HIGHLIGHTS

AGL HY2025

- Earnings: Earnings Per Share (EPS) grew 2.8% from $1.76 to $1.81

- Performance Drivers:

- Revenue Growth

- Lower Margins

- Outlook:

- Growth from Acquisition Activities

- Rating: Maintained at MARKETWEIGHT

TCL Q12025

- Earnings: Earnings Per Share increased 12.4% from $0.15 to $0.17

- Performance Drivers:

- Higher Revenues

- Margin improvements

- Outlook:

- Increased production capacity

- Rating: Assigned as MARKETWEIGHT

This week, we at Bourse review the performance of Trading sector and Manufacturing giants Agostini Limited (AGL) and Trinidad Cement Limited (TCL) for their respective six months (HY2025) and three months (Q12025) reporting periods ended March 31st, 2025. AGL and TCL reported improved performance driven by solid revenue growth. Can both companies continue to improve results in the upcoming months ahead? We discuss below.

Agostini Limited (AGL)

Agostini Limited (AGL) reported an Earnings Per Share of $1.81 for the six months ended March 31st, 2025 (HY2025), an increase of 2.8% relative to $1.76 reported in the previous comparable period.

Revenue expanded 8.1% to $2.78B from a previous $2.57B, driven by recent acquisition activities. Operating Profit grew 2.7% to $276.3M, compared to $269.1M in HY2024. Finance Costs increased 25.8% to $38.7M. Resultantly, Profit Before Taxation marginally fell 0.3% from $237.6M to $238.3M. Taxation Expense dropped from $68.9M in HY2024 compared to $67.8M in HY2025, with AGL’s Profit for the Period amounting to $169.8M compared to $169.4M (0.2% higher). Overall Profit Attributable to Owners of the Parent improved by 3.0% to $125.2M from $121.6M reported in the prior period.

PBT Lower

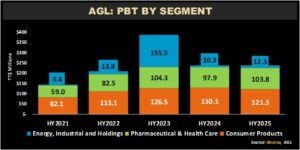

For the second quarter of 2025 (HY2025), AGL’s Profit before Taxation decreased by 0.3% to TT$237.6M.

Consumer Products (Acado), which accounted for 51.1% of PBT, dropped 6.7% year-on-year to $121.3M, reportedly due to restructuring activity related to its St Lucia operations. Pharmaceutical & Health Care (Aventa), (43.7% of PBT) grew 6.0% from $97.9M in HY2024 to $103.8M in HY2025, supported by integration efforts and its regional presence. Energy, Industrial and Holdings, which contributed 4.3% of PBT, advanced a noteworthy 20.7% over the period to $12.5M from a prior $10.3M, despite reduced sales.

According to AGL, the acquisition of Massy Distribution (Jamaica) by Acado is awaiting final regulatory approval. In a recent media release – the Fair Trading Commission (FTC) in Jamaica expressed concerns of the proposed transaction citing that it might reduce competition in Jamaica’s distribution and pharmaceutical sectors, with AGL already owning Health Brands Limited (Jamaica). The transaction has advanced to a second-phase review, which is expected to conclude by the end of June. This scrutiny introduces an element of uncertainty as to whether the acquisition will proceed as planned.

Margins Decline

Despite solid revenue growth, AGL’s Operating and Profit before Tax margins declined year-on-year to 9.9% and 8.6%, respectively. Operating Profit Margin decreased from 10.5% in HY2024 to 9.9% in HY2025, falling below the Group’s trailing five-period average of 10.3%. Meanwhile, the Profit before Tax Margin contracted to 8.6% from 9.3%, due to higher finance costs.

The Group’s 12M Trailing EPS amounted to $3.56 in HY2025, a 13.4% increase compared to $3.14 in HY2024. The Group’s Price-to-Earnings (P/E) multiple fell to 18.8 times from 22.0 times in the prior corresponding period, still reasonably fair compared to its 5-year historical average of 17.1 times, however above average when compared to the current Trading sector average of 13.9 times.

