HIGHLIGHTS

Local Markets

- 9M2021 Performance:

- TTCI ↑ 8.1%

- All T&T ↑9.0%

- CLX ↑ 6.0%

- Performance Drivers:

- Gradual Sector Reopening

- Outlook:

- Inflation Challenges

- Economic Normalization

International Markets

- 9M2021 Performance:

- US Markets – S&P 500 ↑ 14.7%

- European Markets- Euro Stoxx 50 ↑8.1%

- Asian Markets – MXASJ ↓ 3.9%

- Latin American Markets – MSCI EM ↓ 9.1%

- Performance Drivers:

- Vaccine Distribution

- Continuing Fiscal/Monetary Support

- Outlook:

- Economic Normalization

- Global Supply Constraints

This week, we at Bourse recap the performance of local and international stock markets for 9M2021. Despite soaring energy prices, supply chain challenges and the continuing impact of COVID-19 on the global economy, equity markets have forged ahead to the delight of investors. Could this positive market sentiment be sustained going into the final quarter of 2021? We discuss below.

Local Markets Advance

The Trinidad and Tobago Composite Index (TTCI) built on strong Q2 2021 gains to record a notable improvement in 9M 2021, advancing 8.1%. The All Trinidad and Tobago Index (All T&T) led the gains among the three major indices, increasing 9.0% while the Cross Listed Index (CLX) expanded 6.0% at the end of 9M 2021. JMMB Group Limited and GraceKennedy Limited were the volume leaders on the First Tier Market for Q3 2021 with 8.7M and 5.6M shares being traded respectively.

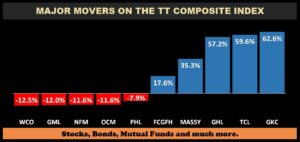

Major Movers

Cross-Listed conglomerate GraceKennedy Limited (GKC) advanced 62.6%, boosted by positive earnings momentum and investor sentiment. GKC completed the acquisition of Scotia Insurance Eastern Caribbean on August 3rd, 2021, rebranded under the name GraceKennedy Life Insurance Eastern Caribbean Limited (GK Life)”.

Trinidad and Tobago Cement Limited (TCL) was up 59.6%, following reported revenue growth and improved margins mainly due to higher cement sales volumes across the region and stronger market demand in Jamaica. Guardian Holdings Limited’s (GHL) increased 57.2%, fuelled by investor sentiment around its cross-listing on the Jamaican Stock Exchange (JSE) and good earnings growth.

Rounding out the top 5 major advancers, Massy Holdings Limited (MASSY) appreciated 35.3%, invigorated by its currently anticipated cross-listing onto the JSE in January 2022. First Citizens Group Financial Holdings (FCGFH) increased 17.6%.

Major decliners for 9M 2021 included, West Indian Tobacco Company Limited (WCO, â 12.5%), Guardian Media Limited (GML, â 12.0%), National Flour Mills (NFM, â 11.6%) followed by One Caribbean Media Limited (OCM, â 11.6%) and Prestige Holdings Limited (PHLâ 7.9%).

US Markets Continue to Climb

US stocks as measured by the S&P 500 index expanded 14.7% at the end of 9M 2021. The Energy Select Sector SPDR Fund (XLE) continues to be the strongest performing sector in 2021, up 37.4% YTD and increasing 8% in Q3 2021. This performance was boosted by a surge in energy prices, supported by the increasingly complex global supply chain bottlenecking. The Consumer Staples Select Sector SPDR Fund (XLP) continues to lag the S&P 500 (up 2.1%), as investors move away from traditionally defensive stocks and concerns about the inflationary impact on the sector’s margins and profitability grows.

European markets turned the corner in 9M 2021, advancing 8.1% after a decline of 10.9% in 9M 2020 as measured by the Euro Stoxx 50 Index. Improving economic conditions and stronger-than-expected earnings pushed the benchmark, along with the European Union pumping more support through its post-pandemic recovery fund. The UK’s FTSE 100 rebounded strongly (up 8.1%), supported by re-opening optimism and accommodative Central Bank Policies. France and Italy were among the best performing markets in the region, increasing 10.3% and 9.5% respectfully when compared to the prior period.

India and Taiwan equities recorded the strongest market performance for the period, increasing 22.3% and 16.0% respectively, underpinned by strong fiscal support and solid macroeconomic data. Asian Equity markets (excluding Japan) declined 3.9% compared to a gain of 0.8% in 9M 2020. South Korea posted the smallest Asian market gain in 9M 2021, up 1.9%. The Hang Seng Index in Hong Kong slumped 10.1% following a larger depreciation in 9M 2020 of 16.4%. The index led losses in 9M 2021, affected by the fallout of embattled Chinese property developer China Evergrande Group which continued to weigh on investor sentiment. China’s market, as measured by the Shanghai Composite Index grew 4.0% in 9M 2021, lagging behind projections. China’s growth momentum has taken a sharp hit from the combination of deleveraging, squeeze on property speculations and energy shortages.

