JMMBGL Improves, AMBL Slips | 05.09.2022

HIGHLIGHTS

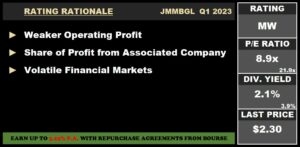

JMMBGL Q1 2023

- Earnings: Earnings Per Share of $0.044 increase from Earnings Per Share of $0.040

- Performance Drivers:

- Geographic Diversification

- Share of Profit from Associated Company

- Weaker Operating Profit

- Outlook:

- Volatile Financial Markets

- Rating: Maintained at MARKETWEIGHT

AMBL HY 2022

- Earnings: Loss Per Share of $1.50, down 200.7% from Earnings Per Share of $1.49

- Performance Drivers

- Non-Cash Mark-to-Market Losses in Investment Portfolios

- Outlook:

- Acquisition Activity

- Volatile Financial Markets

- Rating: Maintained at MARKETWEIGHT

This week, we at Bourse review the performance of Non-Banking Finance sector stocks JMMB Group Limited (JMMBGL) and Ansa Merchant Bank Limited (AMBL) for the three-month and six-month period respectively, ended June 30th, 2022. Both entities were adversely affected by volatility across global financial markets, with JMMBGL benefiting significantly from its Share of Profit from Associate Companies. How will both companies fare in the upcoming months despite the still uncertain operating environment? We discuss below.

JMMB Group Limited (JMMBGL)

JMMB Group Limited (JMMBGL) reported an Earnings Per Share (EPS) of TT$0.044 for the three-month period ended June 30th 2022 (Q1 2023), TT$0.004 higher than the EPS reported in Q1 2022.

Net Interest Income marginally increased 2.1% to TT$130.7M. Fee and Commission Income advanced 74.7% to TT$75.1M from TT$43.0M in Q1 2022. Gains on Securities Trading dipped 58.1% to TT$46.0M. Overall, Operating Revenue declined 4.5% year-on-year (YOY) from TT$308.2M in Q1 2022 to TT$294.2M in Q1 2023. Operating Expenses advanced 12.7% to TT$238.7M, while Impairment Loss on Financial Assets increased from TT$10.8M in Q1 2022 to TT$16.8M in Q1 2023. Operating Profit declined 42.4% from TT$96.3M in Q1 2022 to TT$55.5M in Q1 2023. This decline was offset by a rebound improvement in Share of Profit of Associate of TT$56.4M. Resultantly, Profit Before Tax contracted 4.5% to TT$95.3M. Taxation declined to TT$6.7M from TT$13.0M in the prior year. Overall, Profit Attributable to Equity holders stood at TT$86.0M, up 11.8% compared to TT$76.9M reported in the previous period.

Operating Revenue Contracts

JMMBGL’s Operating Revenue contracted 4.5% to TT$294.2M during the Q1 2023 period. Net Interest Income accounted for 44.7% of Operating Revenue, marginally up 2.1% from TT$128M to TT$131M in Q1 2023, attributable to growth in its loan and investment portfolios. Fees and Commissions Income (25.7% of Operating Revenue) advanced from TT$43.0M in Q1 2022 to TT$75.1M in Q1 2023, reflecting significant growth in managed funds and collective investment schemes across the Group. Foreign Exchange Margins from Cambio Trading accounted for 13.6% of Operating Revenue, increasing 52.5% from TT$26M to TT$40M in Q1 2023. However, Gains on Securities Trading declined 58.1% to TT$46.0M, as the segment was affected by volatile equity and financial markets.

Geographic Diversification Boosts Performance

The Group continues to focus on its ‘smart growth’ strategy, emphasizing on strategic revenue diversification, strong capital management and growing core activities in key business lines. JMMBGL’s 23.3% stake in associate company, Sagicor Financial Company Limited (SFC), contributed TT$565M in this quarter. According to the Group, its operations in the Dominican Republic contributed 25.0% of Operating Revenue, evidenced by its continued geographic expansion in this territory, particularly in the commercial and banking sector with the recently acquired 100% shareholding of Banco Múltiple Bell Bank SA.

In the upcoming quarters, focus on geographic diversification will remain with sharp focus on Trinidad and Tobago.

JMMBGL’s trailing Earnings Per Share (EPS) increased from TT$0.19 in Q1 2022 to TT$0.26 in Q1 2023, as The Group’s trailing 12-month Price-to-Earnings (P/E) ratio fell from a peak of 15.9 times in Q1 2020 to 8.9 times in Q1 2023. The Group continues to grow earnings through a combination of both organic means and acquisition activity.

The Bourse View

At a current price of $2.30, JMMBGL trades at a price to earnings ratio of 8.9 times, below the sector average of 21.9 times. The stock currently has a trailing dividend yield of 2.1% relative to the Non-Banking Finance sector average of 3.9%. The Group noted that its operating environment was affected by rising inflation and increased interest rates, which – if persistent – could affect gains on securities trading. On the basis of increasing geographic diversification, but tempered by lingering economic uncertainties and financial market volatility, Bourse maintains a MARKETWEIGHT rating on JMMBGL.

ANSA Merchant Bank Limited (AMBL)

- Go to the previous page

- 1

- …

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- …

- 496

- Go to the next page