HIGHLIGHTS

Investor Considerations:

Local Market

- Calming Inflation

- Low Interest Rates

- Economic Recovery

- Limited Public Bond Issuances

Investor Considerations:

International Market

- Cooling Inflation

- Interest Rates Peaking

- Bond Market Recovery?

- Credit Quality Improvement?

This week, we at Bourse consider the implications for bond markets and investors with inflation trending lower. As inflation begins to cool on both the international and local stages, could new opportunities arise? We discuss below.

Local Fixed Income Markets

Domestic Inflation Cooling

After peaking in January 2023, domestic inflation started to moderate. Headline Inflation continues to trend downward, declining from 6.0% in the prior month to 5.7% in May 2023. Core inflation remained somewhat sticky at an annualized rate of 4.8%, according to data obtained from the Central Bank of Trinidad and Tobago (CBTT). Food inflation exhibited the most pronounced decline, slowing from 11.2% in April 2023 to 9.7% as at May 2023, driven by downward movement in the prices of poultry and fish products.

In recent developments, Nutrimix Group announced a drop in flour prices effective July 3rd, 2023 from 10 – 13% on Country Pride and Nutrimix Premium Grade 2kg. Following this, State-owned National Flour Mills stated its intentions to adjust prices downwards by 10% on all main retail brands of flour, in line with world grain prices. According to both companies, the reduction in the prices were due to fall in global wheat and shipping costs. Lower price of consumer staples such as flour should support lower inflation numbers in subsequent periods.

Local ‘GORTT’ Yields Stable

Despite pronounced movements in inflation over the past year, the Government of the Republic of Trinidad & Tobago (GORTT) TT-Dollar bond yield curve remained relatively stable. The 30-year yields inched up by 13 basis points (bps), moving from 7.36% from December 2022 to 7.49% in June 2023. Marginal moves also occurred along the shorter-term bond yields, as 5-year yields edged up 10 bps from 4.06% to 4.16% during the same period. Overall, the stable yield curve appears to reflect market sentiment that inflation has been more heavily influenced by import prices, as opposed to overheating of domestic economic activity.

T&T Rating Outlook Turns Positive

The Government of the Republic of Trinidad & Tobago’s (GORTT) credit rating outlook was recently upgraded by Moody’s Investor Services (Moody’s) from stable to positive, while the rating was reaffirmed at ‘Ba2’. According to Moody’s, the change in outlook reflects the view that Trinidad and Tobago’s (T&T) prospects have improved due to a more sustained fiscal consolidation, stemming from energy prices.

S&P Global Ratings maintains GORTT’s credit rating at ‘BBB-’ with a stable outlook, which lies one notch above speculative status. T&T’s Minister of Finance referenced Moody’s change in outlook as a positive development for the nation.

NIF ‘A’ to Mature

In the Local space, NIF 4.50% 2023 Series A bondholders will be expecting proceeds from maturity on 9th August 2023. NIF’s Series A repayment will likely be funded via the issuance of the new NIF Series D. Credit Rating agency CariCRIS has assigned ‘CariAA’ on the regional rating scale and ‘ttAA’ on the Trinidad and Tobago (T&T) national rating scale on the new issuance, totalling up to TT $1.2 billion. CariCRIS also maintained a stable outlook, supported by the expected continued strong financial performance of the NIF’s underlying assets (RFHL, TGU, AHL, WITCO, OCM).

Local Market Outlook

Local inflation appears to be cooling, in tandem with broader global trends. According to the CSO’s Index of Retail Prices, Headline inflation, Food inflation and Core inflation all declined as at May 2023. With some local suppliers hinting at reduced costs of staple food items, it is likely that local inflation could continue to moderate in the coming months.

Local interest rates are expected to remain relatively stable, with inflationary pressures moderating. The Monetary Policy Committee decided to maintain the Repo Rate at 3.50% in its June 2023 announcement, geared towards continued support to encourage economic activity via access to affordable credit.

GORTT Bond Issuance continues to be scarce. Preliminary indications by the honourable Minister of Finance suggests that, despite some softening of global energy prices and muted domestic energy production, T&T’s FY2023 fiscal deficit may be less than originally projected.

T&T’s Credit Rating should remain stable, given the combination of moderating inflation, a resilient fiscal position and the reduced near-term need for debt financing.

International Fixed Income Markets

Perhaps the best indicator of broader global inflationary trends, US Inflation moderated sharply during the first half of 2023. The Consumer Price Index (CPI), a commonly used measure of inflation, slowed to an annual rate of 3.0% as at June 2023. This follows consecutive monthly declines, after starting at 6.4% in January 2023. As of May 2023, the Personal Consumption Expenditure (PCE) Price Index stood at 4.6% in May 2023, compared to 4.7% in the previous month. For the past five months, PCE has ranged between 4.6% – 4.7%, reflecting some stickiness in prices of goods and services in the U.S. Although both the CPI and PCE remain above the US Federal Reserve’s target level of 2.0%, the trend is in the right direction. US inflation has also moderated more quickly than some of its ‘first world’ peers. Inflation rates in the UK and Europe, for example, currently hover around 7.9% and 7.0% respectively.

