HIGHLIGHTS

MASSY 9M2025

- Earnings per share (EPS):

- EPS: 15.7% higher, from $0.22 to $0.25

- Continuing Operations: EPS 17.4% higher, from $0.21 to $0.25

- Performance Drivers:

- Revenue Growth

- Higher Margins

- Outlook:

- Geographical Diversification

- Acquisition Integration Efforts

- Rating: Maintained at OVERWEIGHT

GKC HY2025

- Earnings: Diluted Earnings Per Share 4.3% lower, from TT$0.194 to TT$0.186

- Performance Drivers:

- Revenue Growth

- Lower Margins

- Outlook:

- Acquisition Integration Efforts

- Rating: Maintained at MARKETWEIGHT

This week, Bourse reviews the performance of two members of the Conglomerate sector on the Trinidad & Tobago Stock Exchange (TTSE), Massy Holdings Limited (MASSY) and Grace Kennedy Limited (GKC) for their nine-months period (9M2025) and six-months (HY2025) ended June 30th, 2025, respectively. Massy delivered improved performance driven by increased revenues. GKC meanwhile, was adversely affected by increasing operating expenses. Can MASSY continue its positive earnings momentum? Will GKC be able to stabilize its margins in the second half of 2025? We discuss below.

Massy Holdings Limited (MASSY)

Massy Holdings Limited (MASSY) reported Earnings per Share (EPS) of $0.253 for the nine months ended June 30th, 2025 (9M2025), 15.7% higher than the $0.219 reported in 9M2024. EPS from Continuing Operations grew 17.4% from $0.209 to $0.246 per share.

Revenue amounted to $11.8B in 9M2025, up 4.0% from $11.4B in 9M2024. Operating Profit after Finance Costs climbed 32.3% to $798.5M. Share of Results of Associates and Joint Ventures fell short to $11.6M, compared to a prior period of $112.3M. Profit Before Tax (PBT) grew by $810.1M, a 13.2% from $715.9M. Profit for the period from continuing operations amounted to $529.4M, 16.3% higher compared to $455.1M in the prior period. MASSY’s Profit for the period from discontinued operations fell to $13.8M, relative to a prior $18.1M in 9M2024. Accordingly, Profit for the period advanced 14.8% to $543.2M compared to $473.2M in the prior period. Overall, Profit Attributable to Owners of the Parent stood at $500.5M, 15.7% higher, compared to $432.6M reported in the prior period.

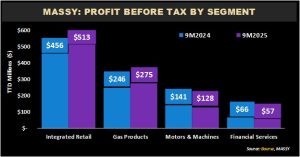

Segment Performance Mixed

MASSY’s 13.2% PBT growth in 9M2025 was primarily supported by its major segment, Integrated Retail.

Integrated Retail, the most significant contributor to PBT (63.3%), expanded by 12.4%, from $456M in 9M2024 to $513M in 9M2025, supported by higher sales volumes and a favourable shift in product mix toward higher-margin products, according to the Group.

Gas Products (34.0% of PBT), the second-largest contributor, climbed by 11.7% from $246M to $275M.

Motor & Machines, (15.8% of PBT) fell 9.1% to $128M from $141M in 9M2024, supported by growth in the Group’s Colombia operations despite a softer performance in the T&T market.

Financial Services, representing 7.0% of PBT, dropped 13.7% quarter on quarter to $57M, relative to $66M in the prior period.

Margins Recover

MASSY’s profit margins improved relative to the prior reporting period, moving toward the higher end of its recent ranges. Operating Profit Margin rose to 6.7% compared to 5.3% in 9M2024. Profit Before Tax Margin increased to 6.8% in 9M2025, from 6.3% a year earlier. Profit after Tax grew from 4.0% to 4.5% in 9M2025.

According to the Group, the group’s profitability was impacted by weaker results from the Gas Products Portfolio, a notable 8.5% contraction in PBT performance quarter on quarter.

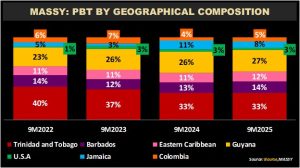

Geographic Diversification Ongoing

The Group continues to see positive contributions from its recent acquisitions and diversification initiatives across local, regional, and international markets, as reflected in the geographic breakdown of PBT. The Group’s generation of PBT (ex-adjustment) outside of T&T grew from 60% in 9M2022 to 67% in 9M2025.

Trinidad & Tobago, the largest contributor to PBT before adjustments (32.7%), rose 6.9% year-on-year, moving from $297.9M to $318.4M. Guyana’s share of PBT (26.7%) grew by 10.6%, from $234.5M in 9M2024 to $259.5M in the current reporting period. Guyana’s overall contribution to PBT ex-adjustments grew from 26% to 27%.

