HIGHLIGHTS

AMCL 9M 2021

- Earnings: EPS 43.5% higher, from $1.15 to $1.65

- Performance Drivers:

- Robust Financial Markets

- Rebranding Initiatives

- Outlook:

- Gradual Economic Reopening

- Rating: Maintained at NEUTRAL

GKC 9M 2021

- Earnings: Earnings Per Share of TT$0.250, up 27.9% from TT$0.196

- Performance Drivers:

- Food Trading segment boosts profits

- Higher Margins

- Outlook:

- Improving Operational Efficiency

- Stabilizing Financial Markets

- Economic Uncertainty

- Rating: Maintained at NEUTRAL

This week, we at Bourse review the performance of Conglomerate sector stalwarts Ansa McAL Limited (AMCL) and GraceKennedy Limited (GKC) for the nine-month period ended September 30th, 2021. Both groups delivered higher year-on-year results, with AMCL benefiting from rebranding efforts and rigorous expense management. GKC, meanwhile, experienced robust growth in both its international and domestic markets. With both groups poised to benefit from reopening initiatives, could positive earnings momentum continue? We discuss below.

Ansa McAL Limited (AMCL)

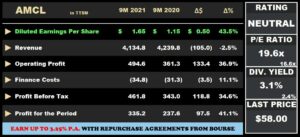

Ansa McAL Limited (AMCL) reported Diluted Earnings per Share (EPS) of $1.65 for the nine months ended September 30th, 2021 (9M 2021), 43.5% higher than $1.15 reported in 9M 2020. Revenue amounted to $4.1B for 9M 2021, down 2.5% or $105M. Despite the decline in revenue, Operating Profit increased 36.9% from $361.3M in 9M 2020 to $494.6M in 9M 2021. Resultantly, the Group’s Operating Margin increased to 12.0% from 8.5% Year-on-Year. Finance costs increased 11.1% to $34.8M, while Share of Results from Associates and Joint Venture Interests fell 84.7% or $11.1M (9M 2021: $2.0M). Profit Before Tax expanded 34.6% from $343.0M in 9M 2020 to $461.8M in 9M 2021, resulting in an increase in PBT Margin (9M 2021: 11.2%). The Group’s effective tax rate fell marginally from 30.7% to 27.4%. Overall, Profit for the Period increased 41.1% from $237.6M reported in 9M 2020 to stand at $335.2M in 9M 2021.

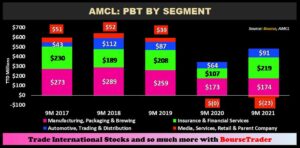

Insurance & Financial Services Recover

AMCL’s main contributor to PBT- Insurance and Financial Services (47.4%) – expanded 104.7% to $219M on account of robust advances across financial markets. The Group’s banking segment also experienced growth as Ansa Merchant Bank, Ansa Bank and Consolidated Finance Company Limited in Barbados all produced new business growth during the period. According to AMBL, Ansa Bank almost doubled previous operations with the Bank booking new loans at an impressive rate.

The second largest contributor to PBT, Manufacturing, Packaging & Brewing (37.7%), increased marginally by 0.6% to $174M with the Group receiving a positive reception to its Carib rebranding initiative. According to AMCL, its Carib Beer USA operations experienced an encouraging 21% volume growth following the reopening of theme parks in Florida.

The Automotive, Trading & Distribution segment, which accounts for 19.8% of PBT, increased 42.2% with the Group noting a 6% growth in volume following the rebranding of Berger in Jamaica. AMCL is likely to benefit from the addition of construction equipment offerings in Guyana, as its plans to serve demand as it relates to numerous road developments to materialize within the year. The Group’s Beverage segment is also poised to benefit following the removal of restrictions on entertainment channels and recent lifting of the State of Emergency (SOE) in effect in Trinidad and Tobago since May 2021.

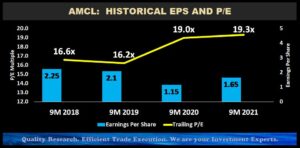

EPS Recovers, P/E expands

AMCL’s earnings per share increased from $1.15 (trailing P/E 18.9) in 9M 2020 to $1.65 (trailing P/E 19.3) in 9M 2021 as the Group continues to recover from the lingering economic effects of COVID-19. The Group’s P/E multiple expanded from a low of 16.2 times in 9M 2019 to a peak of 19.3 times in 9M 2021 (YTD:19.6), a possible signal of investors’ confidence in the Group’s ability to bounce back from an abnormal period of operations.

