HIGHLIGHTS

AMCL HY2023

- Earnings: Diluted Earnings Per Share 606.3% higher, from $0.16 to TT$1.13

- Performance Drivers

- Revenue Growth

- Non-cash Mark-to-Market gains in Investment Portfolios

- Outlook:

- Growth Opportunities

- Rating: Assigned as MARKETWEIGHT

AMBL HY2023

- Earnings: EPS 150.0% increased to $0.75, from a Loss Per Share of $1.50

- Performance Drivers:

- Increase Revenues

- Improving Operating Margins

- Mark-to-Market gains in Investment Portfolios

- Outlook:

- Acquisition Activity

- Rating: Maintained at MARKETWEIGHT

This week we at Bourse review the performance of Ansa McAL Limited (AMCL) and Ansa Merchant Bank Limited (AMBL) for the six-month period ended June 30, 2023. Both AMCL and AMBL reported increased revenue growth and improved operating margins. With both entities experiencing improved results, will this upward trend in revenue persist? We discuss below.

Ansa McAL Limited (AMCL)

Ansa McAL Limited (AMCL) reported a Diluted Earnings per Share (EPS) of $1.13 for the six months ended June 30th, 2023 (HY 2023), 606.3% higher than an EPS of $0.16 reported in HY2022.

Revenue for the period amounted to $3.3B in HY2023, up 3.3% from HY2022 and outpacing the group’s last pre-pandemic performance for the same period in 2019 of $3.1B. Operating Profit advanced 265.8% to $357.6M in comparison to $97.8M in HY2022. Operating Margin increased from 3.1% to 11.0% Year-on-Year (YoY). Profit Before Tax (PBT) grew 233.5% for the period, from $93.9M to $311.0M in HY2023. Finance Costs increased 167.8% to $60.5M. Share of Result of Associates and Joint Venture Interests fell 23% from $18.1M to $13.9M in HY2023. The Group recorded taxation expenditure of $90.3M, with the Effective Tax Rate moving from 64.7% to 29.0%. Consequently, Profit for the Period expanded 571.5% from $32.9M reported in HY2022 to stand at $220.7M in HY2023.

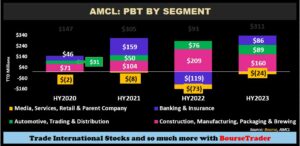

PBT Advances

AMCL’s Profit Before Tax (PBT) recovered to $311M in HY2023 relative to $93M in HY2022. Construction, Manufacturing, Packaging & Brewing PBT declined 23.4% from $209M in HY2022 to $160M in HY2023, as a result of increased input costs. The Automotive, Trading & Distribution segment continue to generate strong profitability, increasing 17.0% to $89M relative to $76M in the prior period. PBT by Banking and Insurance services swung from a loss of $119M to a gain of $86M in HY2023, attributable primarily to positive non-cash mark-to-market gains across investment portfolios. The Media, Services, Retail and Parent Company segment recorded a loss of $24M, smaller than the $72.5M loss reported in the prior comparable period.

Acquisitions, Partnerships Continue

The Group successfully completed the acquisition of general insurer Colonial Fire Insurance Company Ltd (Colfire) on 6th April, 2023. In addition, the Group purchased a minority stake in the Bahamian Brewery & Beverage Company Limited (BBB), a Bahamian-owned brewery and a non-alcoholic beverage producer, effective from 8th, July 2023. The partnership aligns with AMCL’s strategy of driving growth of the beverage brand globally. AMCL also commenced production of Carib beer under contract with strategic brewing partners in Greece and Canada. This is expected to accrue gains to the Group’s Construction, Manufacturing, Packaging & Brewing segment.

AMCL posted an EPS of $1.13 in HY2023, up from $0.16 in the prior comparable period. Its trailing 12-month EPS fell to $2.12 in HY2023 from $2.50 in HY2022, impacted by non-cash mark-to-market losses on account of volatile financial markets. The Group’s Trailing Price-to-Earnings (P/E) multiple expanded from 22.4 times to 25.5 times in the current period.