Barbados (13.9% of PBT) advanced 17.3% to $134.8M, relative to $115.0M in the prior reporting period. Eastern Caribbean (11.7% of PBT) improved 9.8% to $114.1M from $103.9M in 9M2024. Notably, Jamaica’s operations (7.7% of PBT) contracted by 22.1%, from $95.8M in 9M2024 to $74.6M in 9M2025. Colombia’s operations contributed 4.7% to PBT, showed strong growth of 42.6%, climbing from $32.0M to $45.7M. PBT from U.S.A. operations (2.7%) slid 13.9% from $30.0M to $25.8M in 9M2025. Importantly, PBT generated outside of Trinidad & Tobago expanded 7.1% year-on-year, reflecting the Group’s continued focus on implementing its growth strategy for FY2025.

The Bourse View

At a current price of $3.90, MASSY trades at a trailing P/E of 10.6 times, below the Conglomerate Sector average of 11.9 times. The Group declared an interim dividend of $0.0354 per share payable on September 26th, 2025, to shareholders on record by August 29th, 2025. The stock offers investors a trailing dividend yield of 4.5%, above the sector average of 2.4%.

Despite shifting market conditions, MASSY continues to push forward with its strategy, driving efficiency across its businesses, pursuing disciplined acquisitions, and ensuring shareholders benefit through consistent dividend payouts. On the basis of continued revenue growth, resilient profit margins and continued geographical diversification, Bourse maintains an OVERWEIGHT rating on MASSY.

GraceKennedy Limited (GKC)

GraceKennedy Limited (GKC) reported Diluted Earnings per Share (EPS) of TT$0.186 for the half year ended (HY2025) June 30th, 2025, a 4.3% decrease from the TT$0.194 reported in HY2024.

For HY2025 Grace Kennedy Limited posted Revenue of TT$3.9B, a 5.5% climb year on year from TT$3.7B. Direct and operating expenses advanced by 6.7% moving from TT$3.4B to TT$3.7B while Net Impairment Losses on Financial Assets grew 45.1%, from TT$10.4M to TT$15.1M. This led to Total Expenses increasing by 6.8%, from TT$3.5B to TT$3.7B. Profit from Operations saw a 7.9% decline, falling to TT$259.6M from TT$282.0M. Interest Income gained by 11.5% to $20.0M, while Interest Expense was up 6.6% to TT$45.0M. Profit before Taxation had a 5.4% drop from TT$266.8M. As a result, Taxation Expenses fell from TT$76.2M to TT$73.4M, a 3.7% reduction. This led to an overall decrease in Net Profit for the period by 6.1%, lowering from TT$206.0M to TT193.5M. Net Profit Attributable to Owners of GKC came in at TT$185.7M, contracting 4.2% from TT$193.8M.

Profit Before Tax Lower

GKC’s Profit Before Tax (PBT) fell 2.7% to TT$313M before adjustments from the prior comparable period.

Food Trading, the largest contributor to PBT (61.0% excluding eliminations) experienced marginal 1.1% growth, from TT$189M to TT$191M.

Insurance, the second largest contributor to PBT (15.6% excluding eliminations) experienced the highest year-on-year growth out of all sectors, a 14.9% increase from TT$43M to TT$49M in HY2025. Moreover, GKC was able to successfully complete the acquisition of Key Insurance Company Limited, expanding their ownership from 73.2% to 98.8%.

Money Services, which accounts for 15.0% of PBT (excluding eliminations), saw a 26.8% reduction moving from TT$64M to TT$47M, due to the challenging remittance landscape.

Banking and Investments (8.4% of PBT excluding eliminations) grew marginally by 0.7% year on year, moving from TT$26.0M to TT$26.2M, supported by strong loan growth from First Global Bank in Jamaica.

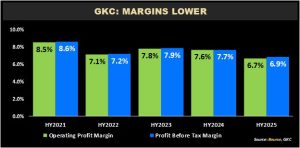

Margins Lower

For six-month reporting period ended June 2025 (HY2025), GKC’s profitability margins narrowed relative to the prior comparable period (HY2024). Operating Profit Margin fell from 7.6% in HY2024 to 6.7% in HY2025, while Profit Before Tax Margin dropped from 7.7% (HY2024) to 6.9% in the current period, despite cost-optimization initiatives. GKC’s margins currently hover at the lower end of its trailing five-year range.

The Bourse View

At a current price of $3.65, GKC trades at a P/E ratio of 10.5 times, below the Conglomerate Sector average of 11.9 times. The stock offers investors a trailing dividend yield of 2.8%, above the sector average of 2.4%. The Group announced an interim dividend of TT$0.024, payable to shareholders on September 22nd, 2025. Importantly, GKC’s dividends are paid in US Dollars.

GKC continues to broaden its portfolio by pursuing strategic acquisitions, diversifying revenue streams and focusing on the integration of existing acquisitions. On the basis of revenue growth and continued acquisition activity, but tempered by lower margins, Bourse maintains a MARKETWEIGHT rating on GKC.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”