HIGHLIGHTS

RFHL 9M2025

- Earnings: Diluted Earnings Per Share up 1.7% to $9.21 from $9.06

- Performance Drivers:

- Increased Revenues

- Outlook:

- Geographical Diversification

- Rating: Maintained at OVERWEIGHT

FCGFH 9M2025

- Earnings: Earnings Per Share increased 5.2% from $2.71 to $2.85

- Performance Drivers:

- Modest Revenue Growth

- Outlook:

- Increased Economic Activity

- Rating: Maintained at OVERWEIGHT

This week, we at Bourse review the performance of two key members of the local Banking Sector, Republic Financial Holdings Limited (RFHL) and First Citizens Group Financial Holdings Limited (FCGFH) for the nine-month period (9M2025) ended June 30th, 2025. Both RFHL and FCGFH delivered increased earnings, amidst a broadly dynamic operating environment. Can both groups continue their positive momentum in the upcoming months? We discuss below.

Republic Financial Holdings Limited (RFHL)

RFHL reported a Diluted Earnings Per Share (EPS) of $9.18 for the nine months ended 31st June 2025 (9M2025), recording a modest 1.8% increase from 9M2024. Net Interest Income grew to $4.04B from the previous $3.76B in 2024, a 7.6% increase. Other income increased 8.8%, up from $1.5B in 9M2024 to $1.6B in 9M2025. Despite 6.7% operating expenses increase, Operating Profit rose a commendable 9.4%. Credit Loss expense increased to $290M, a 79% increase in 9M2025 from $162M for the same comparable period. Taxation Expense saw a 12.6% or a $61M jump from last year’s $486M, implying an effective tax rate of 24.1% compared to 22.5% in 9M2024. Profit Before Taxation (PBT) gained 5.1% from $2.2B in 9M2024 to $2.3B in 9M2025. These factors cumulatively led to an increase in Net Profit Attributable to Equity Holders of 1.6%, a $24M increase from $1.47B in 9M2024.

Revenue Growth Continues

RFHL’s Operating Income rose 7.9% in 9M2025, marking the seventh (7) consecutive period of growth. These positive results were mainly driven by improvements in the operating jurisdictions of Barbados (↑20%) Suriname (↑25.8%) and Ghana (↑31.5%). Growth was also recorded YoY in other markets such as Guyana (↑8.8%) and the British Virgin Island and Cayman Islands, increasing 3.8% and 2.0% respectively. Trinidad & Tobago, which makes up over 50% of Total Operating Income, reported a 10.3% decline. The Eastern Caribbean market also faced a decline of 2.3%.

PBT Grows

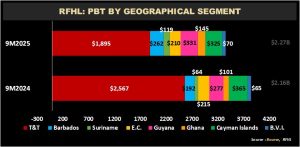

RFHL reported a 5.1% increase in Profit Before Taxation (PBT), reaching $2.27B for the period, with five of its eight operating territories recording year-on-year growth.

PBT contribution from RFHL’s main operating jurisdiction Trinidad and Tobago (56.4% of PBT excluding eliminations) declined 26.2% year-on-year to $1.9B from a previous $2.6B.

Guyana, the second largest contributor to PBT (9.9%) advanced 19.5% from $277M to $331M in 9M2025. Barbados (7.8% of PBT) recorded a gain in PBT of 36.5% to $262M in 9M2025. Ghana advanced 43.6% from $101M in 9M2024 to $145M in the period under review and Suriname improved 85.9% in the current reporting period. British Virgin Islands (BVI) increased 7.7% YoY, recording a PBT of $70M. The Eastern Caribbean (6.3% of PBT) experienced a 2.3% decline in PBT YoY to $210M from $215M in the prior quarter. The Cayman Islands (9.7% of PBT) fell 11.0% from $365M to $325M in 9M2025.

RFHL to Expand Regional Footprint

On May 21st, 2025, The Group announced its intention to make an all-cash conditional offer to purchase the outstanding ordinary shares of Cayman National Corporation Limited (CNC). RFHL owns 31,754,248 ordinary shares (74.98% of CNC) and seeks to acquire up to 10,596,483 of the remaining ordinary shares, representing 25.02% of the issued shares, at an offer price of US$7.75 per share. If fully accepted, the transaction would amount to approximately US$82.1M. The offer circular was posted on the Cayman Islands Stock Exchange (CSX) to shareholders on May 30th, 2025, and expired on July 29th, 2025.

