HIGHLIGHTS

TTNGL

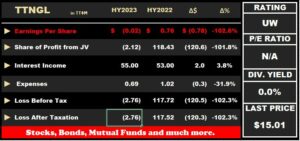

- FY2022 – Earnings: Loss Per Share: ($2.56), 186.2% lower, from EPS of $2.97

- HY2023- Earnings: Loss Per Share: ($0.02), 102.6% lower, from EPS of $0.76

- Performance Drivers:

- Operational/ market challenges faced by PPGPL

- Non-Cash Impairments

- Outlook:

- Potentially increased production

- International Expansion

- Generation of new Revenue streams

- Rating: Assigned at UNDERWEIGHT

Energy Prices Update

- Year to Date Price Performance:

- WTI Crude ↑ 0.8%

- Brent Crude ↑4.5%

- Henry Hub Natural Gas ↓ 41.3%

This week, we at Bourse review the performance of the sole member of the Energy Tier of the local stock exchange, Trinidad and Tobago NGL Limited (TTNGL) for its financial year ended December 31st, 2022 and for the six months ended June 30th, 2023. After extended delays in publishing its audited financials, TTNGL’s results reported a significant drop in earnings as the Company’s sole underlying asset, Phoenix Park Gas Processors Limited (PPGPL), faced considerable operational and market challenges. At the halfway mark of FY2023, results would not have improved. Despite this, TTNGL at a recent Broker meeting would have put forward some points for cautious optimism of improved performance in subsequent periods. Will TTNGL be able to turn its fortunes around, or will it continue to struggle under challenging circumstances? We discuss below.

TTNGL FY2022: Results Underwhelm

TTNGL generated a Loss per Share (LPS) of $2.56 for the year ended 31st December 2022, swinging from a prior Earnings per Share of $2.97 in FY2021.

Share of Profit from its Investment in Joint Venture, Phoenix Park Gas Processors Limited (PPGPL) increased 13.4% to $168.3M from $194.4M in the prior comparable period. Interest Income declined 4.0% while Foreign Exchange Gains increased 3.7%. Cumulatively, Total Income was $168.3M relative to $194.4M in the prior year, down 13.4%.

The major negative impact to TTNGL’s performance came from a significant impairment loss of $562.4M in FY2022, relative to a (restated) impairment reversal of $267.2M in FY2021. This resulted in a Loss Before Tax of $396.6M, compared to a Profit Before Tax of $459.7M in FY2021. Overall, Loss for the Period amounted to $396.6M in FY2022 relative to a prior $459.5M.

Impairments Weigh on Results

Despite still-reasonable operating results, reflected in TTNGL’s share of profit from its joint venture PPGPL (FY2022: $168.1M), impairment charges significantly impacted the overall results of TTNGL. The source of this impairment was primarily from a change in the valuation model utilized by TTNGL in estimating the value of PPGPL, which was switched to the Fair Value Less Costs of Disposal (FVLCD) approach as opposed to the previously utilized ‘Value in Use’ approach. This model change, combined with more conservative model inputs and the introduction of decommissioning costs, would have led to the large impairment loss, which TTNGL stressed is an unrealized non-cash charge.

Broker Meeting Highlights

At a recently held Broker meeting on August 17th 2023, TTNGL and PPGPL executives took the time to provide more insight into both TTNGL and PPGPL’s performance.

Higher feedstock costs. PPGPL confronted higher feedstock costs in the latter half of FY2022 and FY2023 year-to-date, on account of renegotiated prices between itself and supplier NGC Group. Buoyant ammonia and methanol prices during FY2022 had a knock-on effect of bringing NGC and PPGPL into negotiations, resulting in a reported 46% increase in feedstock costs from NGC versus FY2021, which in turn adversely impacted PPGPL’s profits and TTNGL’S share of profits. PPGPL noted it is cautiously optimistic that a pronounced correction in both methanol an ammonia prices could lead to moderating feedstock costs, as NGC and PPGPL return to the negotiating table later in 2023.

