HIGHLIGHTS

Local Markets

- Repo Rate remains at 3.50%

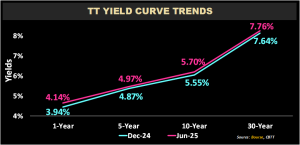

- Local Yield Curve Rises

- 1-year: 4.14% (20 bps YTD)

- 10-year: 7.76% (15 bps YTD)

International Markets

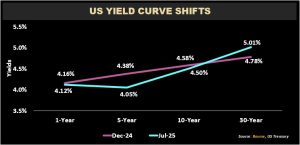

- US Yield Curve Evolves

- 1-year: 4.12% (4 bps YTD)

- 10-year: 4.50% (8 bps YTD)

Investor Considerations:

- Time Horizon

- Liquidity

- Risk Tolerance

- Return Objectives

This week, we at Bourse review the Fixed Income environment, both locally and internationally, a key area of interest for lower-risk investors. With evolving domestic and international conditions, how have fixed income investments fared year-to-date and what are some factors investors should be considering? Is there value on offer to investors in this asset class? We discuss below.

Local Fixed Income Market

TTD Yield Curve Shifts Up

TTD interest rates remain relatively attractive across most tenors, providing an incentive to investors to pay closer attention to fixed income opportunities, such as repurchase agreements, income mutual funds and bonds.

With respect to the Government of the Republic of Trinidad & Tobago (GORTT) yield curve, there was a general (modest) upward shift across most tenors. The 1-year GORTT benchmark yield saw the largest gain in the measured period of 20 basis points (bps) from 3.94% in December 2024 to 4.14% in June 2025. Medium and longer-term yields increased moderately, with the 5-year climb to 10 bps from 4.87% to 4.97% and the 10-year gaining 15 bps from 5.55% to 5.70%. The 30-year rate followed a trend, moving from 7.64% to 7.76% over the observed period of December 2024 and June 2025, respectively.

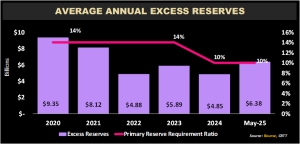

Excess Reserves Remain Healthy – Reserve Requirement Steady

The primary reserve requirement – the percentage of deposit liabilities commercial banks must hold in a non-interest earning cash reserve account with the Central Bank of Trinidad and Tobago (CBTT) – was maintained at 10%. With the last adjustment taking place in July 2024 (a cut from 14% to 10%) to ensure appropriate system liquidity, commercial banks’ average excess reserves improved from TT$4.85B in 2024 to an average TT$6.56B as at May 2025 (latest data from CBTT).

Excess reserves could be supportive of increased open market operations (OMO) and/or bond issuance activity, which would potentially improve asset availability to fixed income investors.

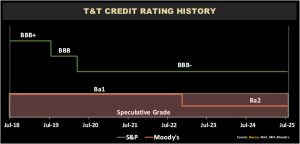

T&T Credit Ratings Stable

Trinidad and Tobago’s credit rating remained stable, with at least one agency rating the Country as investment grade. In June 2025, Moody’s Ratings affirmed the Government of Trinidad and Tobago at ‘Ba2’ – 2 notches below investment grade – with a stable outlook, despite volatile energy sector projections in 2025 and 2026.

Standard and Poor’s rating agency in September 2024 affirmed the Caribbean State’s Short-term Foreign and Local Currency Sovereign credit rating at ‘BBB-’. The ratings were underpinned by moderate fiscal deficits and low growth expected over the next two years. With continued headwinds to economic growth and other structural economic factors to be addressed, it remains to be seen whether T&T would be able to retain its investment-grade status in the near term.