The Bourse View

For the three months ended March 31st, 2025, Trinidad Cement Limited (TCL) reported an Earnings Per Share (EPS) of $0.17, up 12.4% from an EPS of $0.15 earned in the prior comparable period.

Notably, Revenue advanced 9.3% to $626.5M from a previous $573.4M in Q12024. Cost of sales climbed by 9.2% year on year (YoY) to $404.7M, resulting in a Gross Profit increase of 9.3% to $221.8M. Operating expenses increased 9.9% YoY. Operating Earnings Before other expenses and other Income grew to $145.4M in Q12025 from a prior $133.4M. Other Expenses declined 6.5% to $17.6M relative to $18.9M reported in the prior period. Resultantly, Operating Earnings increased 11.0% to $129.5M relative to $116.6M in Q12024. Financial Expenses came in 33.6% lower, from $14.2M in Q12024 to $9.4M in the current period, reflecting a reduction in the Group’s U.S dollar revolving credit facility. Financial Income increased 36.2% to $4.1M, driven by higher interest earned on U.S dollar deposits. Earnings Before Taxation amounted to $124.2M, 17.8% higher than the prior comparable period. Taxation expense rose to $38.3M (+41.1%), with the taxation rate moving from 25.7% to 30.8% in Q12025. Resultantly, Net Income for the period settled at $85.9M, a variance of $7.6M or 9.7% higher than $78.3M reported in the prior period.

Revenues Advance

For the fiscal first quarter 2025, TCL recorded solid revenue growth of 9.3% YoY. The increase was primarily attributed by the Group to stronger sales volumes in the Guyana market, higher export activity from Trinidad and Tobago operations, and favourable pricing strategies in Jamaica. TCL’s revenue maintained its positive momentum for the past five (5) reporting periods.

TCL’s largest segment, Cement, which contributed 97% of Revenue advanced 8.5% to $610M from a prior $562M. Concrete, accounted for 3% of third-party revenue and grew 43.5% YoY to $17M in Q12025.

Margins Improve

The company’s profitability margins have expanded year on year, reflecting improved performance relative to historical levels. Gross Profit Margin remained relatively stable at 35.4%. Operating Profit Margin grew from 20.3% in Q12024 to 20.7% in Q12025. Similarly, Profit Before Tax Margin rose to 19.8% from a prior 18.4%.

In T&T, the Group continues to benefit from robust export activity to CARICOM markets (Guyana, Barbados). In Jamaica, the Q2 2025 completion of the debottlenecking project is expected to reduce import dependency and improve cost efficiency, with the market contributing 90% of the Group’s earnings.

Cement price hikes met with proposed duty cuts

TCL has implemented a series of price increases since late 2021, with the latest being a 7.0% price hike in February 2025. In April 2025, the prevailing Government signalled its intention to cut import duties on hydraulic cement to 0%. This suggested move aims to dampen further price increases by allowing cheaper imports to compete in the local market, thereby easing pressure on consumers and the construction sector.

According to data from the Central Bank of Trinidad and Tobago (CBTT), local cement sales declined roughly 4.0% year-on-year in Q12025. TCL’s profit margins and revenue performance could come under pressure in the near to medium term due to weaker domestic demand and the potential for increased competition from lower-cost imports. The prospect of cheaper imports may prompt TCL to adopt strategic measures to maintain its market position.

The Bourse View

TCL is currently priced at $2.05 and trades at a price to earnings ratio of 4.9 times, below the Manufacturing Sector I & II average of 9.2 times. The stock currently offers investors an attractive dividend yield of 5.9% relative to a sector average of 4.7%. The Group announced a final dividend of $0.12 per share, to be paid to shareholders on 23rd September, 2025. This follows the resumption of dividend payments in September 2024, the first distribution since July 2017.

Notwithstanding good revenue growth and profitability improvements, TCL may face pricing pressure and increased competition if the duty-free cement imports are introduced. In light of these near-term uncertainties, Bourse assigns a MARKETWEIGHT rating to TCL.

This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”