HIGHLIGHTS

AHL 9M2022

- Earnings: Earnings Per Share of $0.44, flat from Earnings Per Share of $0.45

- Performance Drivers:

- Increased Revenues

- Lower Margins

- Outlook:

- Normalization of Economic Activity

- Rating: Maintained at MARKETWEIGHT

NFM 9M2022

- Earnings: Loss Per Share of $0.01, relative to an Earnings Per Share of $0.03

- Performance Drivers:

- Higher Revenues

- Increased Input Costs

- Lower Margins

- Outlook:

- Inflationary Pressures

- Rating: Maintained at MARKETWEIGHT

This week, we at Bourse review the financial performance of Angostura Holdings Limited (AHL) and National Flour Mills Limited (NFM) for the nine-month period ended 30th September 2022. AHL’s profitability dipped on account of a higher taxation rate and an increase in expected credit loss provisions. NFM, meanwhile, experienced lower margins as the Group continues to be affected by inflationary pressures and supply chain constraints. With both entities reporting a decline in performance, will these conditions persist? We discuss below.

Angostura Holdings Limited (AHL)

Angostura Holdings Limited (AHL) reported Earnings Per Share of $0.44 for the nine-month period ended September 30th 2022, 2.2% lower than $0.45 reported in the prior period.

Revenue for the period stood at $711.0M, up 16.0% from $613.1M recorded in 9M2021. Cost of Goods Sold increased 14.8% to $369.7M from $322.0M. Resultantly, Gross Profit expanded 17.2% to $341.3M. Selling and Marketing Expenses advanced 34.1% to $147.3M in 9M2022 relative to $109.9M in 9M2021. Administrative Expenses stood at $73.4M, up 2.5% from the prior period. An Expected Credit Loss of $8.1M was recorded after a loss reversal on trade receivables of $4.0M in the prior period. Results from Operating Activities came in at $111.3M, marginally lower than $111.8M reported in 9M2021. Improvements in Finance Income, up $2.8M from the prior year ($12.1M), contributed to Group Profit Before Tax growth for the period which amounted to $125.3M, 1.7% higher than $123.2M in 9M2021. The Group’s effective taxation rate moved from 25.1% in 9M2021 to 28.5% in 9M2022 with a taxation expense of $35.7M. Overall, AHL reported a Profit for the Period of $89.6M, a 2.9% fall relative to $92.3M in 9M2021.

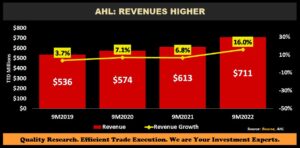

Revenues Higher

The Rum and Bitters manufacturer reported revenue growth of 16.0% in 9M2022. According to the Group, improved revenues were driven by growth in the local market (+10.8%) as economic activity continued to gain momentum with full operations of entertainment channels locally. International revenue grew by 23.4% year-on-year in 9M2022, increasing demand for AHL’s branded products as global markets strengthened. The Group continues to build brand awareness and drive consumption in international markets.

The introduction of new product offerings (such as the launch of the limited edition Ferdi’s Premium Rum, to commemorate Trinidad and Tobago’s 60th Independence) as well as the upcoming Christmas and Carnival season may present opportunities for further revenue growth.

Operating Margins Lower

AHL’s Gross Profit Margin improved marginally from 47.5% to 48.0%, owing to increased revenues of 16.0% year-on-year. Operating Profit Margin declined to 15.7% in 9M2022 relative to 18.2% in 9M2022, attributable to selling and marketing expenses increasing 34.1% and an expected credit loss of $8.1M primarily due to aged receivables from local customers. Profit After Tax Margin fell to 12.6% in 9M2022, weighed by a higher effective tax rate.

The Bourse View

AHL is currently priced at $23.26, up 29.2% year-to-date. The stock trades at a trailing P/E of 30.6 times, above the Manufacturing Sector average of 22.6 times. The stock offers investors a trailing dividend yield of 1.5%, below the sector average of 8.1% (excluding significant special dividends by other sector members, the sector ‘regular’ dividend yield stands at 2.8%). The Group is poised to benefit from seasonal increases in activity in its fourth quarter of 2022 and first quarter of 2023 respectively. Earnings growth, however, would likely depend on the Group’s ability to manage expenses and margins in the current inflationary environment. On the basis of product innovation and continued top-line performance, but tempered by relatively high valuations, Bourse maintains a MARKETWEIGHT rating on AHL.

National Flour Mills Limited (NFM)

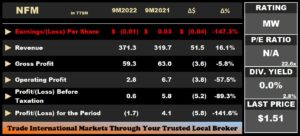

NFM reported a Loss Per Share (LPS) of $0.01 in the nine months ended September 2022 (9M2022), from a prior Earnings Per Share of $0.03 in the previous comparable period. Revenue for the period grew 16.1% to $371.3M from a prior $319.7M. Cost of Sales increased by 21.5% to $311.9M from $256.8M. Resultantly, Gross Profit was down 5.8% to $59.3M in 9M2022. Selling and Distribution Expenses marginally decreased by 2.7%, whilst Administrative Expenses climbed 5.5%. Operating Profit was down 57.5%, from $6.7M to $2.8M. NFM saw an 89.3% drop in Profit Before Tax (PBT) in 9M2022, from a previous $5.8M to $0.6M. Overall, NFM recorded a Loss After Taxation (LAT) of $1.7M, compared to a $4.1M Profit after Tax reported in 9M2021.

Revenue Rises

NFM’s revenue has increased steadily over the last four periods. The increase in revenue from $320M in 9M2021 to $371M in 9M2022 (16.1% increase) was in large part attributable to price increases implemented across its branded products. These increases – viewed as necessary in the face of increased supply chain challenges and elevated commodity prices – were intended to ensure the viability of NFM under the current circumstances.

Margins Lower

The global shortage in the supply of wheat due to geopolitical strains is expected to persist in the near-term, despite the extension of a ‘safe corridor’ export agreement between Russia and Ukraine on November 17th, 2022. Resultantly, NFM continues to confront higher input costs, which have adversely impacted its profitability margins. A decline in all profitability margins was observed. Gross Profit Margin fell from 19.7% to 16.0% in 9M2022 due to the increase in revenue. Operating Profit Margin decreased from 2.1% in 9M2021 to 0.8% in 9M2022, due to increases in Administrative Expenses and other Operating Income. Subsequently, the Profit Before Tax Margin contracted from 1.8% in 9M2021 to 0.2% in 9M2022, as finance costs increased from the comparable period.

The Bourse View

NFM trades at a current price of $1.51, down 22.6% Year to Date. The Group continues to explore additional ways to diversify and generate revenue sources and enhance operational efficiency locally and regionally. Ongoing general inflationary pressures, coupled with supply-demand imbalances (keeping input costs elevated) could continue to weigh on NFM’s profitability in the near-term. This, in turn, could increase the likelihood of further price increases to consumers. On the basis of revenue growth but tempered by increased input costs and lower profitability margins, Bourse maintains a MARKETWEIGHT rating on NFM.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”