Exchange (TTSE), Ansa McAL Limited (AMCL) and GraceKennedy Limited (GKC) for their respective nine-month periods ended September 30th, 2023. AMCL and GKC both benefitted from higher revenues, improved earnings and acquisition activity. As both groups continue to gain profitability, can this momentum be sustained in the upcoming periods? We discuss below.

Ansa McAL Limited (AMCL)

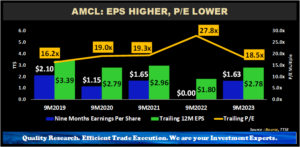

Ansa McAL Limited (AMCL) reported Diluted Earnings per Share (EPS) of $1.63 for the nine months ended September 30th, 2023 (9M2023), compared to an EPS of $0.00 reported in 9M2022. Revenue amounted to $5.2B for 9M2023, up 9.6% or $454.3M. Operating Profit improved 237.7% from $159.8M in 9M2022 to $539.6M in 9M2023. Resultantly, the Group’s Operating Margin grew to 10.4% from 3.4% in the prior period. Finance costs increased 122.5% to $82.7M. Share of Results from Associates and Joint Venture Interests contracted 30.8% to $11.4M (9M2022: $16.5M). Profit Before Tax increased 236.7% from $139.1M in 9M2022 to $468.3M in 9M2023. Taxation expense amounted to $144.5M in the current period under review, relative to $125.4M in 9M2022. Overall, Profit for the Period rose significantly from $13.7M reported in 9M2022 to stand at $323.8M in 9M2023.

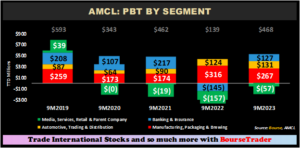

PBT Higher

AMCL reported Profit Before Tax (PBT) of $468M in 9M2023 relative to $139M in 9M2022. The Manufacturing, Packaging & Brewing PBT, its top-earnings segment, retracted 15.5% from $316M in 9M2022 to $267M in 9M2023, which the Group attributed to ‘nonrecurring increased input costs’ related to ensuring supply chain security. The Automotive, Trading & Distribution segment increased 5.3% to $131M relative to $124M in the prior comparable period, increasing both in terms of revenue and profitability year on year. Banking and Insurance services advanced from a PBT loss of $145M in the prior comparable period to a recovery of $127M, likely largely impacted by positive non-cash mark to market gains in its investment portfolios. The Media, Services, Retail and Parent Company segment logged a loss of $57M, smaller than the $157M loss recorded in 9M2022.

Reinvestment and Acquisitions set to drive growth

AMCL reiterated its commitment to its aptly-named ‘2X’ objective, which if successful would result in the Group doubling in size by 2027. Some of the recent initiatives highlighted included:

- The commissioning of a new, advanced bottling line at Carib Brewery, aimed at increasing export capacity and operating in a more environmentally manner.

- The expansion of ANSA Chemicals’ Chlor-Alkali plant, which would deliver capacity to supply 100% of potable water chlorine needs for the entire CARICOM region.

- AMCL also noted improved performance from its recently acquired COLFIRE business, which should serve to enhance its Banking and Insurance segment results in future periods.

AMCL posted an EPS of $1.63 per share in 9M2023, reflecting positive non-cash mark to market gains, reversing non-cash losses in the prior comparable period. Its trailing 12 months EPS moved from $1.80 to $2.78 per share, up 54.4% year-on-year. The Group’s Trailing Price-to-Earnings (P/E) multiple declined from a peak of 27.8 times to 18.5 times in the current period.

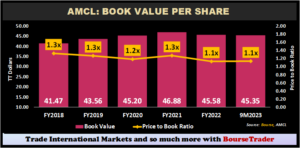

AMCL’s Price to Book Ratio remained relatively stable since FY2020. The Group’s Book Value Per Share (BVPS) marginally declined from $45.58 in FY2022 to $45.35 in the current review period. AMCL’s price to book ratio has remained relatively sticky at 1.1 times in 9M2023 and the previous period FY 2022, having declined from a peak of 1.3 times.

The Bourse View

At a current share price of $51.36, AMCL trades at a trailing P/E multiple of 18.5 times, above the Conglomerate sector average of 14.0 times. The stock offers investors a trailing dividend yield of 3.5%, above the sector average of 3.1%. AMCL’s relatively low leverage, combined with its ambitious growth plans, suggests that continued acquisition activity could be on the horizon. On the basis of increased revenues and relatively attractive dividend yields but tempered by elevated valuations, Bourse maintains a MARKETWEIGHT rating on AMCL.

GraceKennedy Limited (GKC)

GraceKennedy Limited (GKC) reported Earnings per Share (EPS) of TT$0.26 for the nine months ended September 30th, 2023, an increase of 15.5% over the corresponding period in 9M 2022.

