HIGHLIGHTS

AMCL FY2023

- Earnings: Diluted Earnings Per Share 145.9% higher, from $1.22 to $3.00

- Performance Drivers

- Revenue Growth

- Non-cash Mark-to-Market gains in Investment Portfolios

- Higher results from associates and joint venture interests

- Outlook:

- Continued Acquisition Activity / Geographical Diversification

- Rating: Maintained at MARKETWEIGHT

UCL FY2023

- Earnings: Earnings Per Share 75.7% higher, from $0.37 to $0.65

- Performance Drivers:

- Lower Revenues

- Robust Margins

- Outlook:

- Normalized operations post re-organization

- Rating: Maintained at MARKETWEIGHT

This week we at Bourse review the performance of Ansa McAL Limited (AMCL) and Unilever Caribbean Limited (UCL) for their respective fiscal years ended December 31st, 2023. AMCL reported robust earnings growth and improved operating margins. UCL also reported increased earnings, despite lower revenues. How will both entities fare in the upcoming months? We discuss below.

Ansa McAL Limited (AMCL)

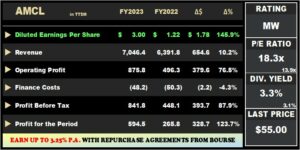

Ansa McAL Limited (AMCL) reported a Diluted Earnings per Share (EPS) of $3.00 for the financial year ended December 31st, 2023 (FY2023), up 145.9% higher relative to $1.22 reported in the prior comparable period (FY2022).

Revenue expanded 10.2% Year-on-Year (YoY), from $6.4B to $7.0B. Operating Profit climbed 76.5% to $875.8M in comparison to $496.3M, a year earlier. Resultantly, the Operating Margin increased from 7.8% to 12.4% Year-on-Year (YoY). Finance Costs fell 4.3% or $2.2M year- on-year. Profit Before Tax (PBT) expand by 87.9% was reported for, from $448.1M to $841.8M in FY2023. AMCL’s Share of Result of Associates and Joint Venture Interests grew to $14.2M from a prior $2.2M. The Group reported taxation expense of $247.4M, with the Effective Tax Rate moving from 40.7% to 29.4%. Resultantly, Profit for the Period expanded by 123.7% from $265.8M in FY2022 to $594.5M in FY2023.

PBT Expands

AMCL’s PBT expanded by 88% relative to a decline of 52% in the prior comparable period. The Construction, Manufacturing, Packaging & Brewing sector, the largest contributor to PBT (56.5%) climbed from $459M in FY2022 to $476M in FY2023, boosted by increased efficiencies and reduced input costs. The second largest contributor to PBT, Automotive, Trading & Distribution (19.5% of PBT) reported a decline in profitability, down 9.5% to $164M relative to $181M a year earlier. PBT from Banking and Insurance services (24.1%) swung from a loss of $20M to a gain of $203M in FY2023, benefitting from higher interest rate environment and favourable non-cash unrealized investment gains. The Media, Services, Retail and Parent Company segment recorded a loss of $1M, smaller than the $173M loss reported in the prior comparable period. According to the Group, recent acquisition COLFIRE, made noticeable contributions to the Group’s current performance.

Acquisitions, Partnerships and Reinvestment

AMCL continues to reinvest in its existing businesses while seeking out inorganic growth opportunities through acquisitions and/or partnerships, consistent with its long-term strategy for growth and its ambitious ‘2X’ target. The Group reported reinvestment of $736M, including the commissioning of a state-of-the-art returnable bottling line at Carib Brewery Trinidad and a bottle washer at Carib Brewery Grenada. With sustainability in mind, AMCL also reported its additional investment of $55.8M to improving energy output at its joint venture solar farm in the Dominican Republic, while continuing to focus on commercially viable renewable energy projects in the Caribbean region. Additionally, AMCL announced its entry into the Asian alcoholic beverages market through a joint venture agreement with Globus Spirits Ltd, to establish Globus Ansa Private Ltd (GAPL). Through its 50% ownership in GAPL, AMCL will now be poised to tap the potentially lucrative Asian market via the production, marketing, sale and distribution of beer and other beverages.

