HIGHLIGHTS

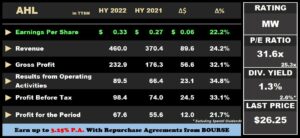

AHL HY 2022

- Earnings: Earnings Per Share of $0.33, an increase from Earnings Per Share of $0.27

- Performance Drivers:

- Increased Revenues

- Increased Operational Efficiency

- New Product Offerings

- Outlook:

- Normalization of Economic Activity

- Supply Chain Disruptions

- Rating: Maintained at MARKETWEIGHT

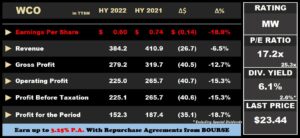

WCO HY 2022

- Earnings: Earnings Per Share of $0.60 a decline from Earnings Per Share of $0.74

- Performance Drivers:

- Reduced Revenues

- Lower Margins

- Outlook:

- Normalization of Economic Activity

- Rating: Maintained at MARKETWEIGHT

This week, we at Bourse review the financial performance of Angostura Holdings Limited (AHL) and The West Indian Tobacco Company Limited (WCO) for the six-month period ended 30th June, 2022. Both companies would be poised to benefit from the reopening of economies and a revival of entertainment industries. AHL reported strong revenue growth driven by improved economic activity and higher demand locally and internationally. WCO, meanwhile, faced company-specific headwinds which contributed to overall lower earnings. Will the normalization of entertainment channels support both companies’ fortunes? We discuss below.

Angostura Holdings Limited (AHL)

AHL reported an Earnings per Share (EPS) of 0.33 for the period ended 30th June, 2022 (HY 2022), a 22.2% increase over the $0.27 reported in the prior comparable period.

Revenue for the period stood at $460.0M, up 24.2% from $370.4M recorded in HY 2021. Cost of Goods Sold increased 17.0% to $227.1M from $194.1M. Resultantly, Gross Profit advanced 32.1% to $232.9M. Selling and Marketing Expenses and Administrative Expenses for the Group increased 26.8% and 6.9% respectively. AHL reported an Expected credit loss on Trade Receivables of $8.4M in HY 2022 owning to increased expenses. Results from Operating Activities stood at $89.5M, a 34.8% increase compared to $66.4M reported in HY 2022. Finance Income increased 14.5% to $9.2M (HY 2021: $8.1M) while Finance Costs fell 34.8% to $0.35M. Group Profit Before Tax for the period increased 33.1% from $74.0M to $98.4M. Taxation expense climbed 67.5% to $30.8M, with the effective tax rate moving from 24.9% in HY 2021 to 31.3% in HY 2022. Overall, AHL recorded a Profit for the Period of $67.6M, 21.7% higher than a previous $55.6M.

Revenue Higher

The Rum and Bitters Manufacturer reported revenue growth of 24.2% in HY 2022. According to the Group, local revenues (57.4% of Total Revenues) for HY 2022 was $264.1M, representing an increase of 19.0% over the prior comparable period. The growth in local revenue was bolstered by the uptick in economic activity as bars, hotels and other entertainment channels reopened, increasing demand for its products. International revenue grew by 29.0% year-on-year in HY 2022, as international markets strengthened, excluding the UK, which is anticipated to rebound soon.

The introduction of new product offerings, such as the launch of a rare, limited edition, ultra-premium rum – Angostura Zenith, the reintroduction of its bitters brand in Mexico and the creation of Tamboo Spiced Rum, both the new brand and its unique bottle, may present opportunities for further revenue growth.

Margins Higher

AHL’s Gross Profit Margin increased from 47.6% in HY 2021 to 50.6% in HY 2022, owing to increased revenues of 24.2% or $89.6M, supported by strong demand for its branded products both locally and internationally. Operating Profit Margin rose to 19.5% in HY 2022 relative to 17.9% in HY 2021 despite the 26.8% increase in Selling and Marketing Expenses. Profit After Tax Margin fell to 14.7% in HY 2022, weighed by a higher effective tax rate.