Revenue from Product and Services improved 9.1% from $TT4.53B to TT$4.95B, while Interest Revenue advanced 25.9% to TT$189.4M. Notably, Total Revenue advanced 9.7% to TT$5.14B in 9M 2023 from $4.68B in 9M2022. Direct and Operating Expenses grew 9.4% to TT$4.86B, similarly, Net Impairment Losses on Financial Assets climbed 9.4% to TT$10.2M, leading to an expansion in Total Expenses by 9.4% from a previous $4.45B in the prior period. GKC’s operating profit margin moved from 7.1% in 9M 2022 to 7.5% in 9M 2023 owing to 15.9% growth in profit from operations, which went from TT$333.5M to TT$386.6M (9M2023). Interest Income from Non-Financial services gained 12% year on year (YoY), supplemented by a 32.1% increase in Interest Expense from Non-Financial Services from $40.1M (9M 2022) to $52.9M (9M 2023). Share of Results of Associates and Joint Ventures jumped 18.4% to $27.8M compared to the previous comparable period. Profit Before Tax (PBT) amounted to $382.2M, up 14.0% from $335.4M in 9M2022. Taxation expense moved from TT$91.1M to TT$103.2M, representing an increase of 13.3% year on year. Overall, Profit for the period rose 14.2%, an increased from TT$244.3M to TT$279.0M in the current review period. GKC’s reported Net Profit Attributable to Owners amounted to TT$260.1M, a notable increase of 15.3% from a prior TT$225.7M.

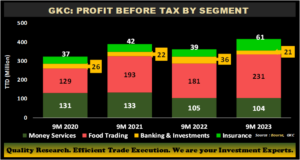

Food Trading Drives PBT

Food Trading, the largest contributor to PBT (55%) increased 27.1% from TT$181M in 9M2022 to TT$231M in 9M2023. The food businesses of GKC experienced increased revenue growth and profitability, notably in the regional and U.S markets, particularly Grace Foods and Services (GFS), Consumer Brands Limited (CBL), World Brands Limited (WBS), and the Hi-Lo Food Stores.

GraceKennedy Money Services (GKMS), the second-largest contributor of PBT (25%) recorded a 0.7% year-over-year decline in performance, attributable to a modest 1% decline in revenues.

The Group’s Insurance Segment, which accounted for 15% of PBT, improved 55.4%. This performance was fueled by notable improvements year on year, in GK General Insurance, Key Insurance and Allied Insurance Brokers, as well as Canopy Insurance operations.

Banking and Investments (5% of PBT) declined 42.5%, on account of GK Capital Management Limited’s (GK Capital) decline in revenue and profitability. This performance was supported by positive gains from First Global Bank in Jamaica but constrained by an underperforming equity market in Jamaica and higher interest rates.

M&A Activities provide boost

GKC announced the completion of its acquisition of Unibev Limited, a Jamaican manufacturing company specializing in fully integrated spring water production, from sourcing raw materials to packaging. Earlier this year GKC fully acquired 876 spring waters, placing GKC in a strong position within Jamaica’s spring water market. To date GKC’s acquisitions also include, 70% share in Catherine’s Peak Bottling Company Limited and 100% ownership in Scotia Insurance Caribbean Limited (SICL), which has been rebranded to GK Life (which currently operate in 13 markets across the Caribbean).

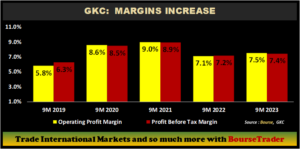

Margins Improve

GKC’s profitability margins, particularly Operating and Profit before tax margins, reported modest growth relative to the prior comparable period. GKC’s Operating Profit margin showed marginal improvement from 7.1% in 9M2022 to 7.5% in 9M 2023, driven by increased revenue growth and effective margin management. Similarly, Profit before tax margin improved from 7.2% to 7.4%. According to the company, this growth was driven by strategic focus on enhancing brand visibility, expanding distribution channels and the implementation of cost management initiatives.

The Bourse View

At a current price of $4.02, GKC trades at a P/E ratio of 12.0 times, below the Conglomerate Sector average of 14.0 times. The stock offers investors a trailing dividend yield of 2.3%, below the sector average of 3.1%. The Group announced a final dividend of TT$0.03, payable to shareholders on December 15th, 2023. Recently, GKC received the necessary requisite regulatory approvals for its share buy-back program, which involves the repurchase of up to 1% of GKC shares in issue for over a period of one year, which commenced in November 2023 on the open market.

The Group is expected to continue with its growth strategy of inorganic opportunities, while simultaneously placing emphasis on cost containment initiatives within its existing businesses. On the basis of improving margins and relatively attractive valuations, aided by continued acquisition activity, Bourse maintains an OVERWEIGHT rating on GKC.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”