For the fiscal year 2023, AMCL reported an EPS of $3.00, up 145.9% from a previous $1.22 in FY2022. The Group’s Trailing Price-to-Earnings (P/E) is 18.3 times, which is more consistent with prior-year multiples. AMCL’s total dividends remained relatively stable at $1.80, except for FY2019 and FY2020.

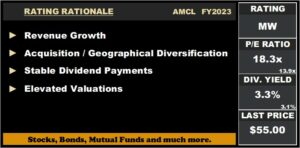

The Bourse View

At a current price of $55.00, AMCL trades at a trailing P/E of 18.3 times, above the Conglomerate sector average of 13.9 times. The stock offers investors a trailing dividend yield of 3.3%, in-line with the sector average of 3.1%. The Group announced a final dividend of $1.50, payable on June 3rd, 2024, to shareholders on record by May 20th, 2024. For the year, AMCL dividends totaled $1.80.

AMCL continues to extend its global footprint, with regional and international diversification into predominantly core areas of business. On the basis of increased revenue growth, continued acquisition activity/ geographical diversification but tempered by elevated valuations, Bourse maintains a MARKETWEIGHT rating on AMCL.

Unilever Caribbean Limited (UCL)

Unilever Caribbean Limited (UCL) declared Earnings Per Share (EPS) of $0.65 for the fiscal year ending December 31, 2023 (FY2023), up from $0.37 in the prior comparable period. Revenue was $204.8M in the current quarter, down 20.1% from $256.1M in FY2022. Cost of Sales reported was 26.7% lower, from $150.9M in FY2022 to $110.6M in the present year. Gross Profit dropped 10.5% to $94.2M. Selling and distribution costs and impairment reversal on trade receivables declined 13.7% and 2.8%, respectively, but Administrative Expenses increased 3.5%, resulting in an 11.7% drop in Operating Profit from $28.8M in FY2022 to $25.4M in FY2023. Restructuring costs fell 92.8% throughout the period, from $30.6M to $2.2M. The majority of UCL’s reorganization costs appeared to have dissipated, leading to a 93.0% increase in Operating Profit after restructuring costs of $23.2M. Profit Before Taxation amounted to $26.5M, a 393.4% gain from a prior $5.4M. Overall, UCL’s Profit for the Period amounted to $17.2M, 75.6% greater than $9.8M recorded in the prior period.

Revenue Lower

UCL Total Revenue decreased from $256M in FY2022 to $205M in FY2023, a decline of 20.1%. The Home Care sector led the decline, with segmental revenue down 41.5% year-on-year, likely due to the highly competitive market and the uncertain macroeconomic conditions that persisted throughout the year. Notably, the Beauty and Personal Care segment by revenue rose 5.8%, which contributed to sales growth in both the local and regional markets.

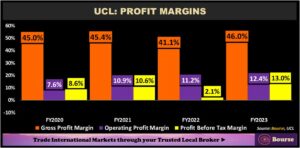

Margins Improve

Notwithstanding lower revenue, UCL’s profit margins improved relative to prior periods. Gross Profit Margin climbed from 41.1% in FY2022 to 46.0% in FY2023, as the Home Care industry improved its operations. According to UCL, the Company benefited from material and freight cost improvements in 2023. Operating Profit Margin improved from 11.2% to 12.4%. UCL’s Profit Before Tax Margin advanced to 13.0% in FY2023 from 2.1% the previous year.

The Bourse View

At a current price of $11.19, UCL trades at a trailing P/E of 17.2 times, above the combined Manufacturing Sector I&II average of 14.9 times. UCL’s P/E ratio excluding Restructuring costs stands at an estimated 15.2 times. The Board of Directors announced a final dividend of $0.48, bringing the total dividend to $0.56 for the financial year. The stock offers investors a trailing dividend yield of 5.0%, above the sector average of 3.8%.

The Company has committed itself to building a sustainable business, with a portfolio of highly competitive and profitable brands. Post-restructuring, investors will likely be assessing UCL’s performance with an eye on (i) operating efficiency and (ii) cash flow via dividends. On the basis of increased profitability margins and relatively attractive dividend yield, tempered by revenue reduction, Bourse maintains a MARKETWEIGHT rating on UCL.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase, or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives, or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”