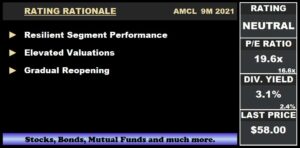

The Bourse View

At a current price of $58.00, AMCL trades at a trailing P/E of 19.6 times, above the Conglomerate sector average of 16.6 times. The stock offers investors a trailing dividend yield of 3.1%, above the sector average of 2.4%. As the Group’s primary markets cautiously continue to reopen, AMCL is likely to rebound as overall demand increases. On the basis of recovering earnings, but tempered by currently elevated valuations, Bourse maintains a NEUTRAL rating on AMCL.

GraceKennedy Limited (GKC)

GKC reported Earnings per Share (EPS) of TT$0.250 for the nine-month period ended September 30st 2021, 27.9% higher than the EPS of TT$0.196 reported in 9M 2020. Product and Services Revenue improved 11.2% from TT$3.65B to TT$4.06B, while Interest Revenue gained 5.3% to TT$150.5M. Overall, Total Revenue increased 11.2% to TT$4.21B from TT$3.78B. Direct and Operating Expenses grew 11.4% to TT$3.9B whilst Net Impairment Losses on Financial Assets fell 37.7% from TT27.7M to TT$17.3M. Consequently, Total Expenses expanded by 11.0%. Profit from Operations increased 16.3% from TT$325.2M to TT$378.2M.

Interest Income from Non-Financial services was up 23.4% year on year (YoY), followed by a 1.7% increase for Interest Expense from Non-Financial Services. Share of Results of Associates and Joint Ventures slid 10.1% to TT$16.2M. Profit Before Tax (PBT) amounted to TT$375.8M in 9M 2021, up 16.9% from TT$321.5M in the corresponding period. Overall, Net Profit Attributable to Equity Holders was TT$249.8M, a 28.3% increase from TT$194.7M reported in 9M 2020.

Food Trading Advances

Food Trading, the largest contributor to PBT (50%), grew 50% in the period to TT$195M, driven by revenue growth and improved margins across the Group’s international and domestic business lines. Demand for GKC’s core products remained strong in its main jurisdiction of Jamaica. New marketing campaigns and product innovations enhanced GK’s Foods brand visibility and recognition on the local and international markets. Double-digit growth was also achieved in domestic sales through Hi-Lo Food Stores, as pandemic restrictions in August and September prompted food offerings through delivery services and the launch of their e-commerce platform via mobile app and web-based online shopping. The Group reported increased product penetration through UK, US, and Canadian retailers. GKC noted the ongoing impact of food inflation as a result of the global supply chain constraints, with rising freight costs potentially affecting production costs.

GraceKennedy Money Services, the second largest contributor to PBT (34% before eliminations), marginally increased 1.1% to TT$134M, driven by a 21.0% increase in its transactions facilitated through Bill Express Online in Jamaica. The Group’s Insurance Segment, which accounted for 11% of GKC’s PBT expanded 13.2% from TT$37M to TT$42M in 9M 2021. Underpinning this performance was growth in the Group motor’s portfolio from Key Insurance and the launch of GraceKennedy General Insurance Company Limited’s (GKGI) “GK Weather Protect” product, offering farmers and fishers disaster risk insurance.

Banking and Investments (6% of PBT) declined 14.6% from TT$26M to TT$22M. Despite this, First Global Bank Limited opened additional bank agents, while brokerage activity also grew as a result of recovering financial markets in Jamaica.

Margins Improve

GKC’s margins continue to trend upwards, with Operating Profit Margin improving from 8.6% to 9.0% in 9M 2021 and the PBT Margin increased from 8.5% to 8.9%. GKC aims to maintain its commitment to margin improvement through its digital transformation via mobile apps and the e-commerce platform arena along with sustaining operational efficiency and cost management initiatives.

The Bourse View

At a current price of $6.26, 62.6% higher YTD, GKC currently trades at a Price to Earnings ratio of 19.1 times, higher than the Conglomerate sector average of 16.6 times. GKC offers investors a trailing dividend yield of 1.3%, relatively lower than the sector average of 2.4% and has declared an Interim Dividend of J$0.55 (USD$0.0035), payable on December 16th, 2021. On the basis of ongoing vaccine rollouts and recovering financial markets, but offset by relatively elevated valuations and the global supply chain challenges giving rise to food inflation concerns, Bourse maintains a NEUTRAL rating on GKC.