HIGHLIGHTS

AHL 9M2023

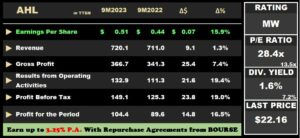

- Earnings: Earnings Per Share increased 15.9% from $0.44 to $0.51

- Performance Drivers:

- Increased revenue

- Margin Improvements

- Higher Finance Costs

- Outlook:

- Increase sales in international markets

- Rating: Maintained at MARKETWEIGHT

UCL 9M2023

- Earnings: Earnings Per Share increased from $0.02 to $0.51

- Performance Drivers

- Lower Revenues

- Margin improvements

- Outlook:

- Improvement in Product Mix

- Cooling inflationary pressures

- Rating: Maintained at MARKETWEIGHT

This week, we at Bourse review the performance of Angostura Holdings Limited (AHL) and Unilever Caribbean Limited (UCL) for their respective nine-month periods ended 30th September 2023. AHL generated higher earnings despite modestly increasing revenue, while UCL sharply increased earnings despite revenue contraction. Will AHL continue to grow earnings? Can UCL return to more stable performance, after making substantial changes to its business model? We discuss below.

Angostura Holdings Limited

For the nine-month period ended September 30, 2023, Angostura Holdings Limited (AHL) reported Earnings per share (EPS) of $0.51, up 15.9% over the previous corresponding period.

Revenue advanced a modest 1.3% to $720.1M from the previous $711.0M, supported by international sales growth and relatively stable domestic sales. A 4.4% decrease in cost of sales resulted in gross profit increasing from $341.3M to $366.7M (+7.4% over prior comparable period). Notable changes to other operating costs included administrative expenses jumping 20.2% to $88.2M, while Other Income was $0.98M versus an expense of $1.1M in the prior period. AHL also benefited from an expected credit writeback of $0.3M versus a loss of $8.1M in 9M 2022. Operating profit amounted to $132.9M, an increase of 19.4%. Finance cost increases of 63.8% higher (from $947K in 9M 2022 to $1.55M) were offset by growth in Finance income to $17.8M from a previous $14.9M. Profit Before Tax (PBT) grew $149.1M from a previous $125.3M, up 19%. Resultantly, AHL’s profit for the period closed at $104.4M, up $14.8M or 16.5% versus the prior comparable period.

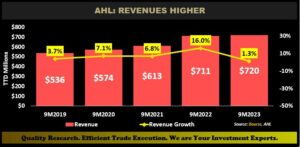

Revenue Higher

AHL’s revenue has continued to trend higher, though the most recent period’s growth rate was notably below the average of the 3 immediate prior comparable periods (9.9%). Total Revenue advanced 1.3%, from $711.0M to $720.1M in the current period. According to AHL, relatively stable domestic revenues accounted for around 60% of total revenue, highlighting the significant contribution of international channels to revenue generation. Despite limited domestic sales growth, AHL noted that international sales grew 4% year on year, suggesting that geographical diversification will be increasingly important to the Group’s financial performance.

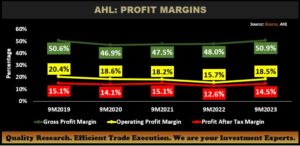

Margins Recover

AHL’s profitability margins, particularly operating and profit after tax, recovered relative to historical levels in 9M 2023. AHL’s Gross Profit margin showed notable improvement from 48% to 51%, driven by revenue growth and lower input costs and recovering to its pre-COVID levels. Similarly, Operating Profit margin grew from 15.7% in 9M2022 to 18.4% in the current period, despite higher operating expenses. Profit After Tax margin expanded to 14.5% compared to 12.6% in the previous period.

The Bourse View

At a current price of $22.16, down 7.67% year-to-date, AHL trades at a trailing P/E of 28.4 times, above the Manufacturing Sector average of 13.5 times. The stock offers investors a trailing dividend yield of 1.6%, below the sector average of 7.2% (inclusive of an extraordinary dividend by Unilever Caribbean Limited or UCL).

AHL’s revenue growth persistence remains an encouraging feature for existing and potential investors, particularly when considering that recent faster growth is being achieved via its international sales. AHL’s margin stability and near-term improvement should also be encouraging for investors, providing a greater degree of confidence in the Company’s ability to convert sales into profits. Additionally, the Group is well-positioned to benefit from seasonality factors in the upcoming months, continuing to make significant strides in solidifying its footprint locally. Notwithstanding positive and persistent trends in revenue and margins, AHL continues to trade at a relatively lofty Price-to-Earnings (P/E) ratio. On the basis of increased revenue growth and margin improvement, tempered by relatively high valuations, Bourse maintains a MARKETWEIGHT rating on AHL.

Unilever Caribbean Limited (UCL)

For the nine months ended September 30, 2023 (9M2023), Unilever Caribbean Limited (UCL) reported Earnings Per Share (EPS) of $0.51, compared to an EPS of $0.02 in the prior comparable period.

Revenue amounted to $168.1M in the current period, a 14.6% decline relative to the $196.9M in earned 9M2022. Cost of Sales recorded was 16.2% lower, from $111.6M in 9M2022 relative to $93.6M in the current period. Gross Profit contracted 12.6% to $74.5M. Selling and Distribution Costs and Administrative Expenses both fell 14.9% and 2% respectively, resulting in an 18.7% decline in Operating Profit from $25.5M in 9M2022 to $20.7M in 9M2023. Restructuring Costs dropped 89.6% over the period from $29.1M to $3.0M with most of UCL’s reorganization costs now seemingly expended, leading to an Operating Profit after restructuring costs of $17.7M. Profit Before Taxation amounted to $20.6M, a 767.4% gain from a prior $2.4M. Overall, UCL’s Profit for the Period amounted to $13.3M, 2711.7% higher than $472K reported in the prior period.

Revenue Lower

UCL’s revenue trend has understandably been volatile during a period of divestments of portions of the business. Total Revenue fell 14.6%, from $196.9M (9M2022) to $168.1M in 9M2023, impacted according to UCL by (i) changing market forces in selected channels and (ii) a decline in macroeconomic environment. According to the Company, weaker performance in its Home Care segment more than offset improvements in its Beauty & Personal Care and Food channels.

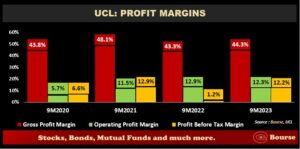

Margins Resilient

UCL’s profit margins were generally improved when compared to the prior period. Gross Profit margin grew from 43.3% in 9M 2022 to 44.3% in 9M 2023, while Profit Before Tax of PBT margin increased to 12.2% from a prior 1.2%. UCL’s Operating Profit margin declined to 12.3% in 9M 2023 from a prior 12.9%, with relatively sticky administrative expenses and lower revenue weighing on its operating performance.

The Bourse View

At a current price of $11.00, UCL trades at a trailing P/E of 12.8 times, in line with the Manufacturing Sector average of 13.5 times.

Despite lower revenue generation, the conclusion of UCL’s most recent reorganisation initiatives paves the way for greater earnings predictability for existing and potential investors. A return to more range-bound operating and PBT margins should also improve the degree of investor confidence in being able to estimate UCL’s earnings capabilities in future periods. Investors will be keenly observing UCL’s dividend payments to establish what shareholder cash flows could look like from the Company post-reorganization. On the basis of improved profitability margins tempered by revenue contraction and some degree of dividend uncertainty, Bourse maintains a MARKETWEIGHT rating on UCL.

DISCLAIMER: “This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase, or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives, or agents, accepts any liability whatsoever for any direct, indirect, or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”