According to the International Monetary Fund (IMF), the Indian economy contracted by 7.3% due to the Covid-19 pandemic, and is expected to grow by 9.5% in FY2021 and 8.5% in FY2022.

The IMF cut its growth forecast of China’s economic growth to 8.0% from 8.4%, due to power shortages, supply chain snags and a property market crisis. The IMF also lowered the outlook for FY 2022 to 5.6%. China’s prospects for 2021 are marked down slightly due to stronger-than-anticipated scaling back of public investment. Markets were also impacted by a shift in focus of Chinese regulatory authorities as more sectors, like medical cosmetics and the gaming industry came under scrutiny. Also, China’s manufacturing sector shrunk for the first time since April 2020.

Latin American Equity markets declined 9.1% in 9M 2021 following a drop of 37.3% in 9M 2020. Mexico was the best performing market, rebounding 12.4% during the period relative to 26.3% decline in 9M 2020. Mexico continues to benefit from a strong U.S recovery via manufacturing exports and remittances, though manufacturing production has suffered from some disruptions due to the ongoing global shortage of microchips. Brazil, Latin America’s largest economy dipped 11.0%, mainly attributable to higher inflation and concerns about fiscal discipline. Peru was the worst performing Latin American market in 9M 2021, retreating 23.1% following a 19.6% decline in 9M 2020. Peru’s underperformance was largely down to the political backdrop of President Castillo taking office and growing political noise.

S&P Global Rating forecasts Brazil’s 2021 economic growth to 5.1% from a previous 4.7% in FY2021 while lowering the FY 2022 growth projection to 1.8% from 2.1%. Brazil is experiencing higher inflation rates which (currently close to 10% YOY). The Central bank continues to increase interest rates in order to anchor inflation expectations, which are currently well above target.

The S&P Global increased the FY 2021 economic growth projections for Mexico to 6.2% from 5.8% previously. Growth in the second-quarter was better than envisioned, helped by continued recovery in consumption with limited lockdowns in the country. FY 2022 growth is forecasted at 2.9%.

Key Theme: Inflation

Inflation has risen to prominence as a key developing theme at both the local and international level. Initially described as ‘transitory’ by the US Federal Reserve, the persistence of rising prices is a growing concern to economic activity, with the potential to derail real economic growth in the coming months. This phenomenon has been compounded by international supply chain challenges, with clogged shipping ports and logistics bottlenecks pressuring prices upward on most goods and services. Escalated energy prices will inevitably have an inflationary impact, affecting the transport/fuel/electricity cost inputs into products.

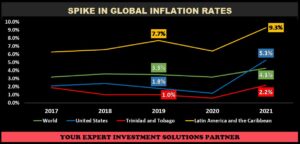

With Latin America and the Caribbean leading the group, retail prices, on a year-on-year basis, moved from 6.4% in 2020 to 9.3% in 2021. The United States experienced a surge in the inflation of 5.3% year-to-date, relative to 1.2% in 2020. The FED is allowing its target inflation rate to run above 2% and is seemingly willing to gamble ‘overheating’ the economy, while delaying hikes in interest rates in an attempt to prime US and broader global economic activity.

Trinidad and Tobago’s headline inflation on a year-on-year basis moved from 0.6% in 2020 to 2.2% as at July 2021. The Central Bank of Trinidad & Tobago attributed higher inflation to higher shipping costs, transportation delays, supply chain constraints and adverse weather conditions. Overall, the Global inflation rate moved from 3.2% in 2020 to 4.3% as at September 2021.

According to the IMF, inflation is expected back to pre-pandemic levels by mid-2022. The uncertainties are fuelling worries that inflation could persistently overshoot central bank targets and de-anchor expectations, leading to a self-fulfilling inflation spiral. Policy decisions by major central banks will be complicated as inflation persists.

Investor Considerations

With most indicators pointing to recovery, investors would expect a fairly benign last few months of 2021. The investor community has managed to climb every ‘wall of worry’ confronted in the year thus far, shrugging off any concerns that could have potentially derailed the robust advances across most equity markets.

While seemingly unperturbed at present, the persistence of inflation – and the associated changes it could necessitate by global policymakers – remains a wildcard in the coming months. Any sudden changes to interest rates or other monetary policy tools could potentially affect the currently positive investor sentiment pervading equity markets. Continued inflationary pressure could result in international equity investors rotating into sectors with exposure to commodities, real estate and technology through individual stocks and/or sector-focused exchange-traded funds (ETFs).

At home, resurgent energy prices and continued economic reopening should support generally positive market sentiment, despite concerns of rising sovereign debt levels and inflationary threats. Equity investors will, however, be hoping that corporate earnings catch up with current stock prices, to validate the currently elevated/stretched valuations evident in market prices

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”