This week, we at Bourse review the performance of JMMB Group Limited (JMMBGL) and Sagicor Financial Corporation (SFC), for their twelve-month and three-month reporting periods respectively, ended March 31st, 2023. JMMBGL reported lower-than-expected earnings due to dampened financial markets, whereas SFC benefitted from improved results. In an ever-changing operational environment, how will both companies progress in the future months? We discuss below.

JMMB Group Limited (JMMBGL)

JMMB Group Limited (JMMBGL) reported an Earnings Per Share (EPS) of TT$0.14 for its fiscal year ended March 31st, 2023 (FY2023), 44.1% lower than the corresponding period FY 2022.

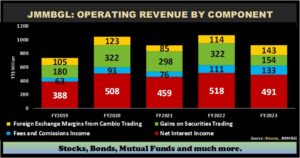

Net Interest Income dropped 5.3% from TT$518.4M to TT$490.7M. Fee and Commission Income increased by 19.1%, from TT$111.3M to TT$132.6M. Gains from Securities Trading reported a more pronounced decrease, down 52.0%, from TT$321.5M (FY2022) to TT$154.2M (FY2023). Foreign exchange margins from Cambio Trading generated TT$142.7M in FY2023, representing 25.6% growth over the previous period. Consequently, Operating revenue fell 12.0% year on year (YOY) from TT$1.17B in FY2022 to TT$1.03B in FY2023. Operating Expenses rose 7.6% to TT$874.2M, with notable increases related to Marketing, Corporate Affairs, Asset Tax and Information Technology costs. likely probable to increased inflationary pressures while Impairment Loss on Financial Assets edged down 19.2% from TT$84.86 in the preceding comparable quarter (FY2022). The Group recorded a Share of Profit of Associate of TT$117.3M, down 47.4% from the prior year, leading to a drop in Profit Before Tax of TT$203.2M, 58.7% lower YOY. Tax expenses significantly increased 333.5% to TT$72.3M with the effective tax rate moving from 3.4% in FY2022 to 35.6% in FY2023. Profit for the period amounted to TT$275.5M in FY2023 or TT$233.6M lower than TT$509.1M in FY2022. Overall, Profit Attributable to Equity Holders stood at TT$270.7M, down 44.1% compared to TT$483.9M reported in the previous period.

Operating Revenue Contracts

JMMBGL’s Operating Revenue contracted 12.0% to TT$1.03B for the fiscal year ended March 31st, 2023. Gains on Securities Trading (16.6% of Operating Revenue) fell 52.0% from TT$321.5M FY2022 to TT$154.2M FY2023, likely affected by volatile equity and financial markets.

Net Interest Income (52.8% of Operating Revenue) declined 5.3% to TT$491M despite the 25% increase in the Group’s loan portfolio. Fees and Commissions Income (14.3% of Operating Revenue) advanced 19.1% from TT$111M in FY2022 to TT$133M, due to increased trading activity, as well as growth in managed funds, collective investment schemes and 46% increase in capital market segment across the Group. Foreign Exchange Margins from Cambio Trading gained 25.6% over the previous reporting period to TT$143M.

JMMBGL’s earnings per share (EPS) declined from TT$0.26 in FY2022 to TT$0.14 in FY 2023, while the Group’s Price-to-Earnings (P/E) ratio increased from 9.5 times in FY2022 to 10.2 times in FY2023.

Focus on Diversification

The Group continues to focus on its ‘smart growth’ strategy, centered on diversification of revenue streams into new geographies, business lines and stronger capital management while improving operational efficiency.

JMMBGL’s 23.3% stake in associate company Sagicor Financial Company Limited (SFC) contributed 42.6% to the Group’s profitability with TT$117M in share of profits in FY2022. Notably, JMMBGL’s value measurement of its position in SFC was included as a key audit matter during in the FY2023 financials. The market capitalization of JMMB’s shareholding in SFC was TT$793M as at March 31st 2023, 55.2% lower than its carrying value of TT$1.8B at the end of FY2023 financial period. In other words, the difference in the carrying and market values of JMMBGL’s SFC stake represents just over 41% of JMMBGL’s total shareholder equity.

Despite the differential between market and carrying values, JMMBGL’s management conducted an impairment assessment ‘involving a review of the performance of SFC as well as the fair value of the underlying assets’, with the determination being that no impairment in the carrying value was required.