According to data extracted from the Central Bank of Trinidad and Tobago (CBTT), ammonia and methanol prices peaked at US$1500/Tonne and US$605.5/Tonne respectively in April 2022. Year-to-date, energy commodity prices have corrected with ammonia and methanol prices down to US$232.5/Tonne (â 75.7%) and US$414.0/Tonne (â 23.0%) respectively as at July 2023.

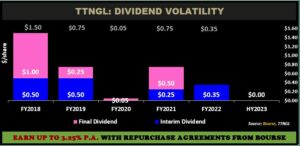

The question of dividend payments was also brought up at the meeting, specifically if any dividend would be paid by TTNGL to shareholders in the foreseeable future. TTNGL has traditionally been viewed as a stock for income-oriented investors, offering a reasonably healthy dividend yield. Investors would have noted a palpable absence of any dividend announcement related to both the release of TTNGL’s FY2022 and HY2023 results, periods for which the declaration of respective final and interim dividends are customary. In response to the question, TTNGL noted that certain approvals would need to be received at its next shareholder meeting, in order to facilitate the payment of a dividend. It should be noted that no timeline for the payment of a dividend was provided. Importantly, TTNGL as at June 2023 had cash and near cash resources (including a dividend receivable from PPGPL) totalling $120.8M. Put differently, TTNGL, if fully deploying cash resources as a dividends, could pay a dividend of up to $0.78 per share.

Other factors affecting performance which were highlighted at the Broker meeting included an unplanned shutdown during the course of FY2022, increased major maintenance in its Hull Terminal facilities and a bad debt write-off of US$5.2M. It was noted that the bad debt write-off would have been the subject of legal proceedings, with PPGPL optimistic of a favourable outcome.

HY2023 Update

TTNGL reported a Loss per Share (LPS) of $0.02 for the six-months ended 30th June 2023, down from a previous Earnings per Share of $0.76.

Share of Profit from its Investment in Joint Venture, PPGPL, decreased from $118.4M in HY2022 to a Loss of $2.12M in HY2023.

Interest Income climbed 3.8% to $55M. Total expenses declined to $0.69M in HY2023, 31.9% lower than a prior $1.0M. Resultantly, Total Loss before Tax was $2.76M relative to a Profit Before Tax of $117.7M in the prior year. Overall, Loss after Tax was $2.76M in HY2023, relative to a Profit After Tax of $117.5M in the previous reporting period.

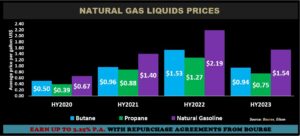

NGLs Prices Lower

Natural Gas Liquids (NGLs) prices have shown a sizeable decline relative to prior comparable periods, as a result of weaker demand for NGLs caused by a warmer-than-expected winter in HY2023. NGL inventories have remained well above the five- year averages, exerting further downward pressure on its prices.

Average Butane prices decreased 38.6% from US$1.53 per gallon in HY2022 to US$0.94 per gallon in HY 2023, while average Propane prices dwindled 23.5% from US$1.27 per gallon to US$0.75 per gallon. Natural Gasoline experienced a significant price fall with average prices declining 29.7% to US$1.54 per gallon in HY2023 from $2.19 in the prior comparable period. Year to date, the weighted basket of NGLs has averaged US$1.05 per gallon.

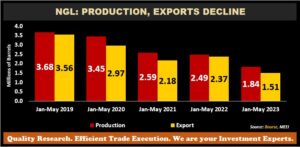

Domestic Production, Exports Decline

Based on the latest data published by the Ministry of Energy and Energy Industries (MEEI), production of NGLs decreased significantly over the five (5) comparable reporting periods. NGLs output declined 26.1% from 2.49M (BBLS) in January-May 2022 to 1.84M BBLS in January-May 2023.

Exports of NGLs by PPGPL reached its lowest level of 1.5M BBLS over the comparable periods during the period Jan-May 2023, relative to a previous 2.37M BBLS in Jan-May 2022, down 36.2%.

