HIGHLIGHTS

AMCL Q12024

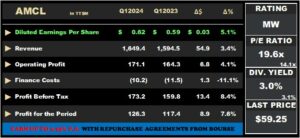

- Earnings: Diluted Earnings Per Share 5.1% higher, from $0.59 to $0.62

- Performance Drivers

- Resilient Revenues

- Lower Input Costs

- Higher results from associates and joint venture interests

- Outlook:

- Continued Acquisition Activity / Geographical Diversification

- Rating: Maintained at MARKETWEIGHT

AGL HY2024

- Earnings: Earnings Per Share 55.2% lower to $1.76 from $3.93 (including the net gain) in HY2023

- Performance Drivers:

- Higher Revenues

- Lower Margins

- Outlook:

- Regional Expansion

- Rating: Maintained at MARKETWEIGHT

This week we at Bourse review the performance of Ansa McAL Limited (AMCL) and Agostini’s Limited (AGL) for their respective first quarter and half year ended March 31st, 2024. AMCL would have benefited from improved revenues and margins, supported by its acquisitions/geographical initiatives. AGL, meanwhile, experienced a decline in earnings accompanied by reduced margins. Could AMCL continue to grow its earnings? Can AGL effectively manage its costs as the financial year progresses? We discuss below.

Ansa McAL Limited (AMCL)

Ansa McAL Limited (AMCL) reported a Diluted Earnings per Share (EPS) of $0.62 for the financial year ended March 31st, 2024 (Q12024), up 5.1% higher relative to $0.59 reported in the prior comparable period (Q12023).

Revenue expanded 3.4% Year-on-Year (YoY), from $1.59B to $1.65B. Operating Profit climbed 4.1% to $171.1M in comparison to $164.3M, a year earlier. Finance Costs fell 11.1% or $1.3M year- on-year. Profit Before Tax (PBT) expanded by 8.4%, from $159.8M to $173.2M in Q12024. AMCL’s Share of Result of Associates and Joint Venture Interests grew 75.7% to $12.3M from a prior $7.0M. The Group reported taxation expense of $46.9M in Q12024, from a prior $42.4M. Profit for the Period expanded by 7.6% from $117.4M in Q12023 to $126.3M in Q12024. Resultantly, Profit attributable to equity holders of the parent advanced 4.5% to $107.0M in Q12024.

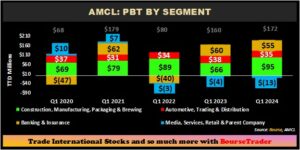

PBT Expands

AMCL’s Profit Before Tax (PBT) increased to $172M in Q12024 relative to $160M in Q12023. Construction, Manufacturing, Packaging & Brewing the largest contributor to PBT (55.0%) climbed from $66M in Q12023 to $95M in Q12024, boosted by higher sales and increased operational efficiencies particularly in the Beverage sector. Banking and Insurance Services, the second largest contributor to PBT (31.9%) contracted 8.5% year-on-year to $55M. Automotive, Trading & Distribution (20.4% of PBT) reported a decline in profitability, down 5.8% to $35M relative to $38M in the prior comparable quarter. The Media, Services, Retail and Parent Company segment recorded a loss of $13M in Q12024, higher than the $4M loss reported in the last reported quarter.

Reinvestment and Acquisitions set to drive growth

AMCL reiterated its commitment to its ambitious ‘2X’ objective, as it continues to reinvest in its existing businesses while pursuing inorganic growth opportunities through acquisitions and/or partnerships. Some of the recent initiatives include:

- Carib Brewery’s $200 million smart manufacturing ‘Lucky’ Line 7 was successfully commissioned to produce 54,000 bottles per hour, increasing production capacity, quality and operational efficiencies while facilitating the exploration of additional opportunities, such as partnerships and collaborations.

- Its entry into the Asian alcoholic beverages market through a joint venture agreement with Globus Spirits Limited, to establish Globus Ansa Private Ltd (GAPL). This partnership will specialize in the production and distribution of beer and other beverages across the Indian subcontinent.

- A 50% expansion of ANSA Chemicals’ Chlor-Alkali plant to be completed during Q3 2024, ensuring that it can fully service the CARICOM market.