Other initiatives of the Group during the financial year included (i) JMMB Bank’s rollout of its point-of-sale solutions in Jamaica, (ii) deepening investment into alternative investment classes such as real estate and (iii) introduction of the JMMB SL managed private equity vehicle, Vertex SME Holdings. According to the Group CEO, Keith Duncan, JMMBGL is expected to expand its digital payments solutions and add-value to its clients by introducing innovative payment solutions and accelerating digital projects to improve its client experience.

The Bourse View

At a current price of $1.35, JMMBGL trades at a price to earnings ratio of 10.2 times, below the sector average of 36.7 times. The stock currently has a trailing dividend yield of 0.8% relative to the Non-Banking Finance sector average of 5.7%.

The Group indicated that its financial performance continues to be impacted by the challenging economic conditions, characterized by a high interest rate environment, inflationary pressures coupled with weaker trading activity across regional markets. The Group could potentially benefit from financial market stabilization with commensurate improvement in asset valuations.

On the basis of increasing geographic diversification but tempered by reduced revenues and lingering market volatility which could continue to weigh on gains on securities trading, Bourse maintains a MARKETWEIGHT rating on JMMBGL.

More on Sagicor Financial Company Limited (SFC)

Sagicor Financial Company Limited (SFC) reported a Fully Diluted Earnings Per Share in Q12023 of US$0.01 (101.8% higher) relative to a Loss Per Share of US$0.57 in Q12022. It should be noted that SFC’s implementation of the new International Financial Reporting Standard (IFRS) 17 would have significantly adjusted the presentation of its financial performance.

Insurance Service Result contracted 80.9% from US$12.0M in the prior period to US$2.3M in Q12023.Net Investment Income amounted to US$219.6M, up 280.8% relative to a net investment expense in the prior quarter of $121.5M. Net Insurance finance expense stood at a negative US$133.7M, driven by negative effect on interest rate changes from insurance contracts issued compared to a positive net insurance finance income of US$73.2M in Q12022. Subsequently, Net insurance and investment result increased 342.9% to US$88.2M in Q12023 from a loss of US$36.3M in Q12022. Fees and other income fell 11.3% from US$36.6M in Q12022 to US$32.5M in the current reporting period. Share of income of associates and joint ventures declined by US$1.8M (down 79.4%) to US$0.5M. Other operating expenses expanded 3.5% to US$74.0 in Q12023. Other interest and finance costs advanced 37.8% from US$21.8M to US$30.1M in Q12023. Income Before Taxes rose 118.7% to US$17.0M from a loss in the prior comparable period of US$90.8M. Income taxes stood at US$7.8M. Net Income for the period stood at US$9.2M increasing 111.2% from a net income loss in Q12022 of US$82.3M. Overall, Net Income attributable to Shareholders of the Company recorded an increase of US$82.4M to US$1.4M, (101.7% higher) compared to a loss of US$81.0M in the same period last year. Net income and net income attributable to shareholders benefited from positive mark-to-market movements on financial assets carried at FVTPL in this quarter.

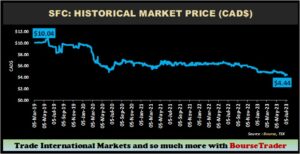

Share Price Struggle Continues

SFC’s market price has languished since listing on the Toronto Stock Exchange (TSX). Since listing, SFC’s stock price has declined from C$10.04 per share to a current level of C$4.44, a 55.8% decline.

SFC, however, continues to grow through acquisition, with an announcement in August 2022 that it entered into a definitive agreement to acquire Ivari, (a leading middle-market individual life insurer in Canada). The Group expects Ivari to be accretive on a book value and earnings basis and approximately neutral to Return on Equity (ROE) upon closing of the transaction in Q3 2023.

SFC has also extended its Normal Course Issuer Bid (NCIB) on the TSX through which the company may purchase up to 8.8M of Sagicor’s common shares during the 12-month period commencing June 24, 2023 and ending June 23, 2024. Purchases under the NCIB may be conducted on the open market through the TSX and/or alternative Canadian trading systems at the market price at the time of acquisition, as well as through other ways permitted by TSX regulations and applicable securities laws.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”