HIGHLIGHTS

AHL FY2023

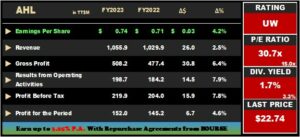

- Earnings: Earnings Per Share of TT$0.74, 4.2% higher from EPS of TT$0.71

- Performance Drivers

- Revenue Growth

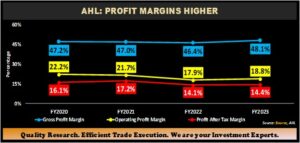

- Improved Margins

- Outlook:

- Increase sales in international markets

- Rating: Maintained at UNDERWEIGHT

WCO FY2023

- Earnings: Earnings Per Share of TT$1.10, 5.8% higher from EPS of TT$1.04

- Performance Drivers:

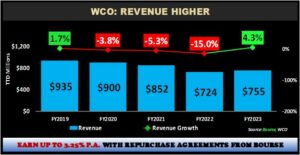

- Increased Revenues

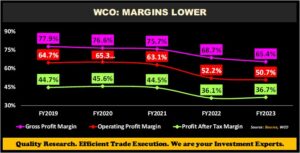

- Stabilized Margins

- Geographical Diversification

- Outlook:

- New Investments

- Rating: Upgraded to OVERWEIGHT

This week, we at Bourse review the performance of Angostura Holdings Limited (AHL) and West Indian Tobacco Company Limited (WCO) for their respective full year financial results for the period ending December 31st, 2023 (FY2023). AHL reported improved earnings owing to improved margins with increased market share within the region, while WCO benefitted from increased revenue growth. Will both companies continue this positive momentum in the upcoming months? We discuss below.

Angostura Holdings Limited (AHL)

AHL reported an Earnings per Share (EPS) of $0.74 for the period ended 31st December 2023 (FY2023), a 4.2% climb relative to the $0.71 reported in the prior comparable period.

Revenue for the quarter was reported at $1.06B, a 2.5% increase over $1.03B recorded in FY2022 and a record level of sales for the Group. Cost of Goods Sold fell 0.9% to $547.7M from $552.5M. As a result, Gross Profit grew by 6.4% to $508.2M. Selling and marketing expenses expanded by 9.9% to $198.2M in FY2023, compared to $180.3M in FY2022. Administrative expenses totaled $112.7M, up 9.7% over the previous period. AHL reported an expected credit writeback of $0.99M in FY2023, compared to a loss of $7.4M in FY2022. Operating Activities generated $198.7M, 7.9% higher than the $184.2M recorded in FY2022. (Note: Excluding the impact of expected credit writeback/losses across both comparable periods, results from Operating Activities would have improved 3.1%). Finance Income rose 9.6% to $23.5M (FY2022: $21.4M), while Finance Costs advanced 37.9% to $2.3M (FY2022: $1.7M). Group Profit Before Tax gained 7.8% over the period, from $204.0M to $219.9M. Taxation expenses grew by 15.6% to $67.9M from $58.8M, with the effective tax rate moving from 28.8% in FY2022 to 30.9% in FY2023. Overall, AHL’s Profit for the Period was $152.0M, 4.6% higher than FY2022’s $145.2M.

Revenues Grow

The Rum and Bitters manufacturer reported revenue growth, in FY2023, with Total revenue advancing 2.5%, from $1.03B to $1.06B in the current period. According to AHL, over 75% of its revenue growth was driven by its ‘internationalization strategy’, with sales growth experienced both in its rum and bitters lines. Local market revenue growth was relatively subdued, advancing 1.6%.

Higher Margins

The Group’s profitability margins improved over the prior comparable period, signaling improving efficiencies in operating performance. Gross Profit Margin widened to 48.1% relative to 46.4% in FY2022. Despite an increase in operating expenses, Operating Profit Margin advanced to 18.8% from a prior 17.9% in FY2022. The expected credit writeback and other income contributed to this improvement. Profit After Tax Margin improved to 14.4% in FY2023 from 14.1% in FY2022.