The Bourse View

At a current price of $54.00, AMCL trades at a trailing P/E of 25.5 times, well above the Conglomerate sector average of 15.6 times.

The stock offers investors a trailing dividend yield of 3.3%, relatively in line with the sector average of 3.2%. The Group announced an interim dividend of $0.30, to be paid on September 8th, 2023 to shareholders on record by August 24th, 2023. AMCL’s continues to pursue growth via inorganic means as represented by its minority interest stake in Bahamian Brewery and Beverage Company Limited. On the basis of increased revenues and continued acquisition activity but tempered by elevated valuations, Bourse assigns an MARKETWEIGHT rating on AMCL.

Ansa Merchant Bank Limited (AMBL)

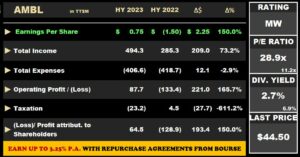

For the six months ended on June 30th, 2023 (HY2023), Ansa Merchant Bank Limited (AMCL) reported Earnings per Share (EPS) of $0.75, compared to a loss per share of $1.50 in HY2022.

Notably, Total Income increased from $285.3M to $494.3M in the current period, an improvement of 73.2%. Total Expenses declined 2.9% to $406.6M, resulting in a gain on overall Profit Before Tax (PBT) of $87.7M from a loss of $133.4M (HY 2022). Operating Profit stood at $87.7M relative to an Operating Loss in the prior comparable period of $133.4M. Taxation Expense swung from a credit of $4.5M (HY2022) to an expense of $23.2M (HY2023). From a loss of $128.9M in HY2022, the Profit after Tax (PAT) grew $64.5M. AMBL’s Net Profit Attributable to Owners stood at $64.5M, compared to a loss of $128.9M in HY 2022.

PBT Improves

Notably, AMBL reported increased revenue growth across all segments. Banking Services, the largest contributor to PBT (66.1%) excluding eliminations, expanded from $22.3M in HY2022 to $81.1M in HY2023, up 263.8%. AMBL’S Banking Division comprised of ANSA Merchant Bank Limited, ANSA Merchant Bank (Barbados) Limited and ANSA Bank Limited. Positive results according to the Group, were driven by income growth in Investment Banking, Forex Trading, New loans, and its Investment Portfolio.

The Group’s Insurance Segment, which includes TATIL, TATIL Life, Colfire, and Trident (Barbados), accounted for 32.6% of PBT, swung from a loss of $151.0M in HY2022 to $40.0M in HY2023, attributed to increased growth in their underwriting results in both Life and Property & Casualty (P&C) businesses, and positive mark-to-market valuations of Investment Portfolios. The Colfire acquisition is anticipated to increase AMBL’s market share of the General Insurance business.

The Mutual Funds segment, contributing the least to PBT (1.3%), reported a gain of $1.6M during the period, relative to a loss of $18.7M in HY 2022.

AMBL posted an EPS of $0.59 in HY2022, representing an increase of 161% in the current period. The Group’s trailing 12-month EPS amounted to $1.54 in HY2023. The Group’s Price-to-Earnings (P/E) multiple lowered from 71.4 times to 28.9 times in the current reporting period.

The Bourse View

At a current price of $44.50, AMBL trades at a P/E ratio of 28.9 times, above the Non-Banking Finance Sector average of 11.2 times. The stock offers investors a trailing dividend yield of 2.7%, below the sector average of 6.9%. AMBL announced an interim dividend of TT$0.20, payable on October 6th, 2023.

The Group is anticipated to continue with its transformation and innovation strategy of providing a digital banking platform and ‘end-to-end’ digital banking capability to retail clients, complementing its existing suite of insurance, wealth management and merchant banking services. On the basis of revenue growth, supported by merger and acquisition activity but tempered by elevated valuations and the impact of non-cash mark-to-market volatility on earnings clarity, Bourse maintains an MARKETWEIGHT rating on AMBL.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”