PPGPL’s International Thrust

On August 3rd, 2023, PPGPL signed a Technical Services Agreement with The Gas Gathering Limited (TGGL), a Ghanaian consortium, marketing its skills and expertise by providing technical and commercial advisory services. Chairman Dr. Joseph Khan stressed that this agreement “is in alignment with government’s policy and strategy as it relates to building competitive businesses locally, regionally and internationally, and it translates into improvement in the economic welfare of both Ghana and T&T.”

On August 9th, 2023, Phoenix Park Energy Marketing LLC (PPEM) a wholly owned subsidiary of PPGPL has strengthened its relationship with its largest customer, Intersim SA (SIMSA GROUP, Mexico) by signing a non- binding Letter of Intent in Mexico. The three-year agreement is aimed towards doubling the propane supply to Mexico from the current volume of 300 railcars per month to 650 cars per months. Once realized, PPEM will experience a significant increase in overall product volumes traded.

Dividend Uncertainty Continues

TTNGL’s absence of dividends in the last two regular dividend cycles has led to the company’s trailing dividend yield of 0%. Historically, dividends have been fairly volatile since FY2018, the last period of TTNGL’s robust annual dividend flow to investors of TT$1.50 per share. Since then, dividend-oriented investors have endured consecutive periods significantly lower dividends.

TTNGL’s book value per share contacted in FY2022, driven by loss in its sole investee company (PPGPL) following weak energy commodity prices. The company’s Book Value Per Share (BVPS) declined from $14.37 in FY2021 to $10.92 in the most recent period.

The P/B ratio peaked at an elevated level 2.1 times for FY2022, above the four- year average of 1.54, raising concerns about overvaluation. At HY2023, the P/B ratio has moderated to 1.4, but still above pre-pandemic 2019 level of 1.1. From a value perspective, investors are currently paying a premium for the stock relative to the book value of its net assets on a per share basis.

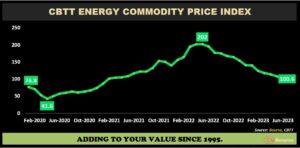

ECPI Falls

The Energy Commodity Price Index (ECPI), calculated and published by the Central Bank of Trinidad & Tobago (CBTT), is a measure of the average energy prices faced by domestic production, based on T&T’s top ten energy-based commodity exports.

The ECPI followed a similar path as global energy prices began to decline. The ECPI stood at 76.8 in January 2020, before the effects of COVID-19 led it to decline to a low of 41.6 in April 2020. The ECPI maintained a relatively upward trend international price trend prices from June 2020, topping at 202.0 in May 2022. As of June 2023, the index was stood at a level of 100.6, down from 107.8 in May 2023. Despite the decline, the ECPI remains elevated relative to prior periods.

The Bourse View

TTNGL currently trades at a market price of $16.37, down 29.6% year-to-date. TTNGL’s operating performance continues to be impacted by adverse market conditions from both revenue and input costs. According to the Group, uncertainties around gas supply, the increasingly unstable climate and shifting market demand will continue to put pressure on margins in the near-term. Input cost moderation and increased plant uptime are expected to support improved performance in subsequent periods. With significant impairments have been recognized in FY2022 on account of its model change and other factors, there is a lower likelihood of major non-cash charges in the near-term. While the absence of any dividend announcement would have come as a surprise to TTNGL shareholders, it would appear the Company has resources to pay a dividend subject to certain approvals. Still, the tenuous operating environment leaves risks to performance in the immediate future.

Notable risks remain to TTNGL in the near-term as an equity investment. Investor sentiment remains fragile, with the main remedy being a return to profitability and some degree of earnings stabilization. This may be difficult to achieve in the current environment, overshadowing a cautiously optimistic view of an eventual return to ‘normalized’ operating conditions and the potential of a dividend payout which longer-term investors may view as attractive. Accordingly, Bourse assigns an UNDERWEIGHT rating to TTNGL

DISCLAIMER: “This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase, or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives, or agents, accepts any liability whatsoever for any direct, indirect, or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”