The Bourse View

AHL is currently priced at $26.25, up 45.8% year-to-date. The stock trades at a trailing P/E of 31.6 times, above the Manufacturing Sector average of 25.3 times. The Group announced an interim dividend of $0.10 payable on September 29th 2022 to shareholders on record by September 15th, 2022. The stock offers investors a trailing dividend yield of 1.3%, below the sector average of 8.8%. It should be noted that, excluding significant special dividends by other sector members, the sector ‘regular’ dividend yield stands at 2.6%

The normalization of entertainment channels, coupled with new product initiatives, should augur well for the Group’s future performance. The pace of growth, however, would likely depend on the Group’s ability to manage expenses in an effort to preserve margins in the current inflationary environment. On the basis of product innovation and robust top-line performance, but tempered by relatively high valuations, Bourse maintains a MARKETWEIGHT rating on AHL.

The West Indian Tobacco Company Limited (WCO)

The West Indian Tobacco Company Limited (WCO) reported Earnings Per Share of $0.60 for the six months ended June 30th 2022 (HY 2022), a 18.9% decline from $0.74 reported in the prior comparable period.

Revenue fell 6.5% Year on Year (YoY) from $410.9M to $384.2M, followed by a 15.1% increase in Cost of Sales. Consequently, Gross Profit fell to $279.2M, 12.7% lower compared to $319.7M reported in HY 2021. Declines in distribution costs and administrative expenses were offset by a 41.6% ($5.6M) increase in Other Operating Expenses to bring Total Expenses to $54.2M, up 0.4% YoY. Operating Profit contracted 15.3% from $265.7M in HY 2021 to $225.0M in HY 2022. Profit Before Tax declined 15.3% to $225.1M. Overall, WCO reported a Profit for the Period of $152.3M, down 18.7% from $187.4M reported in HY 2021.

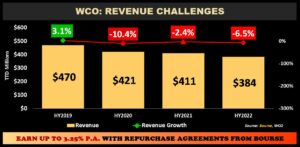

Revenue Lower

WCO’s revenue for its calendar first half (HY) continued to trend downward, declining 6.5% over the prior comparable period. The company’s revenue was negatively impacted by an adjustment in its sales mix during HY 2022 as consumers purchasing patterns changed, characterized by an increasing appetite for lower-priced products and hesitation for the company’s new product offerings following its portfolio transformation. Additionally, domestic sales volumes continued to be impacted by slow economic activity despite the reopening of entertainment channels. According to WCO, the company has taken steps to address consumer preferences in the shortest possible timeframe while introducing an ultra-low-price offer in Q4 2021 to respond to changing market dynamics and maintain its position as the premium supply source for cigarettes for Domestic and Caribbean Markets.

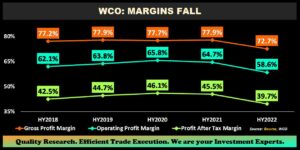

Margins Decline

WCO’s Gross Profit Margin fell from 77.9% to 72.7% in HY 2022, following a 15.1% ($13.8M) increase in Cost of Sales likely owing to a combination of factors including higher royalties and increased costs of direct materials as stated in the previous quarter. The company’s Gross Margins continue to be relatively stable, still within the 72%-77% range. Operating Margins fell to 58.6% in HY2022 relative to a prior 64.7%. Profit After Tax Margin deteriorated to 39.7% as an increase in Finance Income and a decrease in Finance Cost was offset by the company’s effective tax rate increasing from 29.4% to 32.3%.

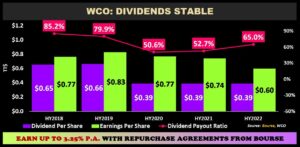

Dividends Stable

Despite a decline in earnings, WCO has rewarded shareholders with a consistent dividend of $0.39 for the past three periods. The company currently offers the third highest trailing 12-month dividend yield (6.1%) on the Trinidad and Tobago Stock Exchange.

The Bourse View

At a current price $23.45, WCO trades at a P/E of 17.2 times, below the Manufacturing Sector average of 25.2 times. The company announced an interim dividend of $0.39 to be paid on August 24th 2022 to shareholders on record by August 5th 2022. The stock offers investors a trailing dividend yield of 6.1%, below the sector average of 8.8%. Again, it should be noted that the sector average dividend yield excluding UCL’s ‘special’ dividend would stand at 2.6%.

Despite relatively lower margins, WCO’s performance could be poised to recover following efforts by the company to adapt to changing consumer preferences along with a possible recovery in economic activity. This likelihood is tempered by rising inflationary pressures, which may dampen demand for leisure activities and the company’s products by extension. On the basis of fair valuations, stable dividends and substitute product competition, Bourse maintains a MARKETWEIGHT rating on WCO.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”