As at August 1st, RFHL’s total ownership is estimated to have increased to roughly 87%, based on its existing ownership and shares tendered during the offer. The final outcome and status of the remaining shares (13%) held by external shareholders are yet to be confirmed.

According to RFHL 2024 Annual Report, Cayman Islands (13.5% of NII) is the second largest generator of net interest income amounting to TT$682M, behind T&T (47% of NII). The move aligns with RFHL’s broader strategy to strengthen its geographic footprint and deepen its presence in key regional markets. This move also reinforces growth by acquisition as an important component of the Group’s growth strategy, particularly in an environment where growth in the dominant jurisdiction (T&T) may be suboptimal.

The Bourse View

At a current price of $110.57, RFHL trades at a trailing P/E of 8.9 times, below the Banking Sector average of 9.3 times. The stock offers investors a trailing dividend yield of 5.2%, above the sector average of 4.8%. The company announced an interim dividend of $1.00 payable on August 29th, 2025, to shareholders on record by August 15th, 2025.

The Group maintains a strong outlook, driven by its diversified portfolio, solid financial performance and growth in core segments. Despite ongoing global uncertainty, RFHL’s blend of earnings performance, dividend payouts, and current valuation presents a compelling value proposition for investors from both capital appreciation and income perspective. The well capitalized position of the Group and strong positioning in emerging economic hotspots such as Guyana and Suriname are supportive of a favourable outlook, notwithstanding uncertainty with global trade and monetary policies.

On the basis of geographical diversification of operations, modest earnings growth and attractive valuations, Bourse maintains an OVERWEIGHT rating on RFHL.

First Citizens Group Financial Holdings Limited (FCGFH)

First Citizens Group Financial Holdings Limited (FCGFH) reported Earnings per Share (EPS) of $2.85 for the nine months ended June 30th, 2025 (9M2025), reflecting a 5.2% increase from $2.71 in the prior comparable period (9M2024).

Net Interest Income rose 2.1% to $1.55B from $1.52B, while Other Income climbed 7.4% from $517.6M to $555.9M. As a result, Total Net Revenue increased by 3.5% to $2.11B, up from $2.04B in 9M2024. Credit Impairment Losses amounted to $49.9M, compared to $23.9M in the prior period. Non-Interest Expenses declined by 1.1% to $1.09B, aiding a 6.3% improvement in Operating Profit to $967.2M. The Group’s Share of Profit from Associates and Joint Ventures stood at $20.3M, down 11.7% year-on-year. Profit Before Taxation rose by 5.8% to $987.5M. Taxation Expense grew 7.7% to $267.9M, with the Group’s effective tax rate remaining stable at approximately 27.1%. Overall, Profit After Taxation advanced 5.1% to $719.6M from $684.5M.

PBT Segment Performance Lower

FCGFH recorded a minor year-on-year decline of 2.0% in Profit Before Taxation (PBT) before eliminations. Including eliminations, PBT rose 5.8%. Retail & Corporate Banking, the primary driver of PBT (contributing 63.7% before eliminations) grew by 4.6% from $769M to $805M. Treasury & Investment Banking (33.2% before eliminations) decreased 11.9% year-on-year to $419M. Trustee & Asset Management, the least segment by contribution (3.1% before eliminations), contracted by 9.3% to $39M.

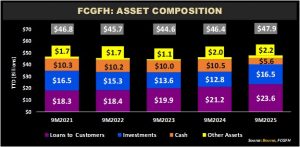

FCGFH’s total assets grew by 3.2% year-on-year, increasing from $46.4B in 9M2024 to $47.9B in the current period. Loans to Customers (49.2% of total assets) rose 11.4% to $23.6B. Investments accounted for 34.5% of total assets and climbed to $16.5B, up 29.1% from the prior period. Meanwhile, Cash and Statutory Deposits (11.7% of total assets) fell by 46.6% to $5.6B. Looking at balance sheet trends, FCGFH has been prioritizing asset growth within its loan portfolios, while also increasing its investment portfolio.

The Bourse View

FCGFH is currently priced at $41.80 and trades at a P/E ratio of 10.6 times, above the Banking Sector average of 9.3 times. The Group declared an interim dividend of $0.53 per share payable on September 5th, 2025, to shareholders on record by August 15th, 2025. The stock offers a dividend yield of 5.9%, above the sector average of 4.8%. FCGFH continues to deliver quarterly dividends, appealing to income-focused investors, while maintaining its emphasis on expanding its credit portfolio. On the basis of improving earnings and an attractive dividend yield, Bourse maintains an OVERWEIGHT rating on FCGFH.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”