The Bourse View

AHL is currently priced at $22.74 and trades at a trailing P/E of 30.7 times, above the combined Manufacturing Sector I & II average of 15.0 times. The Group announced a final dividend of $0.28 payable on July 31st, 2024, to shareholders on record by July 12th, 2024. This brings the total dividend paid by AHL to $0.38 for the fiscal year 2023. The stock offers investors a trailing dividend yield of 1.7%, below the sector average of 3.3%.

AHL’s revenue and earnings continue to trend positively, with improving margins also a generally positive indicator of the Group’s performance. Notwithstanding these trends, AHL stock remains relatively expensive when compared to its peers in the sector, trading at a relatively lofty Price-to-Earnings (P/E) ratio. This suggests that earnings may have some catching up to do with AHL’s current price. On the basis of revenue growth and margin improvement, but tempered by elevated valuations, Bourse maintains an UNDERWEIGHT rating on AHL.

The West Indian Tobacco Company Limited (WCO)

The West Indian Tobacco Company Limited (WCO) reported Earnings per Share (EPS) of $1.10 for the financial year ended December 31st, 2023 (FY2023), up 5.8%, relative to $1.04 reported in the prior comparable period (FY2022).

Revenue climbed 4.3% Year on Year (YoY) from $724.1M to $755.2M. Cost of Sales was marginally higher by 15.5%, from $226.3M in FY2022 to $261.4M in the current period, resulting in a drop in Gross Profit by 0.8%, to settle at $493.8M from a prior $497.8M (FY2022). In comparison to the previous year, distribution costs were 8.0% lower at $13.5M. Similarly, administrative expenses fell by 7.6% from $72.5M (FY2022) to $67M in FY2023. Other Operating Expenses decreased 7.0% to $30.4M from a prior $32.7M. Operating Profit expanded a modest 1.3%, from $378M in FY2022 to $382.9M in FY2023. Finance Income grew to $4.4M in FY2023. WCO’s Finance Costs grew by 98.4% year on year. Profit Before Taxation experienced marginal growth of 2.1%, to settle at $386.9M. Taxation dropped by 6.5% to $109.8M for the period under review, from a prior $117.4M. Overall, WCO reported a Profit for the Period of $277.1M in FY2023, up 5.9%, relative to $261.6M in financial year 2022.

Revenue Higher

After three consecutive years of revenue decline, WCO generated year-on-year revenue growth. According to WCO, improved revenue was as a result of ‘inventory movements, market adjustments and consumer repositioning. Total Revenue amounted to $755.2M, an increase of 4.3% year on year.

Domestic revenue (81.2% of Total Revenue) grew 3.9% to $613.2M from a previous $590.3M, while revenue from CARICOM & Non-CARICOM (18.8% of Total Revenue) advanced 6.2% to $142M (FY2022: $133.8M).

Stabilized Margins

WCO’s profitability margins experienced moderate declines when compared to FY2022, with the exception of its Profit After Tax (PAT) Margin. WCO’s Gross Profit Margin narrowed to 65.4%, relative to 68.7% in the prior period, owing to increased Cost of Sales. Operating Margin amounted to 50.7%, relative to 52.2% in FY2022. Profit After Tax Margin was 36.7%, a modest improvement relative to FY2022’s margin of 36.1%. Investors would be comforted by the stabilization in WCO’s PAT margin in FY2023.

The Bourse View

Investors have responded quite positively to WCO’s recent results, with the stock price advancing 70.7% year-to-date. At a current price $15.19, WCO trades at a P/E multiple of 13.8 times, below the Manufacturing Sector average of 15.0 times. The company proposed an interim dividend of $0.52 payable on May 24th, 2024, to shareholders on record by May 8th, 2024. The stock offers investors a trailing dividend yield of 6.9%, significantly above the sector average of 3.3%.

Revenue stabilization and/or growth appears to have been the catalyst for investors to change their sentiment on WCO stock, as evidenced by the rapid turnaround in price. WCO continues to undertake initiatives to grow its revenue and earnings, while stabilizing its operating margins. These measures should continue to restore confidence in investors seeking WCO’s traditionally robust and reliable dividends, which in turn could continue to provide strong support to WCO’s price. Notwithstanding the already significant advance in pricing, the prospect of more predictable dividends and growing investor confidence suggests additional upside to WCO stock. On this basis, Bourse upgrades WCO to an OVERWEIGHT rating.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”