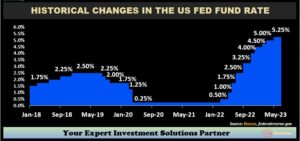

Have US Interest Rates Peaked?

After 15 months of interest rate hikes, the Fed held interest rates unchanged at its June 2023 policy meeting. The decision left the benchmark federal funds rate in a target range of 5.00% to 5.25%. The minutes from the Fed’s June 13th -14th meeting, however, indicated further tightening was still possible. Investors will be keenly observing announcements/developments at the Fed’s upcoming policy meeting, carded for 25th & 26th July 2023.

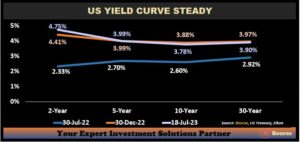

US Treasury Yields Remain Elevated

Despite moderating inflation data, yields on two-year US treasuries notably increased from 4.41% in December 2022 to 4.75% in July 2023, while ten-year bonds decreased 10 basis points year-to-date. Shorter-term US Treasury bonds continue to offer higher yields than longer-term issues, indicating that (i) investors remain unclear as to US interest rate policy and (ii) there remains some scepticism about the near-term health of the US economy. Treasury Secretary, Janet Yellen’s recent statements that “an economic slowdown in the United States is inevitable, but a recession is not” have not helped to allay concerns about interest rate policy or US economic health.

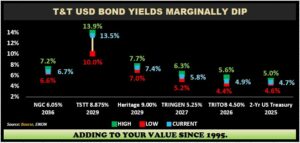

Bond Yields Trend Lower

Trinidad & Tobago-related USD-denominated bond yields continued to broadly trend lower, underpinned by the Fed’s recent decision to pause interest rates. For instance, the National Gas Company of Trinidad and Tobago’s (NGC 6.05% 2036) bond, which would have peaked at a yield of around 7.2% in August 2022, currently trades at 6.7%, just about 10 bps above its 12-month low. Similarly, The Government of the Republic of Trinidad and Tobago (TRITOB 4.50% 2026) after hitting a 12-month high of 5.6% in October 2022 is now trading at a 4.9% yield. Lower-trending yields, for investors with a buy/hold investing approach, could be a sign to capitalize on a relatively good yields while the opportunity exists.

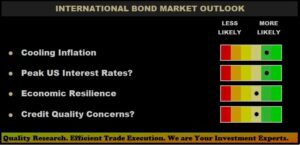

International Fixed Income Outlook

The latest US Consumer Price Index released by the Bureau of Labor Statistics indicated that US annual inflation slowed to 3% for June 2023. Cooling inflation could strongly influence the US Federal Reserve’s decisions with respect to interest rate policy. Interest rates are more likely to peak, with some consensus estimates suggesting one final 25 bps rate hike before US rates stabilize.

With the overall improved fixed income outlook, bond market price stability is likely, underpinned by moderating inflation and more predictable interest rates. One feature of bond markets which could be a cause for concern is credit quality, particularly for less credit-worthy or lower-rated companies having to refinance existing and/or raise new debt funding in an elevated interest rate environment.

Investor Considerations

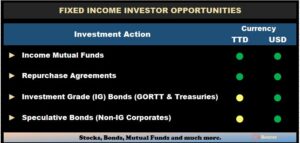

With seemingly improving market sentiment and data, what does this mean for investors and their portfolios? On the local side, fixed income investors with a lower risk appetite and shorter-term investment horizon could consider solutions such as Repurchase Agreements, available for both TTD and USD. This is particularly in the context of somewhat limited domestic fixed income options. Repurchase Agreements are fully-collateralized, unlike fixed deposits which are subject to Deposit Insurance Corporation (DIC) maximum coverage limits. For investors seeking (i) enhanced liquidity or (i) a short-term storage solution for funds while waiting for longer-term opportunities, Income Mutual Funds could be considered.

For fixed income investors with a greater risk appetite, the prospect of stabilizing US interest rates and relatively stable domestic interest rates may encourage investors to look at longer-term bonds, whether investment or non-investment grade bonds. Locally, exchange-traded opportunities such as the Government of the Republic of Trinidad & Tobago (GORTT) 4.25% 2037 Bond (J314) and NIF Series B and Series C bonds remain (relatively) more actively traded and available. Internationally, the menu of fixed income opportunities remains much wider, ranging from near risk-free short-term US Treasuries to longer-term speculative bonds.

To learn more about fixed income opportunities and what may be better-suited to your needs, it makes sense to contact an expert investment provider, like Bourse, to make the most informed investment decisions.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”