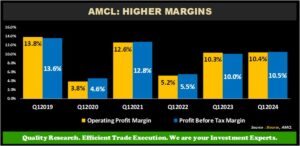

Margins Improve

AMCL’s profitability margins increased incrementally year-on-year, remaining below pre-COVID levels (Q12019). In the first quarter of 2024, the Operating Profit Margin for AMCL stood at 10.4%, up from 10.3% in Q12023. Profit Before Tax Margin in Q12024 improved to 10.5%, up from 10.0% in Q12023.

The Bourse View

At a current market price of $59.25, up 9.6% year-to-date, AMCL trades at a trailing P/E of 19.6 times, above the Conglomerate sector average of 14.1 times. The stock offers investors a trailing dividend yield of 3.0%, below the sector average of 3.1%.

AMCL’s continues to strengthen and boost the value of its existing operations via strategic partnerships and acquisitions, while concurrently diversifying its presence regionally and internationally. On the basis of increased revenue growth, continued acquisition activity/ geographical diversification but tempered by elevated valuations, Bourse maintains a MARKETWEIGHT rating on AMCL.

Agostini’s Limited (AGL)

Agostini’s Limited reported an Earnings Per Share (EPS) of $1.76 for the six months ended March 31st, 2024 (HY2024), 55.2% lower than $3.93 (inclusive of one-off gain) reported in the previous period. Excluding the one-off gain in HY2023 with an EPS of $1.88, EPS would have contracted 6.4% in HY2024.

Revenue expanded 7.0% to $2.6B from the previous $2.4B. Operating Profit was flat, up 0.4% to $269.1M compared to $268.0M in HY2023. Finance Costs grew 49.2% to $30.8M (HY2024) from $20.6M (HY2023). Profit Before Taxation declined 38.3% from $386.3M to $238.3M in the current period. Taxation expenses were $68.1M, down from $69.1M in the prior comparable quarter. Profit Attributable to Parent Owners was $121.6M, a 55.2% decreased over the prior period’s profit of $271.6M. The Group’s earnings dipped largely as a result of non-realized gains in the prior period, which included the benefit from the disposal of AGL’s contracting division.

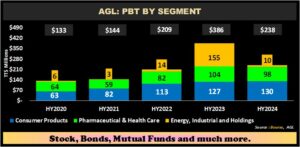

PBT Contracts

Consumer Products, which accounted for 54.6% of PBT, grew 2.8% year-on-year to $130M, supported by revenue growth in each of its operating markets.

Pharmaceutical & Health Care, (41.1% of PBT) dropped 6.1% from $104M in HY2023 to $98M in HY2024, attributable to logistical issues and weaker conditions faced in several regional markets. In April 2024, the Group announced a strategic partnership with Linda’s Bakery, acquiring 14 of their retail outlets via its SuperPharm subsidiary in an effort to enhance its fresh-to-go meal offerings.

Energy, Industrial and Holdings, which contributed 4.3% of PBT, contracted a noteworthy 93.4% over the period to $10M from a prior $155M, in the absence of the one-off non-cash gain on acquisitions.

Margins Dip

AGL’s Operating and Profit Before Tax margins both declined, despite revenue growth in HY2024. Operating Profit Margin declined to 10.5% in HY2024 from 11.2% in HY2023. This filtered into Profit Before Tax Margin, which narrowed to 9.3% relative to 16.1% in the prior period. Excluding the one-off gain, PBT Margin would have been an estimated 10.2% in HY2023.

Excluding one-off gains and the revaluation of investment property in the period under review, margins would not have been impacted as significantly as the reported results suggest.

The Bourse View

At a current price of $68.77, AGL trades at a Price to Earnings (P/E) Ratio of 21.9 times, above the Trading Sector average of 18.0 times. The stock offers a trailing dividend yield of 2.2%, below the sector average of 3.3%. The Group announced an interim dividend of $0.40 per share payable on June 28th, 2024, to shareholders registered by June 3rd, 2024, and closed on June 4th and 5th, 2024.

AGL continues to grow its segments through organic growth and, more significantly, via strategic acquisitions, allowing for more geographic variety within the Group. Integration of these acquisitions successfully and cost-effectively into the group should be an important driver of earning momentum in the coming quarters. On the basis of acquisition activities and revenue growth, tempered by narrower margins and relatively elevated valuations, Bourse maintains a MARKETWEIGHT rating on AGL.