Local Fixed Income Outlook

Notwithstanding a modest increase in GORTT yields year-to-date, the domestic fixed income outlook remains relatively stable. Inflation in Trinidad and Tobago has remained relatively rangebound throughout 2025, with a slight uptick noted in June 2025 (latest). The Central Statistical Office (CSO) reported that headline inflation grew 0.2% month-on-month (MoM) from May 2025. In its May Monetary Policy Report, the Central Bank Monetary Policy Committee noted that higher food prices were the main contributor to the marginally higher inflation. Despite this trend, the benchmark policy rate has remained stable over the past five years at 3.50%.

International Fixed Income Market

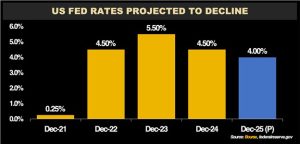

Cuts in the Fed Rate Anticipated

The US Federal Reserve (the Fed) held interest rates steady at its last meeting, as uncertainty with tariff imposition led the Fed to continue its pause. Analysts and policymakers have extended the timing of rate cut forecasts, underpinned by weaker than expected economic growth, increased unemployment and persistent price increases according to Reuters. The Fed commenced cutting rates towards the latter half of 2024, bringing the Fed Funds range to 4.25%-4.50%. At the start of the year, consensus estimates of the target range were 3.75%-4.00% for 2025, anticipating 2 further 0.25% rate cuts. These estimates remain intact, though now projected to occur in September, as opposed to earlier in the year as originally anticipated. With rates cuts increasingly likely, investors might have an eye on locking in yields before they move lower.

USD Yields Shift

The US Treasury yield curve has evolved year-to-date, with no discernible pattern. 1-year US Treasury yields slipped 4 bps from 4.16% in December 2024 to 4.12% in July 2025, while 5-year yields dropped 33 bps and the 10-year US yield slid 8 bps. On the longer end, 30-year yields grew 23 bps over the same period, closing at 5.01% in July 2025. Modestly lower short-term yields could be reflecting the growing likelihood of a cut to the policy of US interest rates.

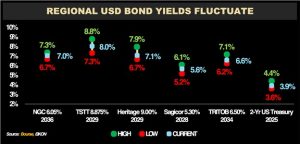

Regional USD Bond Yields Remain Attractive

Regional USD-denominated bond yields have fluctuated year to date, remaining within their respective year-to-date (YTD) high-low ranges. For example, National Gas Company of Trinidad and Tobago, NGC 6.05% 2036 bonds are currently trading at an indicative yield of 7.0%, in the middle of its YTD range of 6.7% to 7.3%. The pattern is similarly reflected in the two-year Treasury, currently trading at a yield of around 3.9% (YTD range: 3.6% to 4.4%). With anticipated rate cuts on the horizon, current yields present opportunities to investors who would like to partake in the bond markets, whether in Investment Grade Bonds or otherwise.

Fixed Income Investor Considerations

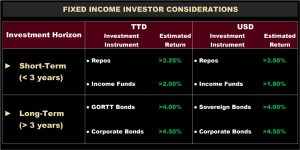

As we look towards the second half of the year, Fixed Income Investors have multiple opportunities to consider given the small uptick in liquidity.

Investors with a short-term horizon of up to 1 year can consider easily accessible fixed income mutual funds. Mutual funds offer a lower risk solution with a good balance of liquidity and returns. For example, the TTD Savinvest Income Fund, managed by Bourse, offers investors an annualized return of 2.50% p.a.

For the short-to-medium term investors, solutions for consideration would include repurchase agreements, fixed deposits and medium term bonds (subject to availability). These investments would offer returns in the range of 3.00%-5.00% for TTD and a similar range for USD, depending on the tenor of investment.

Investors with a longer-term horizon and lower risk tolerance might consider investment grade or higher credit quality government and corporate bonds, which are available in both the TTD and USD space. 10-year GORTT TTD bonds currently offer investors an annual return of around 5.40%, while USD bonds issued by GORTT with approximately 10-years to maturity would offer approximately 6.00%.

As always, it would be advisable to consult an experienced advisor, like Bourse, to make more informed investment decisions for your portfolio.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”